Kansas City Mo Local Tax

Kansas City Mo Local Tax - Are we responsible for local taxes? Therefore, the amount of tax businesses collect from the purchaser. You can click on any city or county for more details, including the. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. We have information on the local income tax rates in 2 localities in missouri. My business has a single employee working from a home office location in kansas city, missouri. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. How to use quick tax? Cities, counties, and certain districts may also impose local sales tax;

Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. My business has a single employee working from a home office location in kansas city, missouri. Are we responsible for local taxes? You can click on any city or county for more details, including the. Cities, counties, and certain districts may also impose local sales tax; Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. We have information on the local income tax rates in 2 localities in missouri. How to use quick tax? Therefore, the amount of tax businesses collect from the purchaser.

Therefore, the amount of tax businesses collect from the purchaser. Cities, counties, and certain districts may also impose local sales tax; You can click on any city or county for more details, including the. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. My business has a single employee working from a home office location in kansas city, missouri. How to use quick tax? We have information on the local income tax rates in 2 localities in missouri. Are we responsible for local taxes? Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to.

Where are the new residents of Kansas City, MO moving from?

We have information on the local income tax rates in 2 localities in missouri. You can click on any city or county for more details, including the. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Residents of kansas city pay a flat city income.

Map of Kansas City, MO, Missouri

Are we responsible for local taxes? Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. We have information on the local income tax rates in 2 localities in missouri. How to use quick tax? You can click on any city or county for more details,.

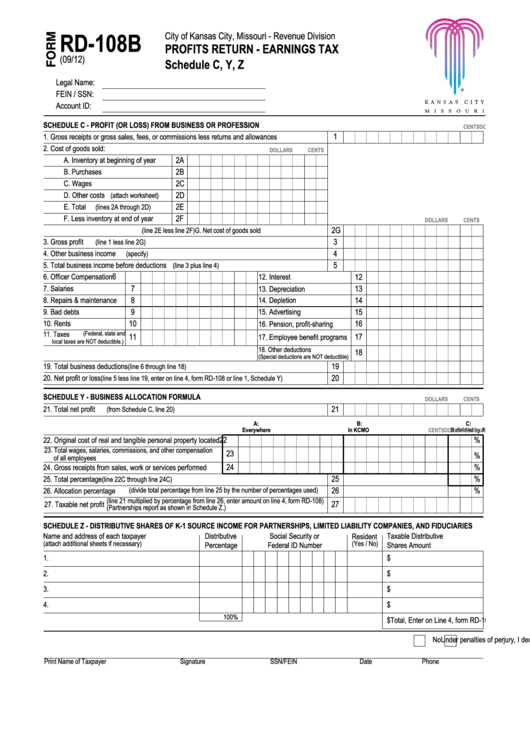

Top 7 Kansas City Tax Forms And Templates free to download in PDF format

Cities, counties, and certain districts may also impose local sales tax; Therefore, the amount of tax businesses collect from the purchaser. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. We have information on the local income tax rates in 2 localities in.

Kansas City Missouri Logo LogoDix

We have information on the local income tax rates in 2 localities in missouri. Therefore, the amount of tax businesses collect from the purchaser. How to use quick tax? Are we responsible for local taxes? Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,.

Race, Diversity, and Ethnicity in Kansas City, MO

Are we responsible for local taxes? We have information on the local income tax rates in 2 localities in missouri. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. How to use quick tax? You can click on any city or county for.

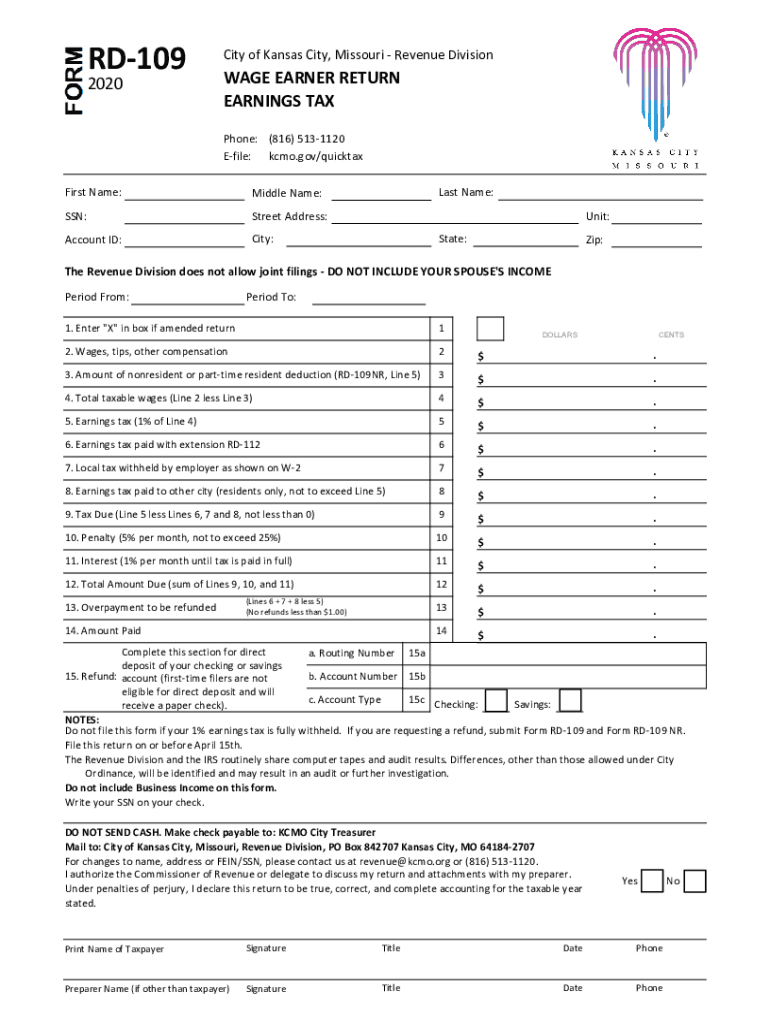

MO RD109 Kansas City 20202022 Fill out Tax Template Online US

Are we responsible for local taxes? Therefore, the amount of tax businesses collect from the purchaser. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes.

Resident Engagement

Are we responsible for local taxes? Therefore, the amount of tax businesses collect from the purchaser. You can click on any city or county for more details, including the. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. How to use quick tax?

Map of Kansas City MO

Are we responsible for local taxes? We have information on the local income tax rates in 2 localities in missouri. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business,.

Best Restaurants In Kansas City, MO

We have information on the local income tax rates in 2 localities in missouri. Are we responsible for local taxes? You can click on any city or county for more details, including the. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Therefore, the amount.

kansas city, mo Olivia Rodrigo Official Store

You can click on any city or county for more details, including the. My business has a single employee working from a home office location in kansas city, missouri. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income. Forms to be filed with.

How To Use Quick Tax?

Are we responsible for local taxes? You can click on any city or county for more details, including the. My business has a single employee working from a home office location in kansas city, missouri. Residents of kansas city pay a flat city income tax of 1.00% on earned income, in addition to the missouri income tax and the federal income.

Cities, Counties, And Certain Districts May Also Impose Local Sales Tax;

We have information on the local income tax rates in 2 localities in missouri. Therefore, the amount of tax businesses collect from the purchaser. Quick tax is an online system kcmo taxpayers may use to file tax returns, make payments, register a business, view and make changes to. Forms to be filed with the division other than tax returns including releases, authorizations, requests for tax clearance and penalty waiver,.