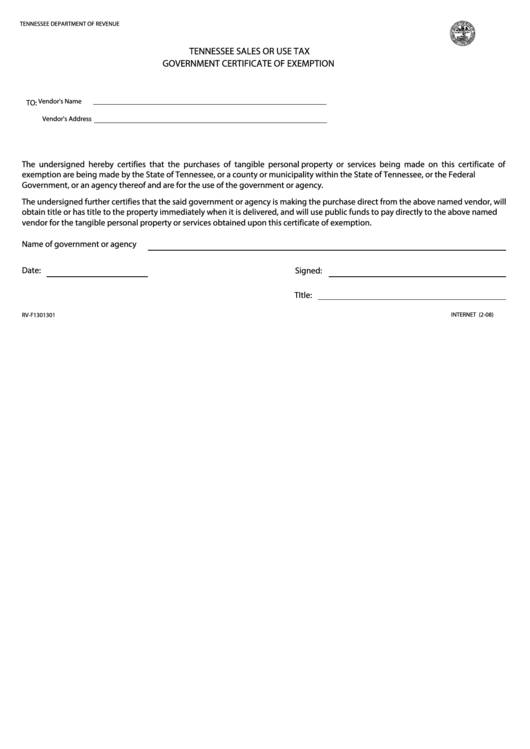

Tennessee Sales Tax Exempt Form

Tennessee Sales Tax Exempt Form - If an organization qualifies as exempt from sales and use tax under tenn. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for broadband infrastructure sales and use tax exemption; Application for research and development. This application for registration is to be used to register your organization for exemption from the tennessee sales or use.

Application for research and development. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. If an organization qualifies as exempt from sales and use tax under tenn. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for exemption from the tennessee sales or use.

Application for broadband infrastructure sales and use tax exemption; To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. If an organization qualifies as exempt from sales and use tax under tenn. Application for research and development.

Tennessee Sales Tax Complete with ease airSlate SignNow

Application for broadband infrastructure sales and use tax exemption; If an organization qualifies as exempt from sales and use tax under tenn. Application for research and development. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Purchasers must provide a new resale or exemption certificate if there are changes.

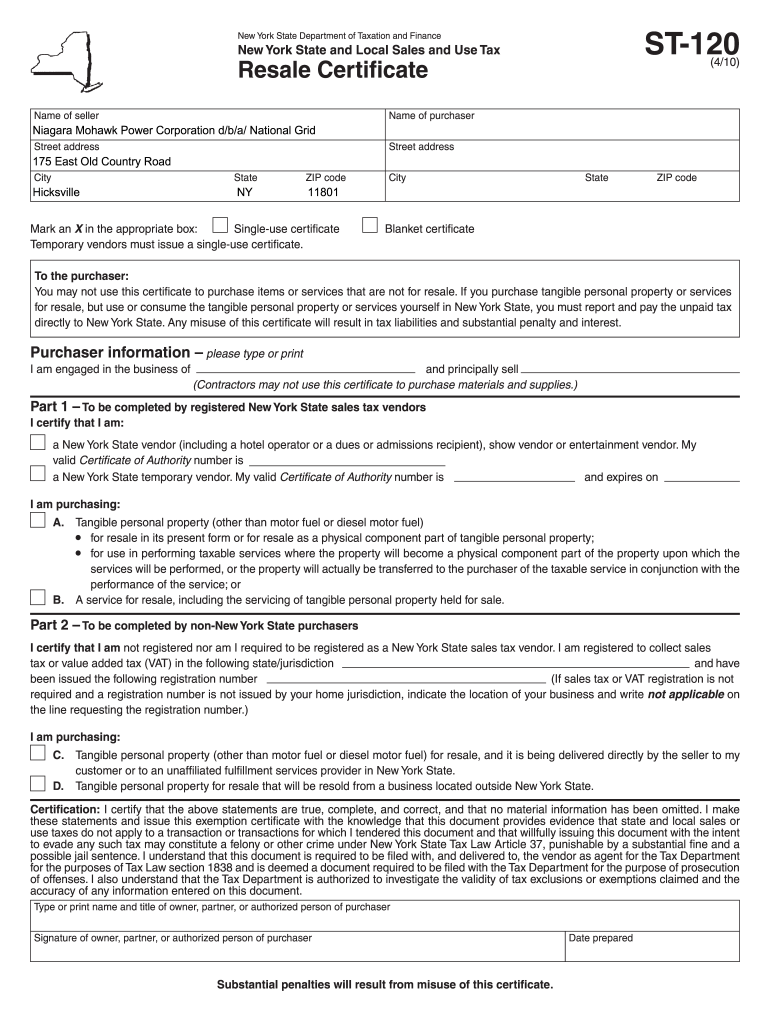

Blanket Certificate Of Exemption Form Fill Online, Printable

Application for research and development. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for broadband infrastructure sales and use tax exemption; If an organization qualifies as exempt from sales and use tax under tenn. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and.

