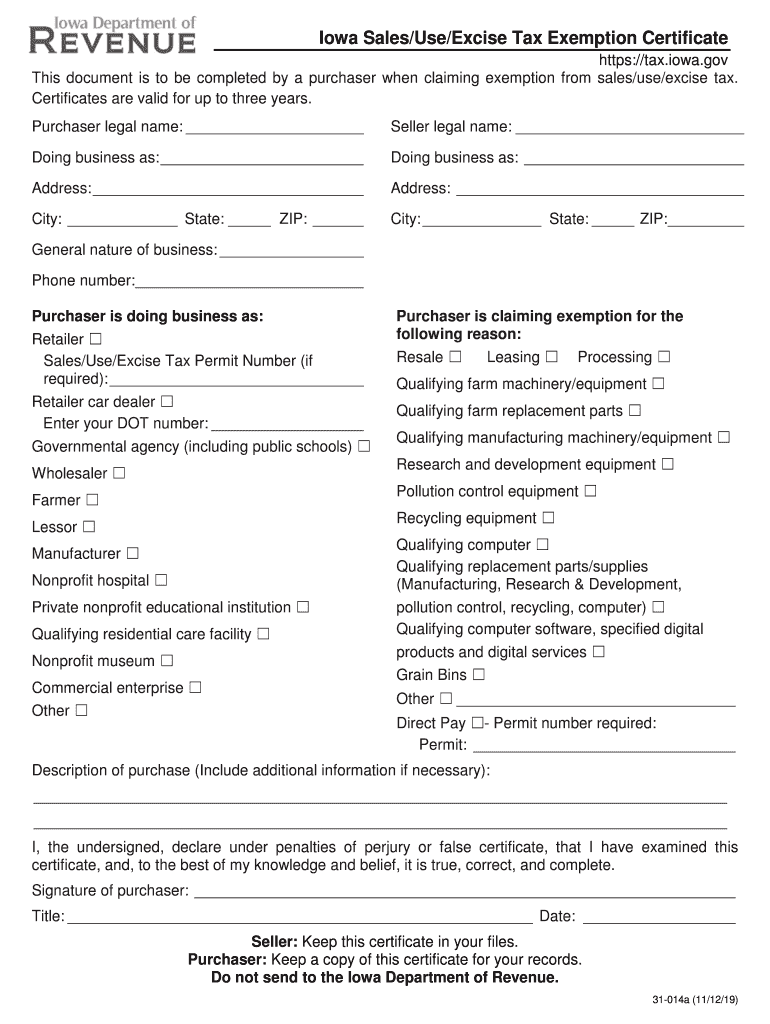

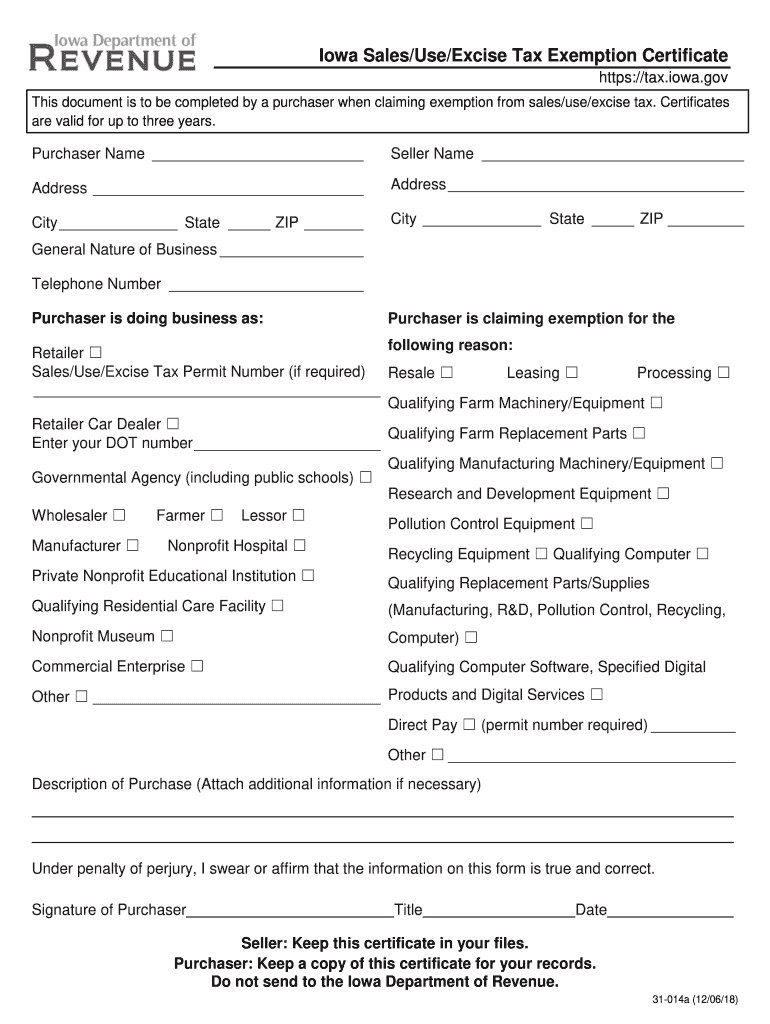

State Of Iowa Sales Tax Exemption Form

State Of Iowa Sales Tax Exemption Form - This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this. When normally taxable sales are made free of sales or use tax, the seller must require the purchaser to complete and sign a sales tax. The seller must retain this. Certificates are valid for up to three years. Certificates are valid for up to three years. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this.

The seller must retain this. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. The seller must retain this. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this. Certificates are valid for up to three years. When normally taxable sales are made free of sales or use tax, the seller must require the purchaser to complete and sign a sales tax. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Certificates are valid for up to three years.

The seller must retain this. Certificates are valid for up to three years. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this. The seller must retain this. When normally taxable sales are made free of sales or use tax, the seller must require the purchaser to complete and sign a sales tax. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller.

Exemption Sales Iowa Fillable Complete with ease airSlate SignNow

The seller must retain this. Certificates are valid for up to three years. The seller must retain this. The seller must retain this. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax.

