State Of Arizona Tax Liens

State Of Arizona Tax Liens - Redeemed liens have been paid off by their owners. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. Make an online payment at aztaxes.gov. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Request a monthly installment plan. 29 rows state liens have been auctioned at each tax sale, but did not sell.

29 rows state liens have been auctioned at each tax sale, but did not sell. Make an online payment at aztaxes.gov. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. Request a monthly installment plan. You may be eligible if you owe more tax than you can pay. Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through.

Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. You may be eligible if you owe more tax than you can pay. Make an online payment at aztaxes.gov. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Request a monthly installment plan. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. 29 rows state liens have been auctioned at each tax sale, but did not sell. Redeemed liens have been paid off by their owners.

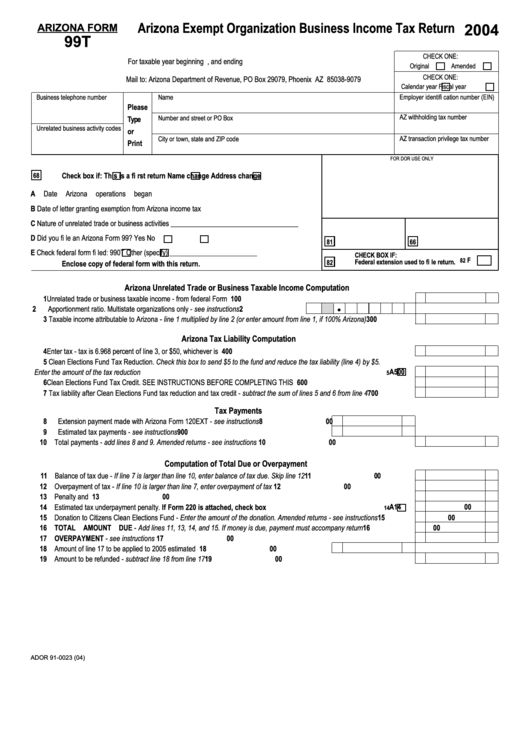

Arizona Tax Exempt Form

Redeemed liens have been paid off by their owners. You may be eligible if you owe more tax than you can pay. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Individual income tax filing season in the state provides potential benefits for arizonans whose income level is.

Arizona Tax Credit Choices Pregnancy Centers

Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. Make an online payment at aztaxes.gov. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Also known as a state cp, assignments are unsold tax liens.

