Irs Form 1088

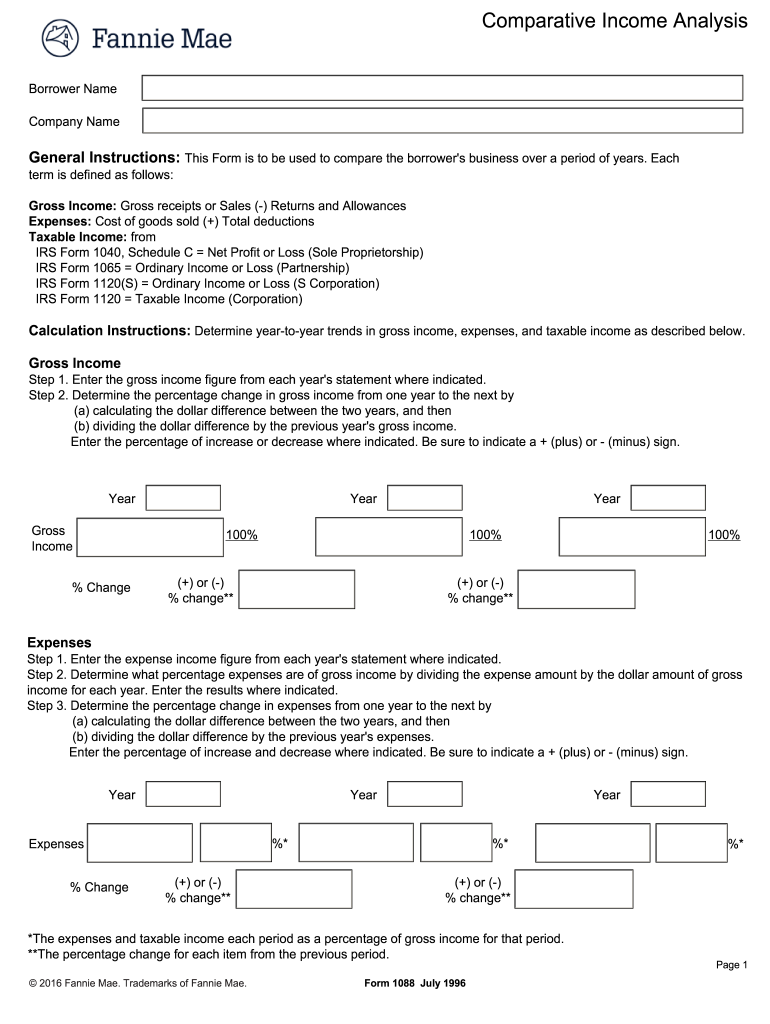

Irs Form 1088 - So what does the 1088 do? This form is to be used to compare the borrower's business over a period of years. Each term is defined as follows: Access irs forms, instructions and publications in electronic and print media. 1) evaluates gross revenue of the business, comparing year to year growth or loss. Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit).

Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. This form is to be used to compare the borrower's business over a period of years. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). 1) evaluates gross revenue of the business, comparing year to year growth or loss. So what does the 1088 do? Each term is defined as follows: Access irs forms, instructions and publications in electronic and print media.

Each term is defined as follows: Access irs forms, instructions and publications in electronic and print media. This form is to be used to compare the borrower's business over a period of years. So what does the 1088 do? 1) evaluates gross revenue of the business, comparing year to year growth or loss. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or.

IRS Form 3949A Instructions

So what does the 1088 do? Access irs forms, instructions and publications in electronic and print media. 1) evaluates gross revenue of the business, comparing year to year growth or loss. Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. Use form 8880 to figure the amount, if any, of your.