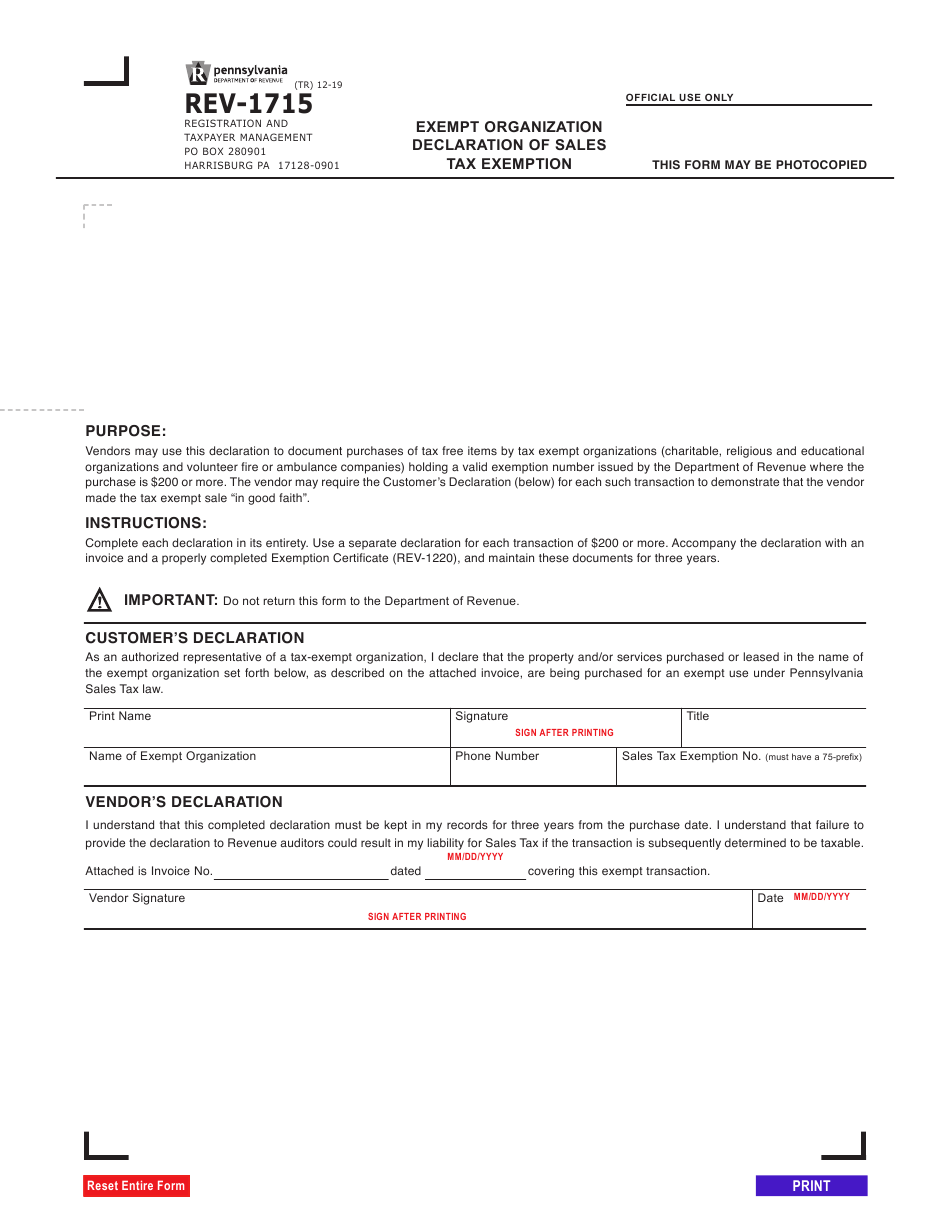

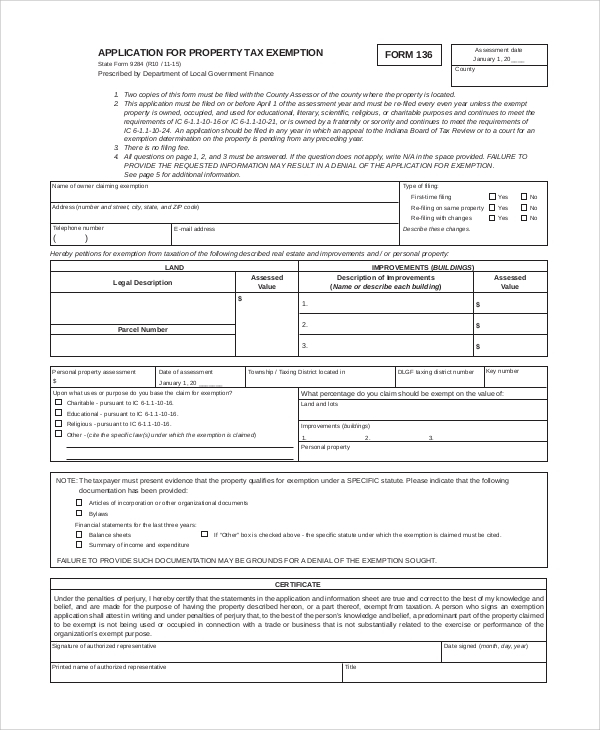

Pa Sales Taxe Exemption Form

The seller must retain this. Certificates are valid for up to three years. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this.

Tax Exemption Form 2024 Printable Ynez Analise

The seller must retain this. Certificates are valid for up to three years. Certificates are valid for up to three years. When normally taxable sales are made free of sales or use tax, the seller must require the purchaser to complete and sign a sales tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax.

