Schedule C Tax Form Instructions

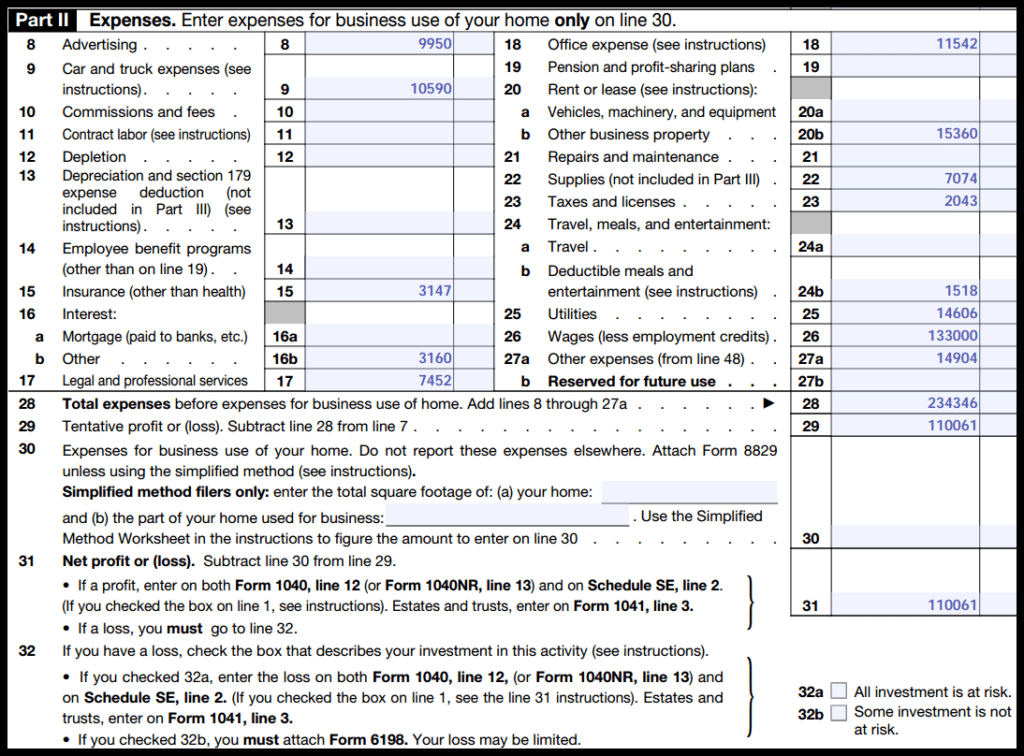

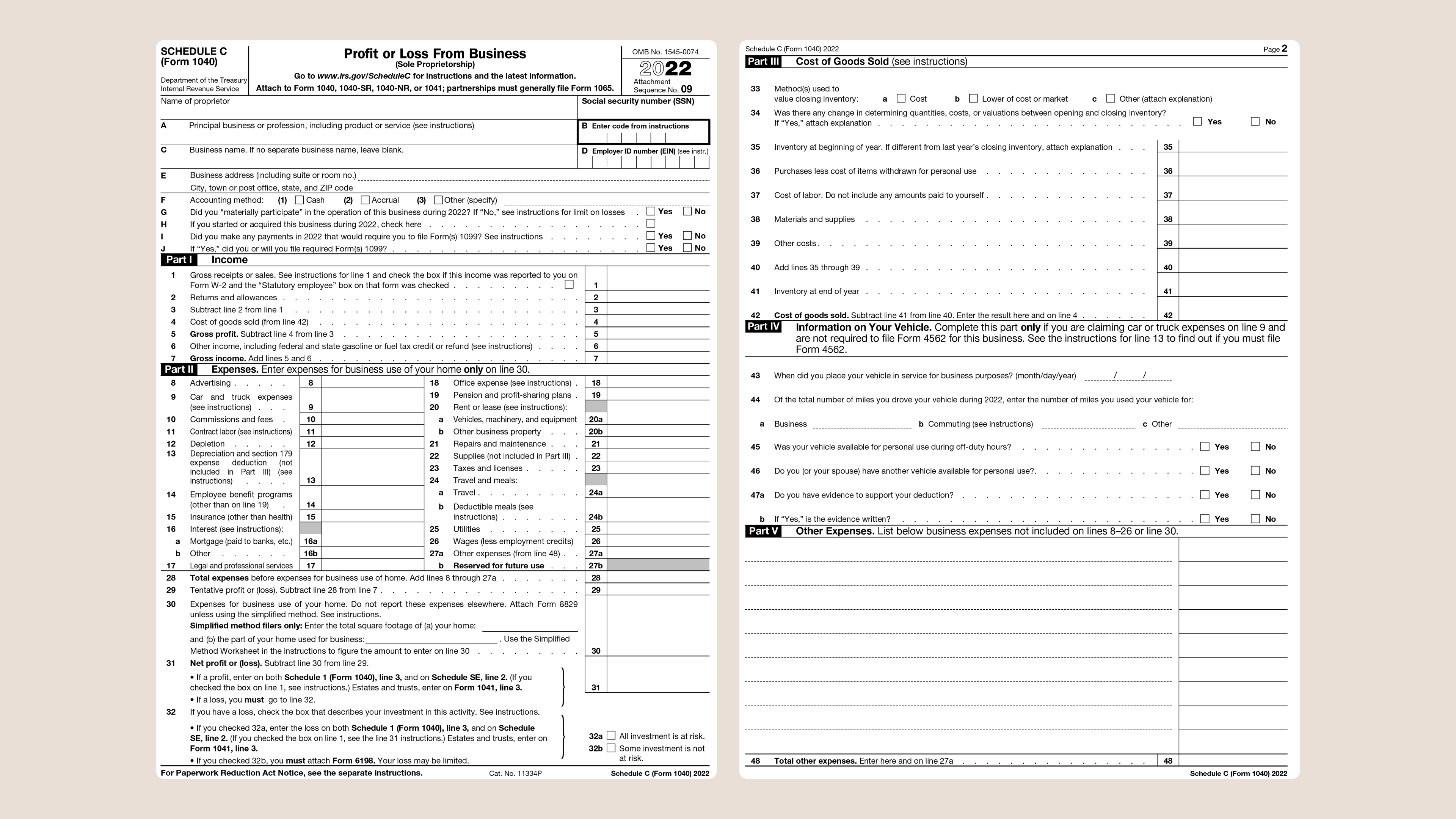

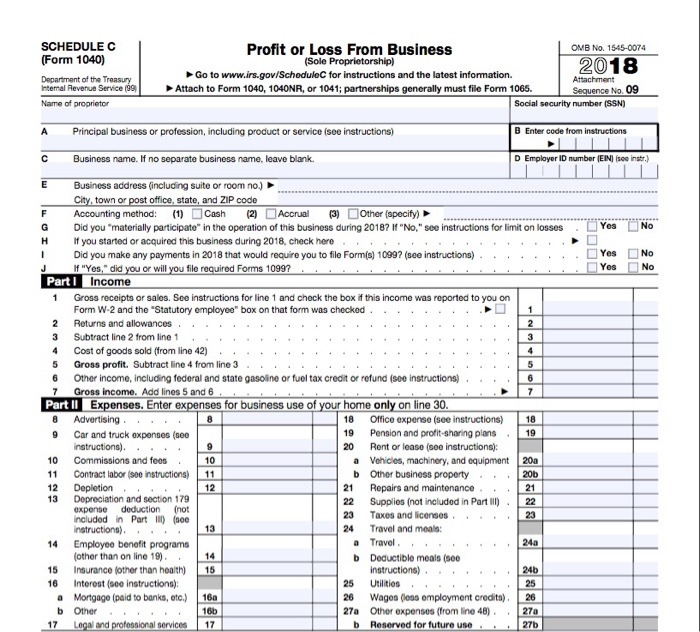

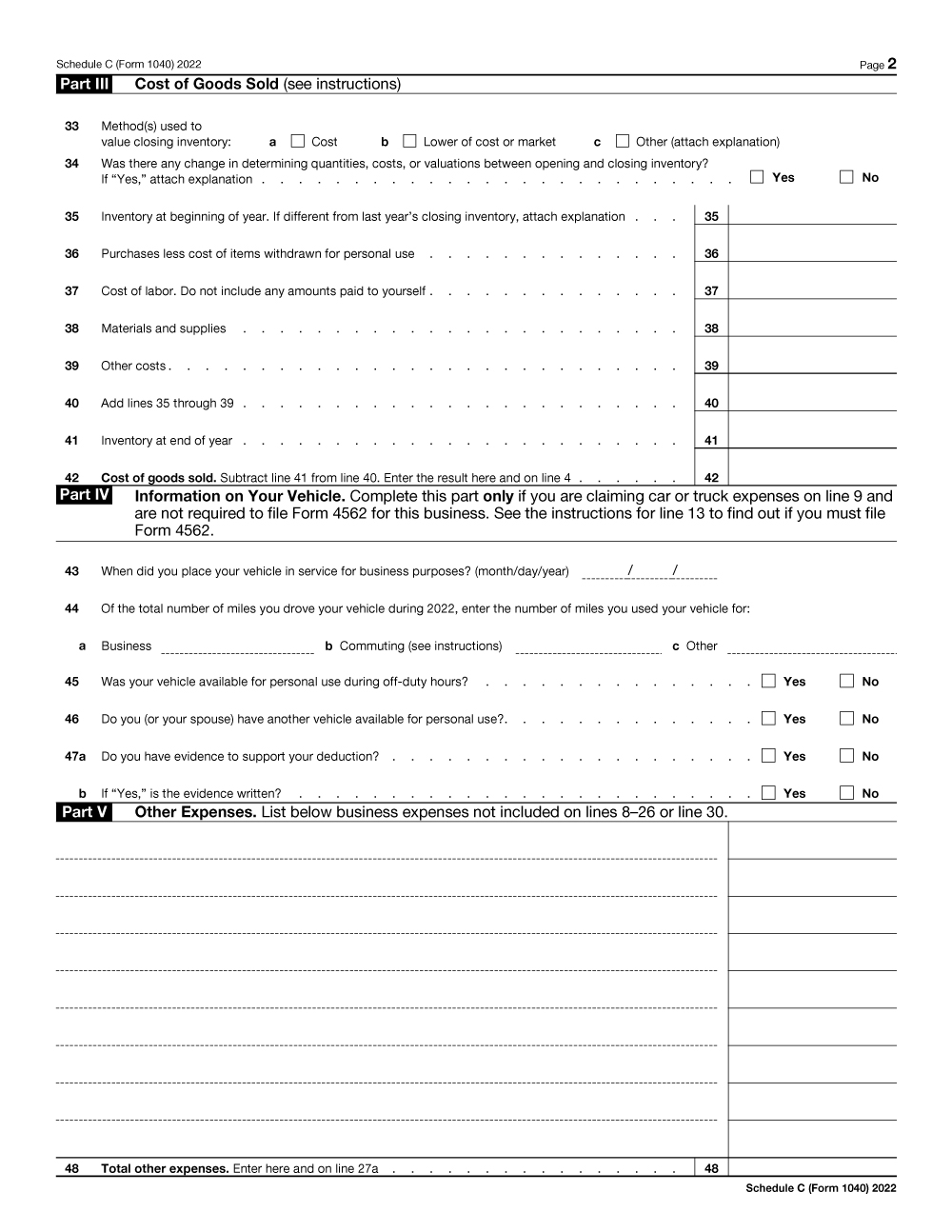

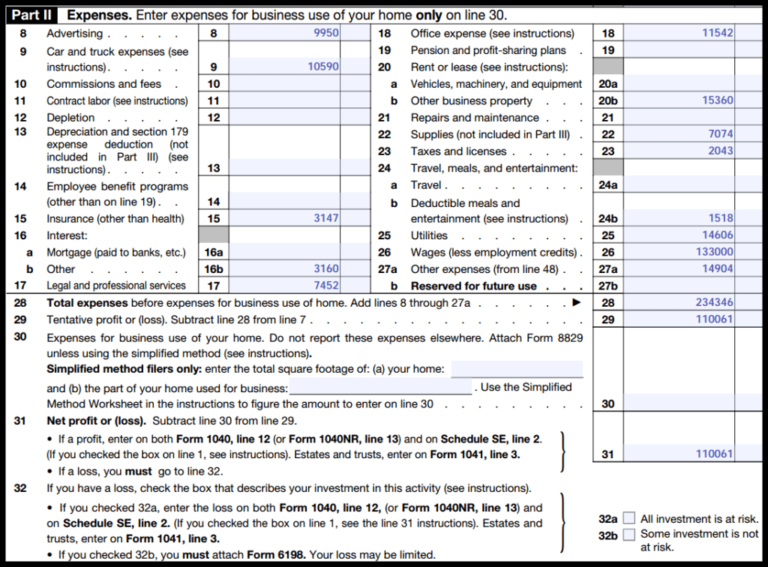

Schedule C Tax Form Instructions - Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Schedule c must be submitted with. The irs’s instructions for schedule c; Here is what schedule c form 1040 looks like. An activity qualifies as a business if your primary purpose for. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; This document allows you to report income, deductions, profits, and losses for your business. Before you fill it out, you’ll need: Your ssn (social security number) your ein (employer.

The irs’s instructions for schedule c; Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Your ssn (social security number) your ein (employer. Schedule c must be submitted with. This document allows you to report income, deductions, profits, and losses for your business. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Before you fill it out, you’ll need: An activity qualifies as a business if your primary purpose for. Here is what schedule c form 1040 looks like.

