Local Earned Income Tax

Local Earned Income Tax - Wyoming does not have an individual income tax. The wyoming tax summary 2020 is your quick reference guide to wyoming state and local government taxes. Each section includes the tax basis, rate, exemptions, collection procedures. File taxes locally with a tax preparer at an h&r block office near you. Wyoming also does not have a corporate income tax. Wyoming has a 4.00 percent state sales tax rate and an average combined state and local. We have information on the local. Sales tax collections for the retail trade sector, which are itemized by sub‐sector components, and for the accommodation and food services sector are provided in the report. With an average of 10 years’ experience, our tax professionals have the tools you need!

We have information on the local. Sales tax collections for the retail trade sector, which are itemized by sub‐sector components, and for the accommodation and food services sector are provided in the report. Each section includes the tax basis, rate, exemptions, collection procedures. File taxes locally with a tax preparer at an h&r block office near you. With an average of 10 years’ experience, our tax professionals have the tools you need! Wyoming has a 4.00 percent state sales tax rate and an average combined state and local. Wyoming does not have an individual income tax. Wyoming also does not have a corporate income tax. The wyoming tax summary 2020 is your quick reference guide to wyoming state and local government taxes.

With an average of 10 years’ experience, our tax professionals have the tools you need! We have information on the local. Wyoming also does not have a corporate income tax. Wyoming has a 4.00 percent state sales tax rate and an average combined state and local. The wyoming tax summary 2020 is your quick reference guide to wyoming state and local government taxes. Wyoming does not have an individual income tax. Each section includes the tax basis, rate, exemptions, collection procedures. File taxes locally with a tax preparer at an h&r block office near you. Sales tax collections for the retail trade sector, which are itemized by sub‐sector components, and for the accommodation and food services sector are provided in the report.