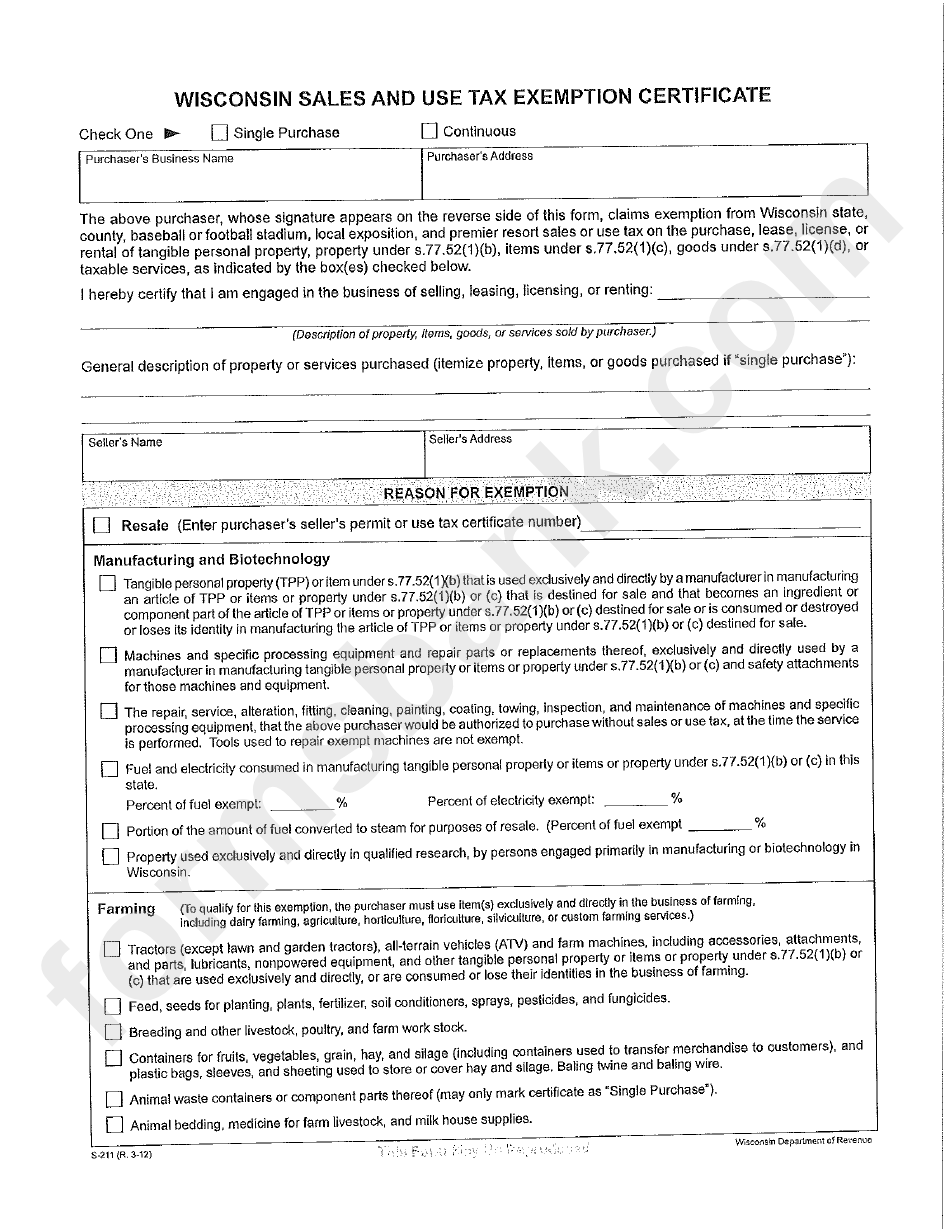

Wisconsin Sales And Use Tax Exemption Certificate Fill In Form

Certificates are valid for up to three years. Certificates are valid for up to three years. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this.

