Local Services Tax Pennsylvania

Local Services Tax Pennsylvania - Employers with worksites located in pennsylvania are required to withhold and remit the local. Employers with worksites located in pennsylvania are required. (employee must show proof that $10 was withheld) the rate of the local services tax is. Where can i find information regarding the local services tax/emergency and municipal services tax? The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Dced local government services act 32: In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and. What is the local services tax? Local income tax requirements for employers. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the.

In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and. Employers with worksites located in pennsylvania are required to withhold and remit the local. (employee must show proof that $10 was withheld) the rate of the local services tax is. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the. Local income tax requirements for employers. Local services tax to the city of pittsburgh? Employers with worksites located in pennsylvania are required. Dced local government services act 32: What is the local services tax? The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and. Employers with worksites located in pennsylvania are required. What is the local services tax? Local services tax to the city of pittsburgh? Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the. Employers with worksites located in pennsylvania are required to withhold and remit the local. (employee must show proof that $10 was withheld) the rate of the local services tax is. Where can i find information regarding the local services tax/emergency and municipal services tax? Local income tax requirements for employers. Dced local government services act 32:

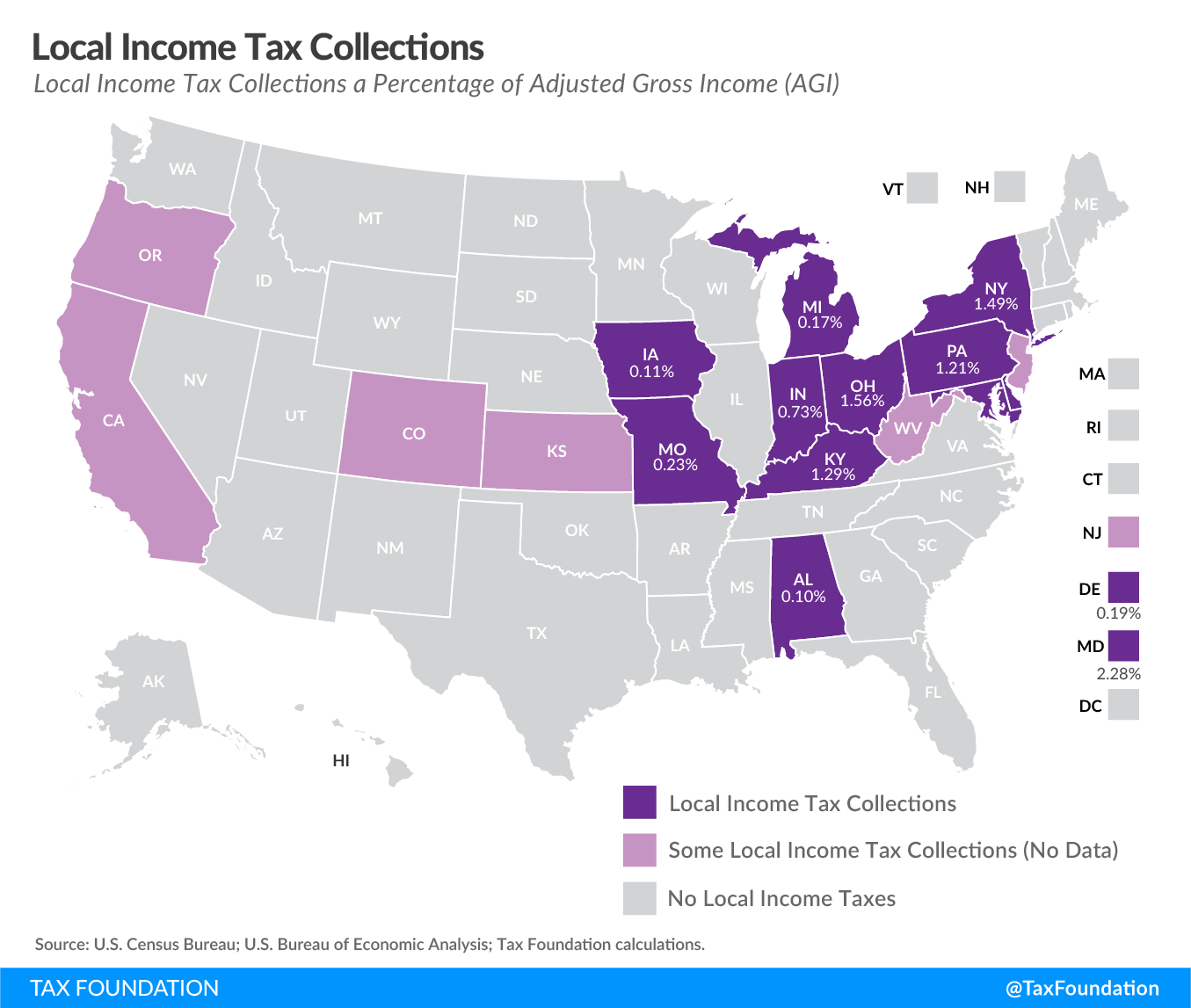

Local Taxes in 2019 Local Tax City & County Level

Employers with worksites located in pennsylvania are required to withhold and remit the local. Where can i find information regarding the local services tax/emergency and municipal services tax? In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and. (employee must show proof that $10 was withheld) the rate of the local services tax.

