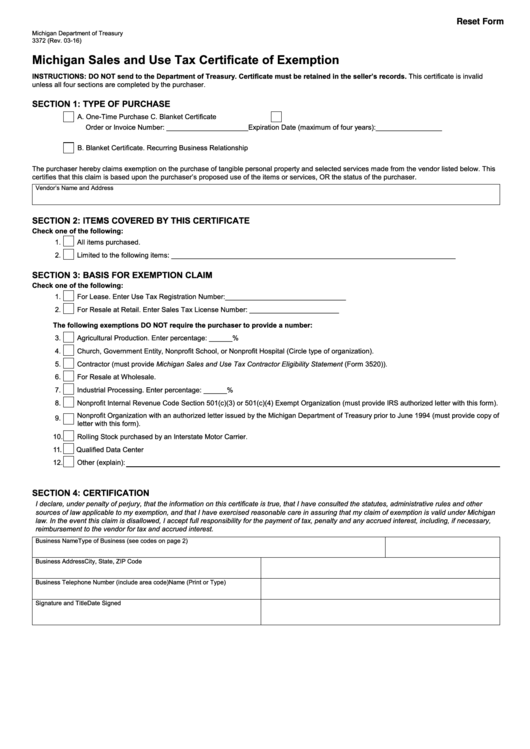

Mi Sales And Use Tax Form

Mi Sales And Use Tax Form - If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. It is the purchaser’s responsibility. Click the link to see the 2024 form instructions. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Click the link to see. This is a return for sales tax, use tax and/or withholding tax. Sales and use tax forms index by year. It is the purchaser’s responsibility. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions.

It is the purchaser’s responsibility. Sales and use tax forms index by year. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. Click the link to see. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. This is a return for sales tax, use tax and/or withholding tax.

Click the link to see the 2024 form instructions. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Click the link to see. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. This is a return for sales tax, use tax and/or withholding tax. It is the purchaser’s responsibility. It is the purchaser’s responsibility. This is a return for sales tax, use tax and/or withholding tax. If you received a letter of inquiry regarding annual return for the return period of 2023, visit.

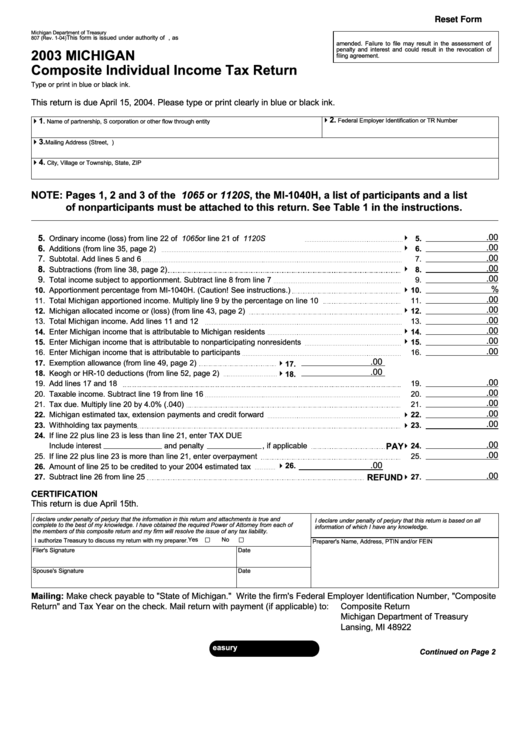

Mi sales tax Fill out & sign online DocHub

Sales and use tax forms index by year. It is the purchaser’s responsibility. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. This is a return for sales tax, use tax and/or withholding tax.

Texas Sales and Use Tax Exemption Certification Forms Docs 2023

It is the purchaser’s responsibility. Click the link to see the 2024 form instructions. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Click the link to see.

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Click the link to see. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. This is a return for sales tax, use tax and/or withholding tax. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Form 5081 is available for submission electronically using.

Alaska Sales And Use Tax Exemption Form

It is the purchaser’s responsibility. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. Click the link to.