Tn Sales Tax Exemption Form

This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for research and development. If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure.

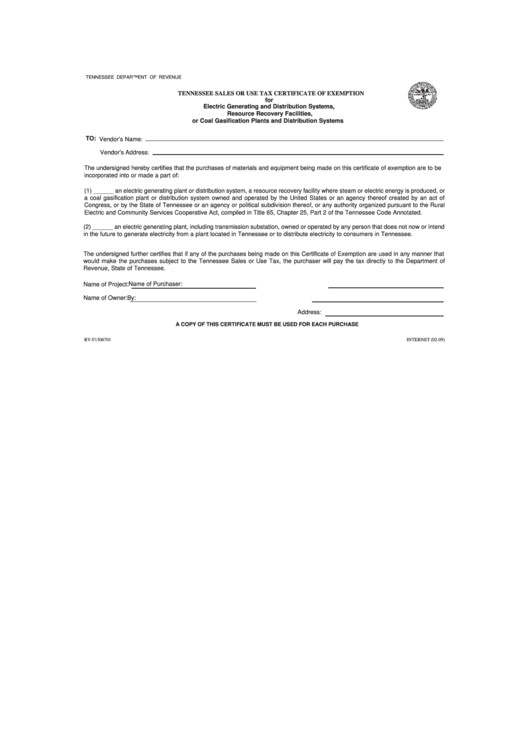

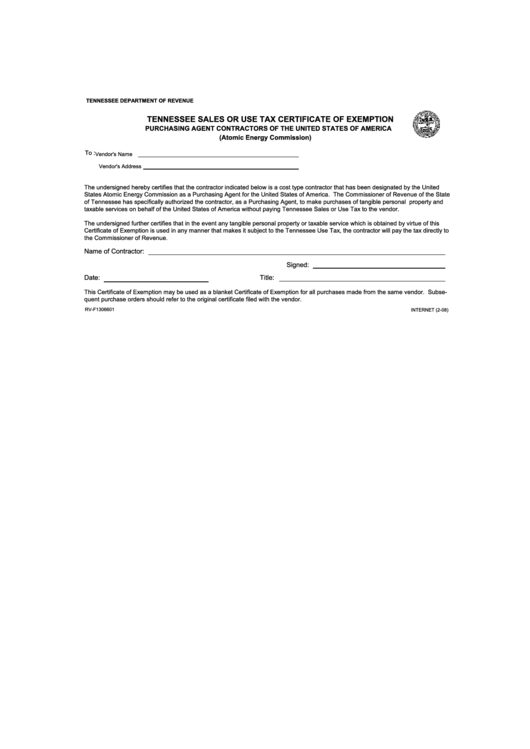

Form RvF1306701 Tennessee Sales Or Use Tax Certificate Of Exemption

Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for broadband infrastructure sales and use tax exemption; If an organization qualifies as exempt from sales and use tax under tenn. Application for research and development. This application for registration is to be used to register your organization for exemption from.