Here is what schedule c form 1040 looks like. This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. The irs’s instructions for schedule c; Schedule c must be submitted with. Before you fill it out, you’ll need: Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; An activity qualifies as a business if your primary purpose for.

Free Printable Schedule C Form

Schedule c must be submitted with. Here is what schedule c form 1040 looks like. This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. An activity qualifies as a business if your primary purpose for.

Do I Have To Fill Out A Schedule C For 2024 Mlb Schedule 2024

The irs’s instructions for schedule c; Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Your ssn (social security number) your ein (employer. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession.

What is an IRS Schedule C Form?

Before you fill it out, you’ll need: This document allows you to report income, deductions, profits, and losses for your business. Schedule c must be submitted with. Here is what schedule c form 1040 looks like. An activity qualifies as a business if your primary purpose for.

Schedule C Instructions 2024 Tax Form Aurie Carissa

Schedule c must be submitted with. The irs’s instructions for schedule c; Here is what schedule c form 1040 looks like. This document allows you to report income, deductions, profits, and losses for your business. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as.

Understanding the Schedule C Tax Form

An activity qualifies as a business if your primary purpose for. This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. Before you fill it out, you’ll need: Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced.

ACE 346 Homework 1 Schedule C Dave Sanders does

This document allows you to report income, deductions, profits, and losses for your business. Your ssn (social security number) your ein (employer. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Schedule c must be submitted with. An activity qualifies as a business if your.

Schedule C (Form 1040) 2023 Instructions

The irs’s instructions for schedule c; Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for. Your ssn (social security number) your ein (employer. Before you fill it out, you’ll need:

IRS Schedule C Instructions Step By Step Including C EZ 1040 Form

Here is what schedule c form 1040 looks like. This document allows you to report income, deductions, profits, and losses for your business. The irs’s instructions for schedule c; Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if.

Irs Schedule C Form 2023 Printable Forms Free Online

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. The irs’s instructions for schedule c; Your ssn (social security number) your ein (employer. Schedule c must be submitted with. This document allows you to report income, deductions, profits, and losses for your business.

Schedule C (Form 1040) 2023 Instructions

This document allows you to report income, deductions, profits, and losses for your business. Here is what schedule c form 1040 looks like. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Your ssn (social security number) your ein (employer. An activity qualifies as a.

Your Ssn (Social Security Number) Your Ein (Employer.

Schedule c must be submitted with. Here is what schedule c form 1040 looks like. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; This document allows you to report income, deductions, profits, and losses for your business.

The Irs’s Instructions For Schedule C;

An activity qualifies as a business if your primary purpose for. Before you fill it out, you’ll need: Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)