Is Florida A Tax Lien Or Deed State

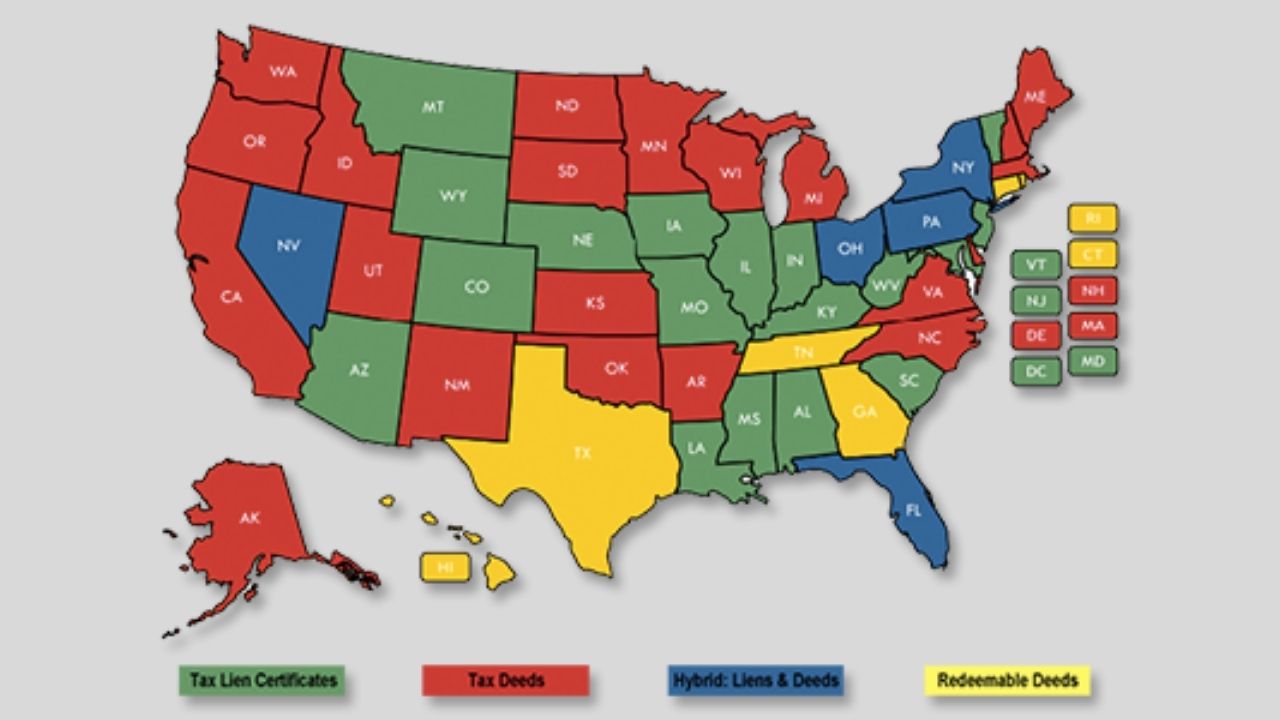

Is Florida A Tax Lien Or Deed State - The process begins with the tax lien. Florida is a hybrid state, which means it combines elements of both tax lien and deed states. When a property owner fails to pay. Florida is both a tax lien and tax deed state. If a property owner has not paid property taxes, the county. Florida is a combined state, offering investors tax liens and tax deeds through county auctions. Is florida a tax deed state? In florida, if taxes on a parcel of land are not paid, the tax collector may sell a tax certificate on the parcel at public auction. All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of.

Florida is a hybrid state, which means it combines elements of both tax lien and deed states. The process begins with the tax lien. In florida, if taxes on a parcel of land are not paid, the tax collector may sell a tax certificate on the parcel at public auction. Florida is both a tax lien and tax deed state. Is florida a tax deed state? Florida is a combined state, offering investors tax liens and tax deeds through county auctions. When a property owner fails to pay. All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of. If a property owner has not paid property taxes, the county.

Is florida a tax deed state? When a property owner fails to pay. If a property owner has not paid property taxes, the county. All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of. Florida is a hybrid state, which means it combines elements of both tax lien and deed states. The process begins with the tax lien. Florida is a combined state, offering investors tax liens and tax deeds through county auctions. Florida is both a tax lien and tax deed state. In florida, if taxes on a parcel of land are not paid, the tax collector may sell a tax certificate on the parcel at public auction.

Tax Deed Vs Tax Lien (3)

Florida is a hybrid state, which means it combines elements of both tax lien and deed states. Is florida a tax deed state? When a property owner fails to pay. In florida, if taxes on a parcel of land are not paid, the tax collector may sell a tax certificate on the parcel at public auction. Florida is both a.

