Virginia Tax Locality Code

Virginia Tax Locality Code - If you're having trouble viewing or using the. 896 rows virginia has state sales tax of 4.3%, and allows local governments to collect a local option sales tax of up to 1.7%. Note that each of five counties has the same name as a city: Use the map to find the general sales and use tax rate and locality code for any location in virginia. Use the map to find the general sales and use tax rate and locality code* for any location in virginia. Bedford, fairfax, franklin, richmond, and roanoke. If you are filing a schedule c, you will need to indicate the locality code for the business. There are a total of 270. What are virginia's locality codes? You can also download locality codes and tax.

What are virginia's locality codes? You can also download locality codes and tax. Use the map to find the general sales and use tax rate and locality code for any location in virginia. If you're having trouble viewing or using the. Note that each of five counties has the same name as a city: There are a total of 270. If you are filing a schedule c, you will need to indicate the locality code for the business. 896 rows virginia has state sales tax of 4.3%, and allows local governments to collect a local option sales tax of up to 1.7%. Bedford, fairfax, franklin, richmond, and roanoke. Use the map to find the general sales and use tax rate and locality code* for any location in virginia.

What are virginia's locality codes? Use the map to find the general sales and use tax rate and locality code* for any location in virginia. If you are filing a schedule c, you will need to indicate the locality code for the business. You can also download locality codes and tax. Note that each of five counties has the same name as a city: If you're having trouble viewing or using the. 896 rows virginia has state sales tax of 4.3%, and allows local governments to collect a local option sales tax of up to 1.7%. Bedford, fairfax, franklin, richmond, and roanoke. There are a total of 270. Use the map to find the general sales and use tax rate and locality code for any location in virginia.

Home Virginia Tax

You can also download locality codes and tax. If you're having trouble viewing or using the. Use the map to find the general sales and use tax rate and locality code for any location in virginia. What are virginia's locality codes? Use the map to find the general sales and use tax rate and locality code* for any location in.

Tax Tip Have Virginia state tax questions? Virginia Tax

Use the map to find the general sales and use tax rate and locality code* for any location in virginia. Note that each of five counties has the same name as a city: If you're having trouble viewing or using the. What are virginia's locality codes? There are a total of 270.

How Virginia is conforming to the Federal Tax Code for 2021 and what

There are a total of 270. If you are filing a schedule c, you will need to indicate the locality code for the business. Note that each of five counties has the same name as a city: Use the map to find the general sales and use tax rate and locality code* for any location in virginia. You can also.

Virginia Tax Exemption Code 84178 PDF Mortgage Law Deed Of

There are a total of 270. If you are filing a schedule c, you will need to indicate the locality code for the business. Note that each of five counties has the same name as a city: What are virginia's locality codes? Use the map to find the general sales and use tax rate and locality code for any location.

Businesses Virginia Tax

There are a total of 270. 896 rows virginia has state sales tax of 4.3%, and allows local governments to collect a local option sales tax of up to 1.7%. Bedford, fairfax, franklin, richmond, and roanoke. Use the map to find the general sales and use tax rate and locality code for any location in virginia. You can also download.

Virginia Elective PassThrough Entity Tax Virginia Tax

There are a total of 270. Use the map to find the general sales and use tax rate and locality code for any location in virginia. Use the map to find the general sales and use tax rate and locality code* for any location in virginia. 896 rows virginia has state sales tax of 4.3%, and allows local governments to.