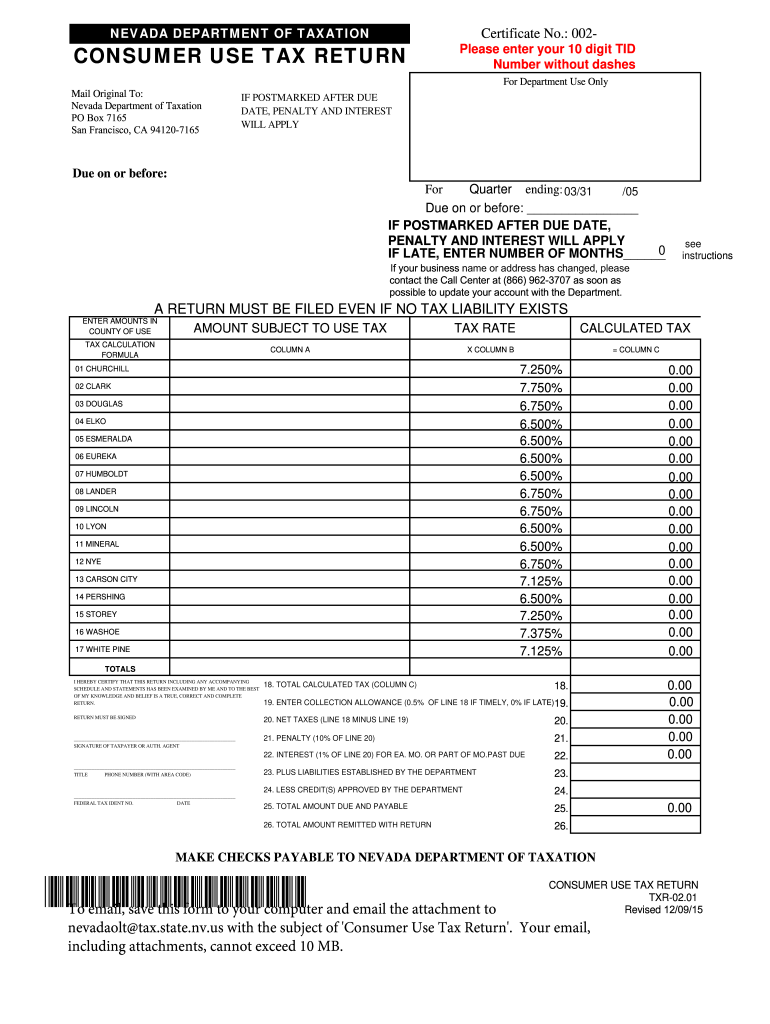

Nevada Use Tax 20152024 Form Fill Out and Sign Printable PDF

Click the link to see. It is the purchaser’s responsibility. This is a return for sales tax, use tax and/or withholding tax. It is the purchaser’s responsibility. If you received a letter of inquiry regarding annual return for the return period of 2023, visit.

