State Tax Lien Definition

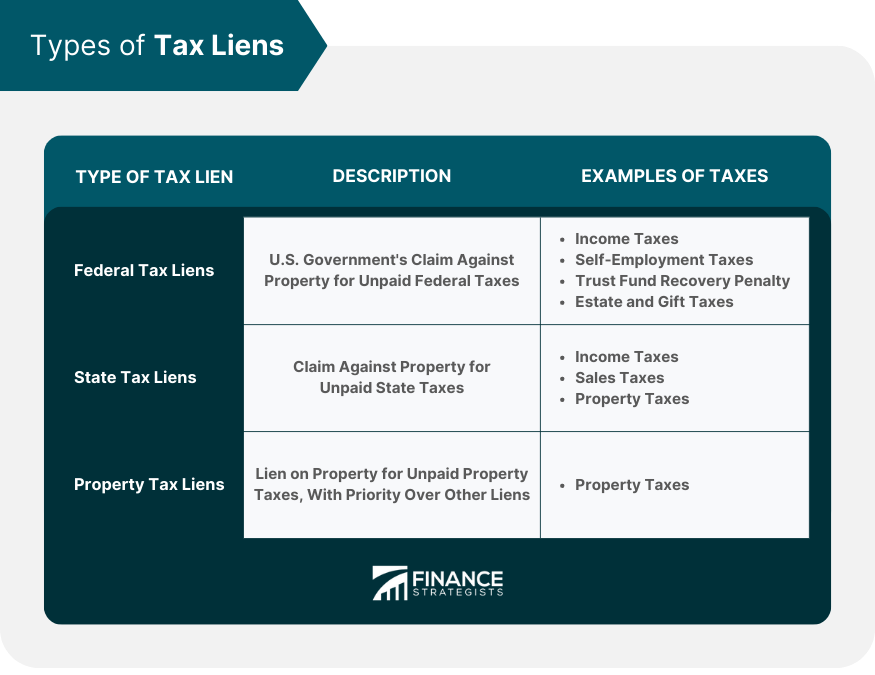

State Tax Lien Definition - State tax liens come into effect when you fail to pay your state taxes by the deadline. It gives the agency an interest in your property if. How state tax liens work. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien?

It gives the agency an interest in your property if. State tax liens come into effect when you fail to pay your state taxes by the deadline. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. A tax lien is a tactic state tax authorities use to collect outstanding debt. How state tax liens work. What is a tax lien?

State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. State tax liens come into effect when you fail to pay your state taxes by the deadline. How state tax liens work. A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien? It gives the agency an interest in your property if.

Quiz & Worksheet State Tax Liens

How state tax liens work. What is a tax lien? It gives the agency an interest in your property if. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. A tax lien is a tactic state tax authorities use to collect outstanding debt.