Arizona Tax Liens Primer Foreclosure Tax Lien

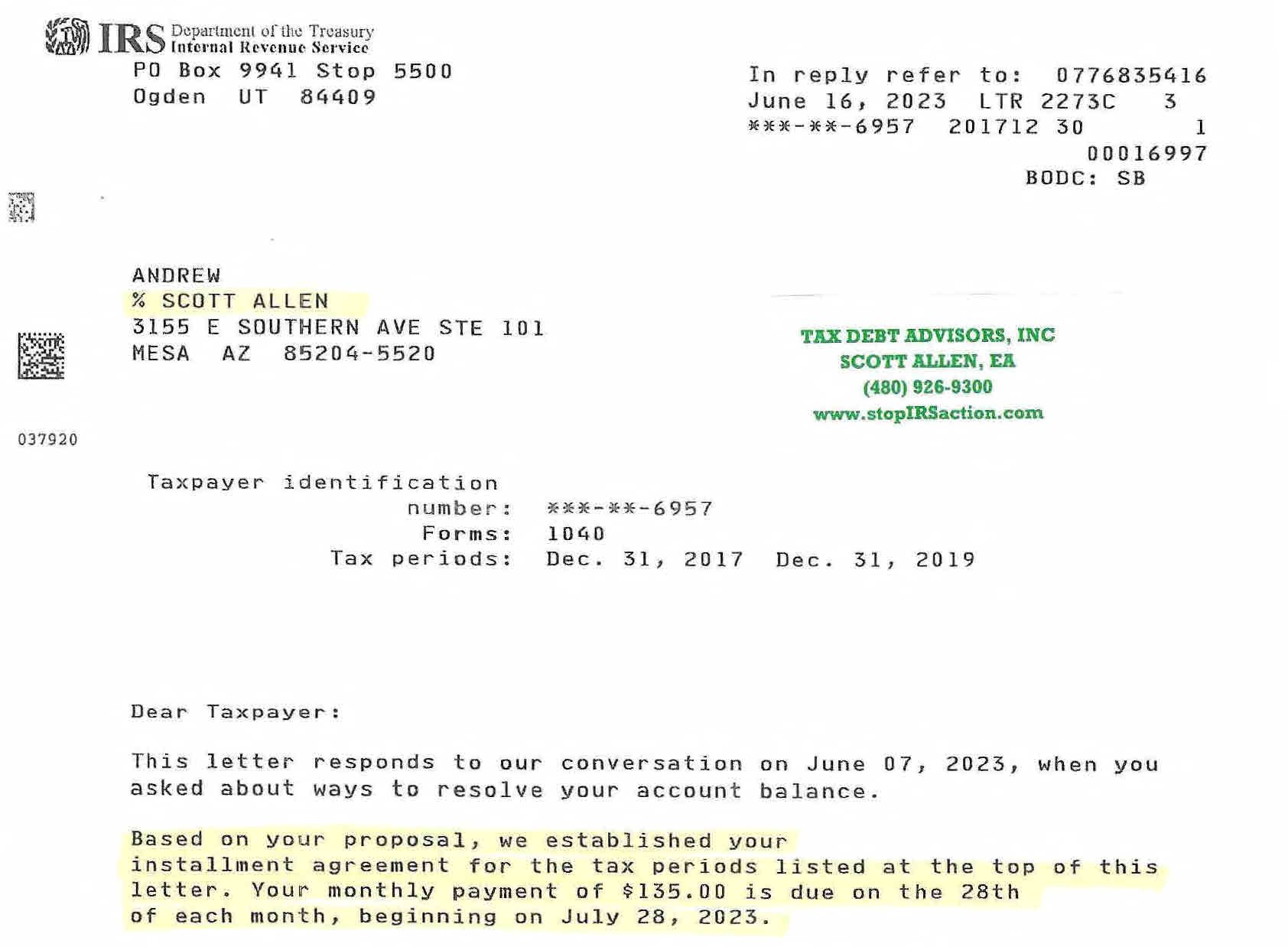

Request a monthly installment plan. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. In arizona, a tax lien is automatically placed on real or personal property when.

Tax liens arizona Fill out & sign online DocHub

Redeemed liens have been paid off by their owners. You may be eligible if you owe more tax than you can pay. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Request a monthly installment plan. Upon receipt of a cashier’s check or certified funds, the department of revenue will.

Arizona Primary Election 2024 Live Results — WSJ

In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. Redeemed liens have been paid off by their owners. You may be eligible.

96 best ideas for coloring Arizona State Tax

Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to. Redeemed liens have been paid off by their owners. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. In arizona, a tax lien is automatically placed on real or.

Learn About 1031 Exchange Rules for Arizona to Pay Less Tax

Make an online payment at aztaxes.gov. Also known as a state cp, assignments are unsold tax liens that are struck to the state of arizona, and available for purchase by bidders through. 29 rows state liens have been auctioned at each tax sale, but did not sell. Request a monthly installment plan. Redeemed liens have been paid off by their.

37+ Arizona State Tax Calculator MegganDeniz

Redeemed liens have been paid off by their owners. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. You may be eligible if you owe more tax than you can pay. Tax liens are a “hold” against your member’s property, superior to all liens except those held by.

Investing In Tax Liens Alts.co

Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Redeemed liens have been paid off by their owners. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. Make an online payment at aztaxes.gov. In arizona, a tax.

Facts about IRS tax liens for Arizona Residents IRS help from Scott

In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. 29 rows state liens have been auctioned at each tax sale, but did not sell. Make an online payment at aztaxes.gov. Also known as a state cp, assignments are unsold tax liens that are struck to the state of.

Upon Receipt Of A Cashier’s Check Or Certified Funds, The Department Of Revenue Will Immediately Provide A Notice Of Intent To.

Request a monthly installment plan. Find out how an arizona tax lien sale works and how to save your home if your arizona property taxes are delinquent. Make an online payment at aztaxes.gov. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government.

29 Rows State Liens Have Been Auctioned At Each Tax Sale, But Did Not Sell.

Individual income tax filing season in the state provides potential benefits for arizonans whose income level is below minimum threshold. You may be eligible if you owe more tax than you can pay. In arizona, a tax lien is automatically placed on real or personal property when taxes are levied, as outlined in state. Redeemed liens have been paid off by their owners.