Pa Small Games Of Chance 60 40 Split

Pa Small Games Of Chance 60 40 Split - The state tavern games tax is 60 percent of net revenue of all tavern games, and the host municipality tax is 5 percent of net revenue. After entering itemized games of chance, clubs are required to report whether total proceeds were $40,000 or less for the prior calendar year. The ratio is a 60/40 split. “under the standard rule in effect before the pandemic, clubs were permitted to retain 40% of their small games of chance. Therefore, pa sgoc licensees can use 100% of their small games of chance net proceeds until june 16, 2022 (1 year from when. Clubs only report small games of chance activity that occurs during the reporting period (the calendar year). A club licensee must use, at a minimum, 60 percent of its games of chance proceeds per calendar year. Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes.

The ratio is a 60/40 split. The state tavern games tax is 60 percent of net revenue of all tavern games, and the host municipality tax is 5 percent of net revenue. Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. Therefore, pa sgoc licensees can use 100% of their small games of chance net proceeds until june 16, 2022 (1 year from when. “under the standard rule in effect before the pandemic, clubs were permitted to retain 40% of their small games of chance. After entering itemized games of chance, clubs are required to report whether total proceeds were $40,000 or less for the prior calendar year. A club licensee must use, at a minimum, 60 percent of its games of chance proceeds per calendar year. Clubs only report small games of chance activity that occurs during the reporting period (the calendar year).

A club licensee must use, at a minimum, 60 percent of its games of chance proceeds per calendar year. The ratio is a 60/40 split. After entering itemized games of chance, clubs are required to report whether total proceeds were $40,000 or less for the prior calendar year. Clubs only report small games of chance activity that occurs during the reporting period (the calendar year). The state tavern games tax is 60 percent of net revenue of all tavern games, and the host municipality tax is 5 percent of net revenue. Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. “under the standard rule in effect before the pandemic, clubs were permitted to retain 40% of their small games of chance. Therefore, pa sgoc licensees can use 100% of their small games of chance net proceeds until june 16, 2022 (1 year from when.

CalTrend Rear 60/40 Split Bench NeoSupreme Seat Covers for 20192020

Clubs only report small games of chance activity that occurs during the reporting period (the calendar year). Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. A club licensee must use, at a minimum, 60 percent of its games of chance proceeds per calendar year. Therefore, pa sgoc licensees can.

