How Long Is A Ucc Filing Good For

How Long Is A Ucc Filing Good For - The lien is effective until. For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Filings are effective for five years. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a period of five years after the date of filing. The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing. Unless a continuation statement is. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing.

Unless a continuation statement is. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. The lien is effective until. For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a period of five years after the date of filing. The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing. Filings are effective for five years.

Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. Unless a continuation statement is. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a period of five years after the date of filing. Filings are effective for five years. For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. The lien is effective until. The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing.

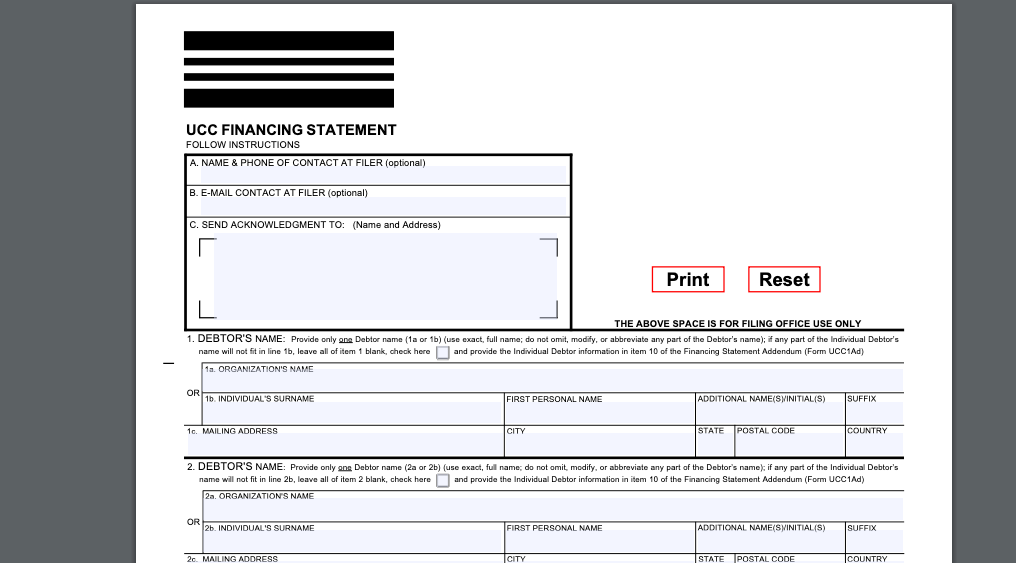

What is a UCC1 Financing Statement? Accracy Blog

The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. The lien is effective until..

UCC Filing What It Is And How It Impacts Your Business, 58 OFF

The lien is effective until. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Filings are effective for five years. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is.

Can A UCC Filing Be Terminated By The Debtor? First Corporate Solutions

Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a period of five years after the date of filing. The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing. Filings are effective for five years. Unless a continuation statement.

What Is a UCC Filing? NerdWallet

For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Unless a continuation statement is. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. Filings are effective for five years. The lien is effective until.

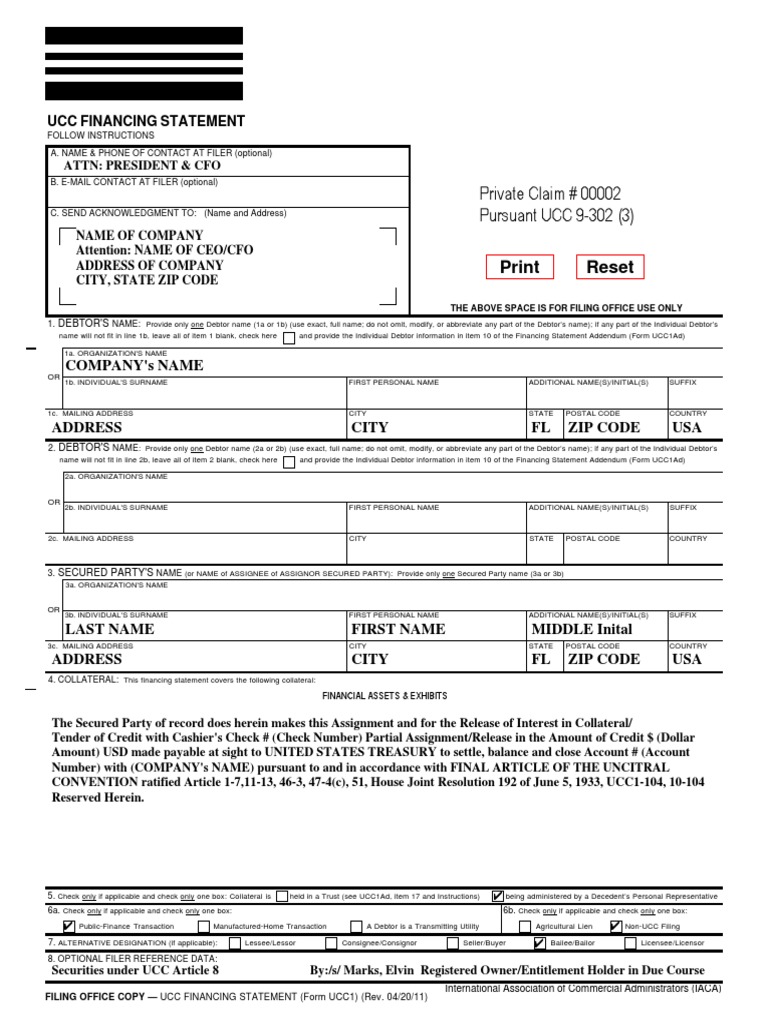

UCC Filing Template PDF Assignment (Law) Business Law

Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing. Unless a continuation statement is. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a.

UCC FIling The Ins and Outs of What a UCC is And Where to Look for One

For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a period of five years after the date of.

Fillable Online UCC Filing Statement (UCC1) Fax Email Print pdfFiller

For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing. Filings are effective for five years. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed.

Acknowledgement of Filing UCC1

Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Unless a continuation statement is. The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing..

What Is a UCC Filing? (and Why You Need to Know)

Unless a continuation statement is. For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. The ucc’s general rule is that a financing statement remains valid for a period of five years from the date of filing..

What Is A UCC Filing How A UCC Lien Works, 46 OFF

Filings are effective for five years. For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a period of five years after the date of filing. The lien is effective until. Unless a.

The Lien Is Effective Until.

For example, if you file on may 1, 2020, then the filing will expire (lapse) on may 1, 2025. Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing. Filings are effective for five years. Unless a continuation statement is.

The Ucc’s General Rule Is That A Financing Statement Remains Valid For A Period Of Five Years From The Date Of Filing.

Except as otherwise provided in subsections (b), (e), (f), and (g), a filed financing statement is effective for a period of five years after the date of filing.