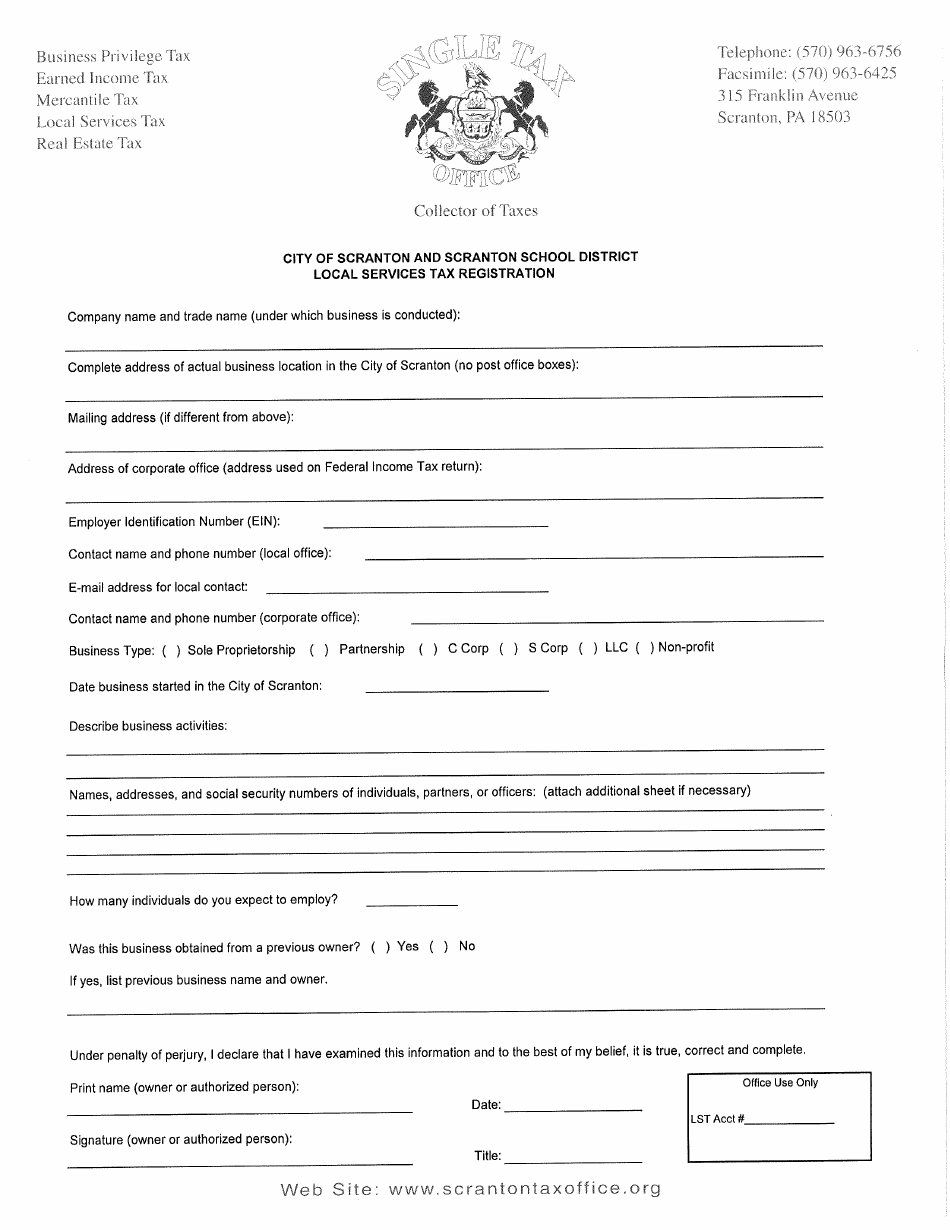

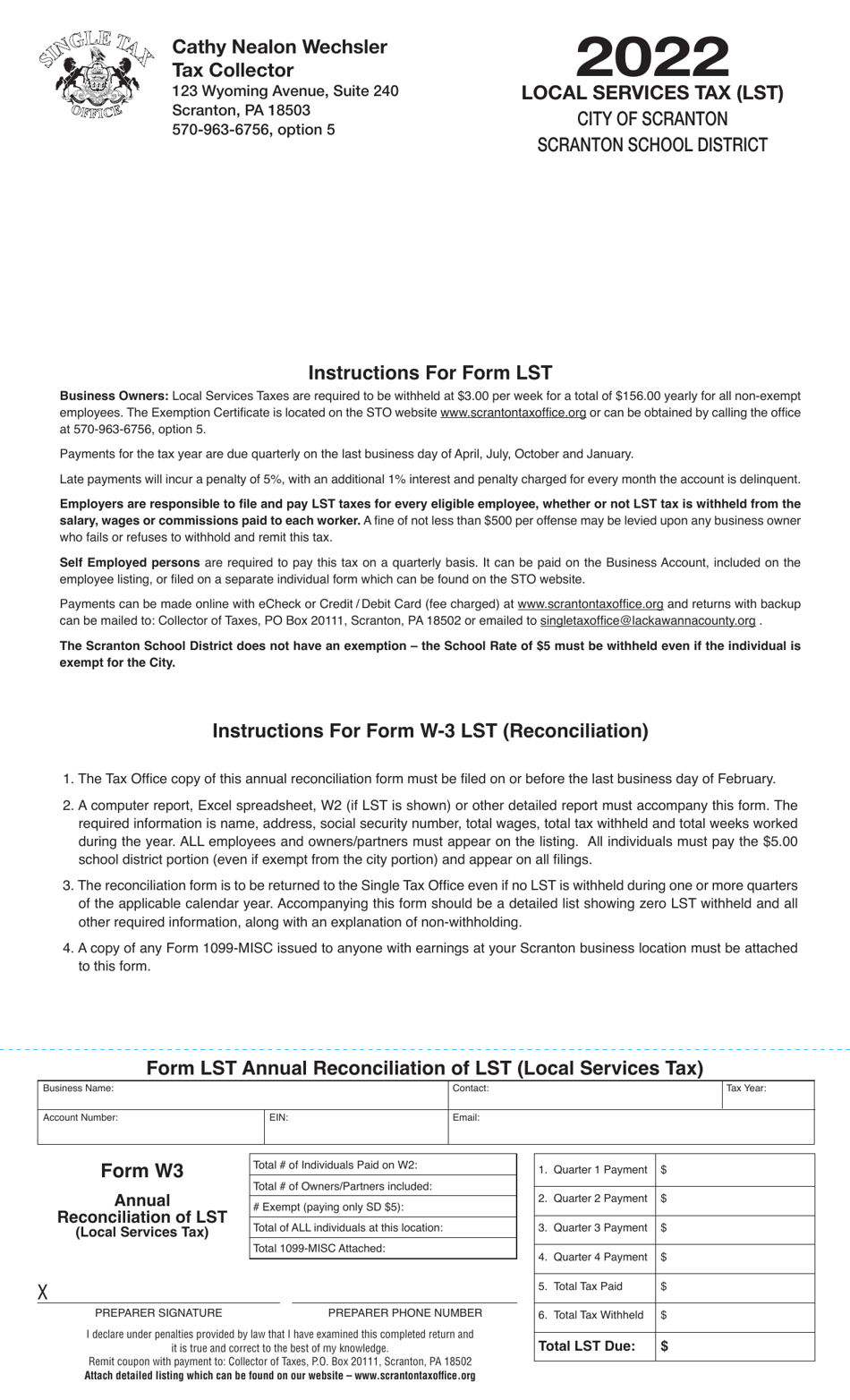

City of Sacranton, Pennsylvania Local Services Tax Registration Fill

What is the local services tax? Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the. In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and. Local income tax requirements for employers. The local services tax is.

