Name Change Ein

Name Change Ein - You don’t need a new ein if you just. If you decide to change. You don’t need a new ein to change your business name ,. When you file your business taxes, the irs uses your ein and business name to identify your business. You need a new ein, in general, when you change your entity’s ownership or structure. You need a new ein, in general, when you change your entity’s ownership or structure. In some situations a name change may require a new employer identification number (ein) or a final return.

In some situations a name change may require a new employer identification number (ein) or a final return. You don’t need a new ein if you just. If you decide to change. You need a new ein, in general, when you change your entity’s ownership or structure. You don’t need a new ein to change your business name ,. You need a new ein, in general, when you change your entity’s ownership or structure. When you file your business taxes, the irs uses your ein and business name to identify your business.

In some situations a name change may require a new employer identification number (ein) or a final return. You don’t need a new ein if you just. If you decide to change. You don’t need a new ein to change your business name ,. You need a new ein, in general, when you change your entity’s ownership or structure. You need a new ein, in general, when you change your entity’s ownership or structure. When you file your business taxes, the irs uses your ein and business name to identify your business.

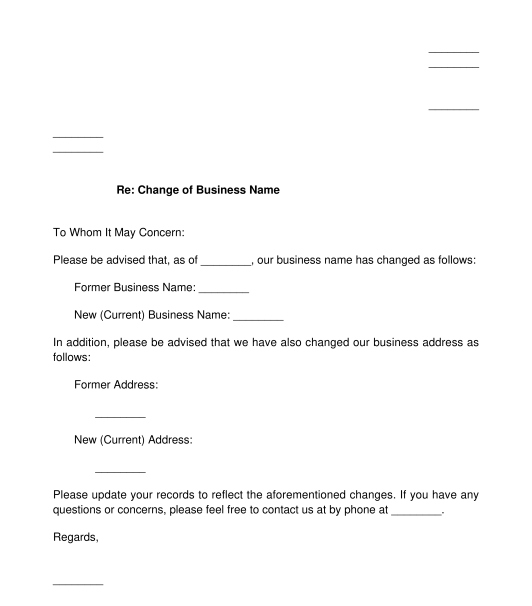

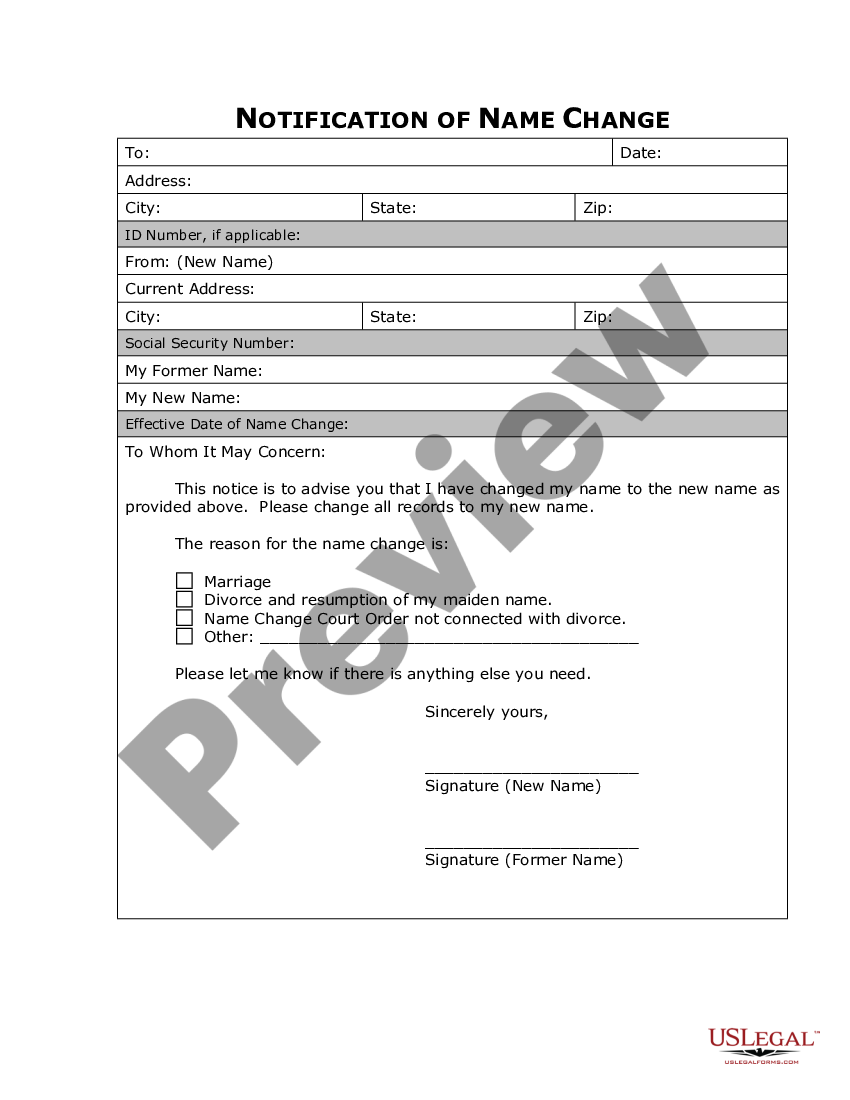

Business Name Change Letter Template

If you decide to change. In some situations a name change may require a new employer identification number (ein) or a final return. You don’t need a new ein to change your business name ,. You need a new ein, in general, when you change your entity’s ownership or structure. You need a new ein, in general, when you change.

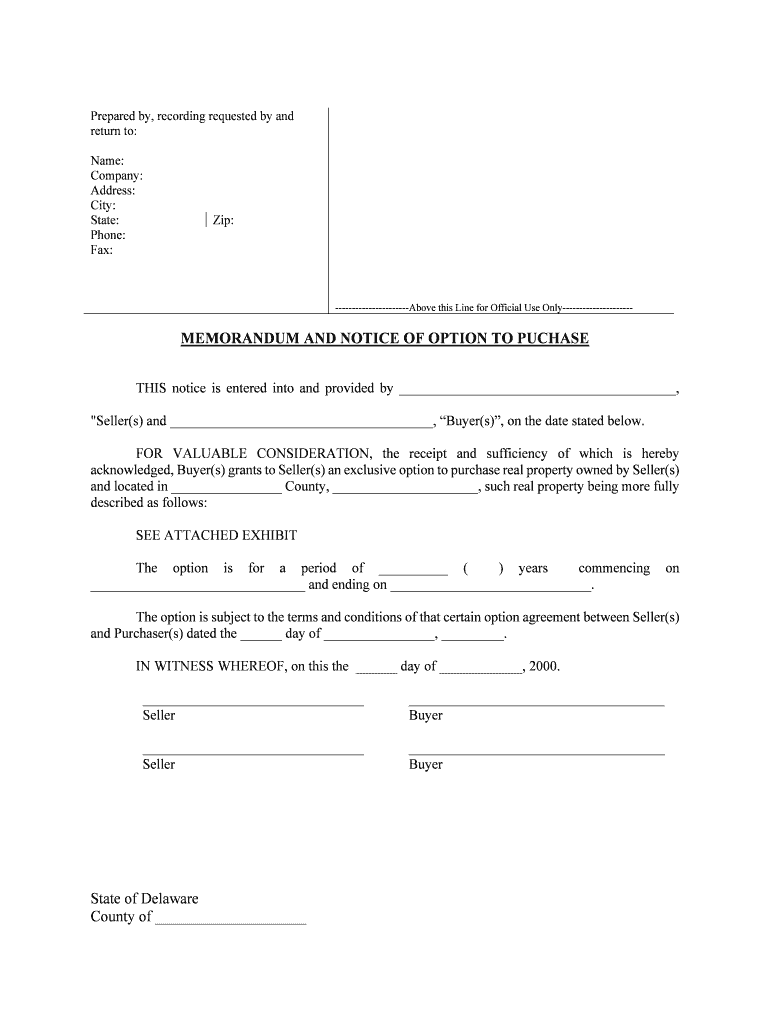

How Do You Change Your Business Name with the IRS? Form Fill Out and

You don’t need a new ein if you just. You need a new ein, in general, when you change your entity’s ownership or structure. When you file your business taxes, the irs uses your ein and business name to identify your business. If you decide to change. You need a new ein, in general, when you change your entity’s ownership.