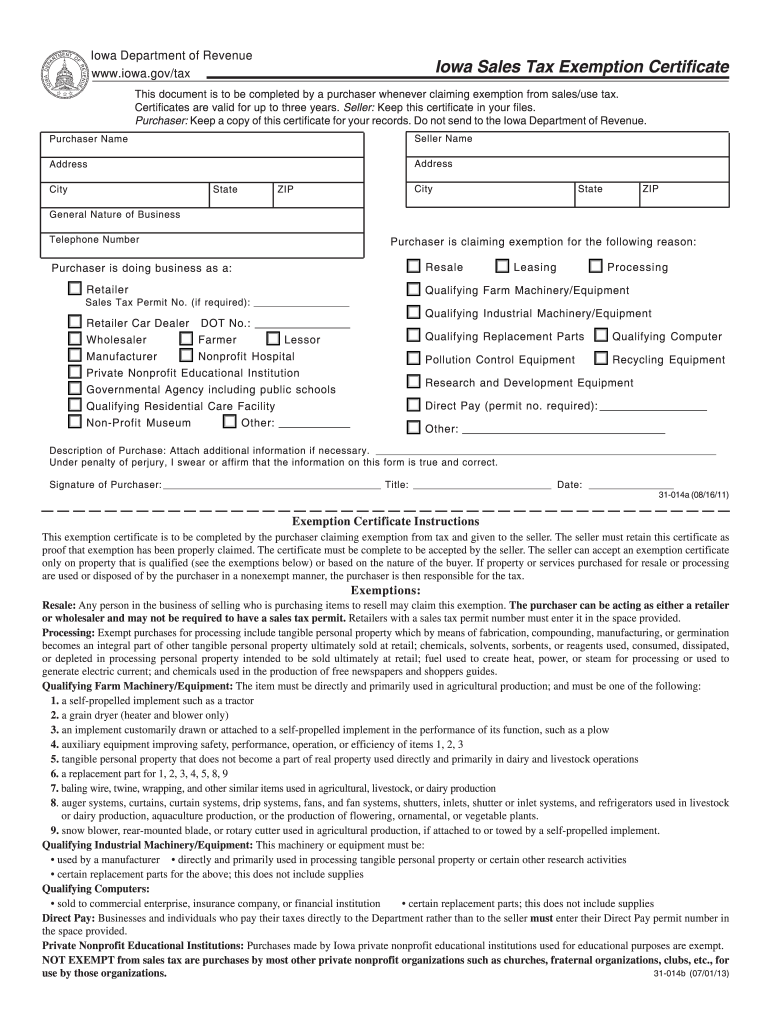

Iowa Sales Tax Exemption Certificate 20182024 Form Fill Out and Sign

Certificates are valid for up to three years. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This exemption certificate.

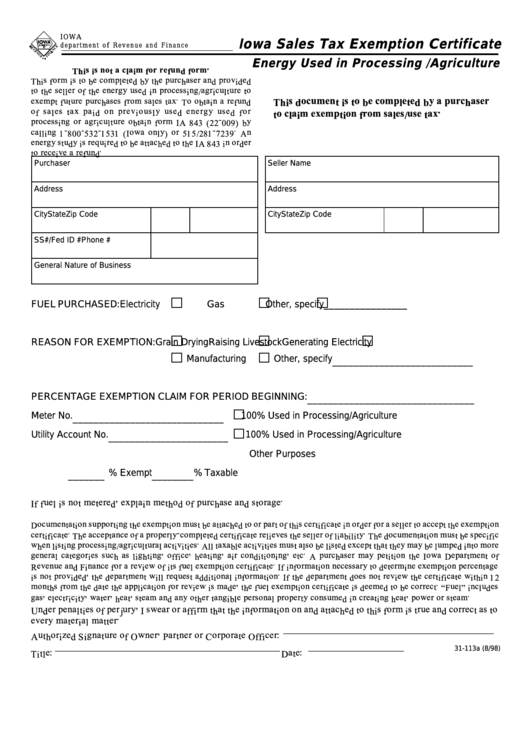

Form 31113b Iowa Sales Tax Exemption Certificate Energy Used In

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This document.

Iowa State Sales Tax Exemption Form Fill Out and Sign Printable PDF

The seller must retain this. The seller must retain this. When normally taxable sales are made free of sales or use tax, the seller must require the purchaser to complete and sign a sales tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Certificates are valid for up to.

