Irs Corporation Name Change

Irs Corporation Name Change - The specific action required may vary depending on. Exempt organizations must report a name change to the irs. Business owners and other authorized individuals can submit a name change for their business. Although changing the name of your business does not. Generally, businesses need a new ein when their ownership or structure has changed. Review a chart to determine the required documents needed for your type of.

Exempt organizations must report a name change to the irs. Although changing the name of your business does not. Business owners and other authorized individuals can submit a name change for their business. Review a chart to determine the required documents needed for your type of. The specific action required may vary depending on. Generally, businesses need a new ein when their ownership or structure has changed.

Although changing the name of your business does not. Review a chart to determine the required documents needed for your type of. Business owners and other authorized individuals can submit a name change for their business. Exempt organizations must report a name change to the irs. The specific action required may vary depending on. Generally, businesses need a new ein when their ownership or structure has changed.

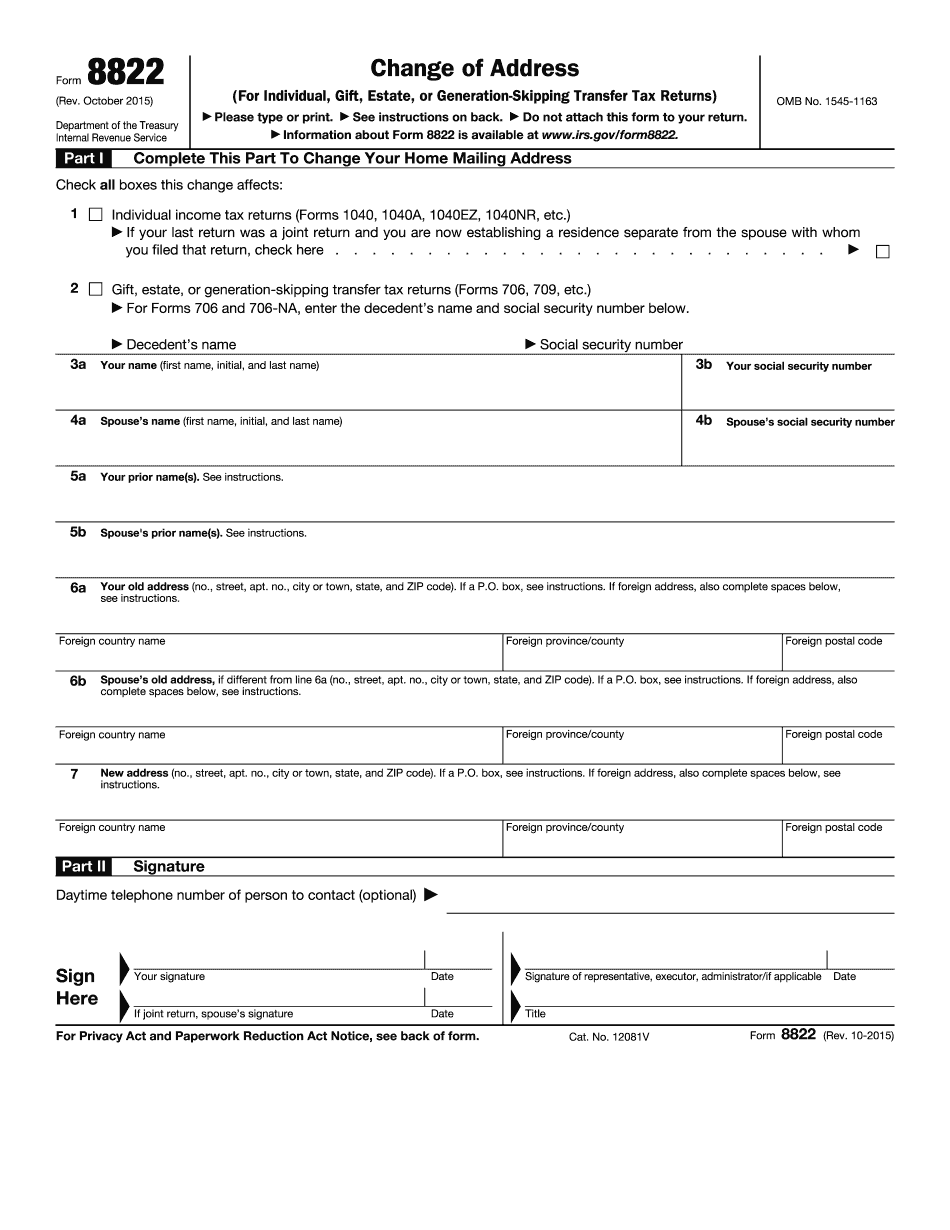

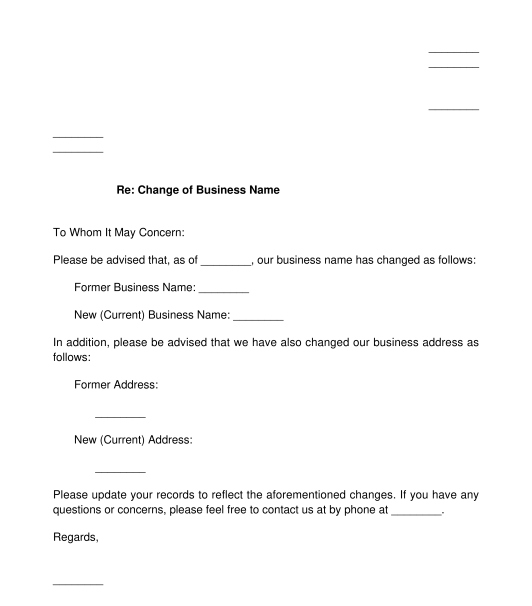

irs name change form Fill Online, Printable, Fillable Blank form

Although changing the name of your business does not. Business owners and other authorized individuals can submit a name change for their business. Generally, businesses need a new ein when their ownership or structure has changed. The specific action required may vary depending on. Exempt organizations must report a name change to the irs.