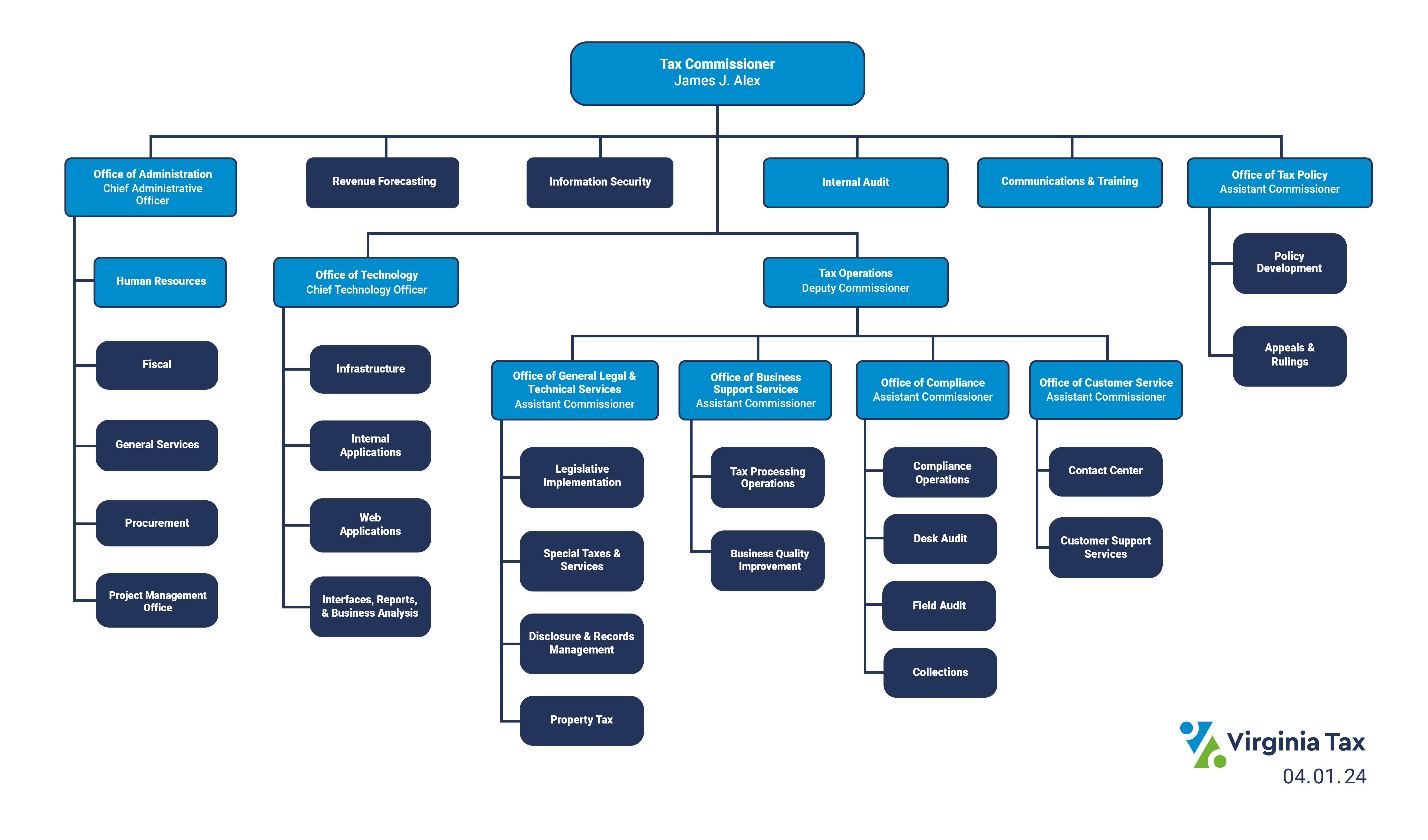

Who We Are Virginia Tax

Bedford, fairfax, franklin, richmond, and roanoke. If you're having trouble viewing or using the. What are virginia's locality codes? Use the map to find the general sales and use tax rate and locality code* for any location in virginia. Use the map to find the general sales and use tax rate and locality code for any location in virginia.

Businesses Virginia Tax

If you're having trouble viewing or using the. You can also download locality codes and tax. Note that each of five counties has the same name as a city: If you are filing a schedule c, you will need to indicate the locality code for the business. 896 rows virginia has state sales tax of 4.3%, and allows local governments.

New Virginia Tax Laws for July 1, 2024 Virginia Tax

Use the map to find the general sales and use tax rate and locality code for any location in virginia. You can also download locality codes and tax. Note that each of five counties has the same name as a city: There are a total of 270. 896 rows virginia has state sales tax of 4.3%, and allows local governments.

Home Virginia Tax

Use the map to find the general sales and use tax rate and locality code for any location in virginia. There are a total of 270. If you are filing a schedule c, you will need to indicate the locality code for the business. Use the map to find the general sales and use tax rate and locality code* for.

If You're Having Trouble Viewing Or Using The.

896 rows virginia has state sales tax of 4.3%, and allows local governments to collect a local option sales tax of up to 1.7%. There are a total of 270. Note that each of five counties has the same name as a city: Use the map to find the general sales and use tax rate and locality code* for any location in virginia.

Bedford, Fairfax, Franklin, Richmond, And Roanoke.

If you are filing a schedule c, you will need to indicate the locality code for the business. Use the map to find the general sales and use tax rate and locality code for any location in virginia. What are virginia's locality codes? You can also download locality codes and tax.