Seattle Local Tax Rate

Seattle Local Tax Rate - The seattle sales tax rate is 3.85%. When you file a business license tax return, enter the gross revenue amount under each appropriate classification. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. There is no applicable county tax or. Use our local tax rate lookup tool to search for rates at a specific address or area in washington. Sign up for our notification service. You’ll find rates for sales and use tax, motor. Look up the current rate for a specific address using the same geolocation technology that powers the avalara.

The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. You’ll find rates for sales and use tax, motor. Sign up for our notification service. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. Use our local tax rate lookup tool to search for rates at a specific address or area in washington. The seattle sales tax rate is 3.85%. There is no applicable county tax or. When you file a business license tax return, enter the gross revenue amount under each appropriate classification.

536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The seattle sales tax rate is 3.85%. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Sign up for our notification service. When you file a business license tax return, enter the gross revenue amount under each appropriate classification. You’ll find rates for sales and use tax, motor. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. Use our local tax rate lookup tool to search for rates at a specific address or area in washington. There is no applicable county tax or.

Seattle Washington State Sales Tax Rate 2023

The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. There is no applicable county tax or. Sign up for our notification service. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Look up the current rate.

Sales Tax In Seattle Washington 2024 Mufi Tabina

536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Use our local tax rate lookup tool to search for rates at a specific address or area in.

City Of Seattle Bo Tax Rate 2018 Tax Walls

Use our local tax rate lookup tool to search for rates at a specific address or area in washington. The seattle sales tax rate is 3.85%. You’ll find rates for sales and use tax, motor. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. When you file a business license tax.

Tax Rate 2024 2024 Almeda Alexina

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Use our local tax rate lookup tool to search for rates at a specific address or area in washington. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Look up the current rate.

Elevated Tax & Accounting ETA always on time Tax & Accounting

When you file a business license tax return, enter the gross revenue amount under each appropriate classification. You’ll find rates for sales and use tax, motor. Sign up for our notification service. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Use our tax rate.

Seattle tax passes first hurdle

The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Use our tax rate lookup tool to find tax rates and location codes for any location in washington..

Seattle Sales Tax Rate 2025 Arlyn Caitrin

You’ll find rates for sales and use tax, motor. There is no applicable county tax or. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The 10.35%.

Tax Rate Comparison Olympia CUSD 16

You’ll find rates for sales and use tax, motor. The seattle sales tax rate is 3.85%. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. When you file a business license tax return, enter the gross revenue amount under each appropriate classification. There is no.

Seattle Sales Tax Rate Changes

There is no applicable county tax or. You’ll find rates for sales and use tax, motor. The seattle sales tax rate is 3.85%. Use our local tax rate lookup tool to search for rates at a specific address or area in washington. When you file a business license tax return, enter the gross revenue amount under each appropriate classification.

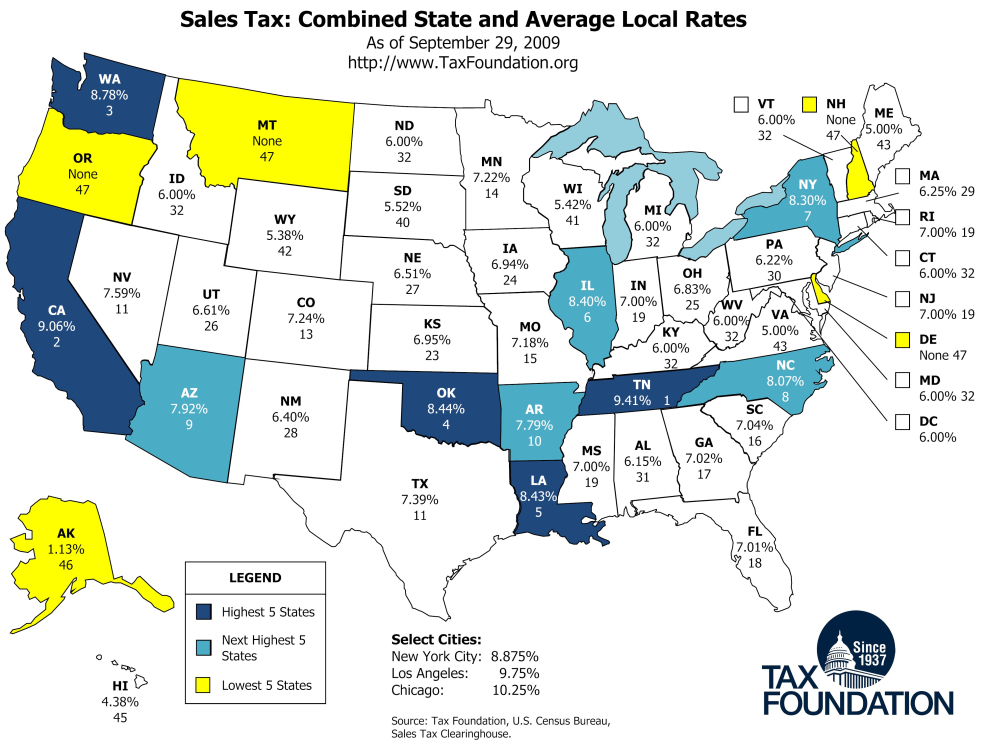

State local effective tax rates map Infogram

You’ll find rates for sales and use tax, motor. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Sign up for our notification service. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Use our local.

Sign Up For Our Notification Service.

Use our local tax rate lookup tool to search for rates at a specific address or area in washington. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax.

There Is No Applicable County Tax Or.

When you file a business license tax return, enter the gross revenue amount under each appropriate classification. You’ll find rates for sales and use tax, motor. Look up the current rate for a specific address using the same geolocation technology that powers the avalara. The seattle sales tax rate is 3.85%.