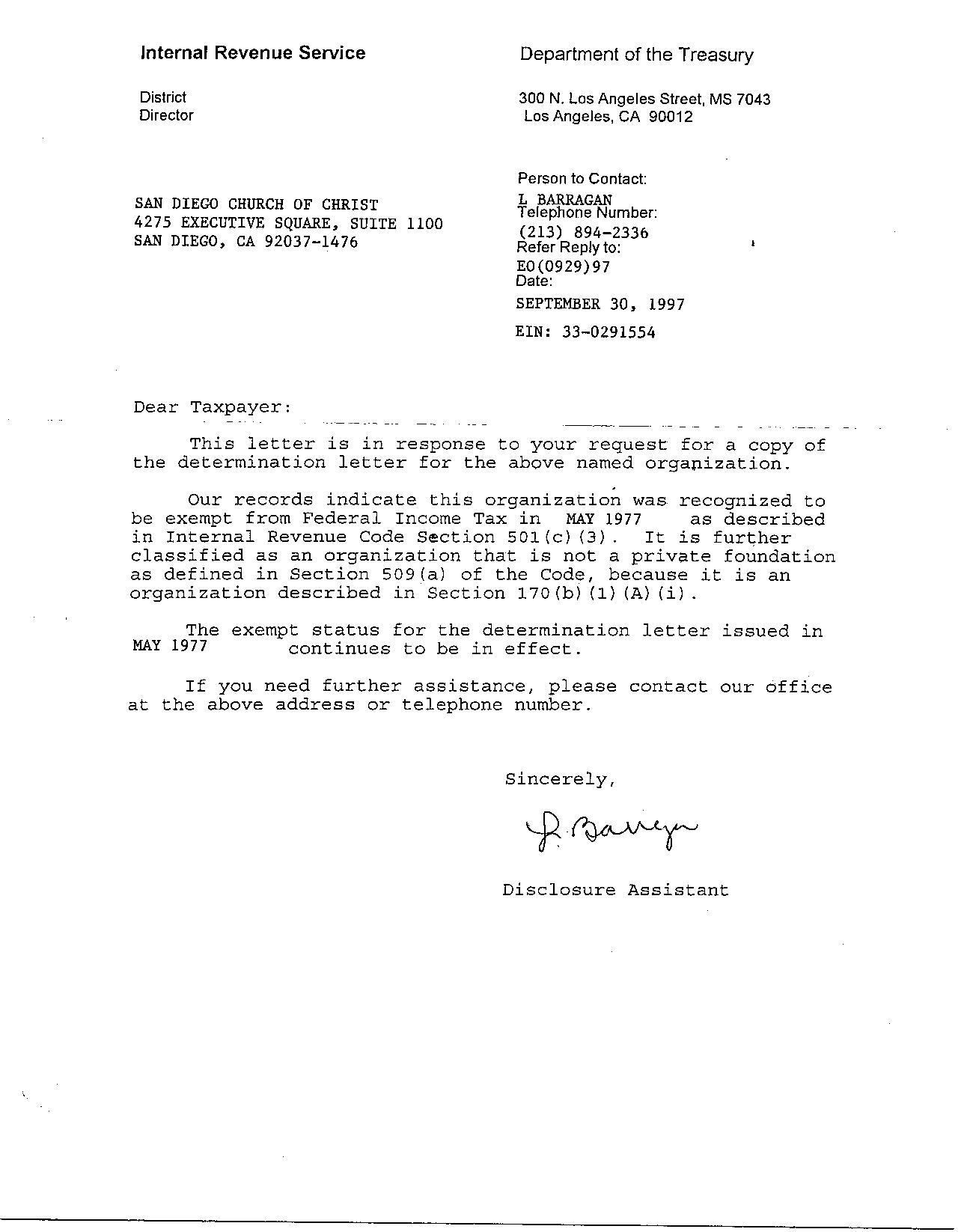

Irs Name Change Letter Sample 28 Irs form 9465 Fillable in 2020 (With

The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business. Although changing the name of your business does not. Exempt organizations must report a name change to the irs. Generally, businesses need a new ein when their ownership or structure has changed.

IRS Name Change How to file the IRS 8822 MissNowMrs

Exempt organizations must report a name change to the irs. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business. Generally, businesses need a new ein when their ownership or structure has changed. Review a chart to determine the required documents needed for your type of.

irs.certification's link in bio Linktree

The specific action required may vary depending on. Generally, businesses need a new ein when their ownership or structure has changed. Review a chart to determine the required documents needed for your type of. Business