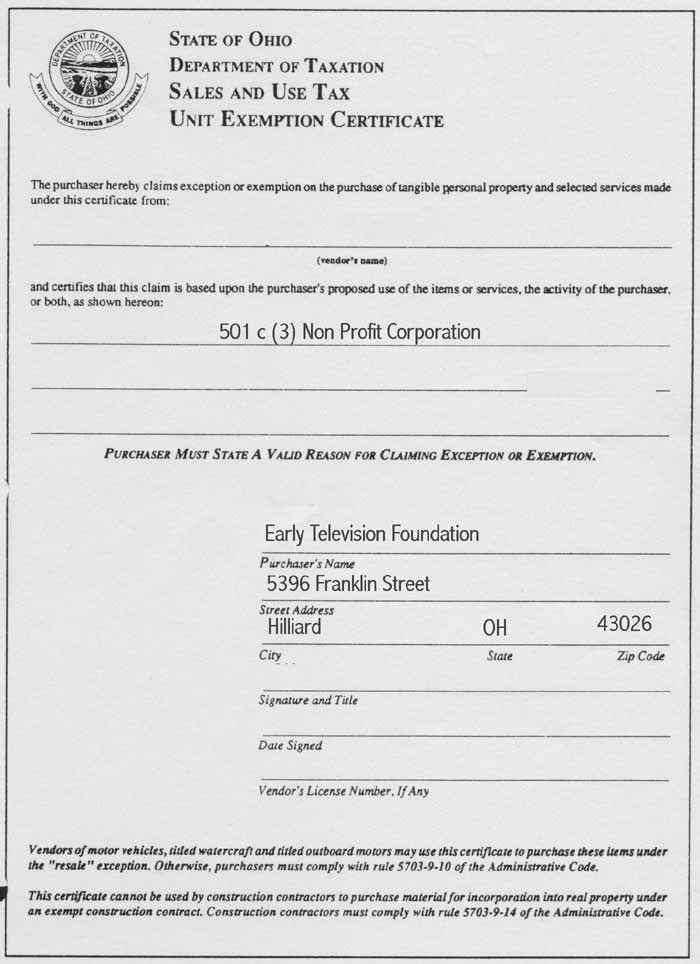

Ohio State Sales Tax Exemption Form

Ohio State Sales Tax Exemption Form - Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Please see the contact information on the relevant department's page or use our contact form. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Provide the id number to claim exemption from sales tax that is required by the taxing state. An official state of ohio site. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. The ohio state university strives to maintain an. Check with that state to determine your. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate.

Please see the contact information on the relevant department's page or use our contact form. An official state of ohio site. Provide the id number to claim exemption from sales tax that is required by the taxing state. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Check with that state to determine your. The ohio state university strives to maintain an. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate.

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. An official state of ohio site. Check with that state to determine your. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Please see the contact information on the relevant department's page or use our contact form. The ohio state university strives to maintain an. Provide the id number to claim exemption from sales tax that is required by the taxing state. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this.