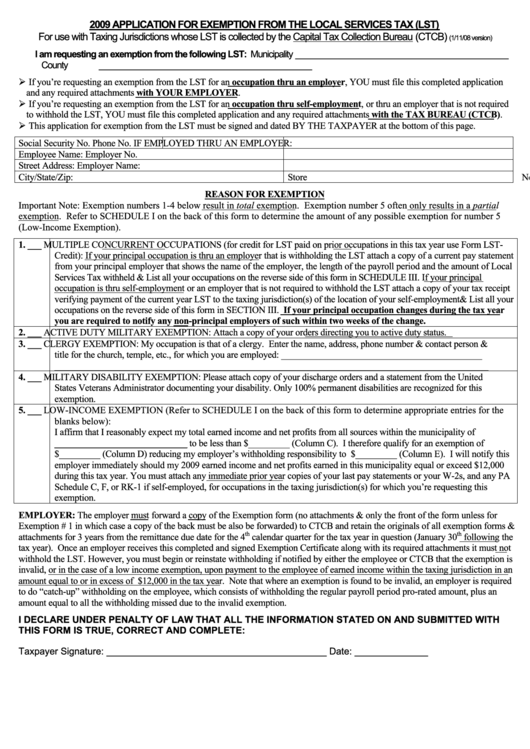

Application For Exemption From The Local Services Tax Pennsylvania

In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the. Dced local government services act 32: The local services tax is a local tax payable by all.

Where'S My State Tax Refund Pennsylvania

Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. What is the local services tax? Where can i find information regarding the local services tax/emergency and municipal services tax? Local services tax to the city of pittsburgh?

Form LST (W3 LST) 2022 Fill Out, Sign Online and Download

Where can i find information regarding the local services tax/emergency and municipal services tax? Dced local government services act 32: (employee must show proof that $10 was withheld) the rate of the local services tax is. Local income tax requirements for employers. In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and.

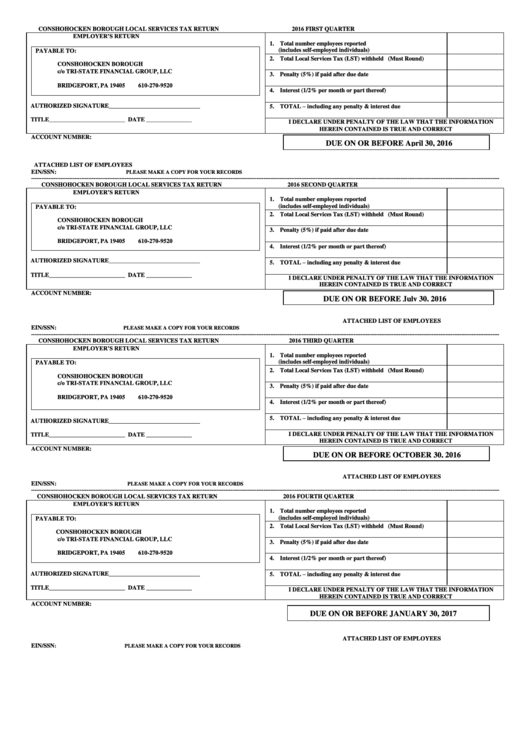

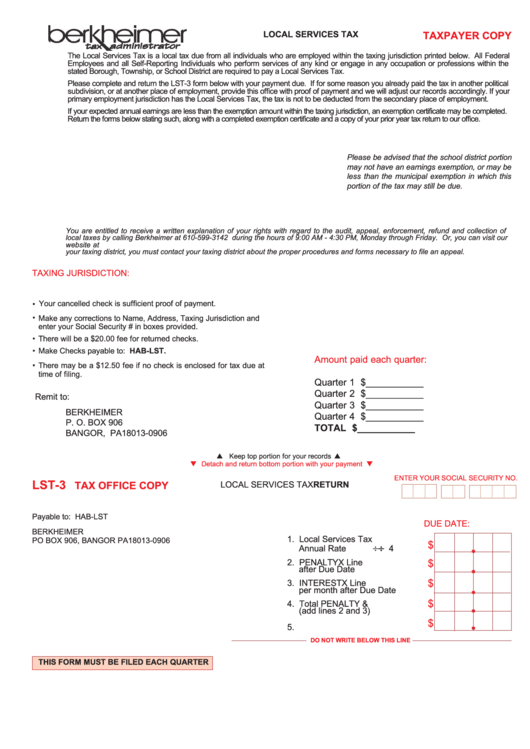

Local Services Tax Return Form 2016 printable pdf download

Employers with worksites located in pennsylvania are required to withhold and remit the local. Where can i find information regarding the local services tax/emergency and municipal services tax? In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and. Dced local government services act 32: Local income tax requirements for employers.