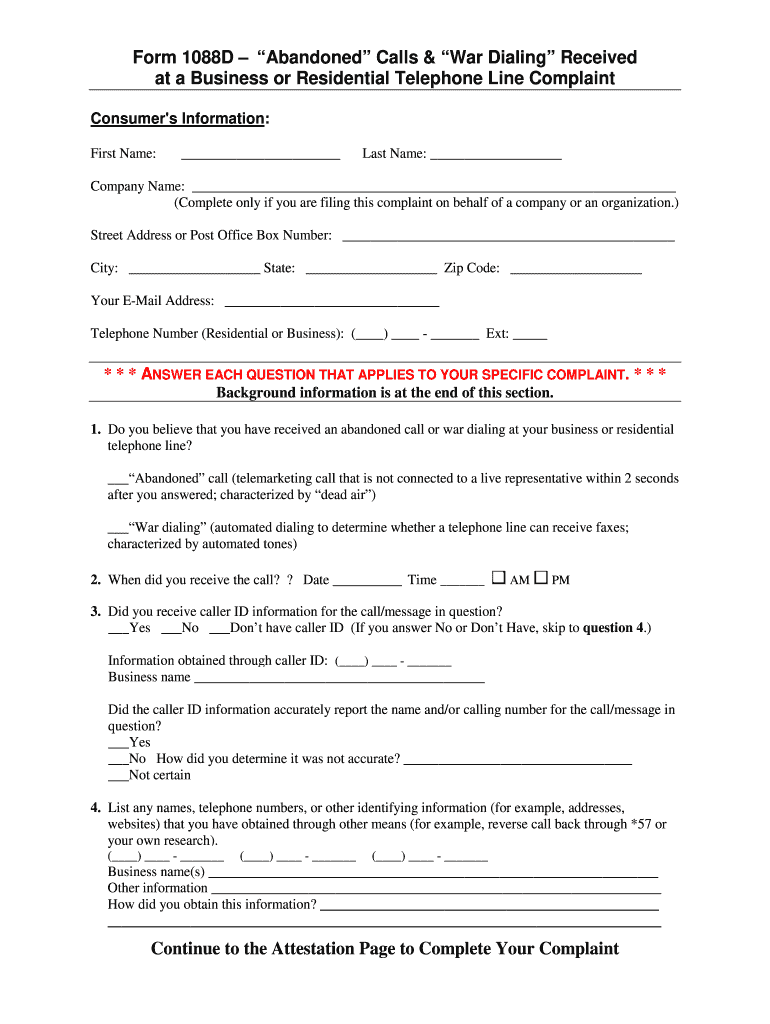

Form 1088 Complete with ease airSlate SignNow

Access irs forms, instructions and publications in electronic and print media. This form is to be used to compare the borrower's business over a period of years. Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. Each term is defined as follows: So what does the 1088 do?