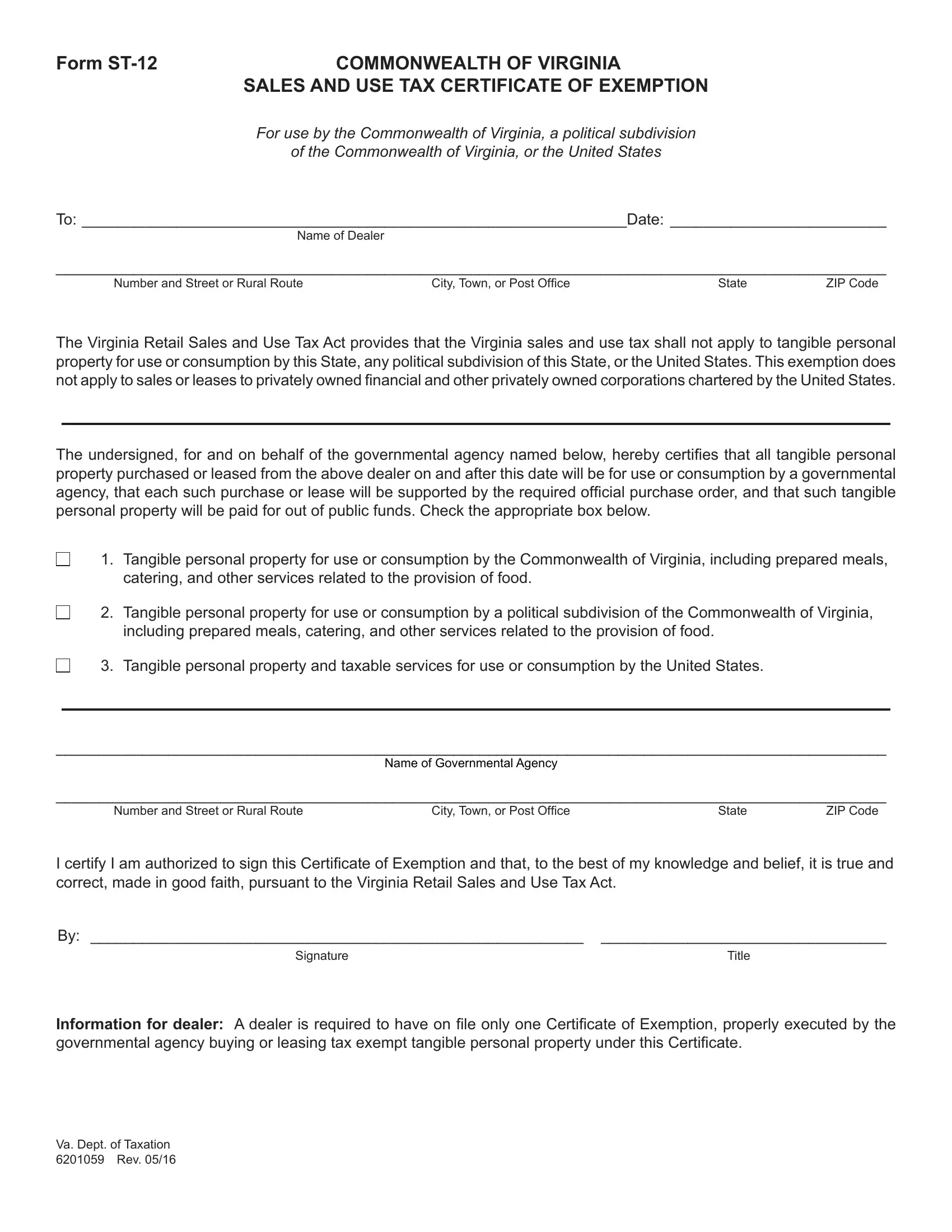

Virginia Sales Tax Exemption PDF Form FormsPal

If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Provide the id number to claim exemption from sales tax that is required by the taxing state. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Check with.

Ohio Sales Tax Exemption Form 2024 Pdf Ranee Casandra

Provide the id number to claim exemption from sales tax that is required by the taxing state. The ohio state university strives to maintain an. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Check with that state to determine your. An official state of ohio site.

Louisiana sales tax exemption form pdf Fill out & sign online DocHub

If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Check with that state to determine your. Provide the id number to claim exemption from sales tax that is required by the taxing state. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on.

Fillable Ohio Tax Exemption Form Printable Forms Free Online

Please see the contact information on the relevant department's page or use our contact form. Check with that state to determine your. Provide the id number to claim exemption from sales tax that is required by the taxing state. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. Ohio.

The Early Television Foundation

Check with that state to determine your. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. The ohio state university strives to maintain an. Please see the contact.

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. The ohio state university strives to maintain an. Please see the contact information on the relevant department's page or.

Ky Tax Exempt Form Pdf Fill Online, Printable, Fillable, Blank

If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. Check with that state to determine your. Please see the contact information on the relevant department's page or use our contact form. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases.

Sd Certificate Of Exemption For Sales Tax

Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under.

Texas Sales And Use Tax Resale Certificate Example / 01 315 Form Fill

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Provide the id number to claim exemption from sales tax that is required by the taxing state. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate. The ohio.

Texas Sales And Use Tax Resale Certificate Example / TaxExempt Forms

An official state of ohio site. Provide the id number to claim exemption from sales tax that is required by the taxing state. Check with that state to determine your. Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases.

Ohio Accepts The Uniform Sales And Use Tax Certificate Created By The Multistate Tax Commission As A Valid Exemption Certificate.

Provide the id number to claim exemption from sales tax that is required by the taxing state. An official state of ohio site. Please see the contact information on the relevant department's page or use our contact form. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this.

Check With That State To Determine Your.

Sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal. The ohio state university strives to maintain an. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a fully completed exemption certificate.