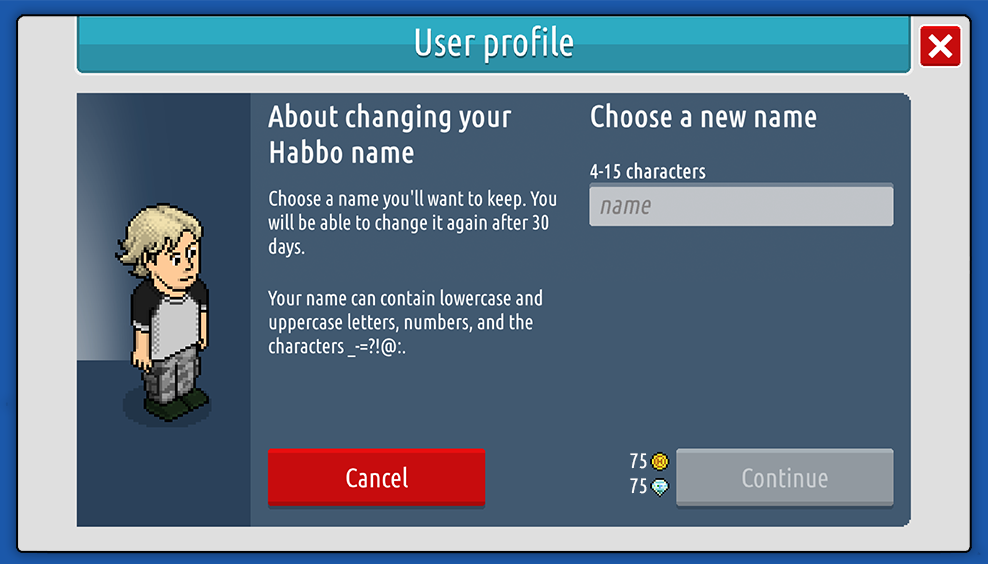

Change your name in our next update! Habbo

You need a new ein, in general, when you change your entity’s ownership or structure. You don’t need a new ein if you just. If you decide to change. In some situations a name change may require a new employer identification number (ein) or a final return. When you file your business taxes, the irs uses your ein and business.