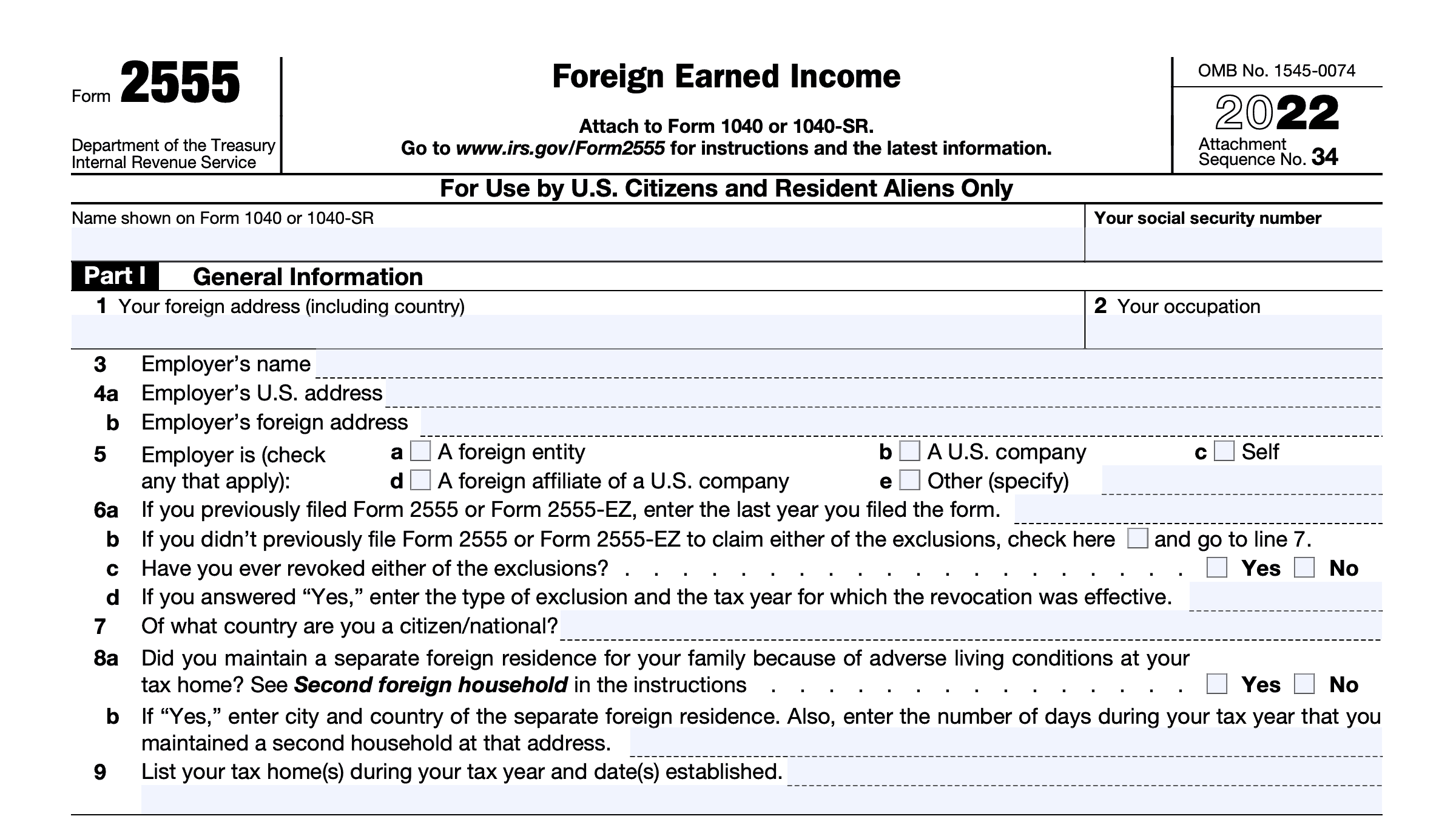

IRS Form 2555 Instructions

Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Access irs forms, instructions and publications in electronic and print media. This form is to be used to compare the borrower's business over a period of years. 1) evaluates gross revenue of the business, comparing year to year growth.

1088 tax form Fill out & sign online DocHub

Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. This form is to be used to compare the borrower's business over a period of years. 1) evaluates gross revenue of the business, comparing year to year growth or loss. So what does the 1088 do? Access irs forms, instructions and publications.

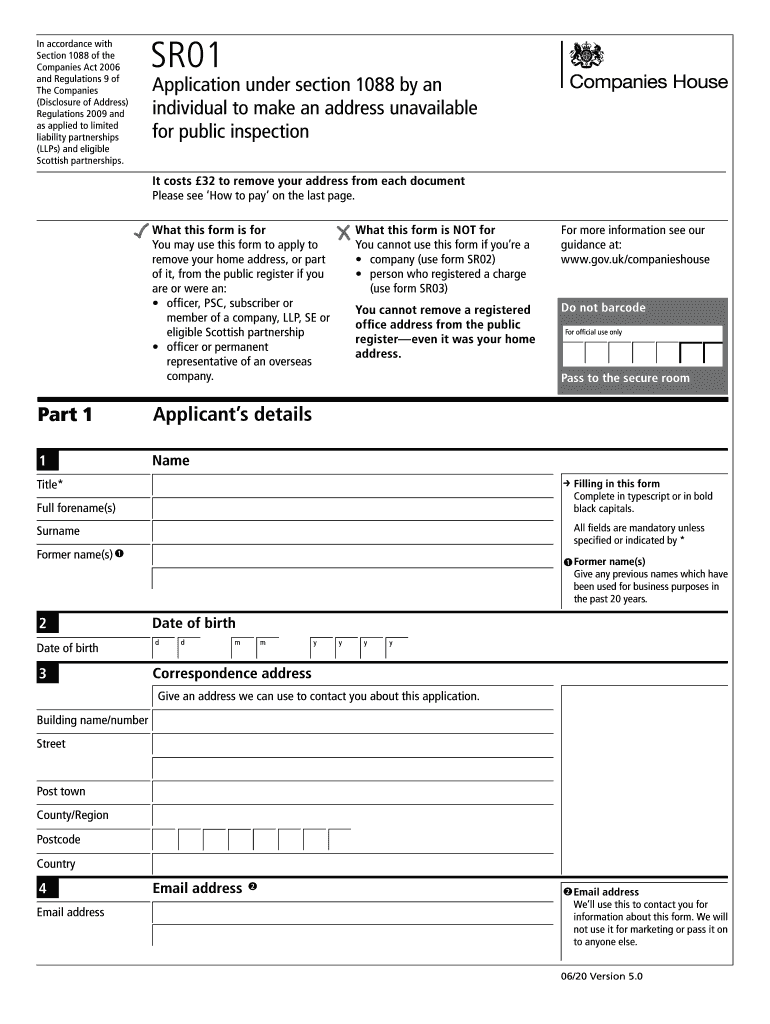

Section 1088 of the Form Fill Out and Sign Printable PDF Template

Each term is defined as follows: 1) evaluates gross revenue of the business, comparing year to year growth or loss. So what does the 1088 do? Access irs forms, instructions and publications in electronic and print media. Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or.