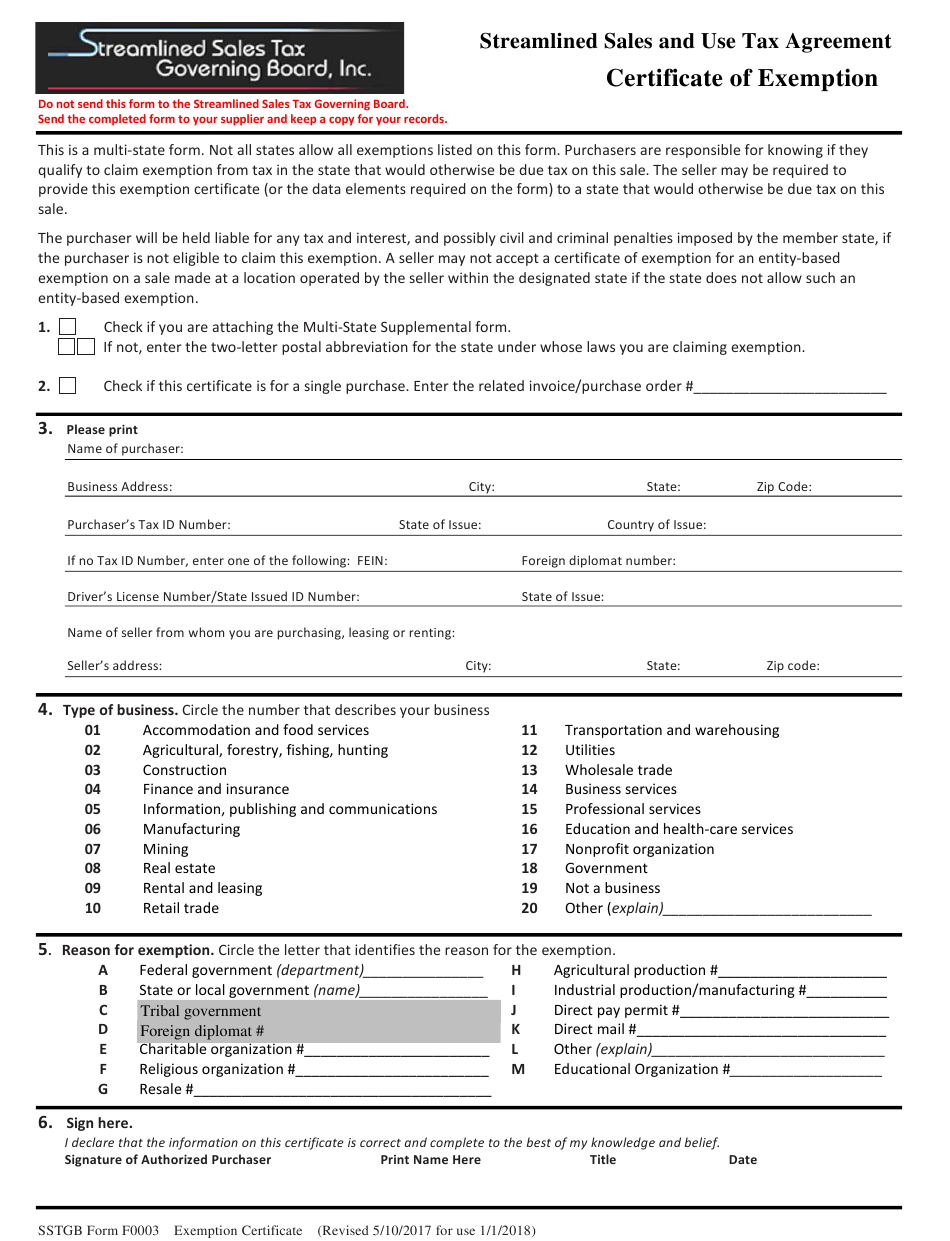

Tax Exempt Forms San Patricio Electric Cooperative

When normally taxable sales are made free of sales or use tax, the seller must require the purchaser to complete and sign a sales tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this. This exemption certificate is to be completed by the purchaser claiming.

Tax Exemption For 2024 Ellie Hesther

Certificates are valid for up to three years. Certificates are valid for up to three years. When normally taxable sales are made free of sales or use tax, the seller must require the purchaser to complete and sign a sales tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller..