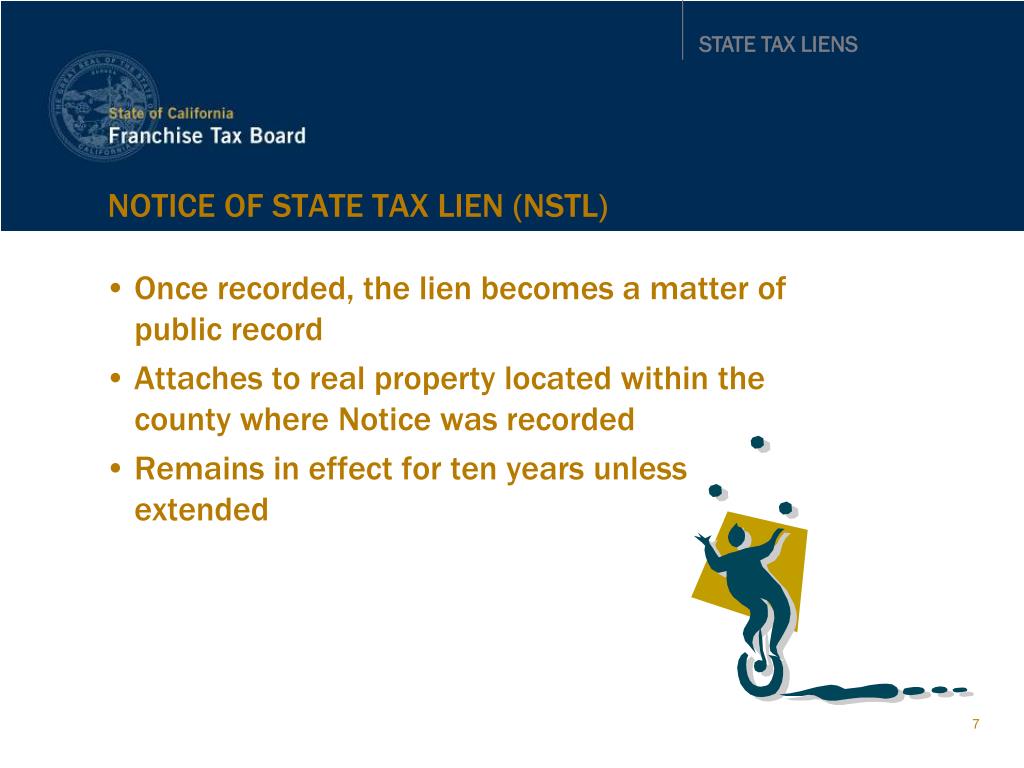

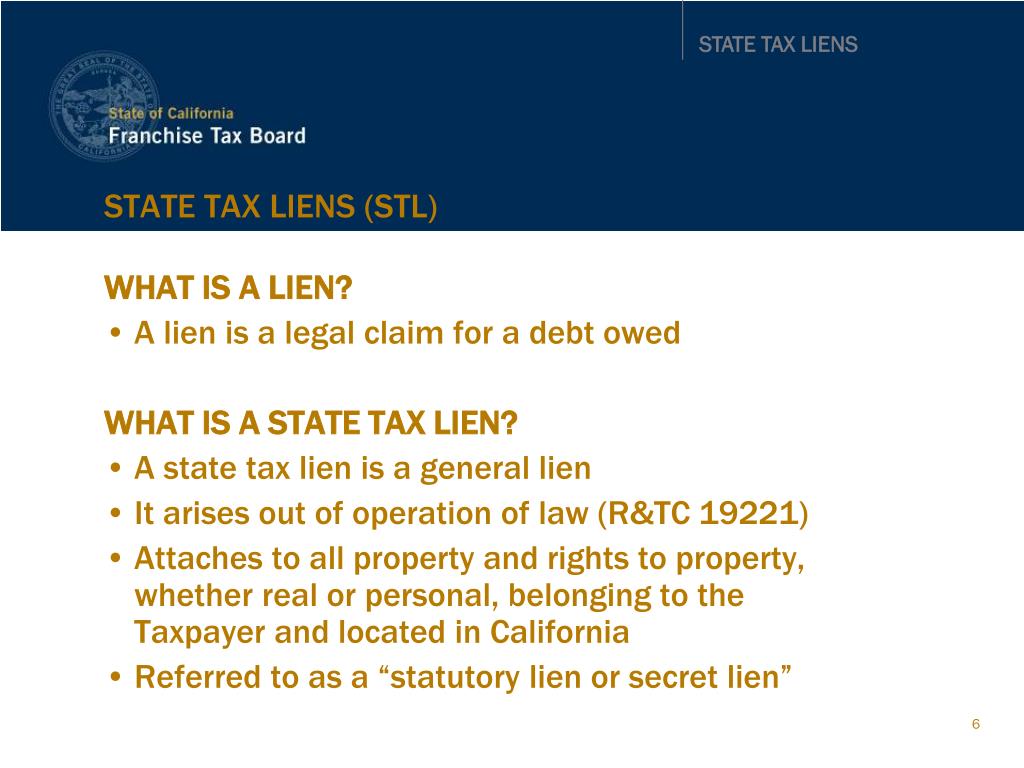

PPT STATE TAX LIENS PowerPoint Presentation, free download ID5396160

State tax liens come into effect when you fail to pay your state taxes by the deadline. A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien? State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. How state tax.

