Pay Ga Tax Lien

Pay Ga Tax Lien - You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as well as. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. Penalties may include fees, liens, levies, and a. Taxpayers who fail to pay their property tax bills before november 15th will incur penalties.

Penalties may include fees, liens, levies, and a. Taxpayers who fail to pay their property tax bills before november 15th will incur penalties. You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as well as. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor.

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. Penalties may include fees, liens, levies, and a. You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as well as. Taxpayers who fail to pay their property tax bills before november 15th will incur penalties.

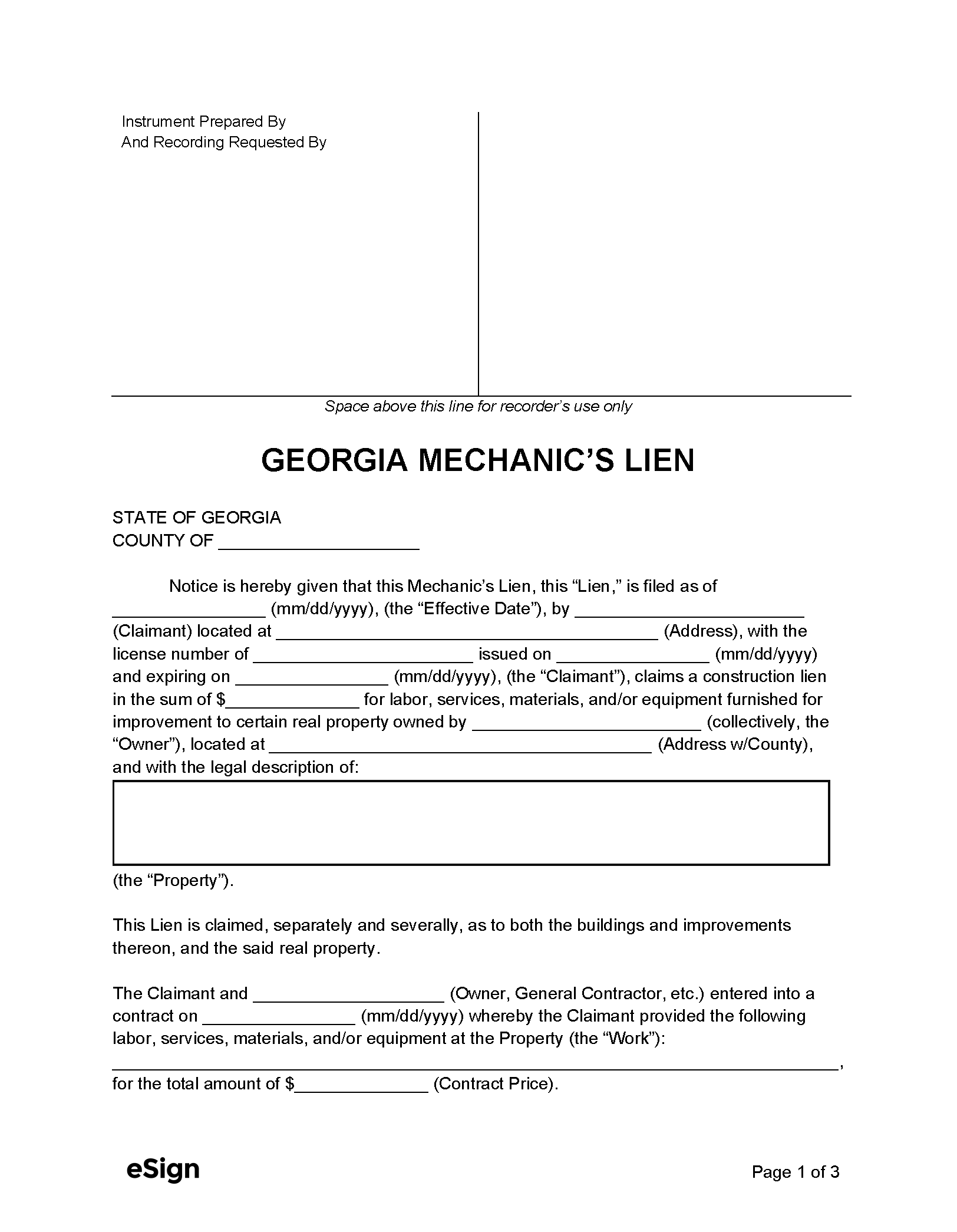

lien Doc Template pdfFiller

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. Taxpayers who fail to pay their property tax bills before november 15th will incur penalties. You can search our site for a wealth of information on any property in pickens county and you.