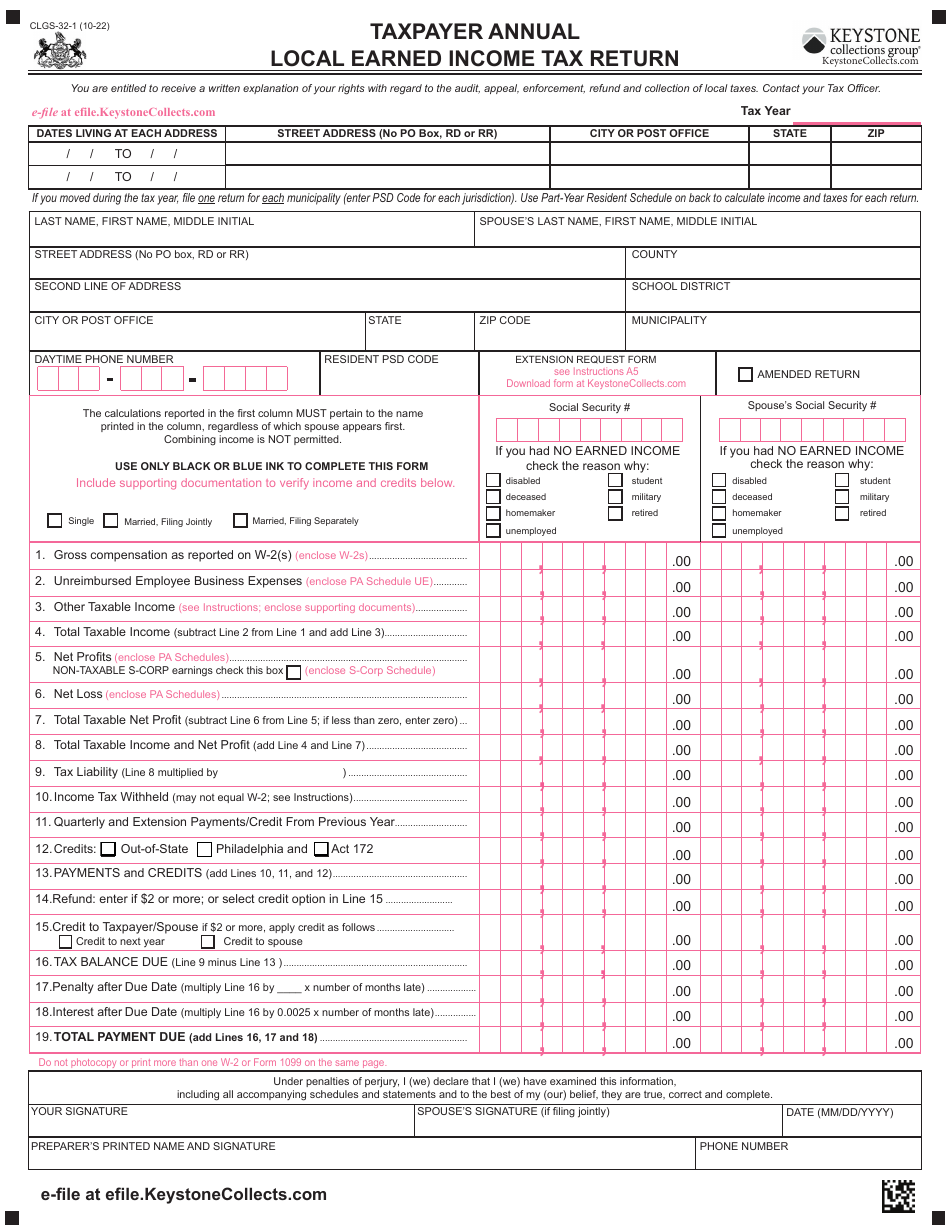

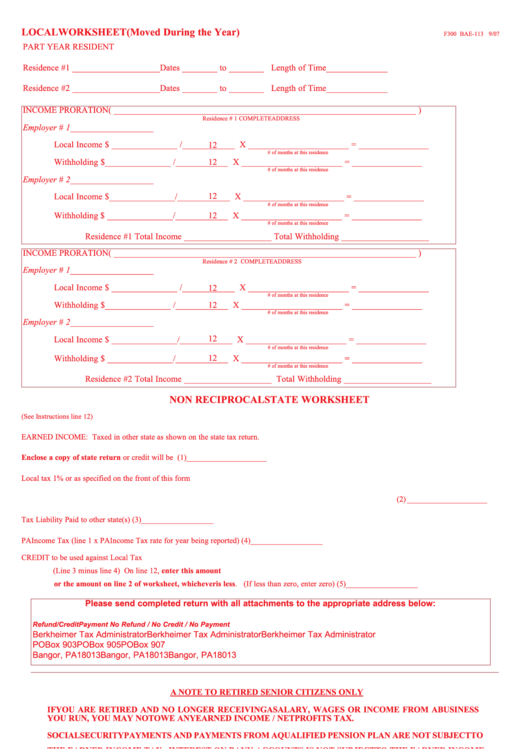

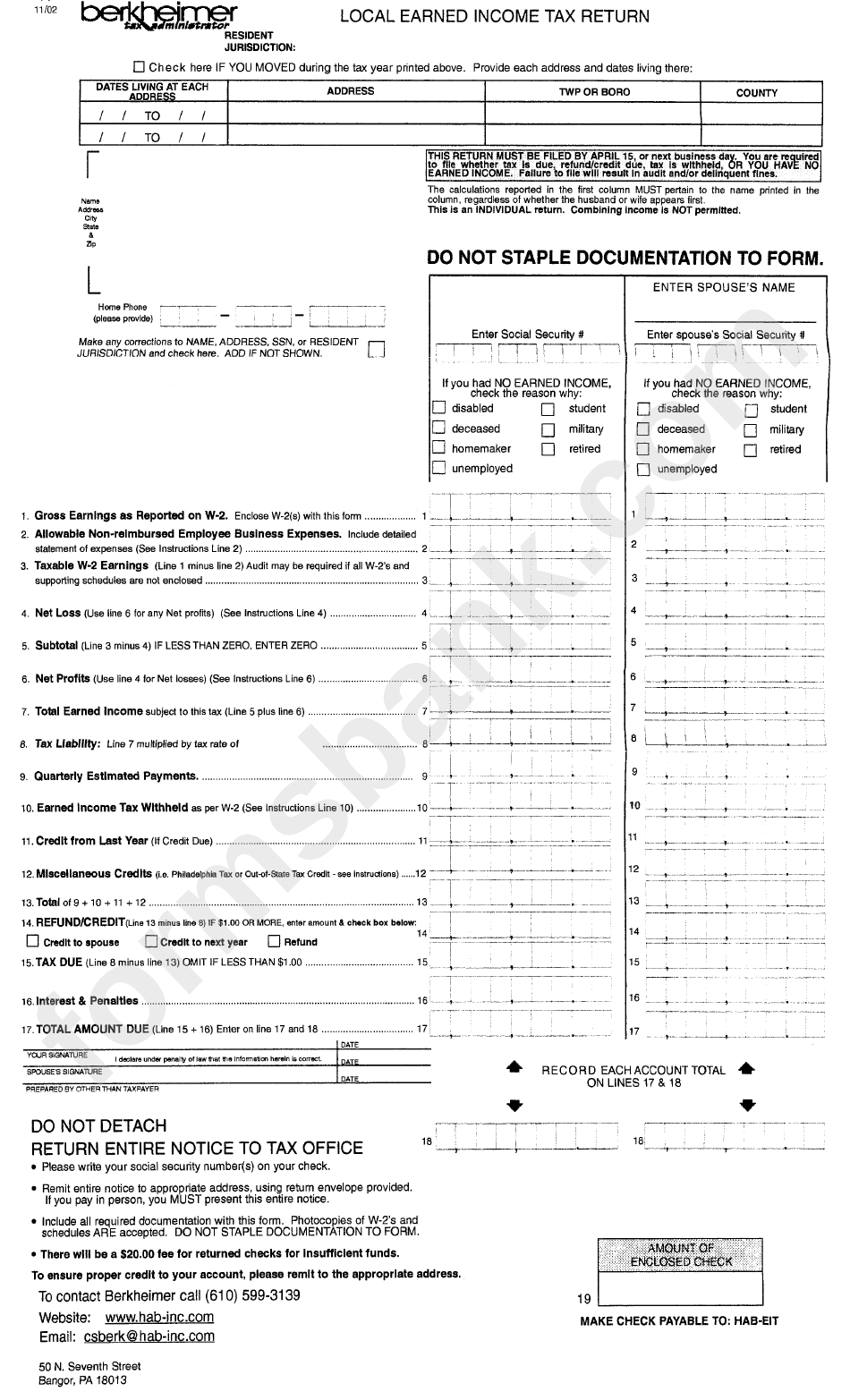

Form CLGS321 Download Fillable PDF or Fill Online Taxpayer Annual

With an average of 10 years’ experience, our tax professionals have the tools you need! File taxes locally with a tax preparer at an h&r block office near you. Wyoming also does not have a corporate income tax. Wyoming does not have an individual income tax. Sales tax collections for the retail trade sector, which are itemized by sub‐sector components,.

