Investment Lien Tax

Investment Lien Tax - When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Here’s what you need to know about these risky assets. In return, you gain the right to collect the debt, plus. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. Each year, states and municipalities sell billions of dollars in tax liens to the public. Tax lien investing is a type of real estate investment that involves purchasing these liens from the government. When you invest in a tax lien, you’re essentially paying someone else’s tax debt. Tax liens are placed on individuals or businesses that fail to pay property taxes. You can purchase tax lien certificates at.

Here’s what you need to know about these risky assets. When you invest in a tax lien, you’re essentially paying someone else’s tax debt. In return, you gain the right to collect the debt, plus. Tax lien investing is a type of real estate investment that involves purchasing these liens from the government. You can purchase tax lien certificates at. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Tax liens are placed on individuals or businesses that fail to pay property taxes. Tax lien investing is an accessible option for individuals looking to diversify their investment portfolios. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes.

Tax lien investing is an accessible option for individuals looking to diversify their investment portfolios. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Here’s what you need to know about these risky assets. You can purchase tax lien certificates at. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. In return, you gain the right to collect the debt, plus. When you invest in a tax lien, you’re essentially paying someone else’s tax debt. Each year, states and municipalities sell billions of dollars in tax liens to the public. Tax lien investing is a type of real estate investment that involves purchasing these liens from the government. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes.

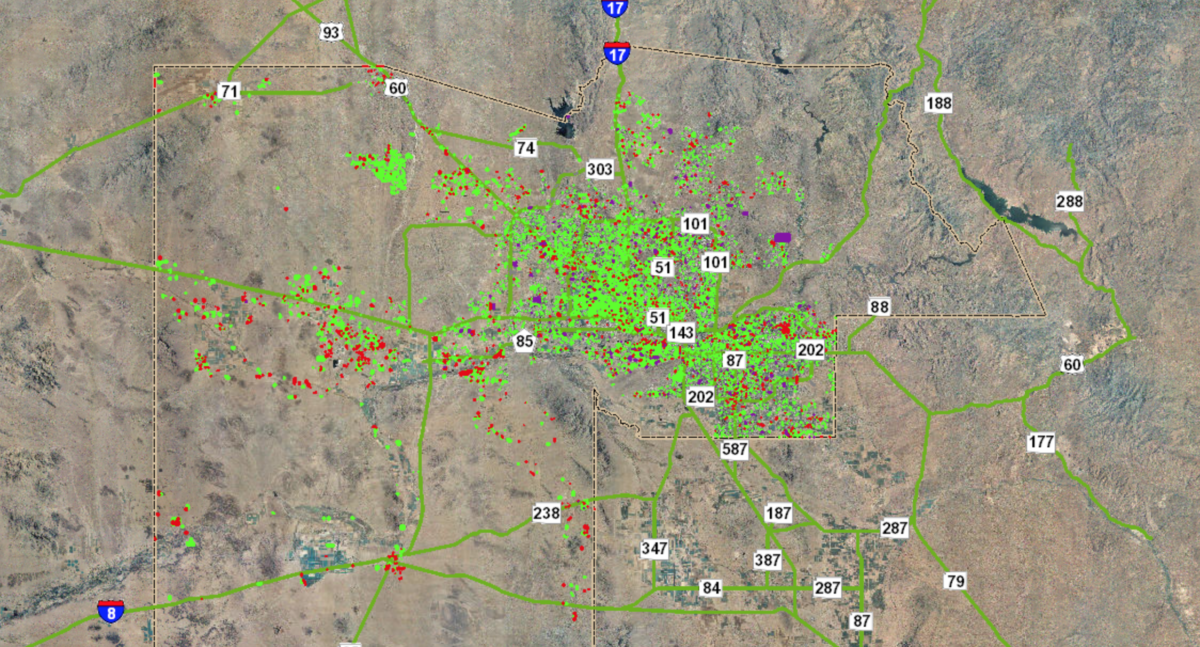

Trading investment RDC

Tax lien investing is a type of real estate investment that involves purchasing these liens from the government. Tax lien investing is an accessible option for individuals looking to diversify their investment portfolios. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. In return, you gain the right to collect.

Tax Lien & Deed Investment Michael Schuett

In return, you gain the right to collect the debt, plus. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Each year, states and.

