Local Sales Tax In Washington State

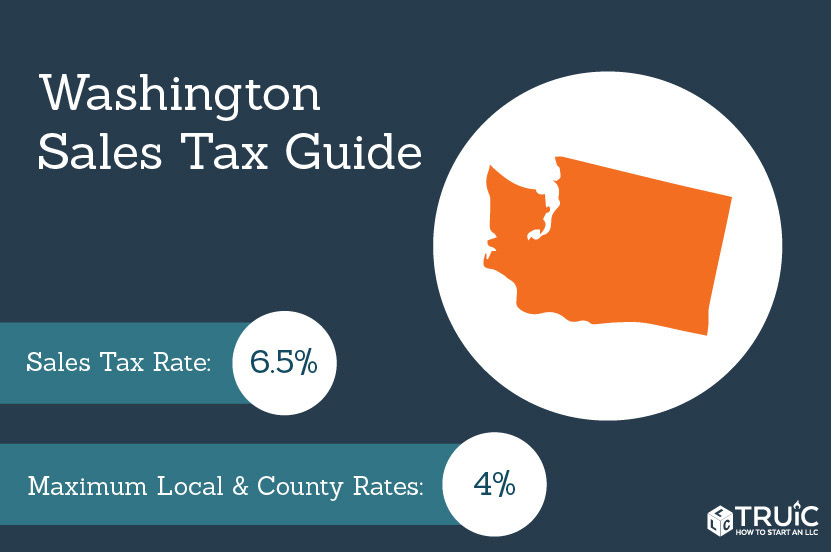

Local Sales Tax In Washington State - Washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4.1%. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. You’ll find rates for sales and use tax, motor. There are a total of 178. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local. Use this search tool to look up sales tax rates for any location in washington.

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. You’ll find rates for sales and use tax, motor. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Use this search tool to look up sales tax rates for any location in washington. Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local. Washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4.1%. There are a total of 178. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%.

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. There are a total of 178. You’ll find rates for sales and use tax, motor. Use this search tool to look up sales tax rates for any location in washington. Washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4.1%. Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local.

Washington Sales Tax Small Business Guide TRUiC

You’ll find rates for sales and use tax, motor. Use this search tool to look up sales tax rates for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. There are a total of 178. Use our tax rate lookup tool.

Washington State Considers Having Highest Sales Tax in the U.S. Tax

You’ll find rates for sales and use tax, motor. Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local. Washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4.1%. Use this search tool to look up sales tax rates.

Ultimate Washington Sales Tax Guide Zamp

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Use this search tool to look up sales tax rates for any location in washington. Retail sales taxes (chapter.

Combined State and Average Local Sales Tax Rates Tax Foundation

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local..

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local. You’ll find rates for sales and use tax, motor. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Use this search tool to look up sales tax.

Monday Map Combined State and Local Sales Tax Rates

Washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4.1%. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Use our tax rate lookup tool to find tax rates and location codes for any.

Tax Foundation Washington has nation's 4th highest combined state

Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local. There are a total of 178. Use this search tool to look up sales tax rates for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax.

Washington state sales tax by Kiven Sea Issuu

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. There are a total of 178. Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local. Use this search tool to look up sales tax rates for any location in washington. Washington has.

Sales Tax Expert Consultants Sales Tax Rates by State State and Local

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option.

What Is the Washington State Vehicle Sales Tax?

You’ll find rates for sales and use tax, motor. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. There are a total of 178. Use this search tool to look up sales tax rates for any location in washington. Washington has state sales tax of.

Use Our Tax Rate Lookup Tool To Find Tax Rates And Location Codes For Any Location In Washington.

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Retail sales taxes (chapter 82.08 rcw) and use taxes (chapter 82.12 rcw) are important revenue sources for many local. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. There are a total of 178.

Use This Search Tool To Look Up Sales Tax Rates For Any Location In Washington.

Washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 4.1%. You’ll find rates for sales and use tax, motor.

.png)

.png)