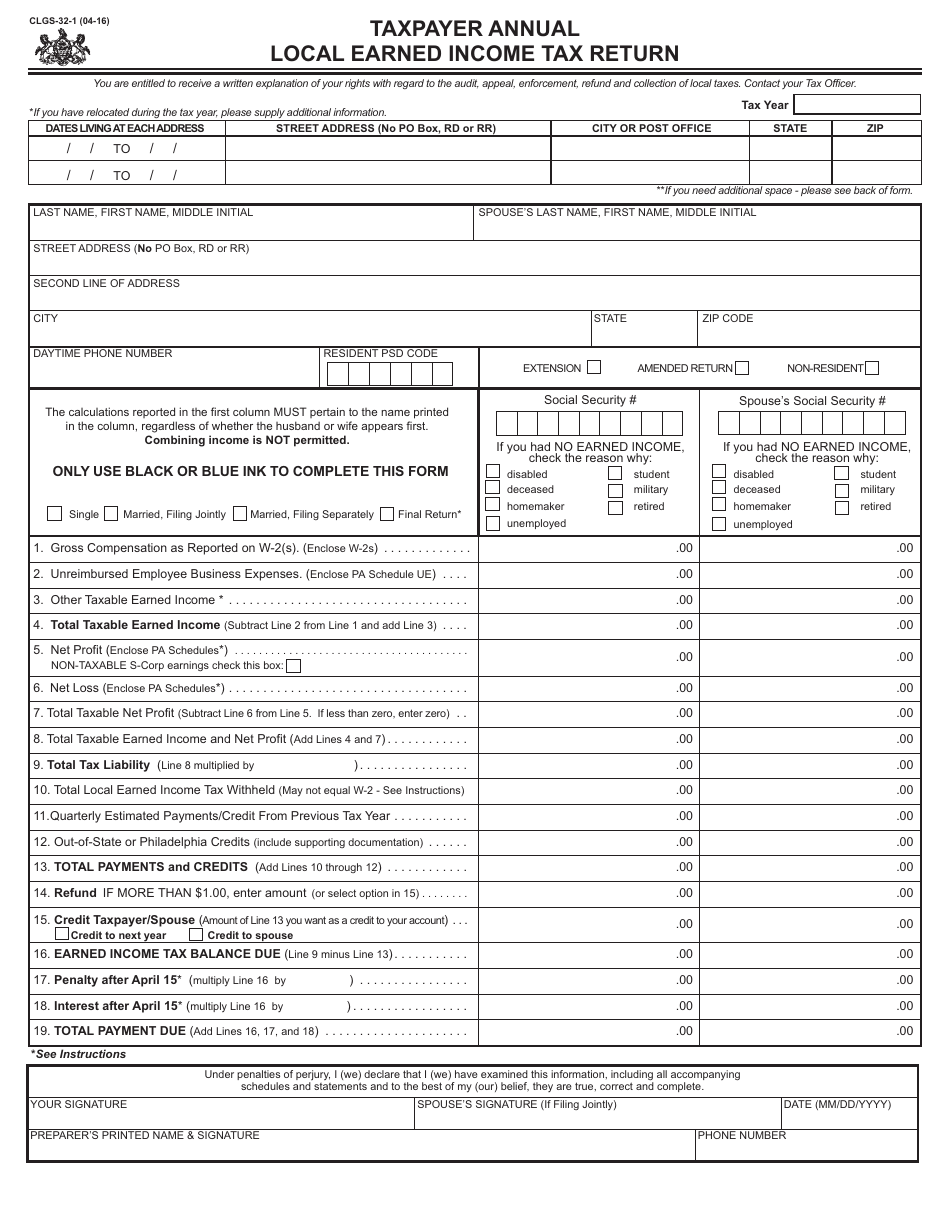

Fillable Local Earned Tax Form Pa Printable Forms Free Online

File taxes locally with a tax preparer at an h&r block office near you. Wyoming does not have an individual income tax. Each section includes the tax basis, rate, exemptions, collection procedures. We have information on the local. Wyoming also does not have a corporate income tax.