My Tax Lien Investment Adventure

Tax lien investing is an accessible option for individuals looking to diversify their investment portfolios. Each year, states and municipalities sell billions of dollars in tax liens to the public. Tax lien investing is a type of real estate investment that involves purchasing these liens from the government. Tax liens are placed on individuals or businesses that fail to pay.

Tax Preparation Business Startup

Each year, states and municipalities sell billions of dollars in tax liens to the public. Tax lien investing is an accessible option for individuals looking to diversify their investment portfolios. Here’s what you need to know about these risky assets. You can purchase tax lien certificates at. Tax lien investing is a type of real estate investment that involves purchasing.

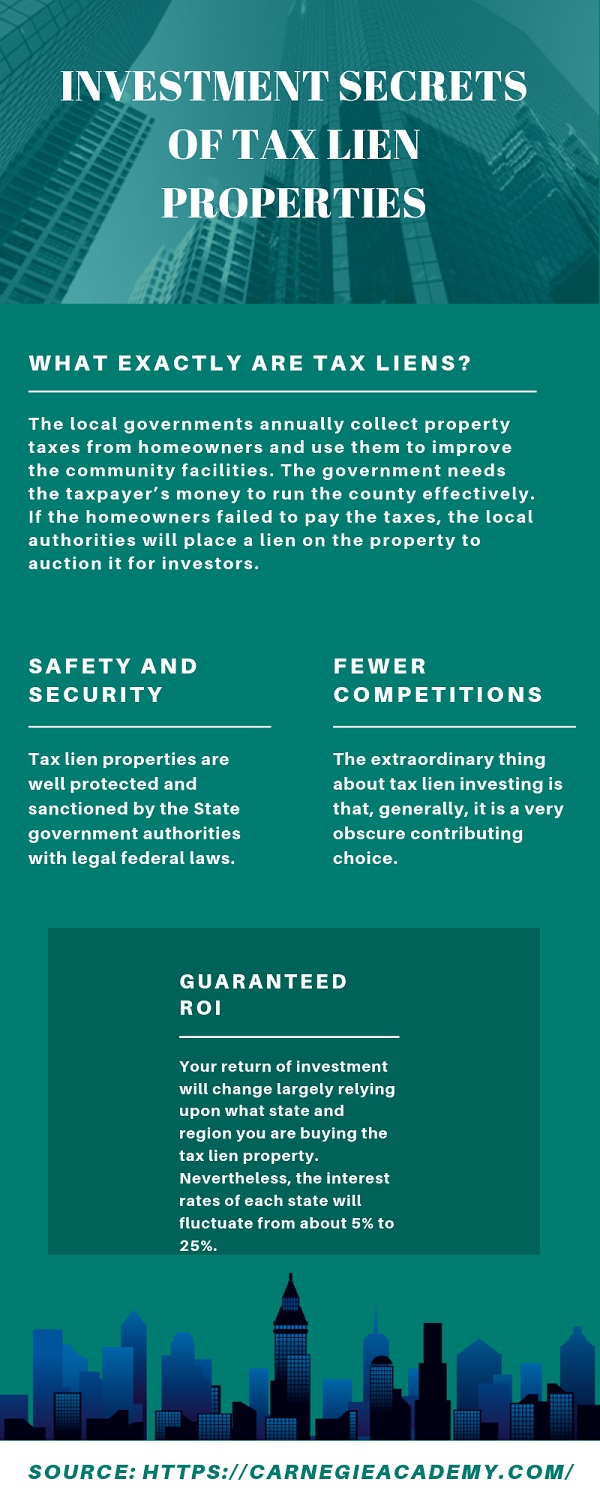

Investment Secrets of Tax Lien Properties Latest Infographics

Tax liens are placed on individuals or businesses that fail to pay property taxes. You can purchase tax lien certificates at. In return, you gain the right to collect the debt, plus. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Investing.

Financially Secured Tax Lien Investment Michael Schuett

Here’s what you need to know about these risky assets. You can purchase tax lien certificates at. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. When property owners fail to pay their property tax bills, the government will eventually place a tax.

Tax Lien & Deed Investment Michael Schuett

In return, you gain the right to collect the debt, plus. When you invest in a tax lien, you’re essentially paying someone else’s tax debt. Tax lien investing is a type of real estate investment that involves purchasing these liens from the government. Tax liens are placed on individuals or businesses that fail to pay property taxes. You can purchase.