What Is A Tax Lien? Atlanta Tax Lawyer Alyssa Maloof Whatley

Taxpayers who fail to pay their property tax bills before november 15th will incur penalties. You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as well as. Penalties may include fees, liens, levies, and a. In georgia, tax liens stay in place until they expire,.

Investing Tax Lien Certificates SWFL Chronicle

Taxpayers who fail to pay their property tax bills before november 15th will incur penalties. You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as well as. Penalties may include fees, liens, levies, and a. In georgia, tax liens stay in place until they expire,.

When It’s Time to Seek Help from an Atlanta, GA Tax Lien Attorney

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as well as. Penalties may include fees, liens, levies,.

Free Mechanic's Lien Form PDF Word

You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as well as. Penalties may include fees, liens, levies, and a. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince.

Tax Lien Sale Download Free PDF Tax Lien Taxes

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as well as. Taxpayers who fail to pay their.

Federal tax lien on foreclosed property laderdriver

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. Penalties may include fees, liens, levies, and a. You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as.

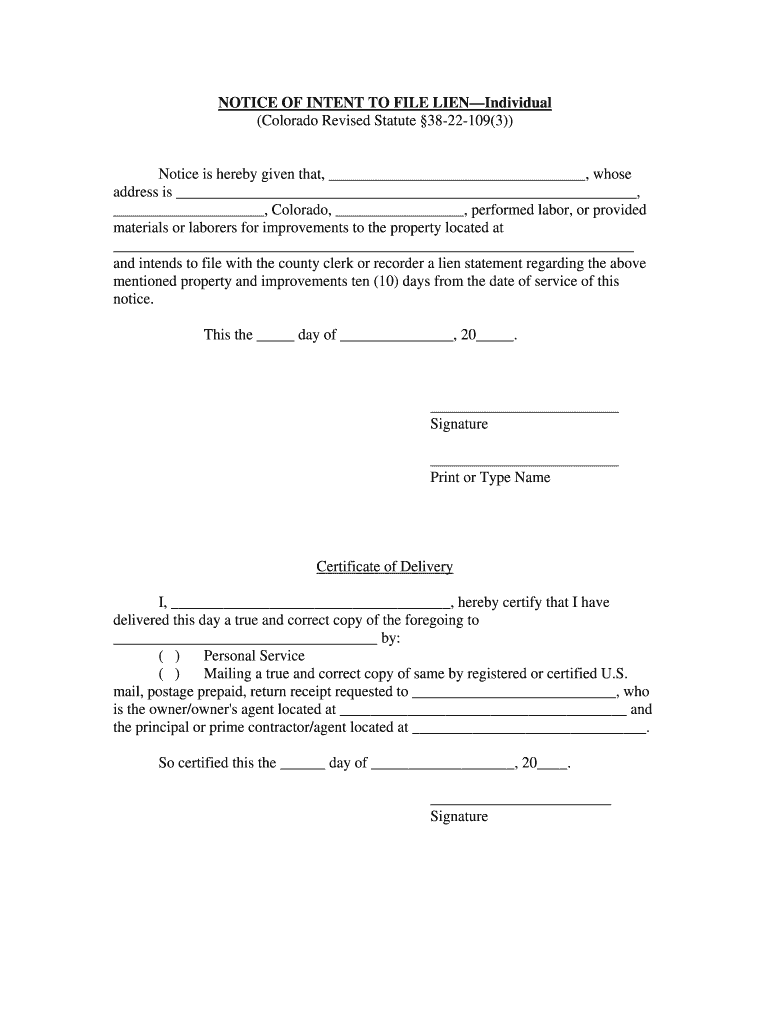

Notice Of Intent To Lien Colorado Pdf Fill Online, Printable

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. Penalties may include fees, liens, levies, and a. You can search our site for a wealth of information on any property in pickens county and you can securely pay your property taxes, as.

What's A Notice Of Federal Tax Lien? (video) IRSProb

Taxpayers who fail to pay their property tax bills before november 15th will incur penalties. Penalties may include fees, liens, levies, and a. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. You can search our site for a wealth of information.

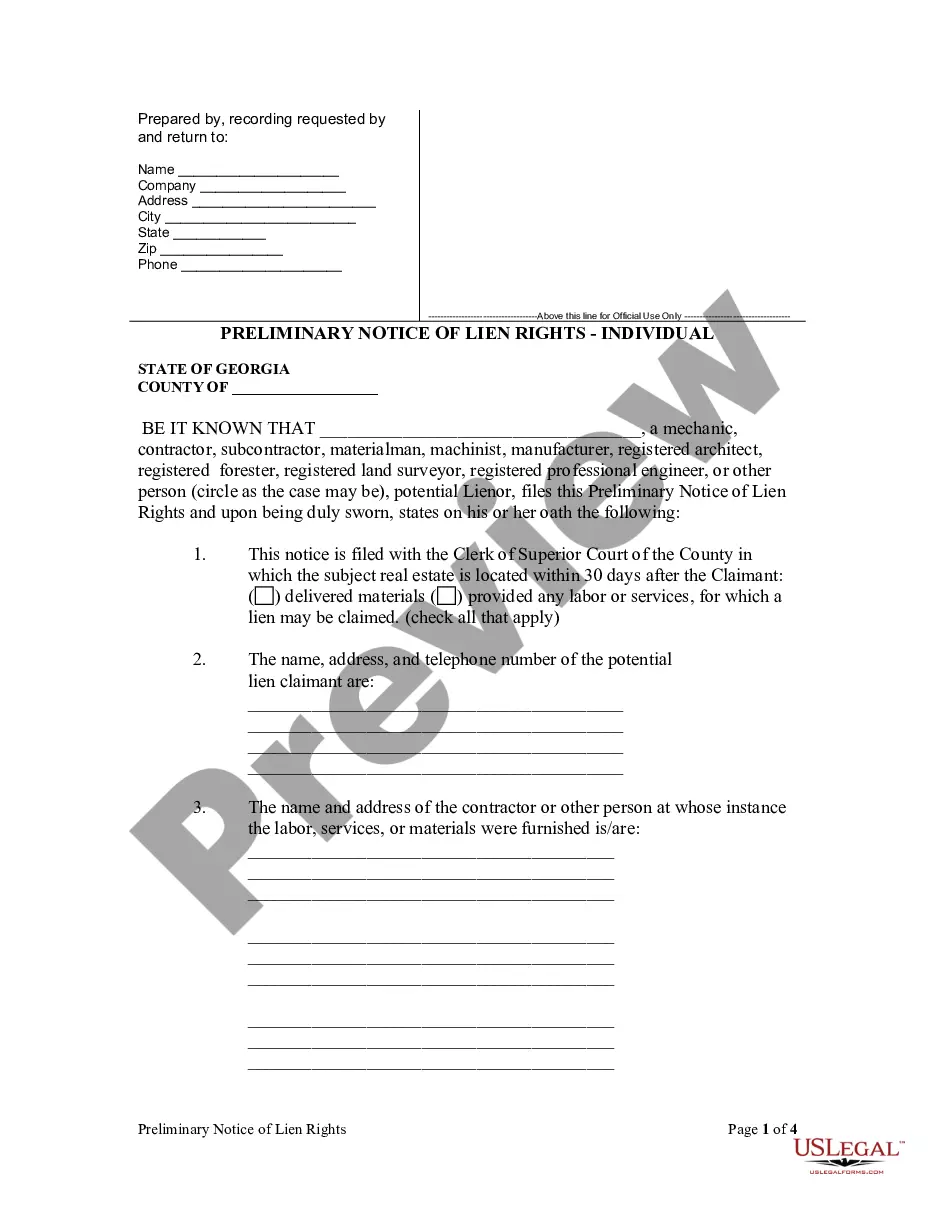

Lien Release Form US Legal Forms

Penalties may include fees, liens, levies, and a. Taxpayers who fail to pay their property tax bills before november 15th will incur penalties. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. You can search our site for a wealth of information.

You Can Search Our Site For A Wealth Of Information On Any Property In Pickens County And You Can Securely Pay Your Property Taxes, As Well As.

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor. Taxpayers who fail to pay their property tax bills before november 15th will incur penalties. Penalties may include fees, liens, levies, and a.