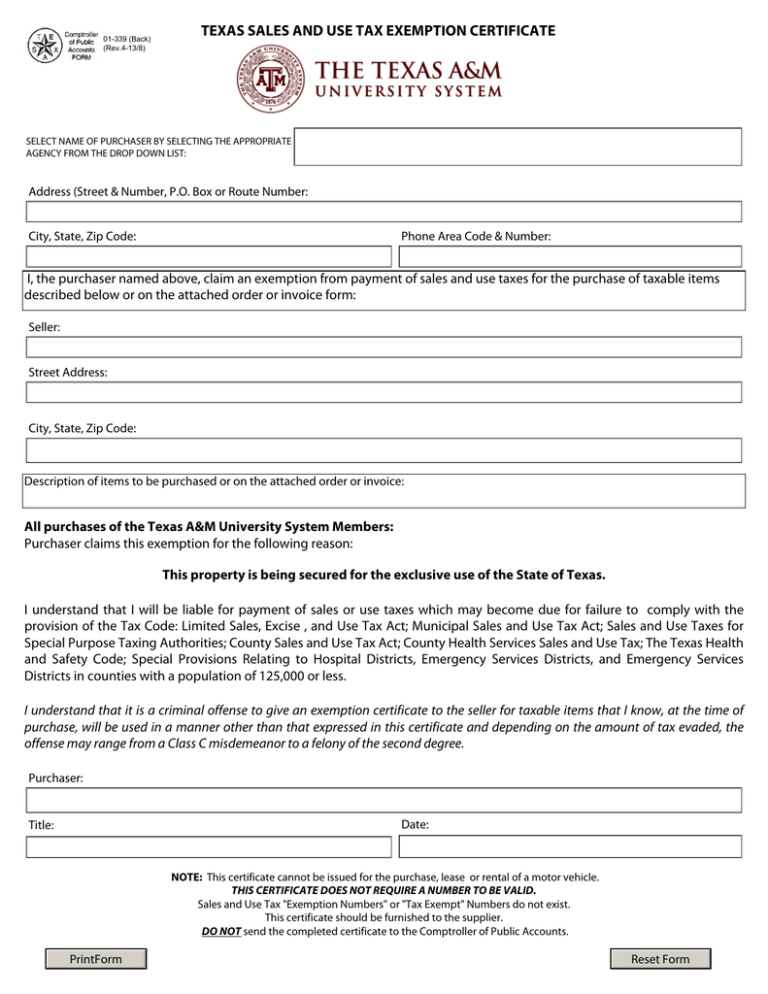

Texas Ag Exempt Form

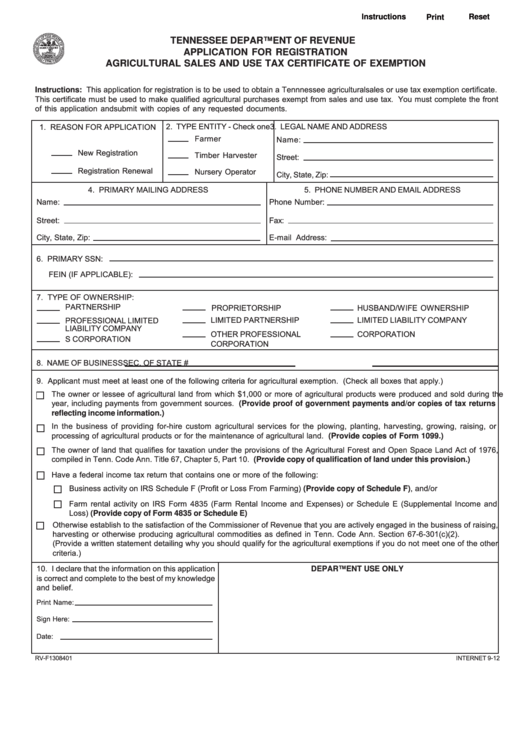

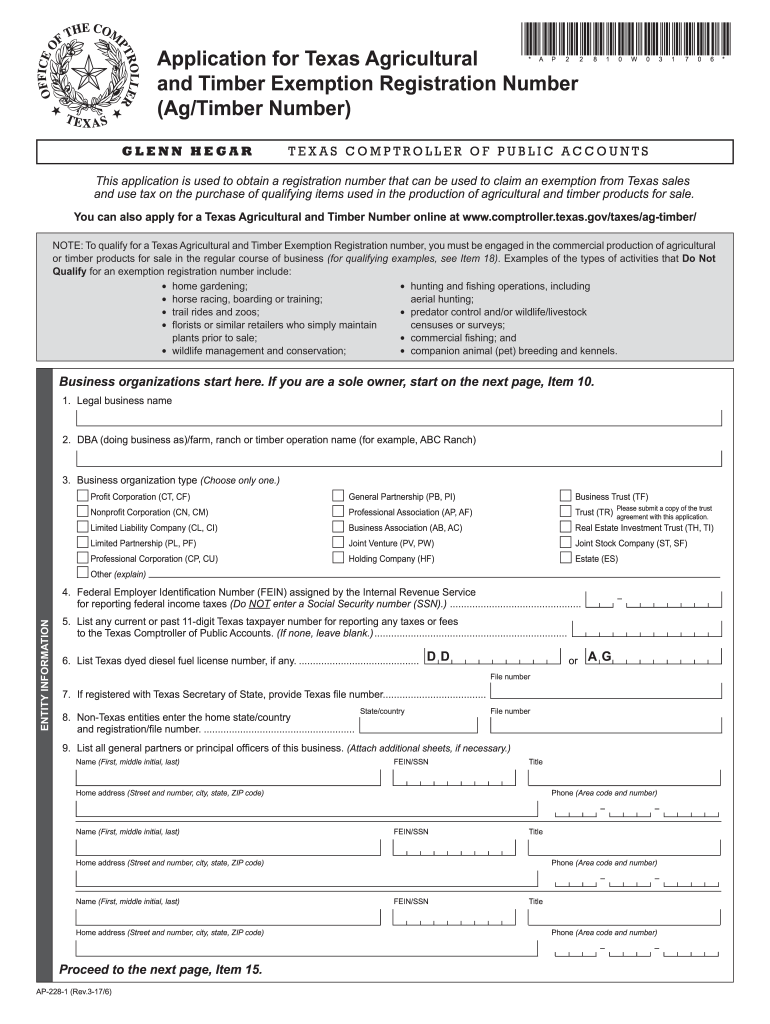

Texas Ag Exempt Form - To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the. This form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. Find pdf forms for applying for and claiming exemptions from sales, motor vehicle and fuels taxes for agricultural and timber activities in. It lists the items that. The form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be.

The form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be. This form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. Find pdf forms for applying for and claiming exemptions from sales, motor vehicle and fuels taxes for agricultural and timber activities in. To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the. This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying. It lists the items that.

The form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be. Find pdf forms for applying for and claiming exemptions from sales, motor vehicle and fuels taxes for agricultural and timber activities in. It lists the items that. To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the. This form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying.