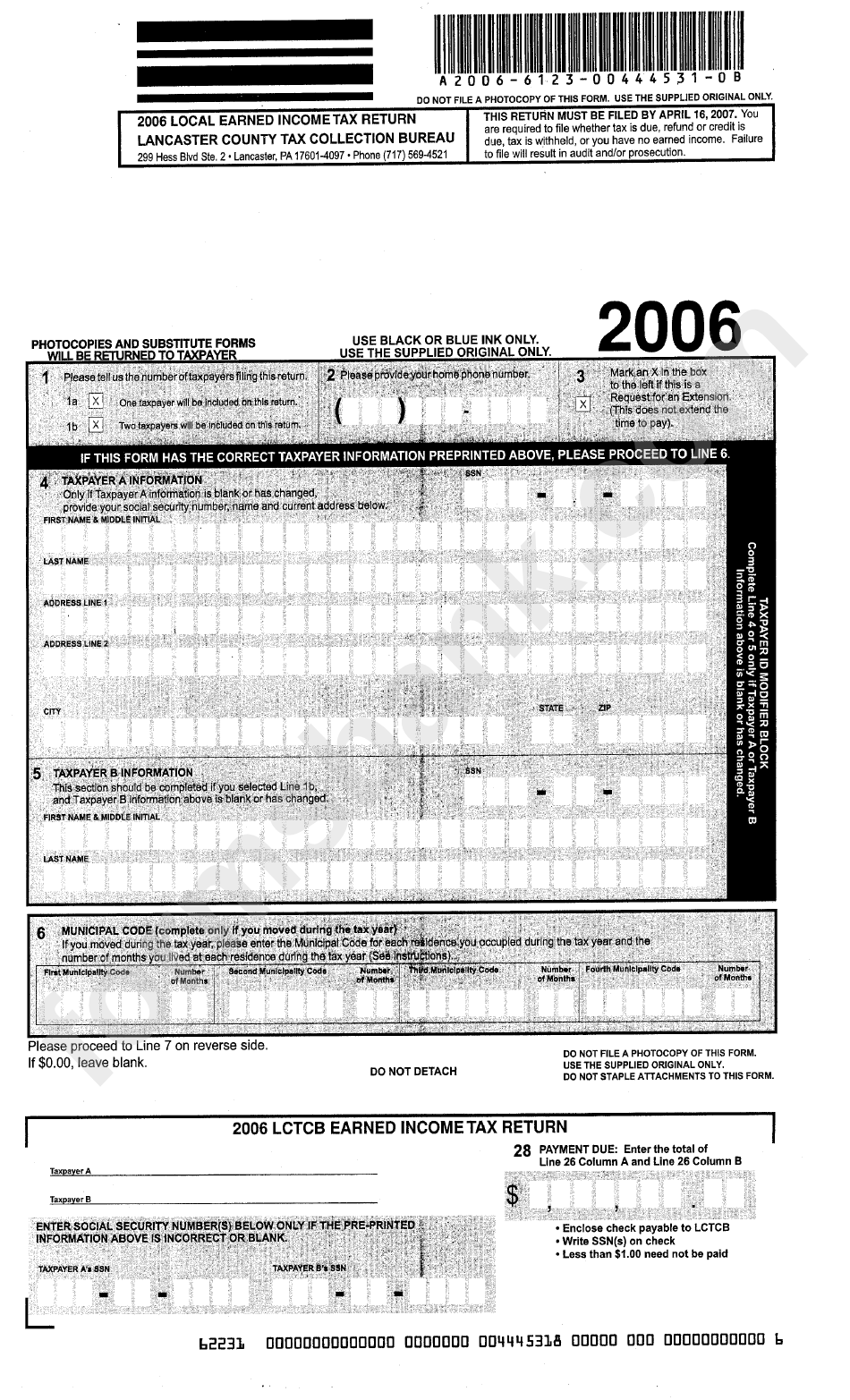

Local Earned Tax Return Form 2006 Lancaster County Tax

Wyoming does not have an individual income tax. Each section includes the tax basis, rate, exemptions, collection procedures. File taxes locally with a tax preparer at an h&r block office near you. The wyoming tax summary 2020 is your quick reference guide to wyoming state and local government taxes. Wyoming has a 4.00 percent state sales tax rate and an.

Fillable Local Earned Tax Form Pa Printable Forms Free Online

The wyoming tax summary 2020 is your quick reference guide to wyoming state and local government taxes. Wyoming also does not have a corporate income tax. We have information on the local. File taxes locally with a tax preparer at an h&r block office near you. Each section includes the tax basis, rate, exemptions, collection procedures.

