Schedule R Instructions Form 990

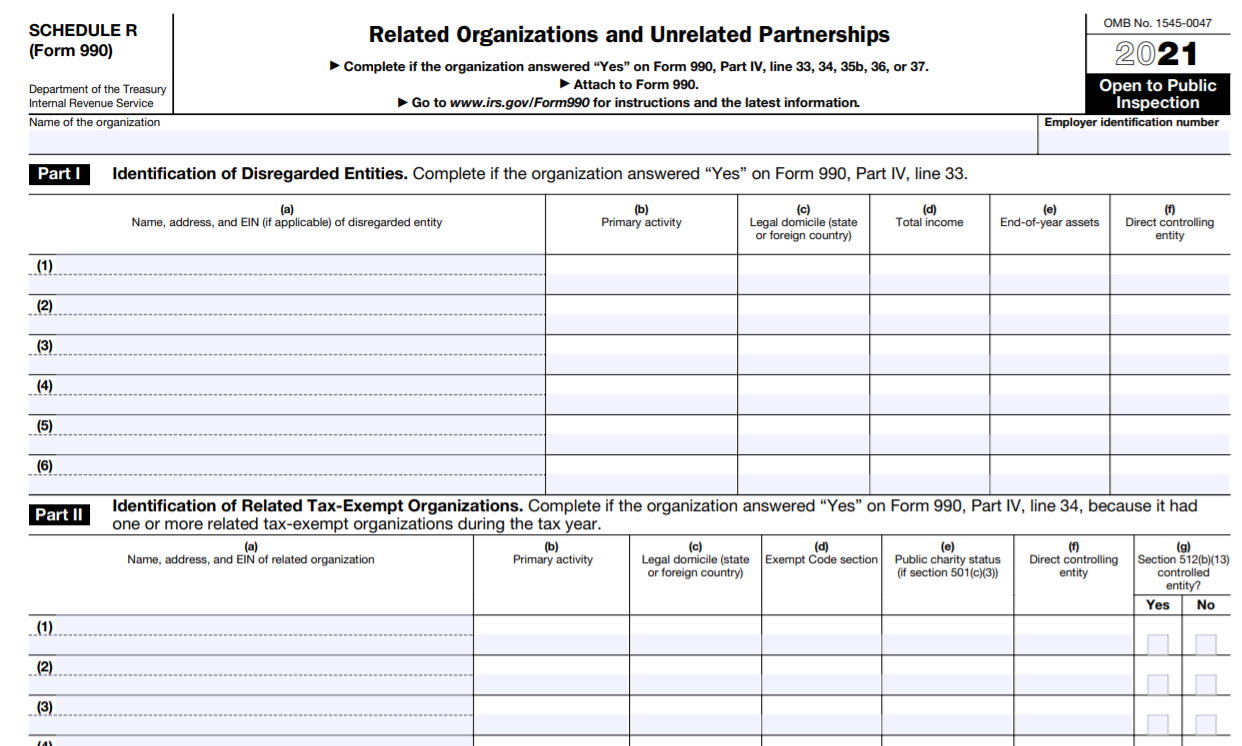

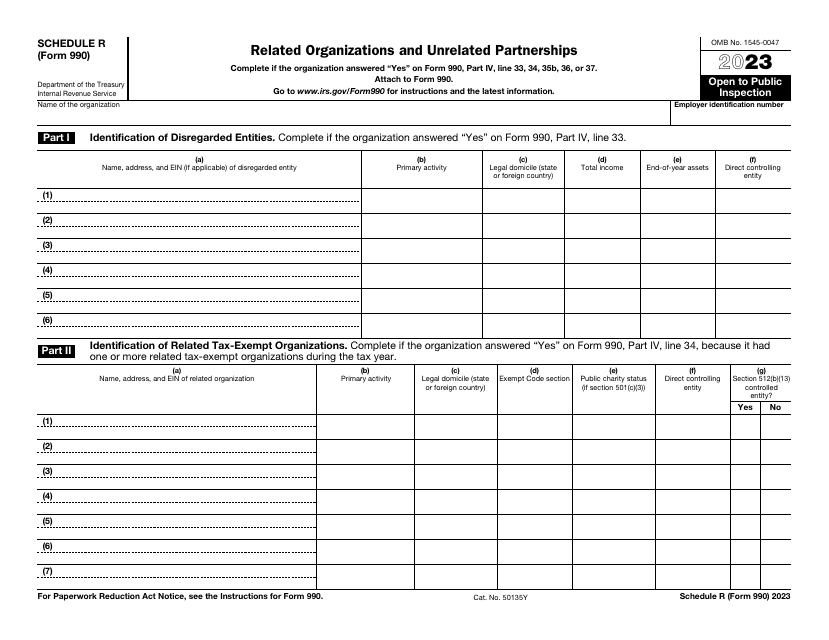

Schedule R Instructions Form 990 - Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Instruction 990 (schedule r) instructions for. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return : This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships.