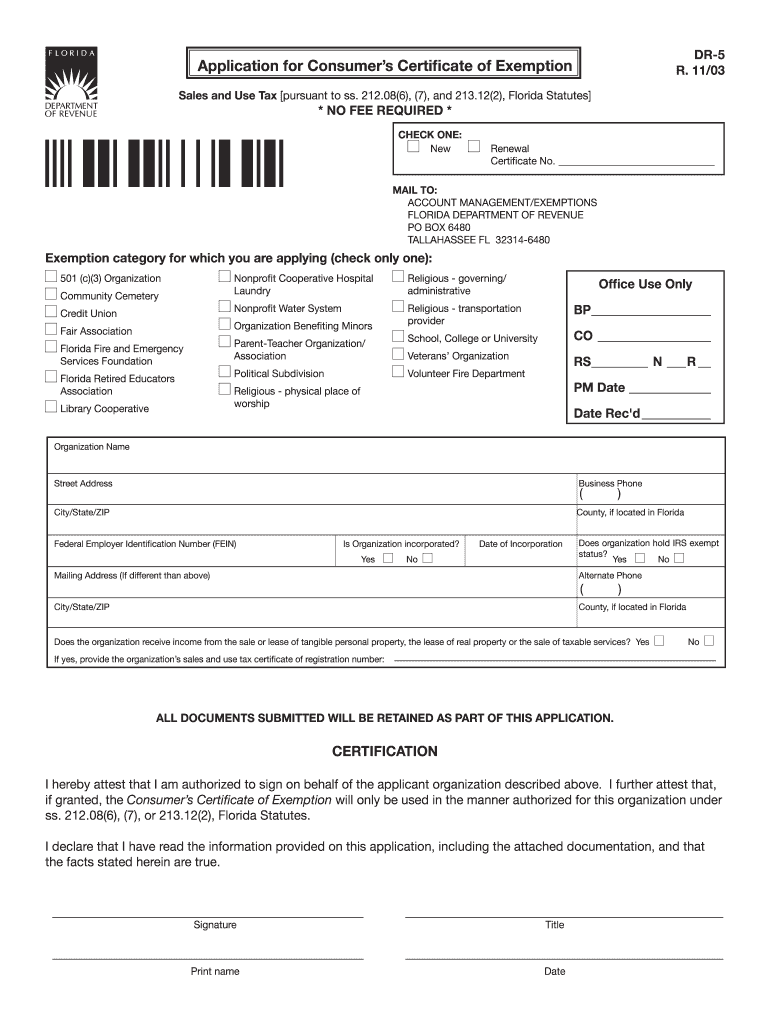

Agriculture Tax Exempt Form Florida

This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying. This form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. The form used to apply for a texas agricultural and timber exemption registration number that can be.

Sales Tax Exempt Form 2024 Va

Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. The form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be. Find pdf forms for applying for and claiming exemptions from sales, motor vehicle and fuels.

Arkansas Farm Use Sales Tax Exemption

This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying. Find pdf forms for applying for and claiming exemptions from sales, motor vehicle and fuels taxes for agricultural and timber activities in. It lists the items that. This form is for producers of agricultural products for sale who.

2023 Sales Tax Exemption Form Texas

The form used to apply for a texas agricultural and timber exemption registration number that can be used to claim an exemption may be. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. This form is for commercial agricultural producers to claim exemption from texas sales and use.

2600 Replacement USB Charger HerculesAG

To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the. Find pdf forms for applying for and claiming exemptions from sales, motor vehicle and fuels taxes for agricultural and timber activities in. The form used to apply for a texas agricultural and timber exemption.

Texas Ag Exemption Certificate Form example download

Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. It lists the items that. To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the. The form used to apply for a texas.

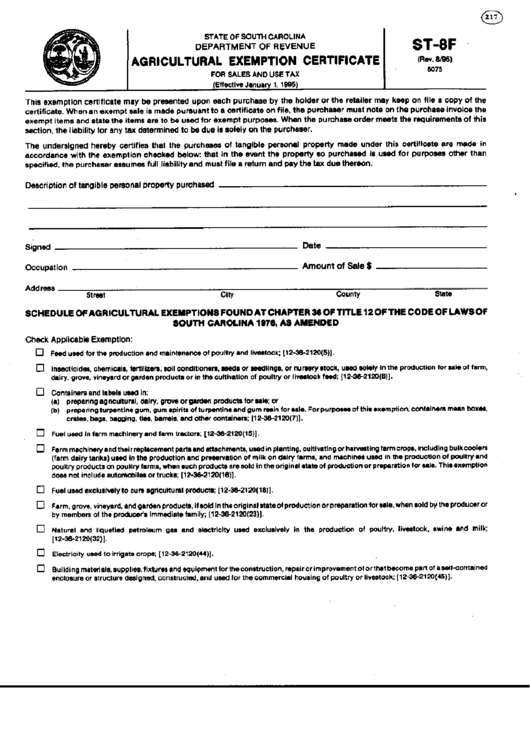

Fillable Form St8f Agricultural Exemption Certificate printable pdf

Find pdf forms for applying for and claiming exemptions from sales, motor vehicle and fuels taxes for agricultural and timber activities in. This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying. To claim exemption from motor vehicle sales and use tax on the purchase of a qualified.

How to Ag Exempt in Texas! — Pair of Spades (2023)

It lists the items that. To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. This form is for producers of agricultural products.

Farm Sales Tax Exemption Form Texas

This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying. It lists the items that. This form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. The form used to apply for a texas agricultural and timber exemption.

Tax Exempt Form 2024 Texas Edith Heloise

To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. This form is for producers of agricultural products for sale who claim exemption.

Find Pdf Forms For Applying For And Claiming Exemptions From Sales, Motor Vehicle And Fuels Taxes For Agricultural And Timber Activities In.

It lists the items that. This form is for producers of agricultural products for sale who claim exemption from sales and use tax on qualifying items. Commercial agricultural producers must use this form to claim exemption from texas sales and use tax when buying, leasing or renting. This form is for commercial agricultural producers to claim exemption from texas sales and use tax when buying, leasing or renting qualifying.

The Form Used To Apply For A Texas Agricultural And Timber Exemption Registration Number That Can Be Used To Claim An Exemption May Be.

To claim exemption from motor vehicle sales and use tax on the purchase of a qualified farm or timber machine or trailer, you must provide the.