Spousal Lien On Marital Property

Spousal Lien On Marital Property - When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying the title to the property. All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of whether title is. You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. Spousal debts can affect property ownership, raising legal and financial considerations for couples. State laws vary widely on the extent of a creditor's ability to place liens on real property jointly owned by spouses. This arrangement allows one spouse to keep the home while the other. One alternative that can simplify this process is a divorce lien.

When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying the title to the property. You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. This arrangement allows one spouse to keep the home while the other. Spousal debts can affect property ownership, raising legal and financial considerations for couples. State laws vary widely on the extent of a creditor's ability to place liens on real property jointly owned by spouses. All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of whether title is. One alternative that can simplify this process is a divorce lien.

State laws vary widely on the extent of a creditor's ability to place liens on real property jointly owned by spouses. You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying the title to the property. This arrangement allows one spouse to keep the home while the other. One alternative that can simplify this process is a divorce lien. All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of whether title is. Spousal debts can affect property ownership, raising legal and financial considerations for couples.

Discussion of family problems with psychologist. Family conflicts

One alternative that can simplify this process is a divorce lien. You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. State laws vary widely on the extent of a creditor's ability to place liens on real property jointly owned by spouses. All.

Pennsylvania Marital Property Settlement Agreement Spousal Waiver

State laws vary widely on the extent of a creditor's ability to place liens on real property jointly owned by spouses. You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. This arrangement allows one spouse to keep the home while the other..

Pennsylvania Marital Property Settlement Agreement Spousal Waiver

You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. This arrangement allows one spouse to keep the home while the other. When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying the.

Premium Vector Marital property division flat composition with couple

Spousal debts can affect property ownership, raising legal and financial considerations for couples. You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of.

Pennsylvania Marital Property Settlement Agreement Spousal Waiver

You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of whether title is. One alternative that can simplify this process is a divorce.

Spousal Rights in Marital Properties PDF

Spousal debts can affect property ownership, raising legal and financial considerations for couples. You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying.

PREMARITAL COUNSELLING LONDON PACKAGE new* M.D.D Dating Coach

When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying the title to the property. Spousal debts can affect property ownership, raising legal and financial considerations for couples. All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of whether title.