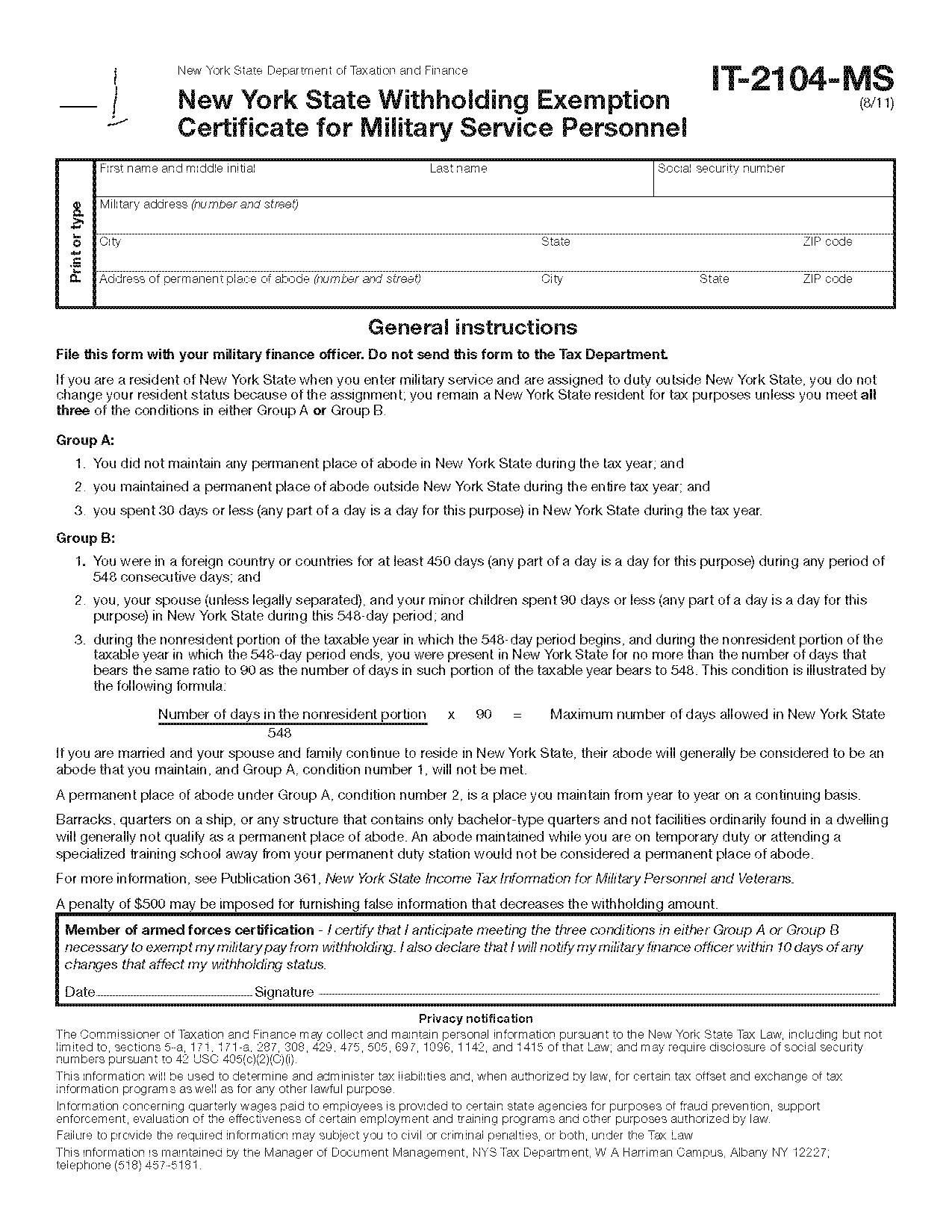

New York State Tax Withholding Exemption Form

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this. When normally taxable sales are made free of sales or use tax, the seller must require the purchaser to complete and sign a sales tax. This exemption certificate is to be completed by the purchaser claiming.

When Normally Taxable Sales Are Made Free Of Sales Or Use Tax, The Seller Must Require The Purchaser To Complete And Sign A Sales Tax.

The seller must retain this. Certificates are valid for up to three years. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller.

The Seller Must Retain This.

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. Certificates are valid for up to three years.