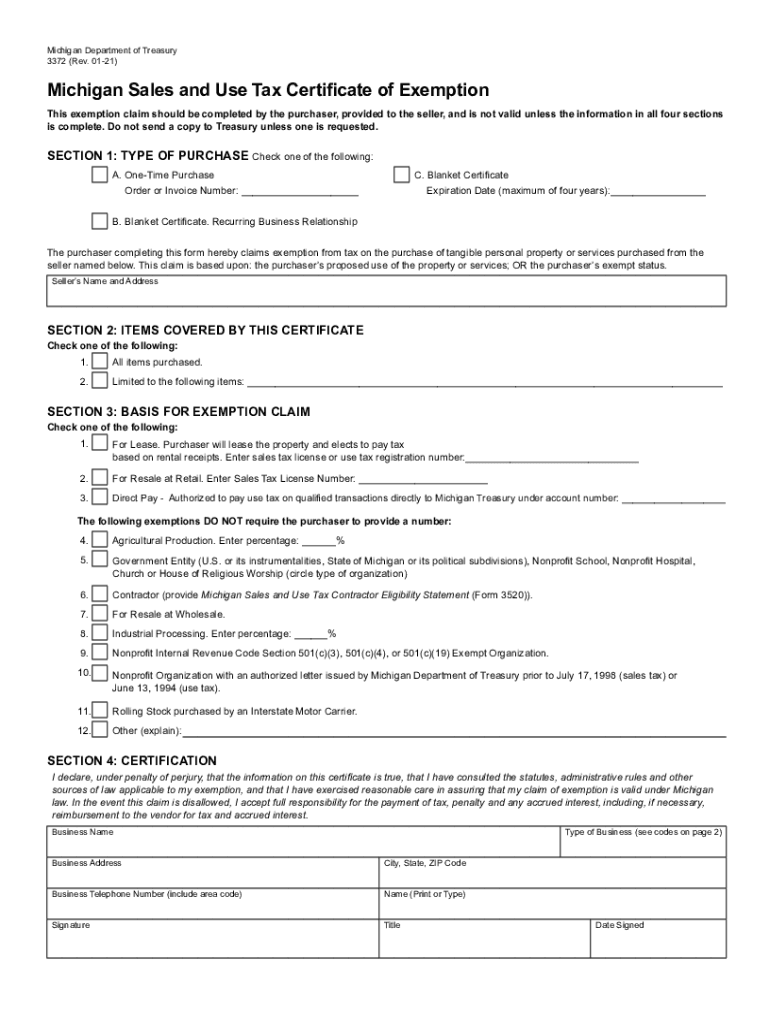

Michigan Sales Tax Exemption 20212024 Form Fill Out and Sign

If you received a letter of inquiry regarding annual return for the return period of 2023, visit. Click the link to see the 2024 form instructions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using..

Types Of Sales Tax Exemption Certificates Form example download

It is the purchaser’s responsibility. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. It is the purchaser’s responsibility. Sales and use tax forms index by year. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use.