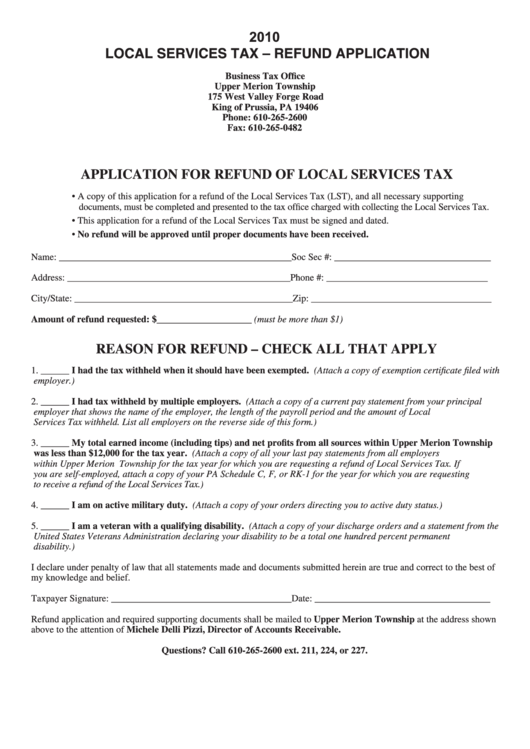

Application For Refund Of Local Services Tax State Of Pennsylvania

(employee must show proof that $10 was withheld) the rate of the local services tax is. Where can i find information regarding the local services tax/emergency and municipal services tax? Employers with worksites located in pennsylvania are required. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following.

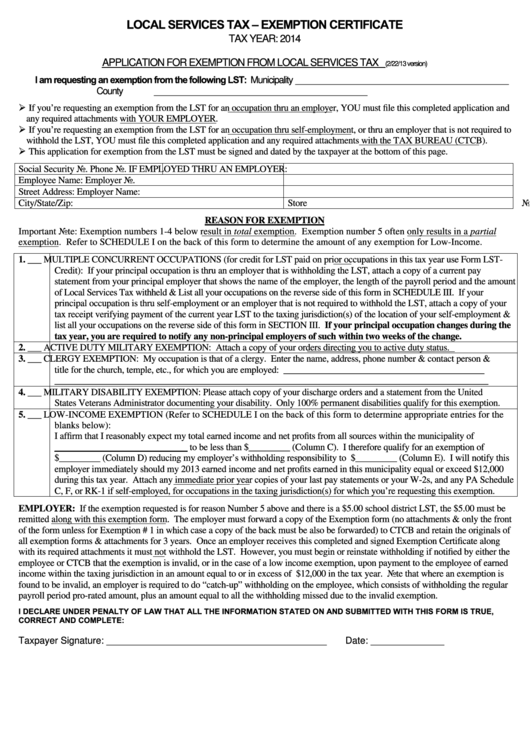

Local Services Tax Exemption Certificate Pennsylvania Capital Tax

Dced local government services act 32: Employers with worksites located in pennsylvania are required. Employers with worksites located in pennsylvania are required to withhold and remit the local. Where can i find information regarding the local services tax/emergency and municipal services tax? What is the local services tax?

20192021 Form PA PSRS996 Fill Online, Printable, Fillable, Blank

Employers with worksites located in pennsylvania are required to withhold and remit the local. The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Employers with worksites located in pennsylvania are required. What is the local services tax? Dced local government services act 32:

Local Services Tax printable pdf download

Local income tax requirements for employers. (employee must show proof that $10 was withheld) the rate of the local services tax is. The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. In 2008, the local services tax replaced the former occupational privilege tax (opt).

(Employee Must Show Proof That $10 Was Withheld) The Rate Of The Local Services Tax Is.

The local services tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Employers with worksites located in pennsylvania are required. Local services tax to the city of pittsburgh? Local income tax requirements for employers.

Dced Local Government Services Act 32:

In 2008, the local services tax replaced the former occupational privilege tax (opt) and the emergency and. Local services tax (lst) act 7 of 2007 amends the local tax enabling act, act 511 of 1965, to make the following major changes to the. Where can i find information regarding the local services tax/emergency and municipal services tax? What is the local services tax?