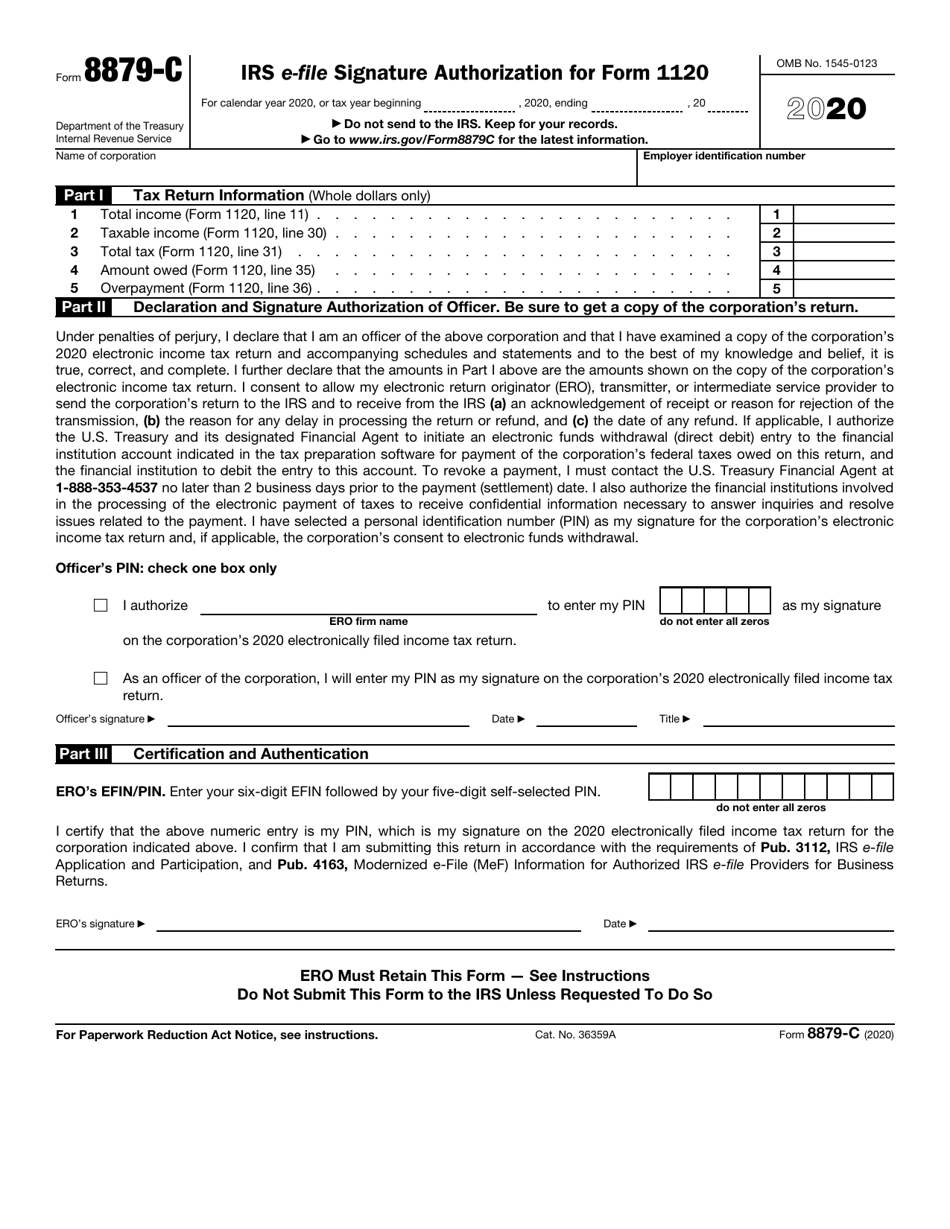

IRS Form 8879C Download Fillable PDF or Fill Online IRS EFile

Access irs forms, instructions and publications in electronic and print media. Each term is defined as follows: This form is to be used to compare the borrower's business over a period of years. Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. So what does the 1088 do?