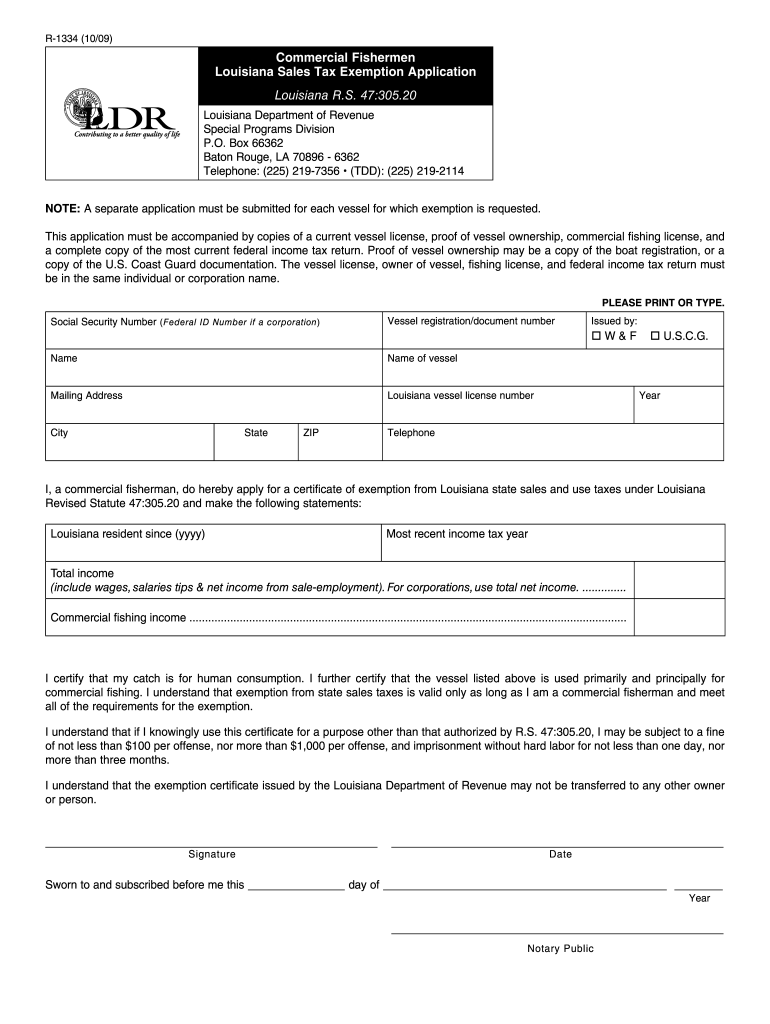

Louisiana Resale Certificate PDF Complete with ease airSlate SignNow

If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for exemption from the tennessee sales or use. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively.

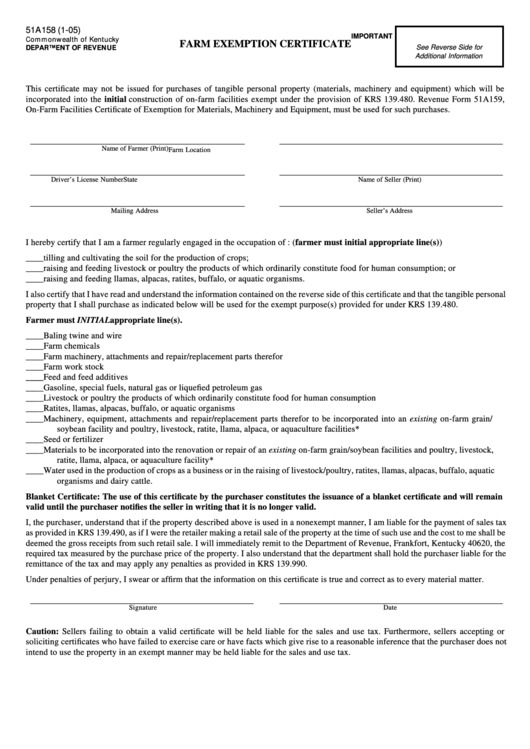

Kentucky Sales Tax Farm Exemption Form Fill Online Printable

Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for broadband infrastructure sales and use tax exemption; Application for research and development. If an organization qualifies as exempt from sales and use tax under tenn. This application for registration is to be used to register your organization for exemption from.