owners and other authorized individuals can submit a name change for their business. Exempt organizations must report a name change to the irs.

Irs Business Name Change Letter Template

Generally, businesses need a new ein when their ownership or structure has changed. Review a chart to determine the required documents needed for your type of. Although changing the name of your business does not. Exempt organizations must report a name change to the irs. Business owners and other authorized individuals can submit a name change for their business.

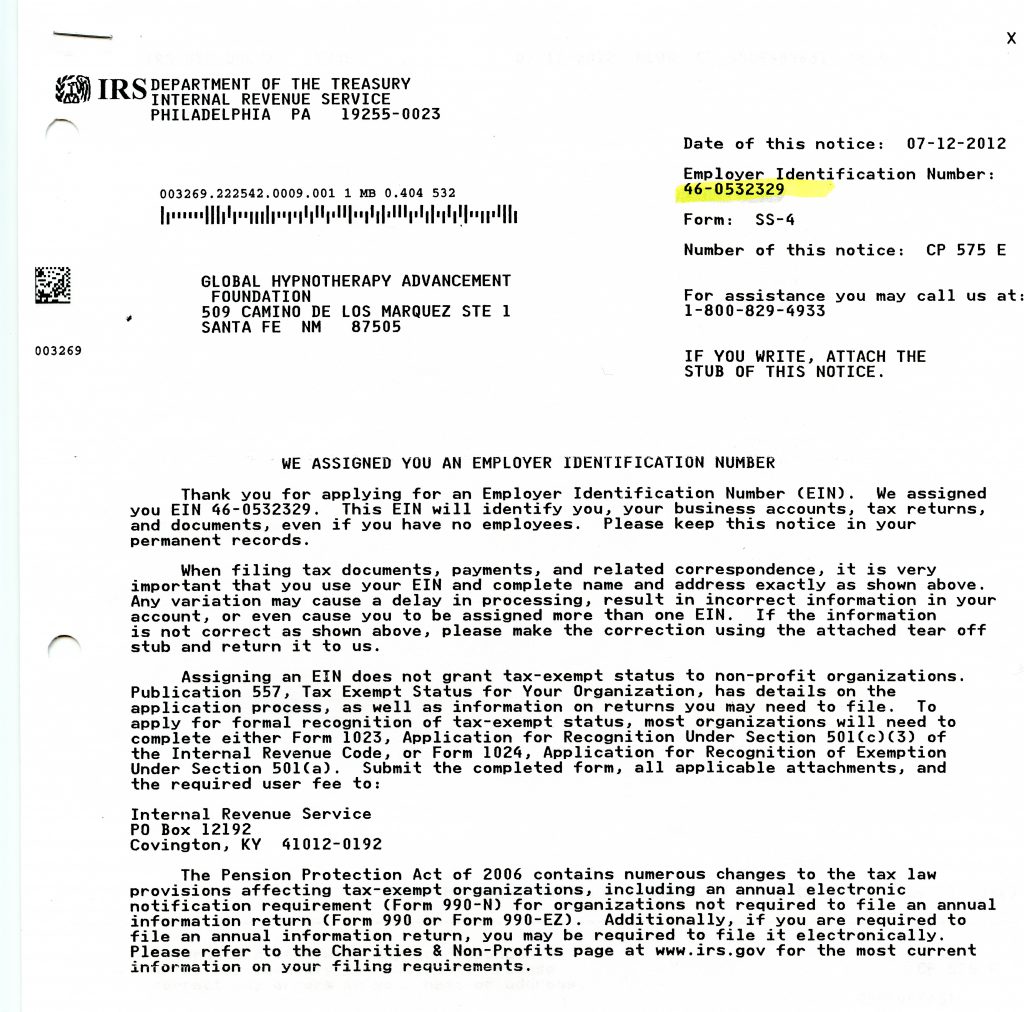

EIN IRS

Generally, businesses need a new ein when their ownership or structure has changed. Review a chart to determine the required documents needed for your type of. Business owners and other authorized individuals can submit a name change for their business. Although changing the name of your business does not. The specific action required may vary depending on.