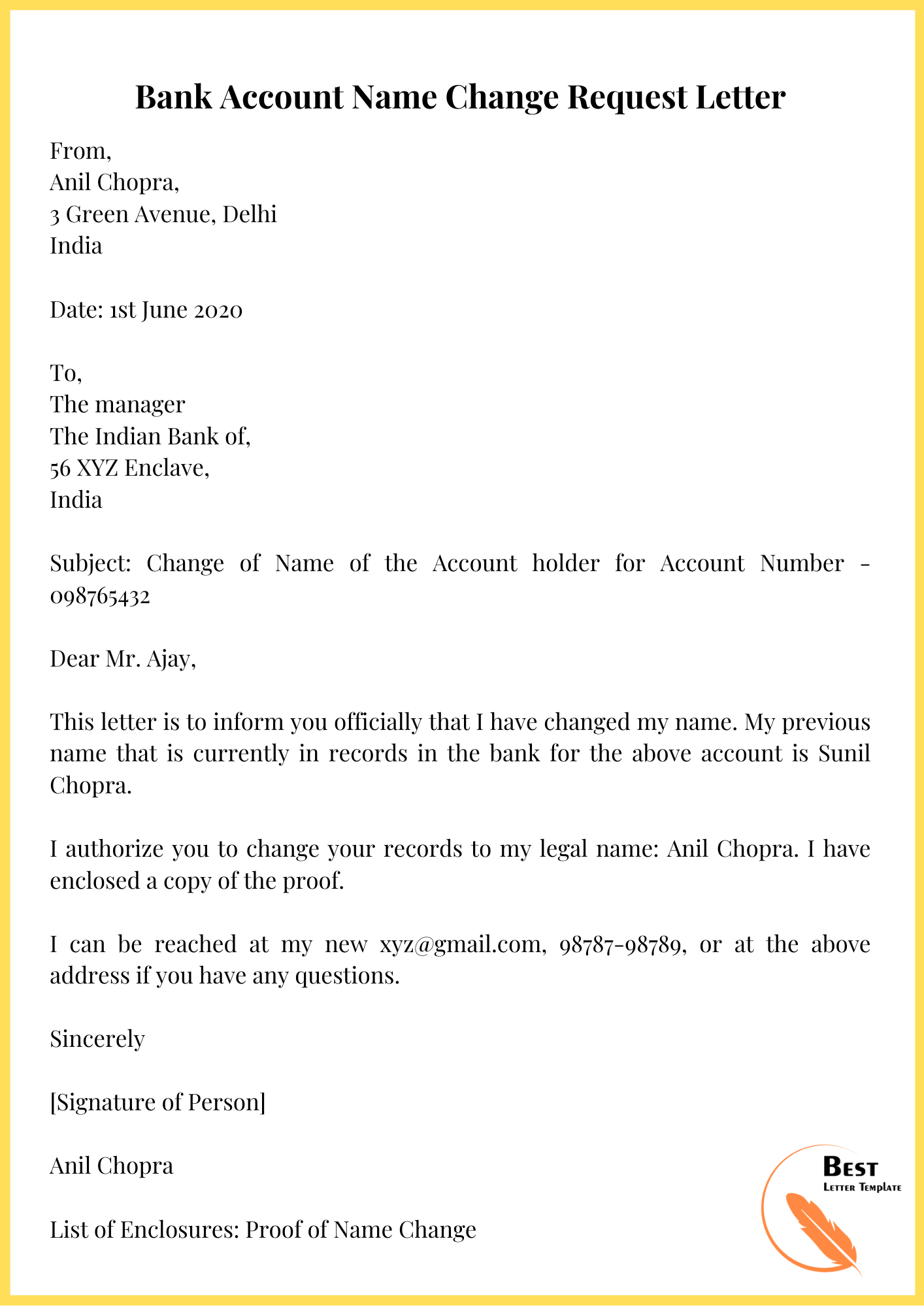

the source / name change image blog

You don’t need a new ein to change your business name ,. You don’t need a new ein if you just. When you file your business taxes, the irs uses your ein and business name to identify your business. You need a new ein, in general, when you change your entity’s ownership or structure. In some situations a name change.

Ein Name Change Letter Template

You don’t need a new ein to change your business name ,. In some situations a name change may require a new employer identification number (ein) or a final return. If you decide to change. When you file your business taxes, the irs uses your ein and business name to identify your business. You don’t need a new ein if.

Business Name Change Letter Gotilo

When you file your business taxes, the irs uses your ein and business name to identify your business. You don’t need a new ein if you just. You need a new ein, in general, when you change your entity’s ownership or structure. In some situations a name change may require a new employer identification number (ein) or a final return..

Get An Ein By Phone

When you file your business taxes, the irs uses your ein and business name to identify your business. You don’t need a new ein to change your business name ,. In some situations a name change may require a new employer identification number (ein) or a final return. If you decide to change. You need a new ein, in general,.

Name Change Template

If you decide to change. When you file your business taxes, the irs uses your ein and business name to identify your business. You need a new ein, in general, when you change your entity’s ownership or structure. You don’t need a new ein if you just. You don’t need a new ein to change your business name ,.

Change of Name (Personal) Free Template Sample Lawpath

When you file your business taxes, the irs uses your ein and business name to identify your business. You need a new ein, in general, when you change your entity’s ownership or structure. In some situations a name change may require a new employer identification number (ein) or a final return. You need a new ein, in general, when you.

Pennsylvania Name Change Form US Legal Forms

If you decide to change. You need a new ein, in general, when you change your entity’s ownership or structure. You don’t need a new ein to change your business name ,. In some situations a name change may require a new employer identification number (ein) or a final return. You need a new ein, in general, when you change.

When You File Your Business Taxes, The Irs Uses Your Ein And Business Name To Identify Your Business.

You don’t need a new ein if you just. You don’t need a new ein to change your business name ,. You need a new ein, in general, when you change your entity’s ownership or structure. You need a new ein, in general, when you change your entity’s ownership or structure.

If You Decide To Change.

In some situations a name change may require a new employer identification number (ein) or a final return.