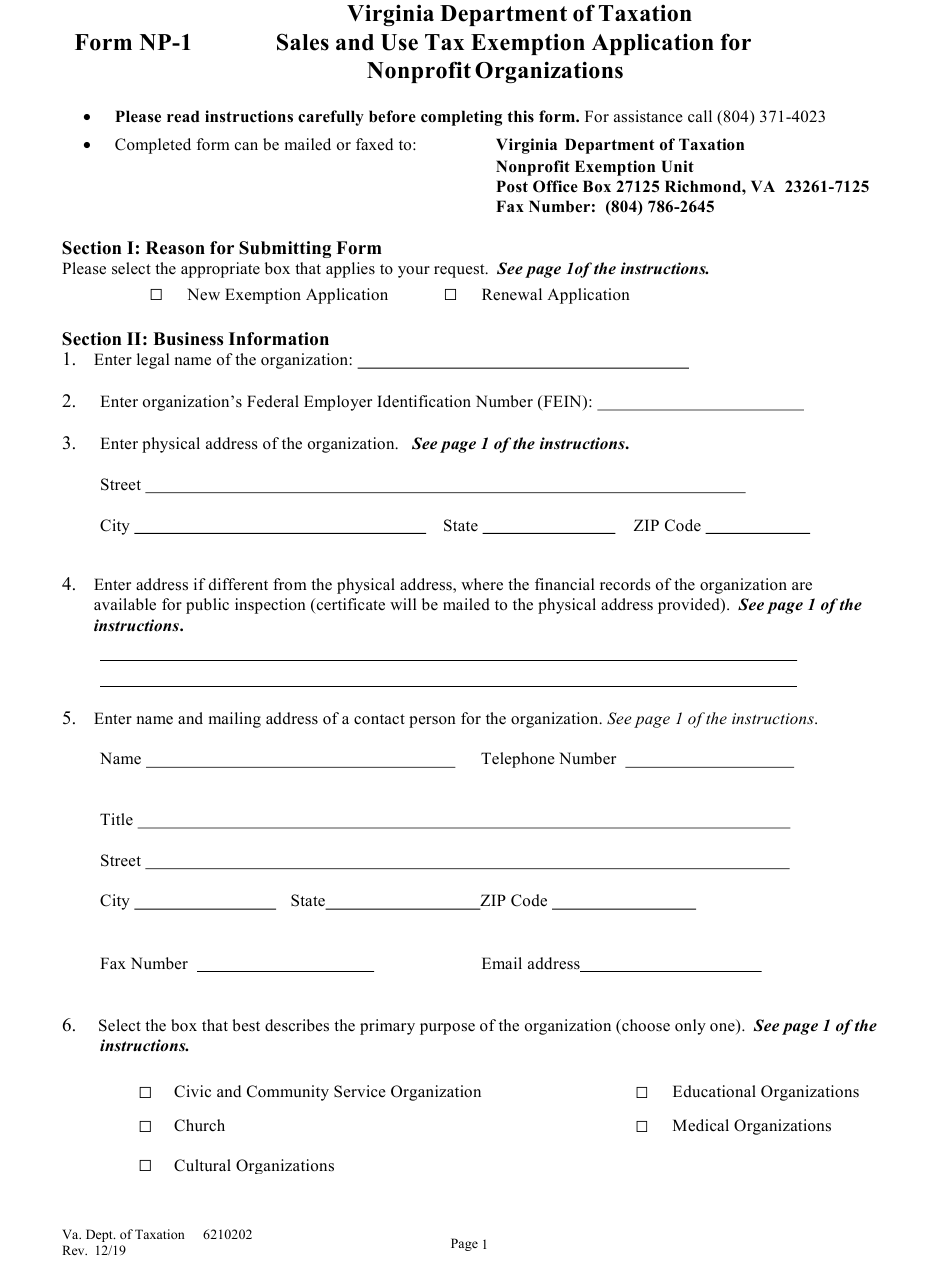

Form NP 1 Download Fillable PDF Or Fill Online Sales And Use Tax

This is a return for sales tax, use tax and/or withholding tax. This is a return for sales tax, use tax and/or withholding tax. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. Click the link to see.

State Of Michigan Sales Tax Forms 2024 Blisse Martie

This is a return for sales tax, use tax and/or withholding tax. If the taxpayer inserts a zero on or leaves blank any line reporting sales tax, use. It is the purchaser’s responsibility. Click the link to see the 2024 form instructions. Click the link to see.

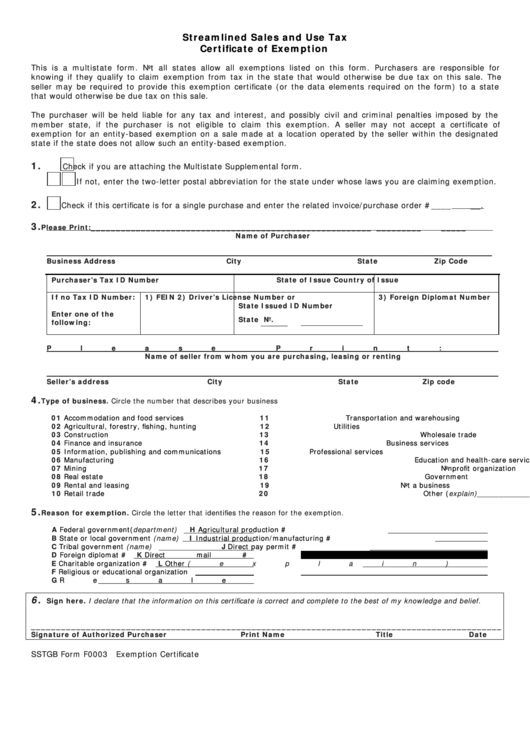

Streamlined Sales & Use Tax Certificate Of Exemption Form

Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. It is the purchaser’s responsibility. This is a.

If The Taxpayer Inserts A Zero On Or Leaves Blank Any Line Reporting Sales Tax, Use.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Form 5081 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using. Purchasers may use this form to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility.

Click The Link To See.

Sales and use tax forms index by year. It is the purchaser’s responsibility. This is a return for sales tax, use tax and/or withholding tax. If you received a letter of inquiry regarding annual return for the return period of 2023, visit.

Click The Link To See The 2024 Form Instructions.

This is a return for sales tax, use tax and/or withholding tax.