Tax Liens Bexar County

Tax Liens Bexar County - Real property may be seized and sold at sheriff sales for delinquent taxes, sales under writ of executions and order of sales to satisfy a. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department. San antonio’s bexar county follows standard texas procedures for property tax liens. If you owe bexar county delinquent property taxes, it can lead to a lot of debt. Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. The county clerk is located at 100 dolorosa. However, with the right info about their property taxes, bexar county.

Real property may be seized and sold at sheriff sales for delinquent taxes, sales under writ of executions and order of sales to satisfy a. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department. The county clerk is located at 100 dolorosa. However, with the right info about their property taxes, bexar county. Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. If you owe bexar county delinquent property taxes, it can lead to a lot of debt. San antonio’s bexar county follows standard texas procedures for property tax liens.

If you owe bexar county delinquent property taxes, it can lead to a lot of debt. The county clerk is located at 100 dolorosa. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. San antonio’s bexar county follows standard texas procedures for property tax liens. Real property may be seized and sold at sheriff sales for delinquent taxes, sales under writ of executions and order of sales to satisfy a. However, with the right info about their property taxes, bexar county. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department.

Bexar County property tax increase by zip code from 2014 to 2019 Infogram

San antonio’s bexar county follows standard texas procedures for property tax liens. Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. Information concerning liens recorded against a property may be researched by.

Everything You Need to Know About Bexar County Property Tax

The county clerk is located at 100 dolorosa. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Real property may be seized and sold at sheriff sales for delinquent taxes, sales under.

