Ohio Tax Lien

Ohio Tax Lien - For individual taxes call 1. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. Specifically, it focuses on the timing of tax payments, the potential. Property taxes may be collected and enforced by local officials. To obtain more information about the lien, contact the attorney general's office. You'll get notice before either.

You'll get notice before either. Specifically, it focuses on the timing of tax payments, the potential. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. Property taxes may be collected and enforced by local officials. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. To obtain more information about the lien, contact the attorney general's office. For individual taxes call 1. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax.

Property taxes may be collected and enforced by local officials. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. For individual taxes call 1. Specifically, it focuses on the timing of tax payments, the potential. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. To obtain more information about the lien, contact the attorney general's office. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. You'll get notice before either. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax.

Tax Lien Sale Download Free PDF Tax Lien Taxes

For individual taxes call 1. To obtain more information about the lien, contact the attorney general's office. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. If you have.

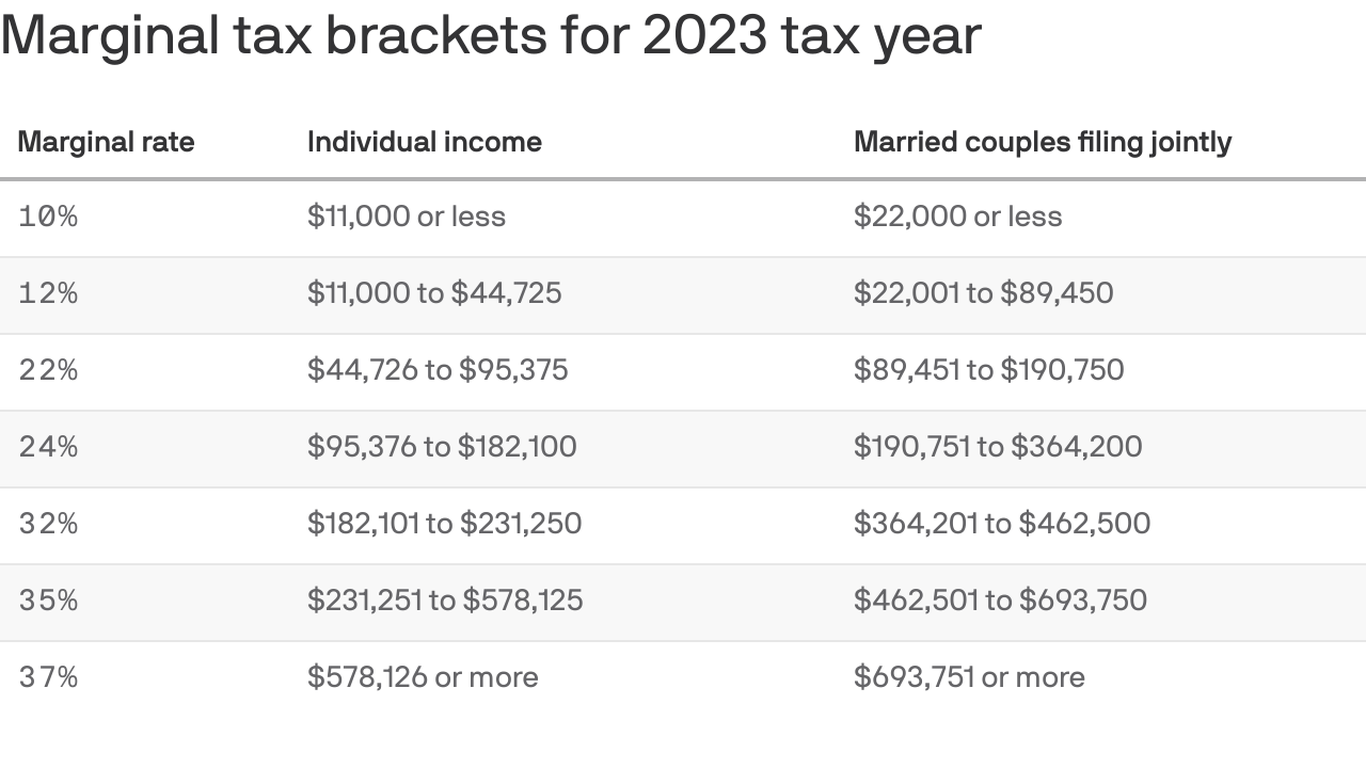

State Of Ohio Tax Rates 2024 Ginny Justinn

Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. To.