Complete Guide to IRS Form 8995 Reconcile Books

Each term is defined as follows: This form is to be used to compare the borrower's business over a period of years. Access irs forms, instructions and publications in electronic and print media. 1) evaluates gross revenue of the business, comparing year to year growth or loss. So what does the 1088 do?

IRS Form 9465 Instructions Your Installment Agreement Request

Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Access irs forms, instructions and publications in electronic and print media. 1) evaluates gross revenue of the business, comparing year to year growth or loss. Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation.

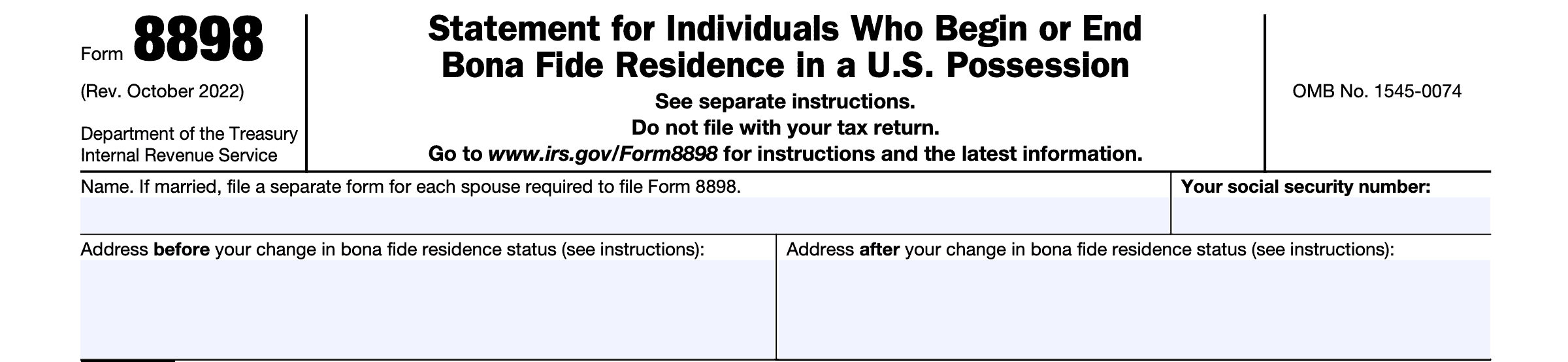

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

Access irs forms, instructions and publications in electronic and print media. Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. Each term is defined as follows: Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). This form is to.

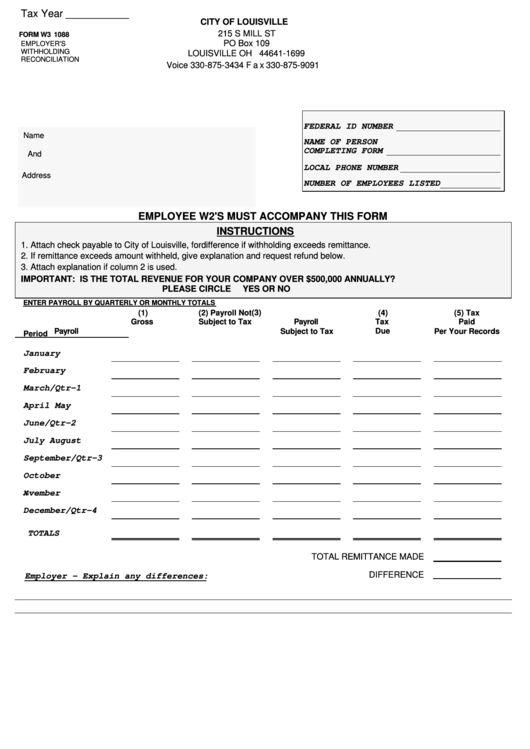

Fillable Form W3 1088 Employer'S Withholding Reconciliation City Of

This form is to be used to compare the borrower's business over a period of years. Each term is defined as follows: Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. So what does the 1088 do? Use form 8880 to figure the amount, if any, of your retirement savings contributions.

1) Evaluates Gross Revenue Of The Business, Comparing Year To Year Growth Or Loss.

Each term is defined as follows: Fannie mae’s comparative income analysis form (form 1088) leads the lender through the calculation of percentage increases (or. This form is to be used to compare the borrower's business over a period of years. So what does the 1088 do?

Use Form 8880 To Figure The Amount, If Any, Of Your Retirement Savings Contributions Credit (Also Known As The Saver’s Credit).

Access irs forms, instructions and publications in electronic and print media.