This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Instruction 990 (schedule r) instructions for. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return : Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re.

Instruction 990 (schedule r) instructions for. Nonresident alien income tax return : Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made.

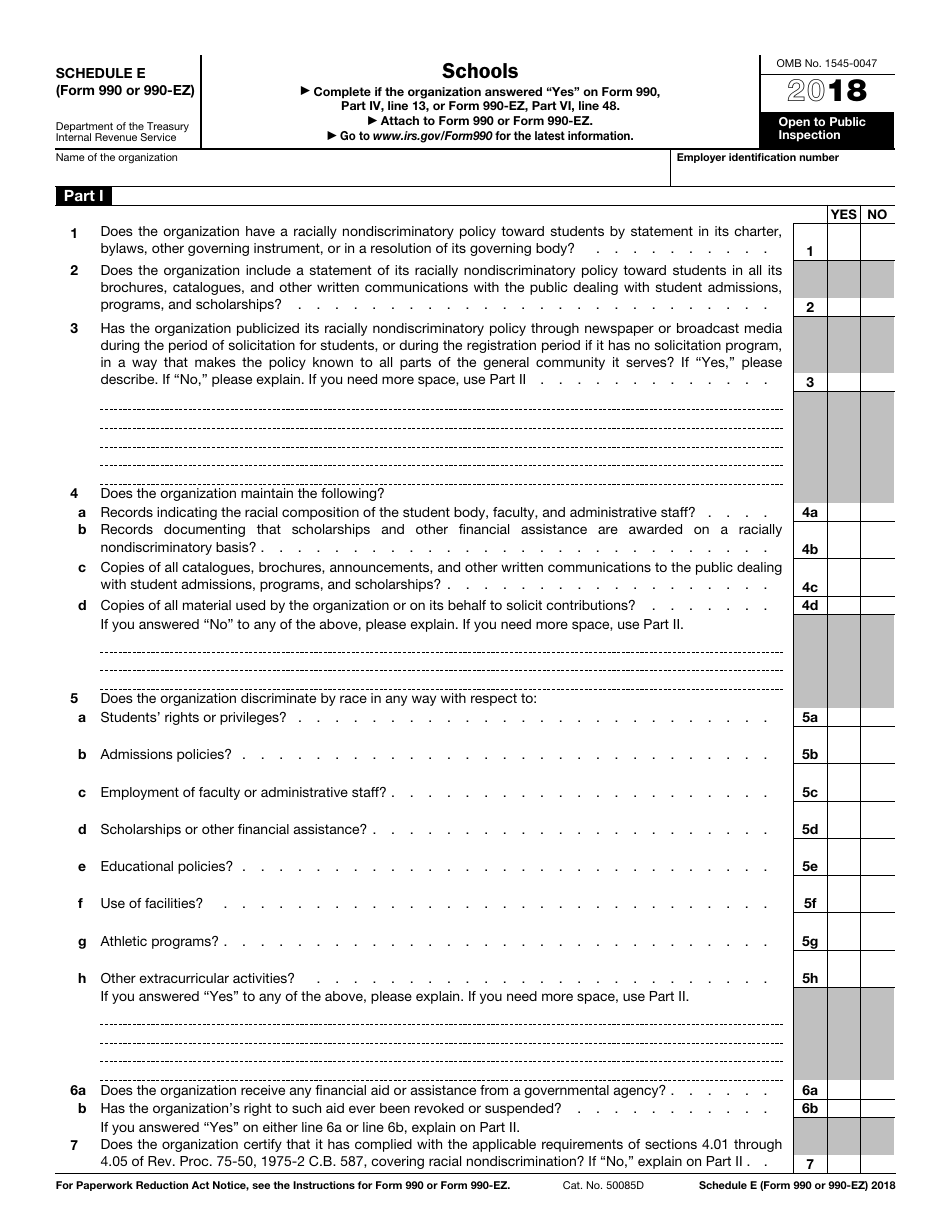

IRS Form 990 (990EZ) Schedule E 2018 Fill Out, Sign Online and

Nonresident alien income tax return : Instruction 990 (schedule r) instructions for. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. This document provides guidelines.