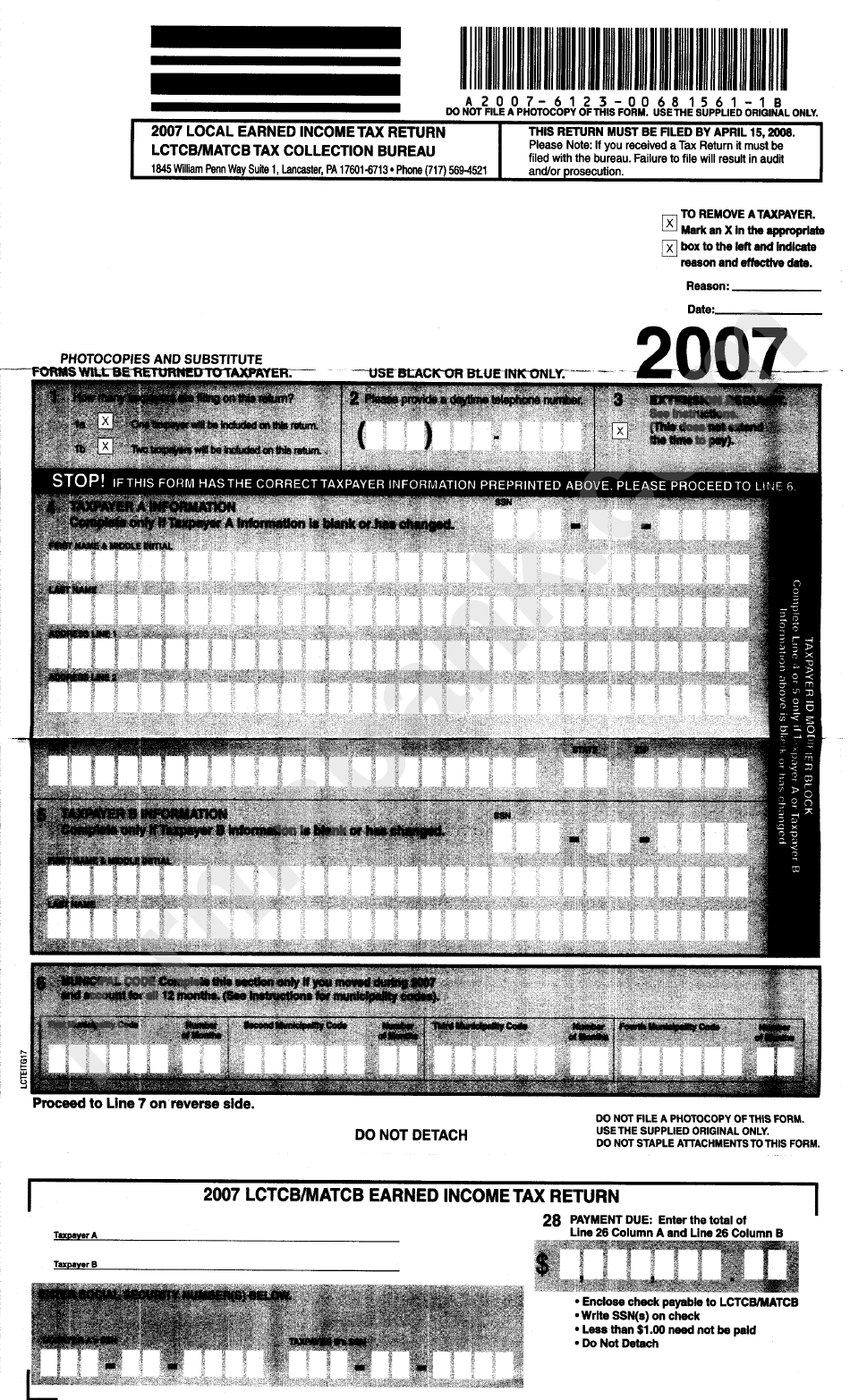

Local Earned Tax Return Form printable pdf download

With an average of 10 years’ experience, our tax professionals have the tools you need! Each section includes the tax basis, rate, exemptions, collection procedures. Wyoming does not have an individual income tax. File taxes locally with a tax preparer at an h&r block office near you. Sales tax collections for the retail trade sector, which are itemized by sub‐sector.

Form I301 Local Earned Tax Return Berkheimer Tax

The wyoming tax summary 2020 is your quick reference guide to wyoming state and local government taxes. Wyoming has a 4.00 percent state sales tax rate and an average combined state and local. We have information on the local. Each section includes the tax basis, rate, exemptions, collection procedures. Wyoming does not have an individual income tax.

Fillable Online Local Earned Tax Return Form Fax Email Print

Sales tax collections for the retail trade sector, which are itemized by sub‐sector components, and for the accommodation and food services sector are provided in the report. Wyoming also does not have a corporate income tax. We have information on the local. Wyoming has a 4.00 percent state sales tax rate and an average combined state and local. The wyoming.

Local Earned Tax Return Form printable pdf download

Each section includes the tax basis, rate, exemptions, collection procedures. File taxes locally with a tax preparer at an h&r block office near you. Wyoming has a 4.00 percent state sales tax rate and an average combined state and local. Wyoming also does not have a corporate income tax. Sales tax collections for the retail trade sector, which are itemized.

Fill LOCAL EARNED TAX RETURN TAXPAYER ANNUAL

File taxes locally with a tax preparer at an h&r block office near you. We have information on the local. With an average of 10 years’ experience, our tax professionals have the tools you need! Wyoming also does not have a corporate income tax. The wyoming tax summary 2020 is your quick reference guide to wyoming state and local government.

Local Earned Tax Return Form Berkheimer Tax Administrator

Wyoming also does not have a corporate income tax. Sales tax collections for the retail trade sector, which are itemized by sub‐sector components, and for the accommodation and food services sector are provided in the report. With an average of 10 years’ experience, our tax professionals have the tools you need! We have information on the local. Wyoming does not.

The Wyoming Tax Summary 2020 Is Your Quick Reference Guide To Wyoming State And Local Government Taxes.

Each section includes the tax basis, rate, exemptions, collection procedures. We have information on the local. Wyoming has a 4.00 percent state sales tax rate and an average combined state and local. With an average of 10 years’ experience, our tax professionals have the tools you need!

Wyoming Does Not Have An Individual Income Tax.

Wyoming also does not have a corporate income tax. Sales tax collections for the retail trade sector, which are itemized by sub‐sector components, and for the accommodation and food services sector are provided in the report. File taxes locally with a tax preparer at an h&r block office near you.