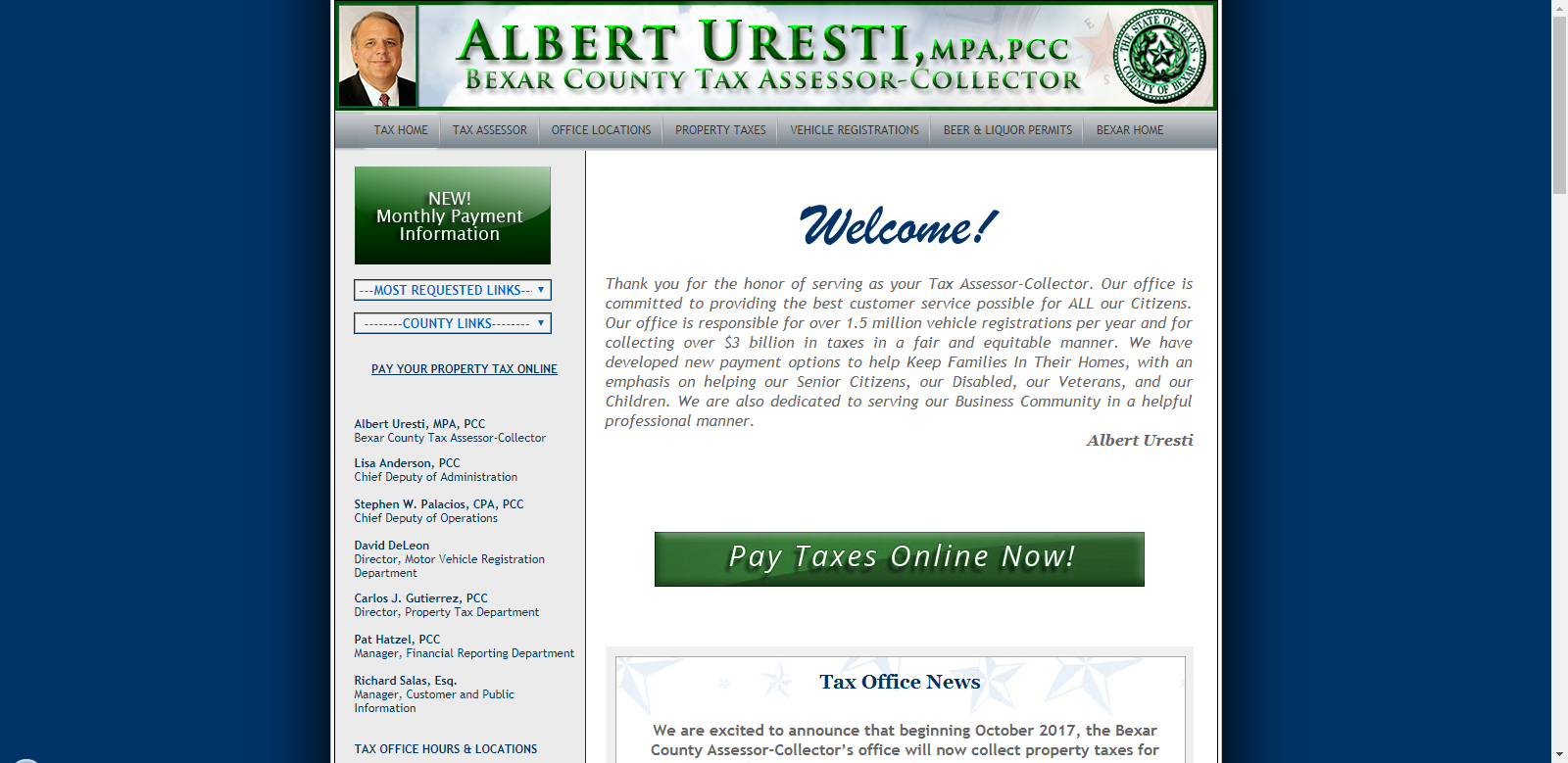

Bexar County Tax Office Pay Online Tax Preparation Classes

If you owe bexar county delinquent property taxes, it can lead to a lot of debt. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. Real property may be seized and sold at sheriff sales for delinquent taxes, sales under writ of executions and order of sales to satisfy a..

Bexar County Service Coverage2Care

Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Real property may be seized and sold at sheriff sales for delinquent taxes, sales under writ of executions and order of sales to satisfy a. However, with the right info about their property taxes, bexar county. If you owe bexar county delinquent.

Bexar County Tax Accessor Forms

Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. San antonio’s bexar county follows standard texas procedures for property tax liens. Real property may be seized and sold at sheriff sales for delinquent taxes, sales under writ of executions and order of sales to satisfy a. If you owe bexar county.

Everything You Need to Know About Bexar County Property Tax

However, with the right info about their property taxes, bexar county. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. If you owe bexar county delinquent property taxes, it can.

Bexar County Tax Office Pay Online Tax Preparation Classes

Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Real property may be seized and sold at sheriff sales for delinquent taxes, sales under writ of executions and order of sales to satisfy a. However, with the right info about their property taxes, bexar county. The county clerk is located at.

Property Tax Bexar 2023

Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. San antonio’s bexar.

Property Tax Bexar 2023

Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department. However, with the right info about their property taxes, bexar county. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and. Real property may be seized and sold at sheriff sales.

Everything You Need to Know About Bexar County Property Tax

If you owe bexar county delinquent property taxes, it can lead to a lot of debt. The county clerk is located at 100 dolorosa. However, with the right info about their property taxes, bexar county. Real property may be seized and sold at sheriff sales for delinquent taxes, sales under writ of executions and order of sales to satisfy a..

Real Property May Be Seized And Sold At Sheriff Sales For Delinquent Taxes, Sales Under Writ Of Executions And Order Of Sales To Satisfy A.

If you owe bexar county delinquent property taxes, it can lead to a lot of debt. San antonio’s bexar county follows standard texas procedures for property tax liens. Information concerning liens recorded against a property may be researched by the public in the county clerk’s deed records department. The county clerk is located at 100 dolorosa.

However, With The Right Info About Their Property Taxes, Bexar County.

Bexar county, tx, currently has 36 tax liens and 2,183 other distressed listings available as of january 8. Enter an address to find property deeds, owner information, property tax history, assessments, home values, sales history, mortgages, and.