Maryland Local Income Tax

Maryland Local Income Tax - You should report your local income tax amount on line 28 of form 502. Maryland’s eitc is a credit for certain taxpayers who have income and have worked. Listed below are the actual 2025 local income tax rates. Local tax is based on taxable income and not on maryland state tax. Maryland has a graduated state individual income tax, with rates ranging from 2.00 percent to 5.75 percent. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. The state eitc reduces the amount of maryland tax you owe. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. There are also jurisdictions that collect local income taxes. We have information on the local income tax rates in 24 localities in maryland.

The state eitc reduces the amount of maryland tax you owe. You should report your local income tax amount on line 28 of form 502. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. We have information on the local income tax rates in 24 localities in maryland. Local tax is based on taxable income and not on maryland state tax. Listed below are the actual 2025 local income tax rates. The local eitc reduces the amount of. Maryland’s eitc is a credit for certain taxpayers who have income and have worked. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. There are also jurisdictions that collect local income taxes.

We have information on the local income tax rates in 24 localities in maryland. Listed below are the actual 2025 local income tax rates. We provide separate tables for the convenience of employers who do. Maryland has a graduated state individual income tax, with rates ranging from 2.00 percent to 5.75 percent. You should report your local income tax amount on line 28 of form 502. Maryland’s eitc is a credit for certain taxpayers who have income and have worked. The state eitc reduces the amount of maryland tax you owe. There are also jurisdictions that collect local income taxes. Your local income tax is based. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year.

Maryland Tax Calculator 2024 2025

There are also jurisdictions that collect local income taxes. Maryland has a graduated state individual income tax, with rates ranging from 2.00 percent to 5.75 percent. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. You can click on any city or county for more details, including the nonresident income tax rate and.

Maryland Tax Calculator 2024 2025

Maryland’s eitc is a credit for certain taxpayers who have income and have worked. Local tax is based on taxable income and not on maryland state tax. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. We provide separate tables for the convenience of employers who do. You should.

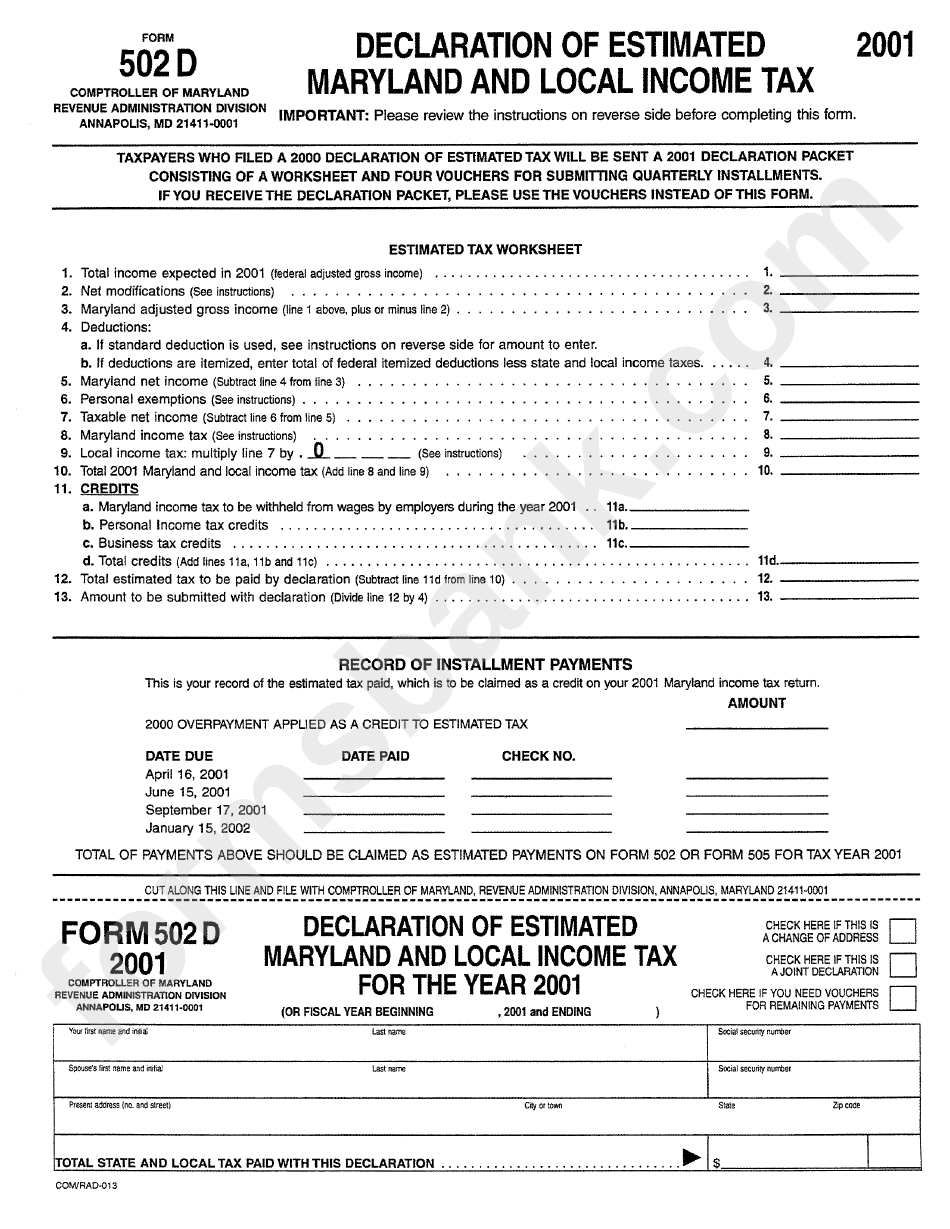

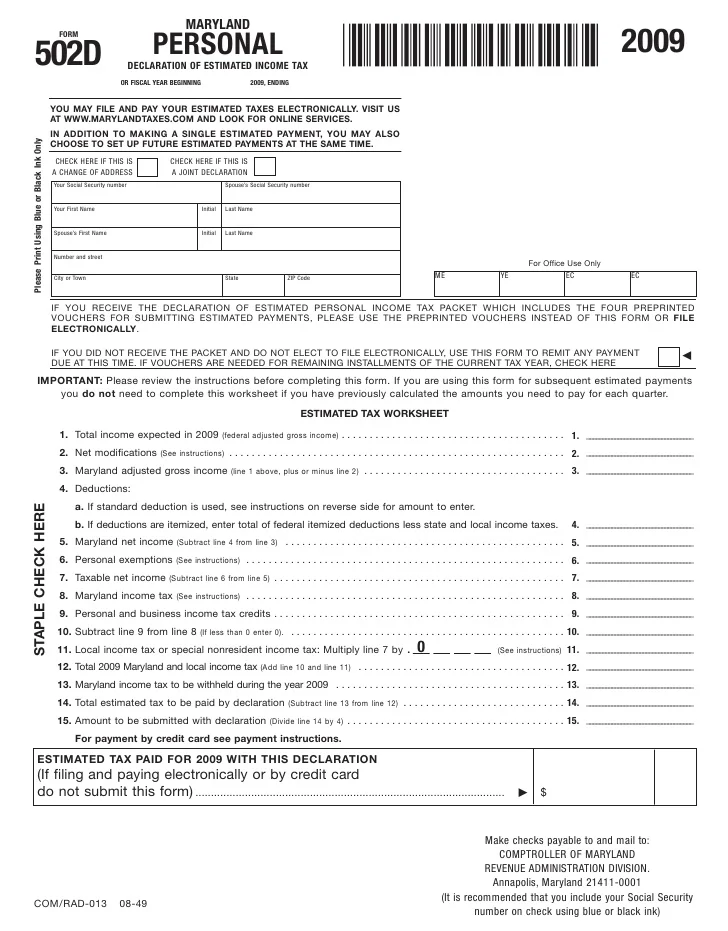

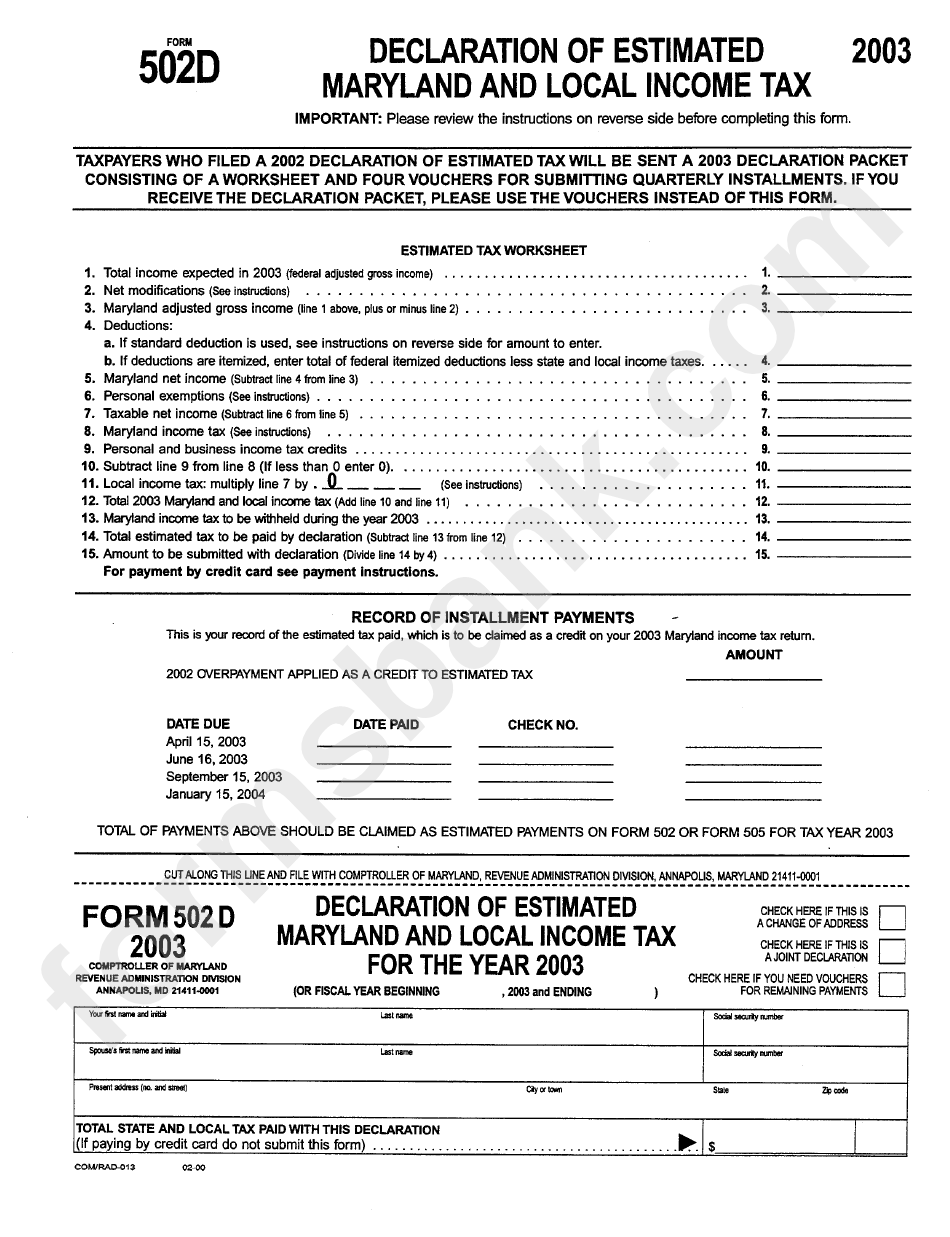

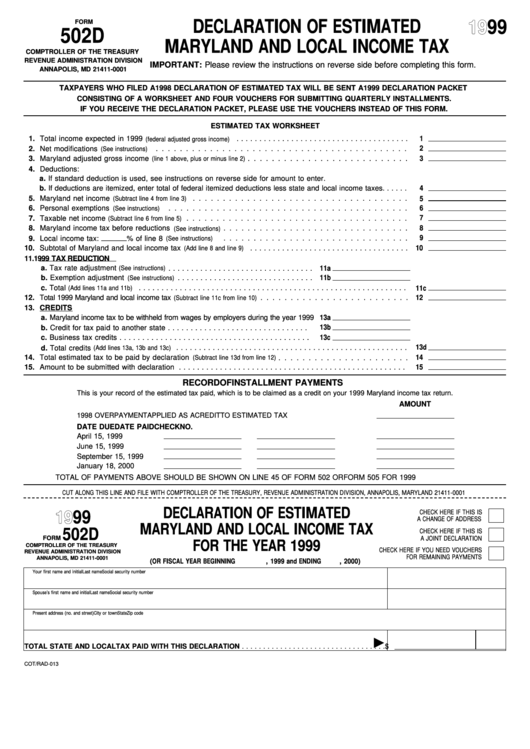

Form 502d Declaration Of Estimated Maryland And Local Tax

Listed below are the actual 2025 local income tax rates. We provide separate tables for the convenience of employers who do. There are also jurisdictions that collect local income taxes. We have information on the local income tax rates in 24 localities in maryland. The local eitc reduces the amount of.

Declaration of Estimated Maryland Tax

Maryland’s eitc is a credit for certain taxpayers who have income and have worked. Local tax is based on taxable income and not on maryland state tax. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. There are also jurisdictions that collect local income taxes. Your local income tax is based.

Tax Forms Maryland Tax Forms

You can click on any city or county for more details, including the nonresident income tax rate and tax forms. The state eitc reduces the amount of maryland tax you owe. We provide separate tables for the convenience of employers who do. Maryland has a graduated state individual income tax, with rates ranging from 2.00 percent to 5.75 percent. Maryland’s.