PPT STATE TAX LIENS PowerPoint Presentation, free download ID5396160

How state tax liens work. State tax liens come into effect when you fail to pay your state taxes by the deadline. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. What is a tax lien? A tax lien is a tactic state tax authorities use to collect.

Senator Browne

It gives the agency an interest in your property if. State tax liens come into effect when you fail to pay your state taxes by the deadline. What is a tax lien? How state tax liens work. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes.

State Tax Lien vs. Federal Tax Lien How to Remove Them

A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. What is a tax lien? It gives the agency an interest in your property if. How state tax liens work.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants, LLC

What is a tax lien? How state tax liens work. A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline. It gives the agency an interest in your property if.

HopOn Inc (HPNN) State and Federal Tax Liens and Judgment...

State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. How state tax liens work. What is a tax lien? A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by.

PPT STATE TAX LIENS PowerPoint Presentation, free download ID5396160

What is a tax lien? It gives the agency an interest in your property if. A tax lien is a tactic state tax authorities use to collect outstanding debt. State tax liens come into effect when you fail to pay your state taxes by the deadline. How state tax liens work.

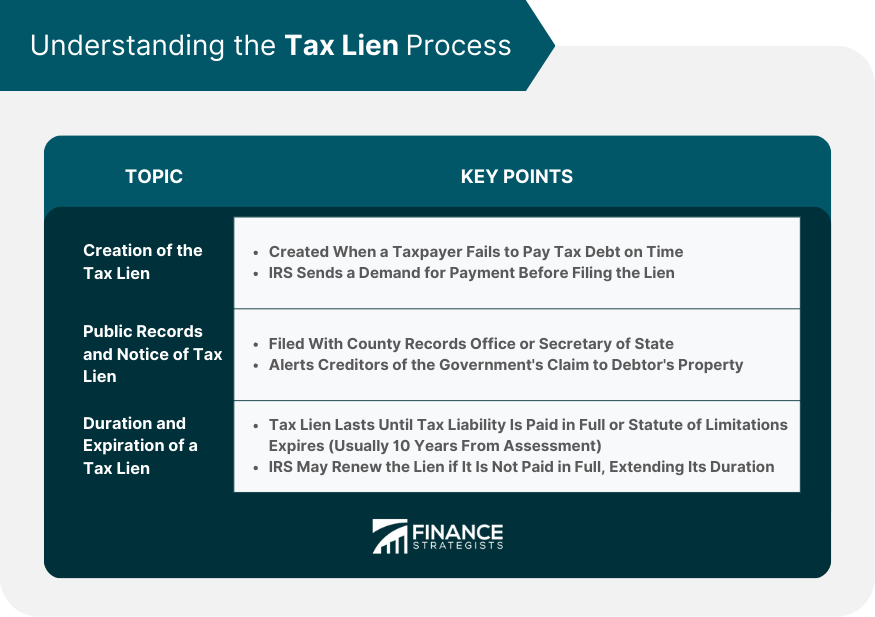

Tax Lien Definition, Process, Consequences, How to Handle

State tax liens come into effect when you fail to pay your state taxes by the deadline. It gives the agency an interest in your property if. How state tax liens work. State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. What is a tax lien?

Tax Lien Definition, Process, Consequences, How to Handle

State tax lien is a legal claim placed by a state government on a taxpayer’s property due to unpaid state taxes. A tax lien is a tactic state tax authorities use to collect outstanding debt. It gives the agency an interest in your property if. State tax liens come into effect when you fail to pay your state taxes by.

How State Tax Liens Work.

A tax lien is a tactic state tax authorities use to collect outstanding debt. What is a tax lien? It gives the agency an interest in your property if. State tax liens come into effect when you fail to pay your state taxes by the deadline.