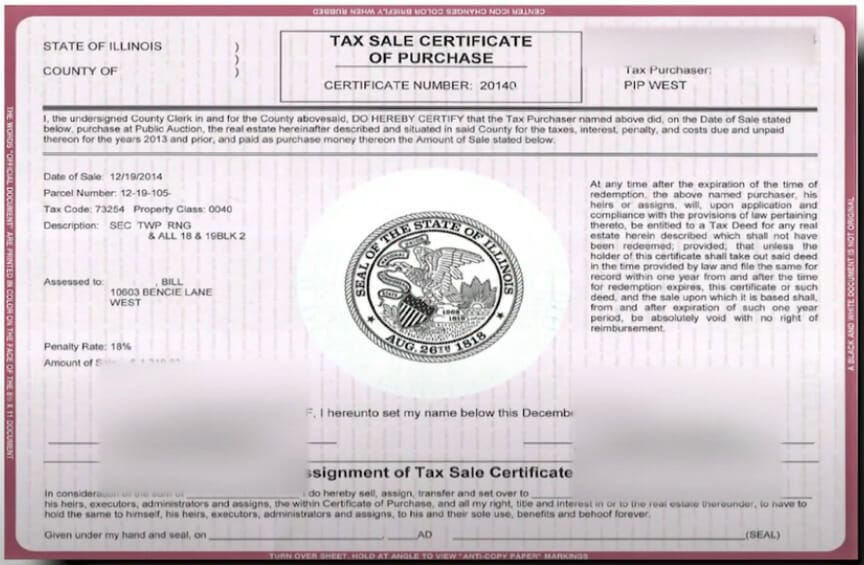

Is Illinois a Tax Lien or Tax Deed State, and Why Is It a 1 Choice

When a property owner fails to pay. All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of. In florida, if taxes on a parcel of land are not paid, the tax collector may sell a tax certificate on the parcel at public auction. If a property.

Florida Deed Forms & Templates (Free) [Word, PDF, ODT]

Florida is both a tax lien and tax deed state. Is florida a tax deed state? All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of. In florida, if taxes on a parcel of land are not paid, the tax collector may sell a tax certificate.

book ️[READ] ️ Florida Tax Lien and Deed Investing Book Buying Real

When a property owner fails to pay. Florida is both a tax lien and tax deed state. Florida is a hybrid state, which means it combines elements of both tax lien and deed states. The process begins with the tax lien. Florida is a combined state, offering investors tax liens and tax deeds through county auctions.

Florida Tax Lien and Online Deed Sales Michael Schuett

All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of. Florida is a hybrid state, which means it combines elements of both tax lien and deed states. Is florida a tax deed state? When a property owner fails to pay. Florida is both a tax lien.

Investing In Florida Tax Lien Certificate School

The process begins with the tax lien. Florida is a combined state, offering investors tax liens and tax deeds through county auctions. Is florida a tax deed state? When a property owner fails to pay. Florida is a hybrid state, which means it combines elements of both tax lien and deed states.

Tax Deed vs Tax Lien Finance Reference

The process begins with the tax lien. When a property owner fails to pay. All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of law and of. Florida is a combined state, offering investors tax liens and tax deeds through county auctions. Is florida a tax deed state?

Tax Lien Certificates in Florida Over 1 Million Available!

Florida is both a tax lien and tax deed state. Florida is a combined state, offering investors tax liens and tax deeds through county auctions. The process begins with the tax lien. When a property owner fails to pay. All tax certificates, accrued taxes, and liens of any nature against the property shall be deemed canceled as a matter of.

Difference between a tax lien certificate and tax deed Orlando Law Firm

The process begins with the tax lien. When a property owner fails to pay. Is florida a tax deed state? In florida, if taxes on a parcel of land are not paid, the tax collector may sell a tax certificate on the parcel at public auction. Florida is a hybrid state, which means it combines elements of both tax lien.

Florida Deed Forms & Templates (Free) [Word, PDF, ODT]

Is florida a tax deed state? The process begins with the tax lien. Florida is a hybrid state, which means it combines elements of both tax lien and deed states. Florida is a combined state, offering investors tax liens and tax deeds through county auctions. When a property owner fails to pay.

All Tax Certificates, Accrued Taxes, And Liens Of Any Nature Against The Property Shall Be Deemed Canceled As A Matter Of Law And Of.

The process begins with the tax lien. Florida is a combined state, offering investors tax liens and tax deeds through county auctions. Is florida a tax deed state? In florida, if taxes on a parcel of land are not paid, the tax collector may sell a tax certificate on the parcel at public auction.

When A Property Owner Fails To Pay.

If a property owner has not paid property taxes, the county. Florida is a hybrid state, which means it combines elements of both tax lien and deed states. Florida is both a tax lien and tax deed state.

![Florida Deed Forms & Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/11/Florida-Quitclaim-Deed-Templates.Legal_.jpg)

![book ️[READ] ️ Florida Tax Lien and Deed Investing Book Buying Real](https://image.isu.pub/240131112711-7cd4b0bfb67b999aac36967027b1241b/jpg/page_1.jpg)

![Florida Deed Forms & Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/11/Florida-General-Warranty-Deed-Templates.Legal_.jpg)