Business Name Change Letter Template To Irs

The specific action required may vary depending on. Review a chart to determine the required documents needed for your type of. Business owners and other authorized individuals can submit a name change for their business. Exempt organizations must report a name change to the irs. Although changing the name of your business does not.

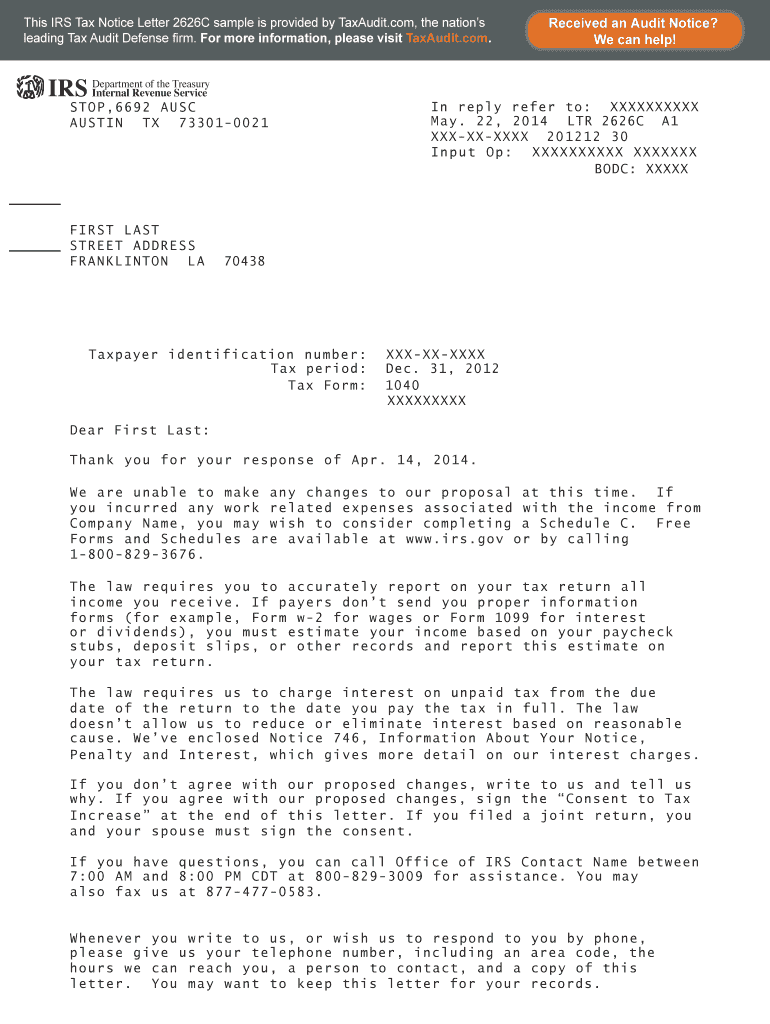

Irs Name Change Letter Sample An irs corporate name change form 8822

Although changing the name of your business does not. The specific action required may vary depending on. Exempt organizations must report a name change to the irs. Review a chart to determine the required documents needed for your type of. Business owners and other authorized individuals can submit a name change for their business.

Irs Business Name Change Letter Template

Although changing the name of your business does not. Business owners and other authorized individuals can submit a name change for their business. Generally, businesses need a new ein when their ownership or structure has changed. The specific action required may vary depending on. Exempt organizations must report a name change to the irs.

IRS funding repeal would be big gift to tax cheats report

Although changing the name of your business does not. Generally, businesses need a new ein when their ownership or structure has changed. Business owners and other authorized individuals can submit a name change for their business. Exempt organizations must report a name change to the irs. Review a chart to determine the required documents needed for your type of.

Exempt Organizations Must Report A Name Change To The Irs.

Although changing the name of your business does not. Generally, businesses need a new ein when their ownership or structure has changed. Business owners and other authorized individuals can submit a name change for their business. Review a chart to determine the required documents needed for your type of.