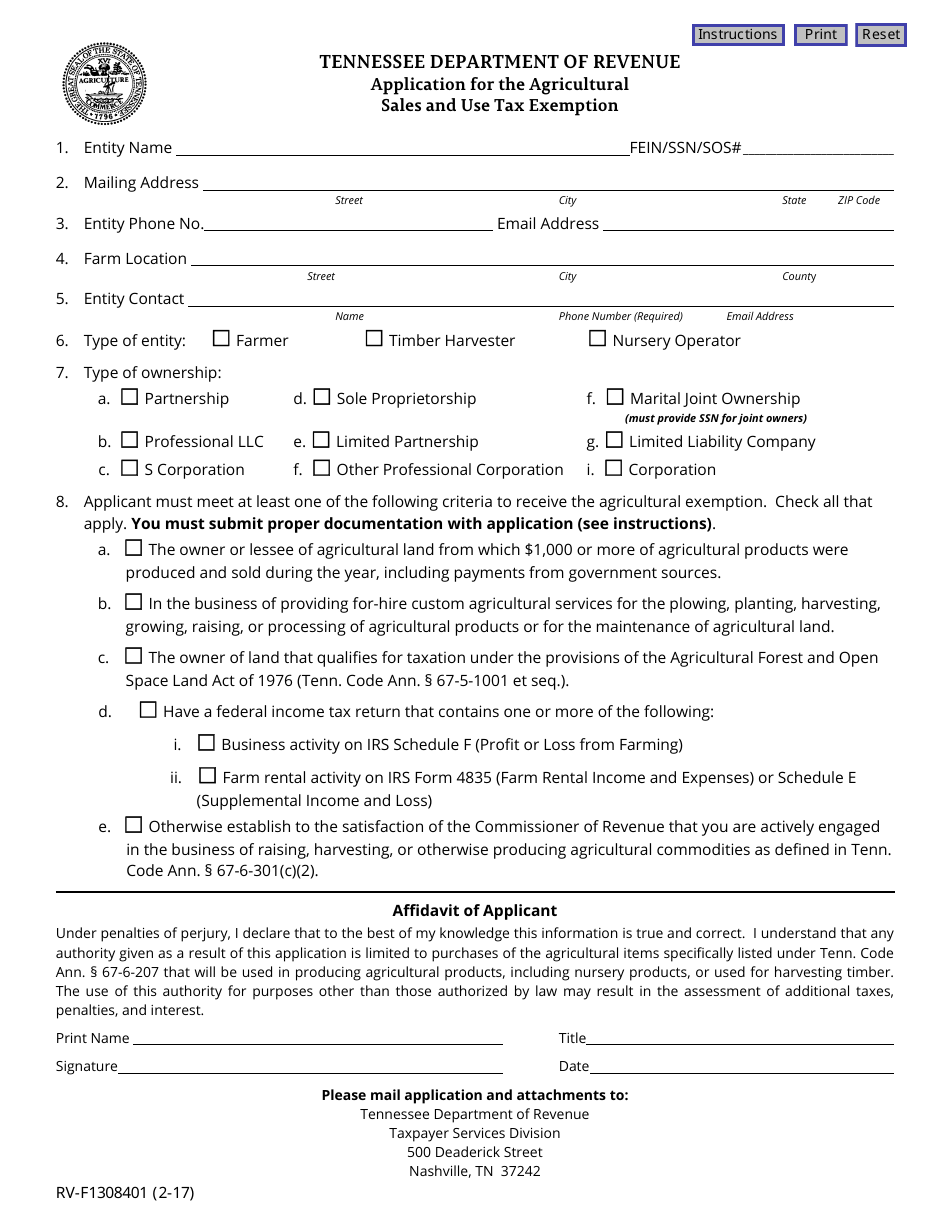

Form RVF1308401 Fill Out, Sign Online and Download Fillable PDF

Application for research and development. If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Purchasers must provide a new resale or exemption certificate if there are changes.

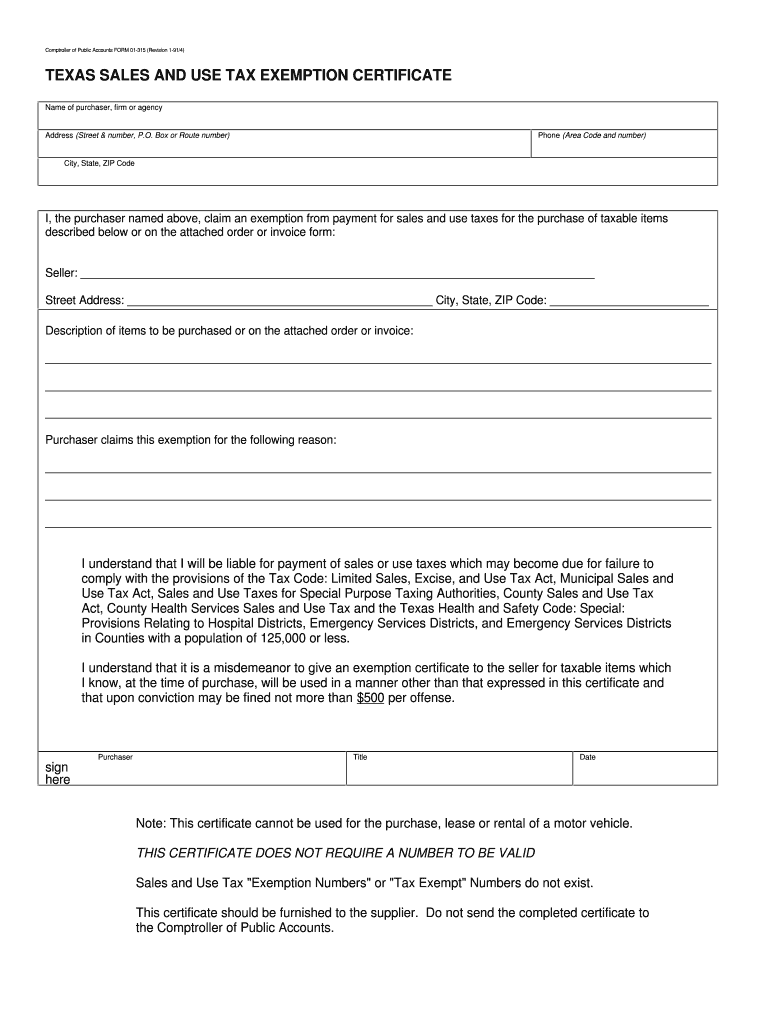

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Application for research and development. Application for broadband infrastructure sales and use tax exemption; Purchasers must provide a new.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Application for research and development. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for exemption from the tennessee sales or use. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Purchasers must provide a new.

Tennessee State Tax Withholding Form

Application for broadband infrastructure sales and use tax exemption; To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. If an organization qualifies as exempt from sales and use.

If An Organization Qualifies As Exempt From Sales And Use Tax Under Tenn.

Application for research and development. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Application for broadband infrastructure sales and use tax exemption;