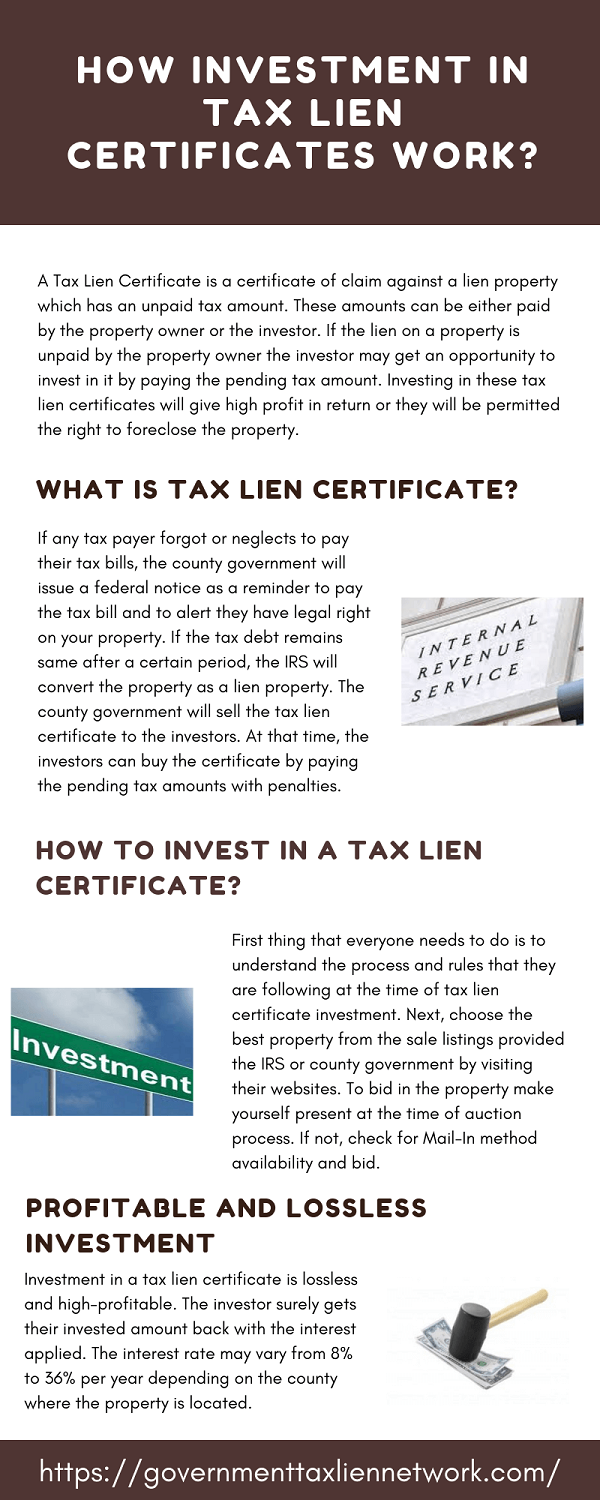

How Investment in Tax Lien Certificates Work? Latest Infographics

Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Tax lien investing is an accessible option for individuals looking to diversify their investment.

Tax Lien Certificate Investment Basics

In return, you gain the right to collect the debt, plus. You can purchase tax lien certificates at. Tax lien investing is an accessible option for individuals looking to diversify their investment portfolios. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Each.

How to Successful in Tax Lien Investment? Latest Infographics

Here’s what you need to know about these risky assets. Tax lien investing is a type of real estate investment that involves purchasing these liens from the government. Each year, states and municipalities sell billions of dollars in tax liens to the public. Tax lien investing is an accessible option for individuals looking to diversify their investment portfolios. Investing in.

Tax Lien Investing Is A Type Of Real Estate Investment That Involves Purchasing These Liens From The Government.

When you invest in a tax lien, you’re essentially paying someone else’s tax debt. Tax lien investing is an accessible option for individuals looking to diversify their investment portfolios. In return, you gain the right to collect the debt, plus. You can purchase tax lien certificates at.

When Property Owners Fail To Pay Their Property Tax Bills, The Government Will Eventually Place A Tax Lien, Or A Note Of Unpaid Debts, On Their Property.

Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Each year, states and municipalities sell billions of dollars in tax liens to the public. Tax liens are placed on individuals or businesses that fail to pay property taxes. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes.