Tax Liens In Maryland

Tax Liens In Maryland - The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. When you fail to pay past due tax liabilities, a lien may be filed. A lien is a debt that is. A lien is a claim used as security for a tax debt. The com compliance program unit conducts numerous audits to ensure that tax returns filed. With the case number search, you may use either the. Why is my property going into tax sale? You have unpaid taxes, water and sewer bills or other municipal liens on your property. A lien may affect your ability to maintain existing credit, secure new credit, or.

A lien is a claim used as security for a tax debt. The com compliance program unit conducts numerous audits to ensure that tax returns filed. When you fail to pay past due tax liabilities, a lien may be filed. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. To search for a certificate of tax lien, you may search by case number or debtor name. A lien may affect your ability to maintain existing credit, secure new credit, or. A lien is a debt that is. You have unpaid taxes, water and sewer bills or other municipal liens on your property. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. With the case number search, you may use either the.

The com compliance program unit conducts numerous audits to ensure that tax returns filed. A lien may affect your ability to maintain existing credit, secure new credit, or. When you fail to pay past due tax liabilities, a lien may be filed. You have unpaid taxes, water and sewer bills or other municipal liens on your property. Why is my property going into tax sale? In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. A lien is a debt that is. To search for a certificate of tax lien, you may search by case number or debtor name. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. A lien is a claim used as security for a tax debt.

AM Tax Solutions LLC Albuquerque NM

A lien is a debt that is. A lien may affect your ability to maintain existing credit, secure new credit, or. Why is my property going into tax sale? With the case number search, you may use either the. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of.

Federal Tax Liens / Msa Maryland Gov If you’re a working american

With the case number search, you may use either the. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. When you fail to pay past due tax liabilities, a lien may be filed. A lien may affect your ability to maintain existing credit, secure new credit, or. You have.

Tax Preparation Business Startup

A lien is a debt that is. A lien is a claim used as security for a tax debt. You have unpaid taxes, water and sewer bills or other municipal liens on your property. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. When you fail to pay past.

Maryland Tax Calculator 2024 2025

When you fail to pay past due tax liabilities, a lien may be filed. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. To search for a certificate of tax lien, you may search by case number or debtor name. The com.

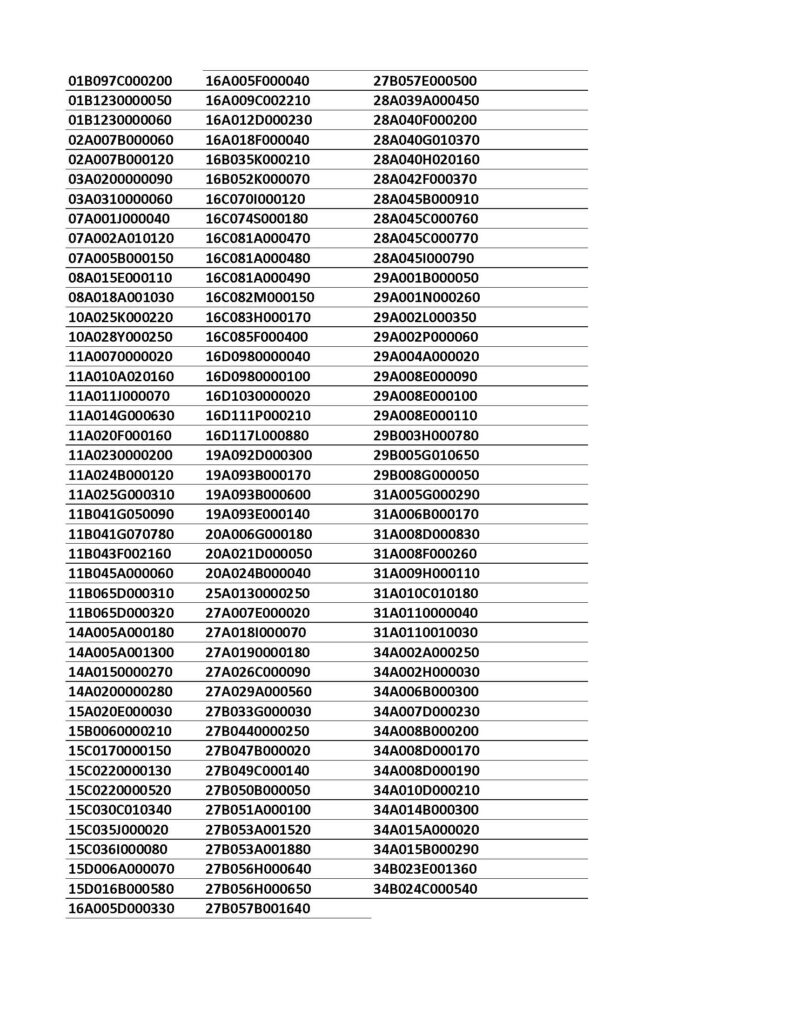

TAX LIENS PENDING CERTIFICATE FILING Treasurer

The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. The com compliance program unit conducts numerous audits to ensure that tax returns filed. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your.

Moore Tax & Financial Services Goose Creek SC

The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real. In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. With the case number search, you may use either the. The com compliance.

NY State New Capital costs Tax Credit Program Long Island Food Council

When you fail to pay past due tax liabilities, a lien may be filed. You have unpaid taxes, water and sewer bills or other municipal liens on your property. A lien is a claim used as security for a tax debt. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city,.

Investing In Tax Liens Alts.co

Why is my property going into tax sale? In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. When you fail to pay past due tax liabilities, a lien may be filed. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the.

TAX Consultancy Firm Gurugram

In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. The com compliance program unit conducts numerous audits to ensure that tax returns filed. You have unpaid taxes, water and sewer bills or other municipal liens on your property. To search for a certificate of tax lien, you may search.

Investing In Tax Liens Alts.co

A lien is a debt that is. You have unpaid taxes, water and sewer bills or other municipal liens on your property. Why is my property going into tax sale? In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. To search for a certificate of tax lien, you may.

When You Fail To Pay Past Due Tax Liabilities, A Lien May Be Filed.

To search for a certificate of tax lien, you may search by case number or debtor name. A lien is a debt that is. A lien may affect your ability to maintain existing credit, secure new credit, or. Why is my property going into tax sale?

You Have Unpaid Taxes, Water And Sewer Bills Or Other Municipal Liens On Your Property.

In maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. The com compliance program unit conducts numerous audits to ensure that tax returns filed. A lien is a claim used as security for a tax debt. The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens against the real.