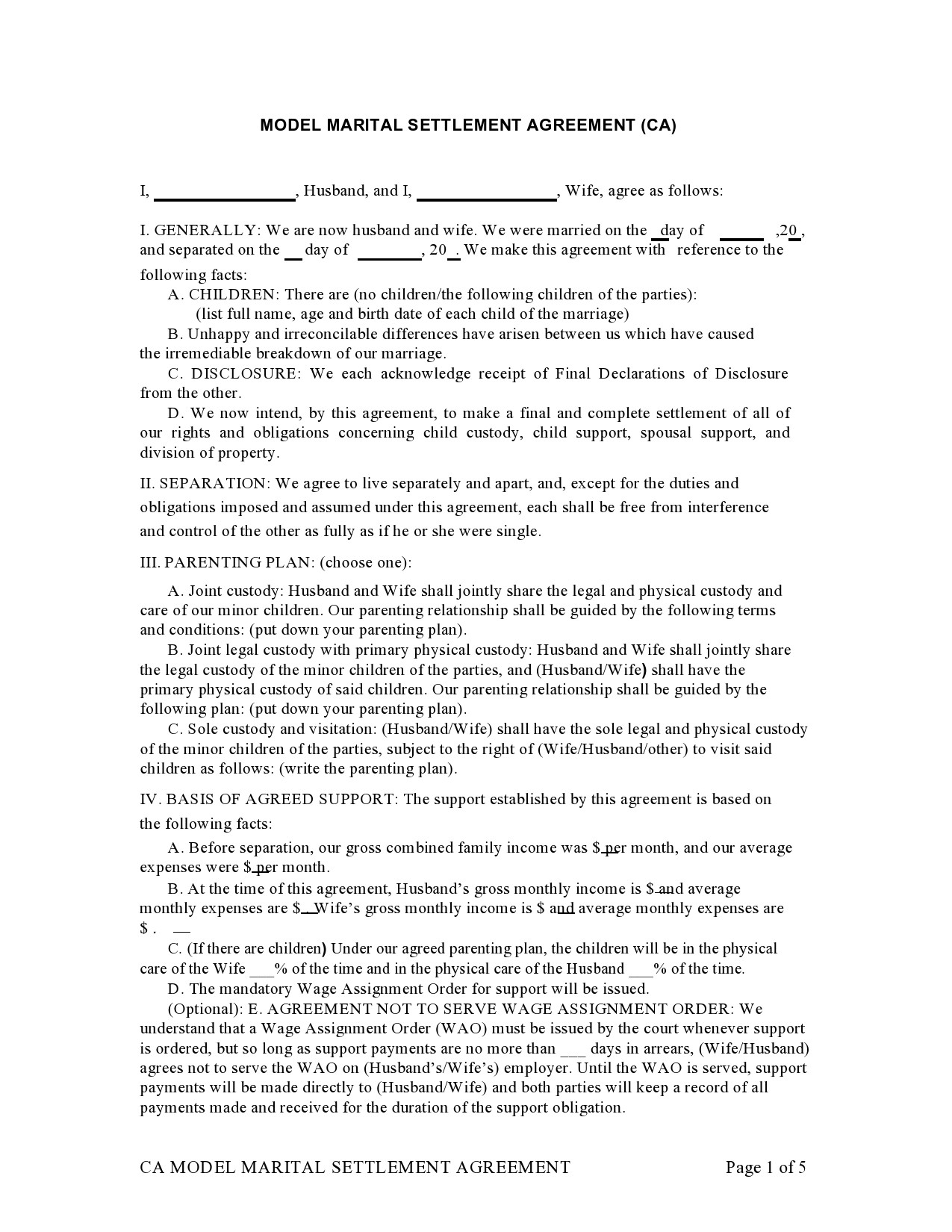

Marital Domestic Separation and Property Settlement Agreement Minor

All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of whether title is. Spousal debts can affect property ownership, raising legal and financial considerations for couples. When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying the title to the.

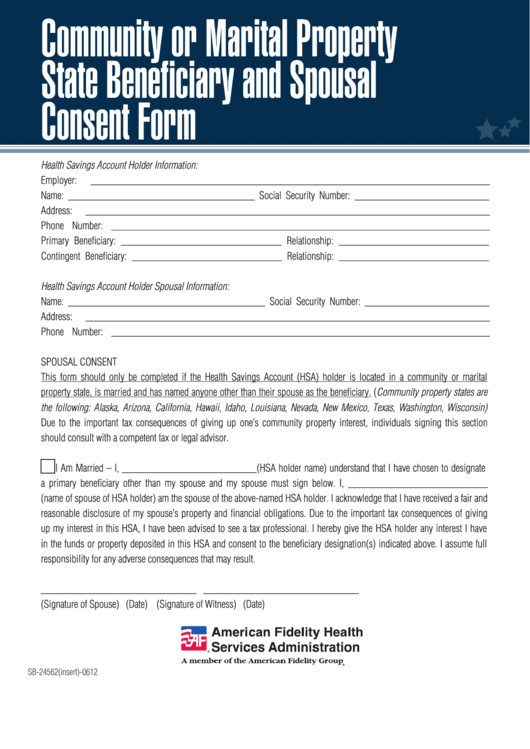

Community Or Marital Property State Beneficiary And Spousal Consent

When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying the title to the property. One alternative that can simplify this process is a divorce lien. All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of whether title is. You'll.

Separation And Property Settlement Agreement Template

Spousal debts can affect property ownership, raising legal and financial considerations for couples. One alternative that can simplify this process is a divorce lien. State laws vary widely on the extent of a creditor's ability to place liens on real property jointly owned by spouses. When couples utilize a divorce lien, the spouse who will not be living in the.

State Laws Vary Widely On The Extent Of A Creditor's Ability To Place Liens On Real Property Jointly Owned By Spouses.

You'll need to look at the spousal laws in your state to determine whether a lien can be placed on your home as a result of your. When couples utilize a divorce lien, the spouse who will not be living in the house signs a deed conveying the title to the property. This arrangement allows one spouse to keep the home while the other. All real or personal property acquired by either party during the marriage is presumed to be marital property regardless of whether title is.

One Alternative That Can Simplify This Process Is A Divorce Lien.

Spousal debts can affect property ownership, raising legal and financial considerations for couples.