Orange County California Tax Lien Search

Orange County California Tax Lien Search - If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. This lien prevents the assessee from recording. Secured / supplemental property tax & related information search by parcel number (apn) parcel number Search by property address parcel number (apn) tax default number You may search your property records and create a cart of documents that may be printed and submitted by mail with payment to the orange.

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: Search by property address parcel number (apn) tax default number You may search your property records and create a cart of documents that may be printed and submitted by mail with payment to the orange. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. This lien prevents the assessee from recording. Secured / supplemental property tax & related information search by parcel number (apn) parcel number

If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: Secured / supplemental property tax & related information search by parcel number (apn) parcel number Search by property address parcel number (apn) tax default number You may search your property records and create a cart of documents that may be printed and submitted by mail with payment to the orange. This lien prevents the assessee from recording.

Mohave County Tax Lien Sale 2024 Dore Nancey

Search by property address parcel number (apn) tax default number Secured / supplemental property tax & related information search by parcel number (apn) parcel number This lien prevents the assessee from recording. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. If unsecured taxes become delinquent,.

Suffolk County Tax Lien Sale 2024 Marne Sharona

If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Secured / supplemental property tax & related information search by parcel number (apn) parcel number To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: On or before june 1, the tax collector.

IRS Tax Liens Help in California Tax Defense Partners

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Secured / supplemental property tax & related information search by parcel number (apn) parcel number You may.

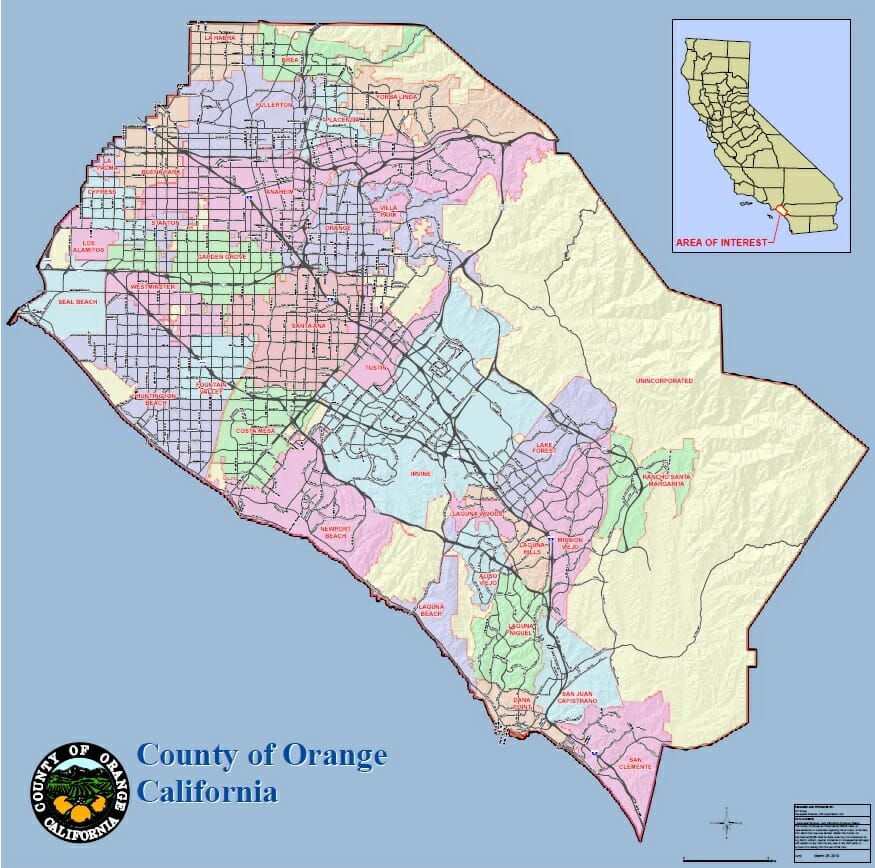

Orange County Maps Enjoy OC

On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. This lien prevents the assessee from recording. Secured / supplemental property tax & related information search by parcel number (apn).

Blac Chyna Secretly Hit With HUGE California Tax Lien She Hadn't Paid

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: Search by property address parcel number (apn) tax default number This lien prevents the assessee from recording. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. On or before june 1, the.

Property Tax Lien Search Nationwide Title Insurance

This lien prevents the assessee from recording. You may search your property records and create a cart of documents that may be printed and submitted by mail with payment to the orange. To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: If unsecured taxes become delinquent, a tax lien.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Search by property address parcel number (apn) tax default number You may search your property records and.

More Than 400 Listings In West Orange 2022 Tax Lien Sale West Orange

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: You may search your property records and create a cart of documents that may be printed and submitted by mail with payment to the orange. This lien prevents the assessee from recording. Search by property address parcel number (apn) tax.

How to Buy California Tax Lien Certificates Pocketsense

This lien prevents the assessee from recording. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. Secured / supplemental property tax & related information search by parcel number (apn).

Orange County, California Genealogy Genealogy FamilySearch Wiki

Search by property address parcel number (apn) tax default number If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. You may search your property records and create a cart of documents that may be printed and submitted by mail with payment to the orange. On or before june 1, the tax collector.

This Lien Prevents The Assessee From Recording.

If unsecured taxes become delinquent, a tax lien may be recorded in the name of the assessee. You may search your property records and create a cart of documents that may be printed and submitted by mail with payment to the orange. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. Secured / supplemental property tax & related information search by parcel number (apn) parcel number

Search By Property Address Parcel Number (Apn) Tax Default Number

To obtain recorded documents such as deeds, judgments and liens contact the county of orange at the following area offices: