Ma Tax Return Forms

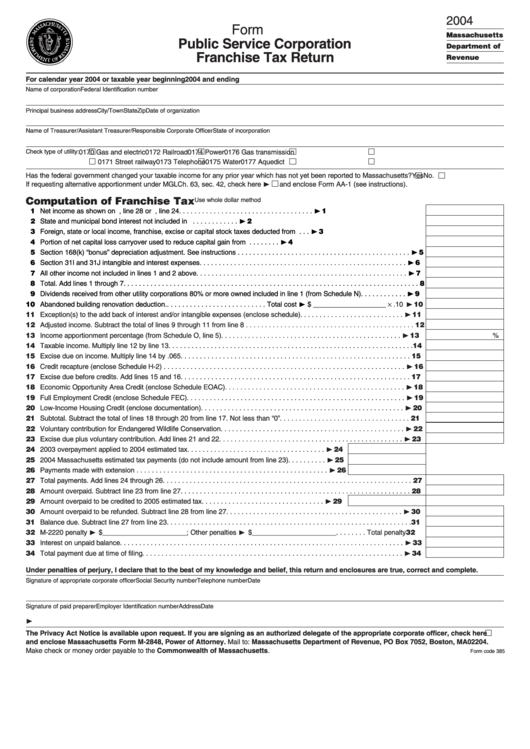

Ma Tax Return Forms - To qualify for the deduction, the following must be true: Form 1 is the general individual income tax return for massachusetts state residents. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. These forms are subject to change only by federal or state legislative action. Dor has released its draft 2024 massachusetts personal income tax forms. You may file by mail on paper forms or online thorugh efiling. This page details specific information and instructions that may apply to your state. Massachusetts income tax return instructions. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Dor has released its 2023 ma personal income tax forms.

Massachusetts income tax return instructions. Dor has released its draft 2024 massachusetts personal income tax forms. Form 1 is the general individual income tax return for massachusetts state residents. You may file by mail on paper forms or online thorugh efiling. These forms are subject to change only by federal or state legislative action. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Dor has released its 2023 ma personal income tax forms. This page details specific information and instructions that may apply to your state. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. To qualify for the deduction, the following must be true:

Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. Massachusetts income tax return instructions. Form 1 is the general individual income tax return for massachusetts state residents. Dor has released its 2023 ma personal income tax forms. These forms are subject to change only by federal or state legislative action. Dor has released its draft 2024 massachusetts personal income tax forms. This page details specific information and instructions that may apply to your state. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. To qualify for the deduction, the following must be true: You may file by mail on paper forms or online thorugh efiling.

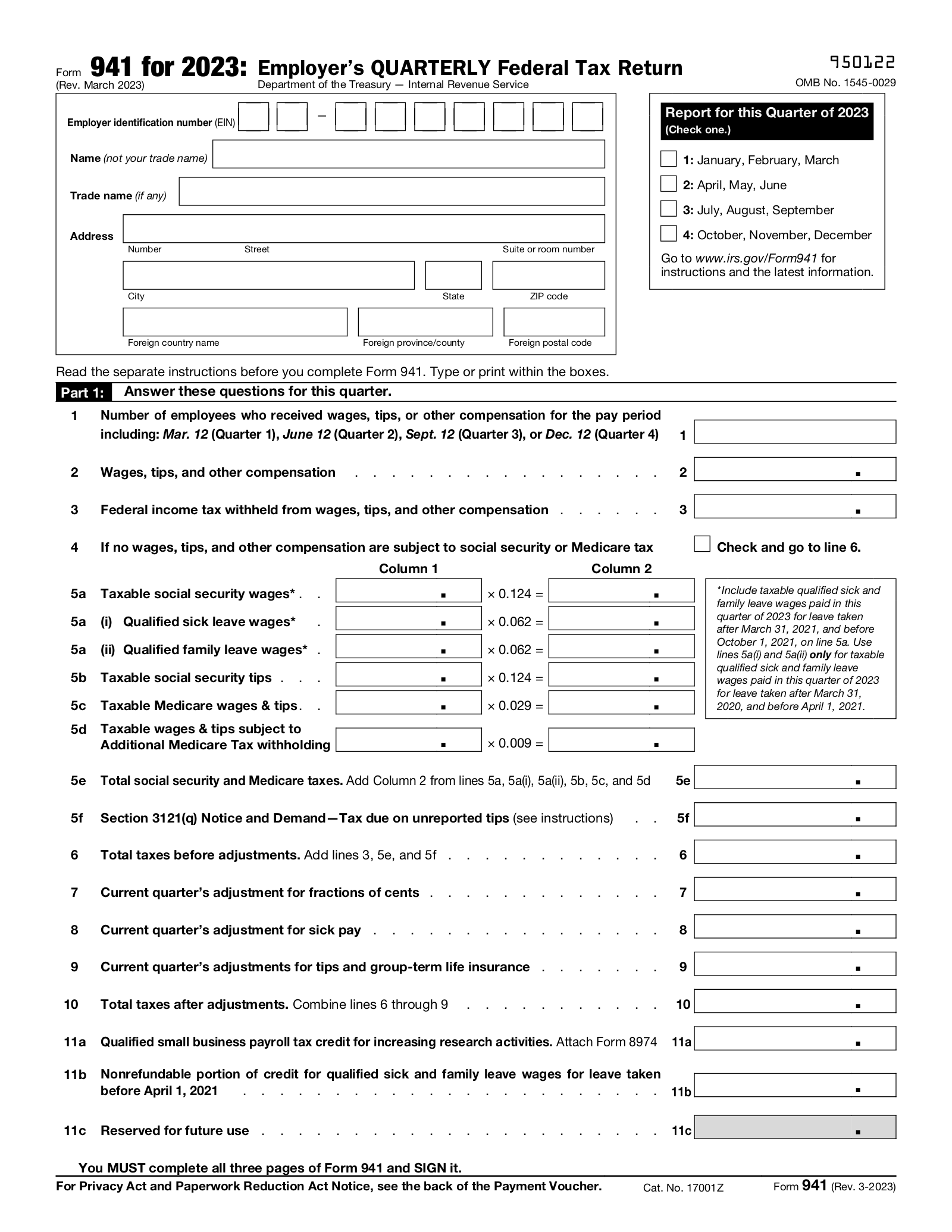

Form 941 Employer’s Quarterly Federal Tax Return eForms

These forms are subject to change only by federal or state legislative action. To qualify for the deduction, the following must be true: You may file by mail on paper forms or online thorugh efiling. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Massachusetts income tax return instructions.

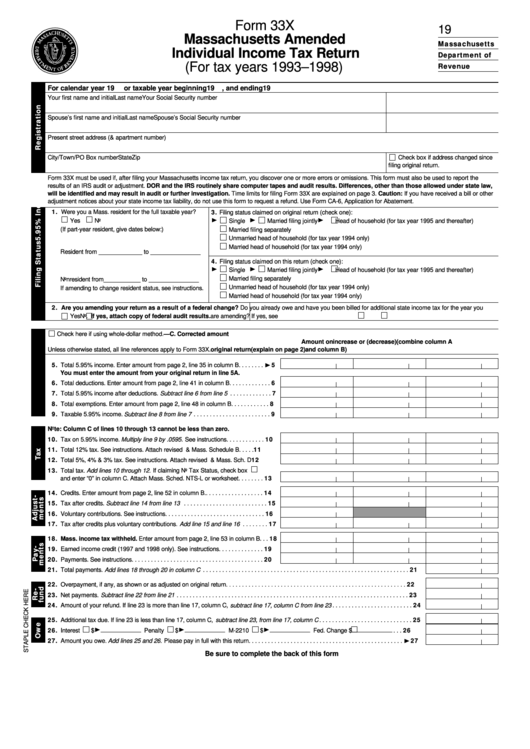

Fillable Form 33x Massachusetts Amended Individual Tax Return

Dor has released its draft 2024 massachusetts personal income tax forms. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. These forms are subject to change only by federal or state legislative action. Dor has released its 2023 ma personal income tax forms. Complete the respective massachusetts tax form (s) then.

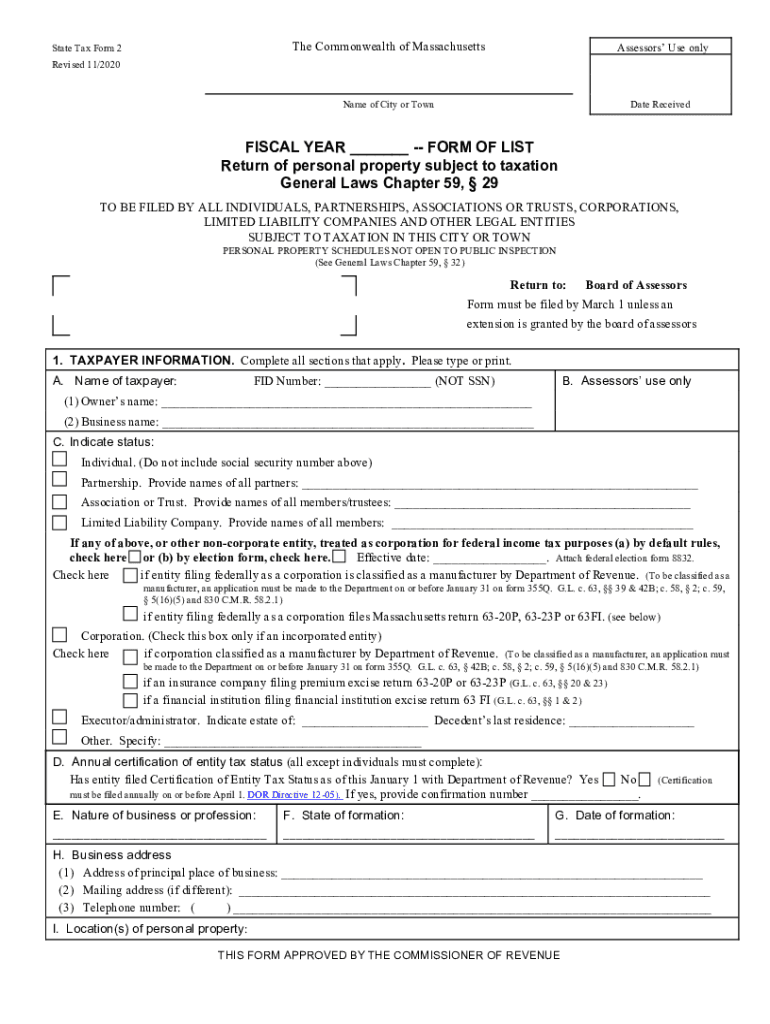

Massachusetts cities Fill out & sign online DocHub

Massachusetts income tax return instructions. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. This page details specific information and instructions that may apply to your state. To qualify for the deduction, the following must be true: You may file by mail on paper forms or online thorugh efiling.