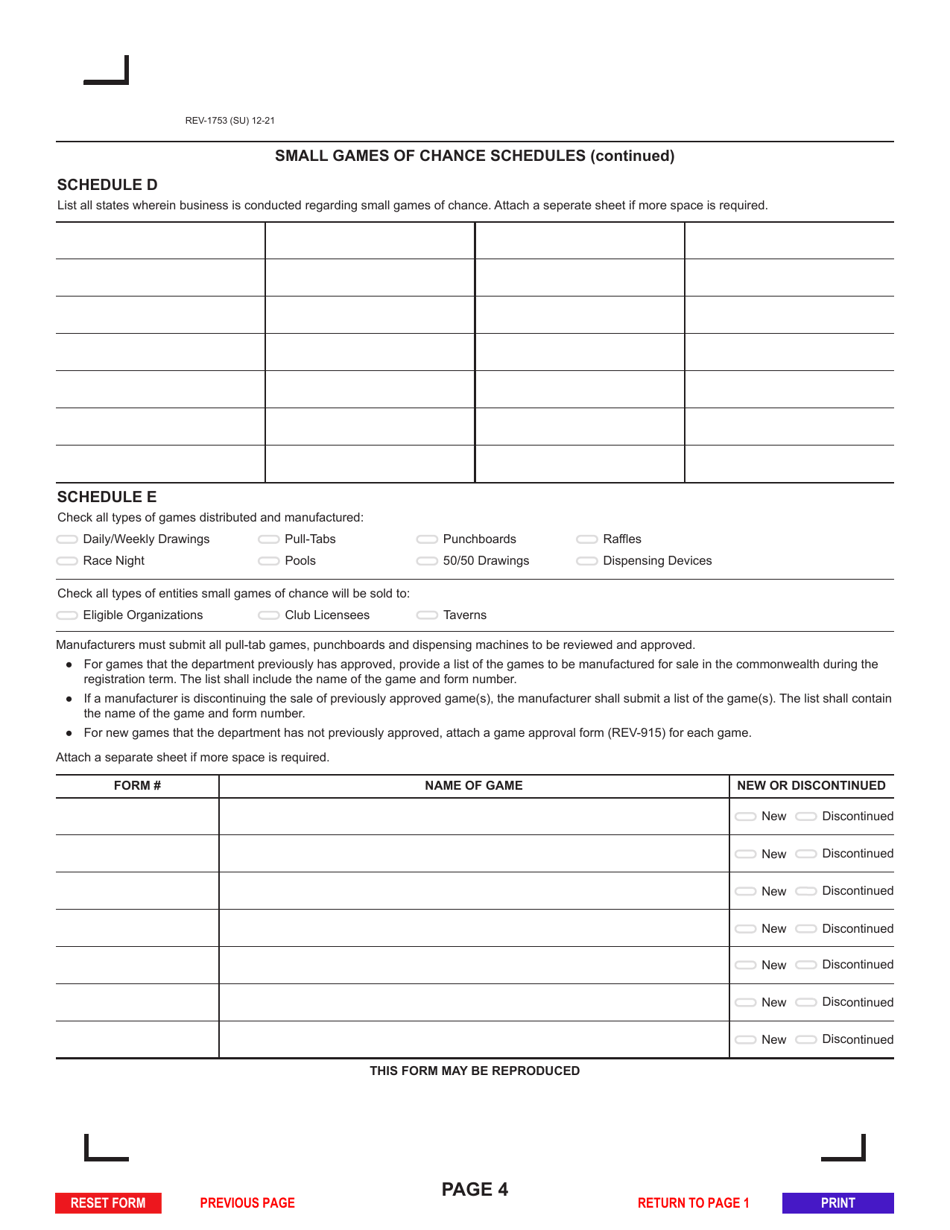

Form REV1753 Download Fillable PDF or Fill Online Application for

Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. After entering itemized games of chance, clubs are required to report whether total proceeds were $40,000 or less for the prior calendar year. The ratio is a 60/40 split. A club licensee must use, at a minimum, 60 percent of its.

REV915 PA Small Games of Chance for Game Approval Free Download

“under the standard rule in effect before the pandemic, clubs were permitted to retain 40% of their small games of chance. Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. A club licensee must use, at a minimum, 60 percent of its games of chance proceeds per calendar year. Clubs.

Small Games of Chance Laws in PA Webinar Feb 23 2021 YouTube

The ratio is a 60/40 split. A club licensee must use, at a minimum, 60 percent of its games of chance proceeds per calendar year. Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. Therefore, pa sgoc licensees can use 100% of their small games of chance net proceeds until.

C5SDC34Designcovers Fits 20042012 Ford Ranger/Mazda BSeries Cotton

Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. “under the standard rule in effect before the pandemic, clubs were permitted to retain 40% of their small games of chance. Clubs only report small games of chance activity that occurs during the reporting period (the calendar year). The state tavern.

Why games of skill are so controversial in PA • Spotlight PA

The state tavern games tax is 60 percent of net revenue of all tavern games, and the host municipality tax is 5 percent of net revenue. “under the standard rule in effect before the pandemic, clubs were permitted to retain 40% of their small games of chance. The ratio is a 60/40 split. Clubs only report small games of chance.

West Goshen Republicans to raffle off AR15style rifle Daily Local

The state tavern games tax is 60 percent of net revenue of all tavern games, and the host municipality tax is 5 percent of net revenue. The ratio is a 60/40 split. After entering itemized games of chance, clubs are required to report whether total proceeds were $40,000 or less for the prior calendar year. Therefore, pa sgoc licensees can.

X 21" X 10" Deep Double Bowl (60/40 Split) Farmhouse Apron Zero 16

The state tavern games tax is 60 percent of net revenue of all tavern games, and the host municipality tax is 5 percent of net revenue. Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. “under the standard rule in effect before the pandemic, clubs were permitted to retain 40%.

PA Small Games of Chance September 2014

The state tavern games tax is 60 percent of net revenue of all tavern games, and the host municipality tax is 5 percent of net revenue. Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. After entering itemized games of chance, clubs are required to report whether total proceeds were.

PPT SMALL GAMES OF CHANCE PowerPoint Presentation, free download ID

“under the standard rule in effect before the pandemic, clubs were permitted to retain 40% of their small games of chance. The ratio is a 60/40 split. Clubs only report small games of chance activity that occurs during the reporting period (the calendar year). A club licensee must use, at a minimum, 60 percent of its games of chance proceeds.

The Ratio Is A 60/40 Split.

“under the standard rule in effect before the pandemic, clubs were permitted to retain 40% of their small games of chance. Clubs throughout pennsylvania must resume allocating 60 percent of their small games of chance revenue to public interest purposes. Therefore, pa sgoc licensees can use 100% of their small games of chance net proceeds until june 16, 2022 (1 year from when. A club licensee must use, at a minimum, 60 percent of its games of chance proceeds per calendar year.

The State Tavern Games Tax Is 60 Percent Of Net Revenue Of All Tavern Games, And The Host Municipality Tax Is 5 Percent Of Net Revenue.

Clubs only report small games of chance activity that occurs during the reporting period (the calendar year). After entering itemized games of chance, clubs are required to report whether total proceeds were $40,000 or less for the prior calendar year.