Tax Lien What Is A State Tax Lien Ohio

For individual taxes call 1. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Property taxes may be collected.

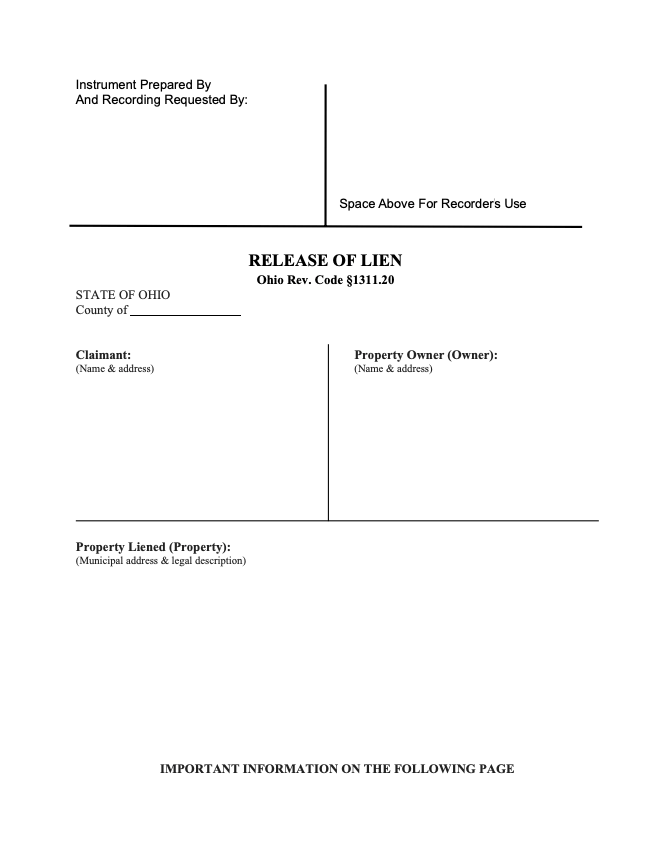

Ohio Mechanics Lien Form Fill Online, Printable, Fillable, Blank

You'll get notice before either. Property taxes may be collected and enforced by local officials. Specifically, it focuses on the timing of tax payments, the potential. For individual taxes call 1. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or.

Ohio Tax Brackets 2024 Ninon Anallese

This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments.

Ohio Mechanics Lien Guide & FAQs Levelset

Specifically, it focuses on the timing of tax payments, the potential. For individual taxes call 1. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. This.

Tax Lien Ohio State Tax Lien

Property taxes may be collected and enforced by local officials. You'll get notice before either. To obtain more information about the lien, contact the attorney general's office. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. Specifically, it focuses on the timing of tax payments, the potential.

Property Tax Lien Sales Ohio Investor's Guide to Success

For individual taxes call 1. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. To obtain more information about the lien, contact the attorney general's office. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. Specifically, it focuses.

Tax Lien What Is A State Tax Lien Ohio

If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure. You'll get notice before either. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals.

Ohio Release of Lien Form Free Template Download

You'll get notice before either. Property taxes may be collected and enforced by local officials. For individual taxes call 1. This section explains how the county treasurer can enforce the lien for taxes against delinquent land or minerals by civil action or. Specifically, it focuses on the timing of tax payments, the potential.

For Individual Taxes Call 1.

Specifically, it focuses on the timing of tax payments, the potential. The tax lien sale provides immediate funding of past due tax dollars to the agencies like schools and local governments that rely on property tax. To obtain more information about the lien, contact the attorney general's office. Property taxes in ohio fund essential services in your community, including public schools, emergency services like police and.

This Section Explains How The County Treasurer Can Enforce The Lien For Taxes Against Delinquent Land Or Minerals By Civil Action Or.

Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Property taxes may be collected and enforced by local officials. You'll get notice before either. If you have delinquent property taxes in ohio, you'll likely face a tax lien sale or a tax foreclosure.