Tip Credit Form

Tip Credit Form - You may use irs form 4070 to report tips to your employer. Your employer may require you to report your tips more frequently than monthly. To figure the fica tip credit: Complete form 8846, credit for employer social security and medicare taxes paid on certain. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the. This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips.

This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. Complete form 8846, credit for employer social security and medicare taxes paid on certain. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the. Your employer may require you to report your tips more frequently than monthly. You may use irs form 4070 to report tips to your employer. To figure the fica tip credit:

Complete form 8846, credit for employer social security and medicare taxes paid on certain. Your employer may require you to report your tips more frequently than monthly. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the. To figure the fica tip credit: This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. You may use irs form 4070 to report tips to your employer.

What Is A Tip Credit, and Why Does It Matter? EMERGING

Your employer may require you to report your tips more frequently than monthly. To figure the fica tip credit: This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. You may use irs form 4070 to report tips to your employer. Complete form 8846, credit for employer social security.

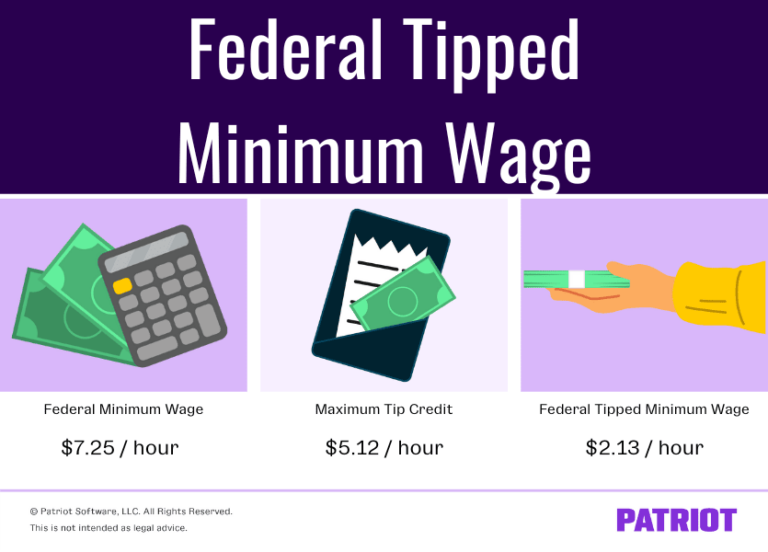

Tipped Minimum Wage Federal Rate and Rates by State (Chart

To figure the fica tip credit: This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. You may use irs form 4070 to report tips to your employer. Your employer may require you to report your tips more frequently than monthly. Certain food and beverage establishments use this form.

What are Tip Credits? Understanding Tips & Minimum Wage

This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. To figure the fica tip credit: Complete form 8846, credit for employer social security and medicare taxes paid on certain. Your employer may require you to report your tips more frequently than monthly. You may use irs form 4070.

2014 TIP Credit Application Form, 91814

Complete form 8846, credit for employer social security and medicare taxes paid on certain. To figure the fica tip credit: You may use irs form 4070 to report tips to your employer. This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. Your employer may require you to report.

What are Tip Credits? Understanding Tips & Minimum Wage

This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. To figure the fica tip credit: Your employer may require you to report your tips more frequently than monthly. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or.

Tip Declaration & Tipout Worksheet for Restaurants RestaurantOwner

Your employer may require you to report your tips more frequently than monthly. To figure the fica tip credit: Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the. You may use irs form 4070 to report tips to your employer. Complete form 8846, credit for employer.

💸 How Does A Tip Credit Work? Hourly, Inc.

Your employer may require you to report your tips more frequently than monthly. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the. Complete form 8846, credit for employer social security and medicare taxes paid on certain. To figure the fica tip credit: You may use irs.

Tipflation has some restaurants asking for up to 30 in tips CBC Radio

Complete form 8846, credit for employer social security and medicare taxes paid on certain. You may use irs form 4070 to report tips to your employer. Your employer may require you to report your tips more frequently than monthly. To figure the fica tip credit: Certain food and beverage establishments use this form to claim a credit for social security.

Tip Policy Template

Your employer may require you to report your tips more frequently than monthly. To figure the fica tip credit: Complete form 8846, credit for employer social security and medicare taxes paid on certain. This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. You may use irs form 4070.

What is Tip Credit? Pros and Cons for Owners and Employees

To figure the fica tip credit: Complete form 8846, credit for employer social security and medicare taxes paid on certain. This form is used to claim a tax credit for employer social security and medicare taxes paid on certain employee tips. Your employer may require you to report your tips more frequently than monthly. Certain food and beverage establishments use.

This Form Is Used To Claim A Tax Credit For Employer Social Security And Medicare Taxes Paid On Certain Employee Tips.

Complete form 8846, credit for employer social security and medicare taxes paid on certain. Your employer may require you to report your tips more frequently than monthly. You may use irs form 4070 to report tips to your employer. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the.

-2.webp#keepProtocol)