Form 502d Declaration Of Estimated Maryland And Local Tax

The local eitc reduces the amount of. There are also jurisdictions that collect local income taxes. We have information on the local income tax rates in 24 localities in maryland. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Maryland has a graduated state individual income tax, with rates.

Fillable Form 502 D Declaration Of Estimated Maryland And Local

You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Your local income tax is based. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. We provide separate tables for the convenience of employers who do. Local tax is based on taxable income.

Paying State Tax in Maryland Heard

We have information on the local income tax rates in 24 localities in maryland. Local tax is based on taxable income and not on maryland state tax. The local eitc reduces the amount of. The state eitc reduces the amount of maryland tax you owe. Local officials set the rates, which range between 2.25% and 3.20% for the current tax.

Maryland Local Tax Reform Details & Analysis

Listed below are the actual 2025 local income tax rates. The local eitc reduces the amount of. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. Your local income tax is based. We have information on the local income tax rates in 24 localities in maryland.

Maryland State Tax 2024 2025

The state eitc reduces the amount of maryland tax you owe. You should report your local income tax amount on line 28 of form 502. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Local tax is based on taxable income and not on maryland state tax. Listed below.

Local Tax Is Based On Taxable Income And Not On Maryland State Tax.

The local eitc reduces the amount of. Local officials set the rates, which range between 2.25% and 3.20% for the current tax year. There are also jurisdictions that collect local income taxes. The state eitc reduces the amount of maryland tax you owe.

We Have Information On The Local Income Tax Rates In 24 Localities In Maryland.

Maryland’s eitc is a credit for certain taxpayers who have income and have worked. Maryland has a graduated state individual income tax, with rates ranging from 2.00 percent to 5.75 percent. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. You should report your local income tax amount on line 28 of form 502.

Your Local Income Tax Is Based.

Listed below are the actual 2025 local income tax rates. We provide separate tables for the convenience of employers who do.