990 schedule r instructions Fill out & sign online DocHub

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Schedule r is filed by the organization with form 990 to report information on related organizations.

IRS Form 990 Schedule R Instructions Related Organizations and

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Instruction 990 (schedule r) instructions for. Nonresident alien income tax return : Schedule r is filed by the organization with form.

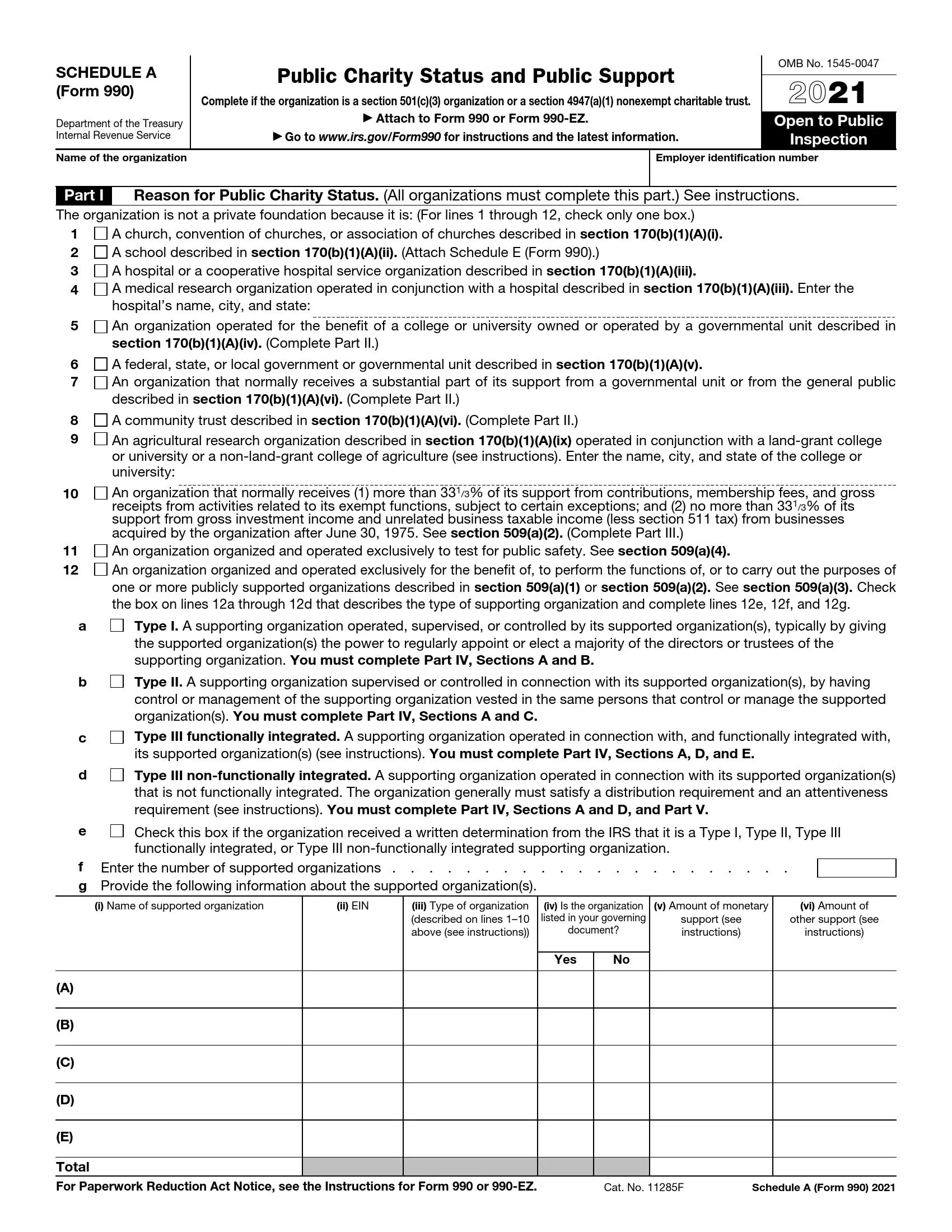

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Nonresident alien income tax return : Schedule r is filed by the organization with form 990.

IRS Schedule A Form 990 or 990EZ ≡ Fill Out Printable PDF Forms Online

Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return : Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990.

990 schedule b instructions Fill online, Printable, Fillable Blank

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return : Schedule r (form 990) is used by an organization that files form 990.