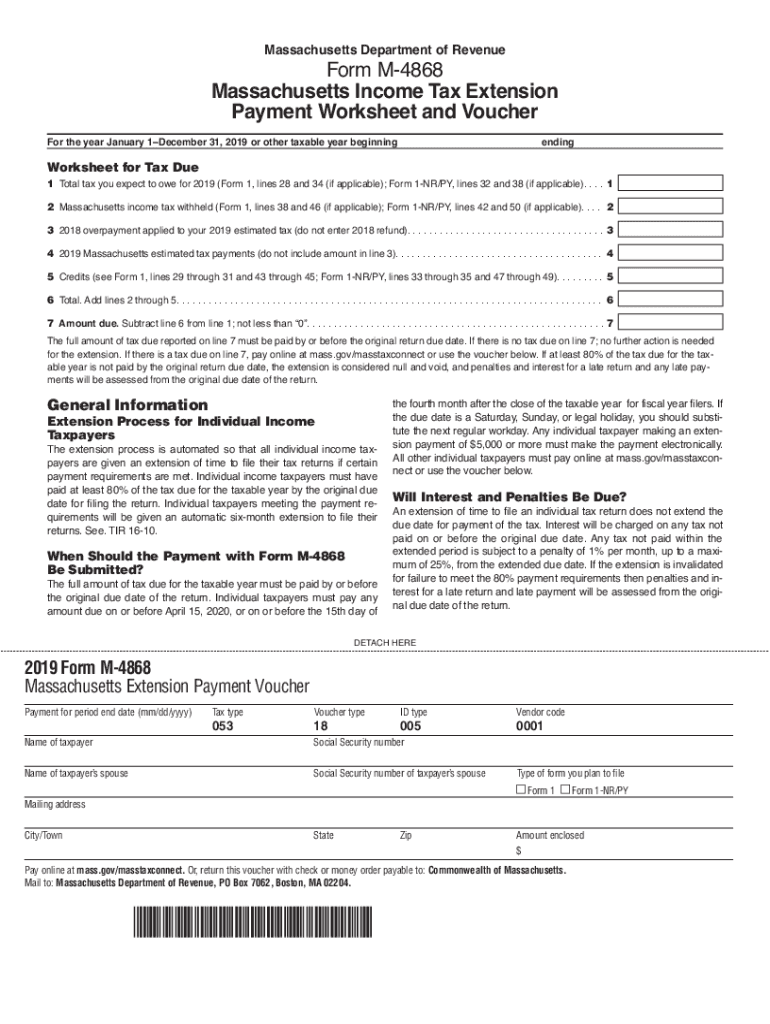

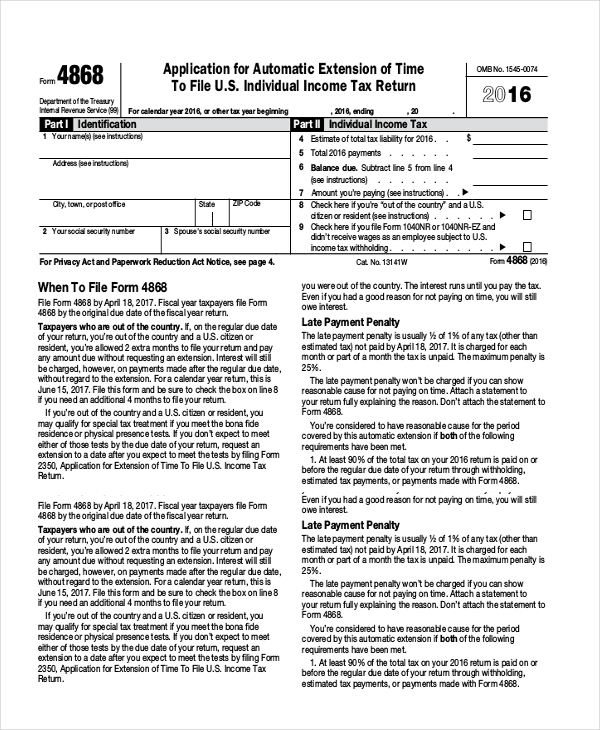

Massachusetts Extension 20192024 Form Fill Out and Sign Printable

These forms are subject to change only by federal or state legislative action. Form 1 is the general individual income tax return for massachusetts state residents. Dor has released its draft 2024 massachusetts personal income tax forms. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Massachusetts income tax return instructions.

Printable Ma Tax Forms Printable Forms Free Online

Dor has released its draft 2024 massachusetts personal income tax forms. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. Massachusetts income tax return instructions. This page details specific information and instructions that may apply to your state. Dor has released its 2023 ma personal income tax forms.

Detailed instructions for completing your Fringe Benefit Tax Return

Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. To qualify for the deduction, the following must be true: Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts. These forms are subject to change only by federal or state legislative action. Dor has released its draft.

MA PV 20192021 Fill out Tax Template Online US Legal Forms

These forms are subject to change only by federal or state legislative action. This page details specific information and instructions that may apply to your state. You may file by mail on paper forms or online thorugh efiling. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Here you will find an updated listing.

Fillable Texas Tax Exempt Form Printable Forms Free Online

Dor has released its 2023 ma personal income tax forms. Dor has released its draft 2024 massachusetts personal income tax forms. To qualify for the deduction, the following must be true: Form 1 is the general individual income tax return for massachusetts state residents. These forms are subject to change only by federal or state legislative action.

Printable Ma Tax Forms Printable Forms Free Online

Dor has released its draft 2024 massachusetts personal income tax forms. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the.

Nirmala Sitharaman return forms available early

Form 1 is the general individual income tax return for massachusetts state residents. Massachusetts income tax return instructions. Enter the amount of medical savings account deduction included on form 1040, schedule 1, line. These forms are subject to change only by federal or state legislative action. This page details specific information and instructions that may apply to your state.

Enter The Amount Of Medical Savings Account Deduction Included On Form 1040, Schedule 1, Line.

Form 1 is the general individual income tax return for massachusetts state residents. Here you will find an updated listing of all massachusetts department of revenue (dor) tax forms and instructions. Dor has released its 2023 ma personal income tax forms. Massachusetts income tax return instructions.

You May File By Mail On Paper Forms Or Online Thorugh Efiling.

This page details specific information and instructions that may apply to your state. To qualify for the deduction, the following must be true: These forms are subject to change only by federal or state legislative action. Complete the respective massachusetts tax form (s) then download, print, sign, and mail them to the massachusetts.