2021 IRS Form 990 by Ozarks Food Harvest Issuu

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Instruction 990 (schedule r) instructions for. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Schedule r (form 990) is used by an organization that files form 990 to provide.

Form 990 (Schedule R) Related Organizations and Unrelated

Nonresident alien income tax return : Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Instruction 990 (schedule r) instructions for. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. This document provides guidelines for completing schedule.

IRS Form 990 Schedule R Download Fillable PDF or Fill Online Related

Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return : Report each type of transaction for which you had $50,000 or more with.

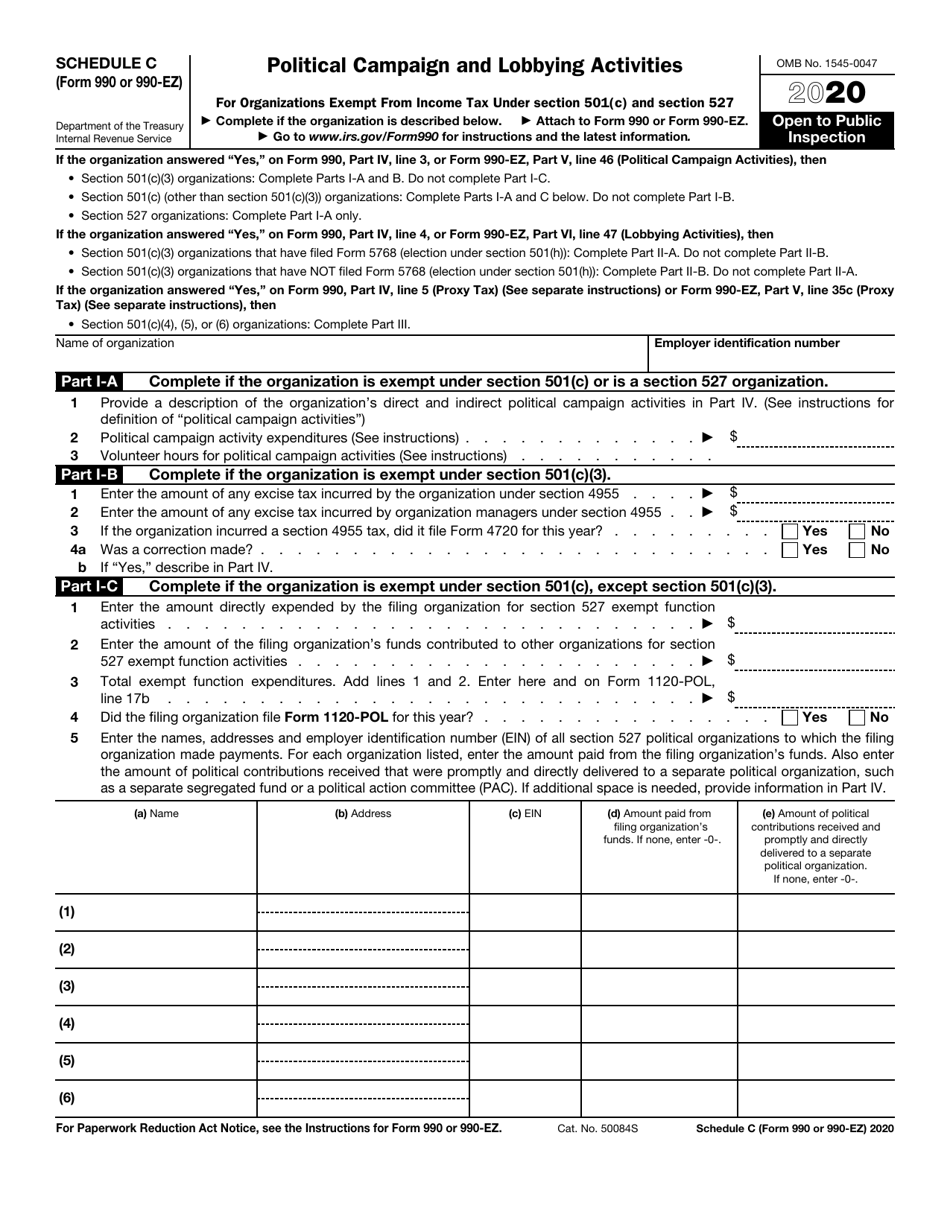

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations,.

Schedule R Is Filed By The Organization With Form 990 To Report Information On Related Organizations And Transactions Made.

This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Instruction 990 (schedule r) instructions for.