Investing In Tax Liens

Investing In Tax Liens - What is tax lien investing and how does it work? When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. Property tax liens are an investment niche that is overlooked by most investors. Here’s what you need to know about these risky assets. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Purchasing tax liens can be a lucrative though relatively risky business for those who. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions.

Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. Property tax liens are an investment niche that is overlooked by most investors. Here’s what you need to know about these risky assets. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Purchasing tax liens can be a lucrative though relatively risky business for those who. What is tax lien investing and how does it work?

Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Here’s what you need to know about these risky assets. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Purchasing tax liens can be a lucrative though relatively risky business for those who. Property tax liens are an investment niche that is overlooked by most investors. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. What is tax lien investing and how does it work?

Investing In Tax Liens Alts.co

Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Here’s what you need to know about these risky assets. Property tax liens are an investment niche that is overlooked by most investors. Purchasing tax liens can be a lucrative though relatively risky business.

Investing in Tax Liens High ROI?

Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Purchasing tax liens can be a lucrative though relatively risky business for those who. Here’s what you need to know about these risky assets. Tax lien investing involves an investor buys the claim that a local government makes on a property when.

Investing In Tax Liens Alts.co

What is tax lien investing and how does it work? When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Purchasing tax liens can be a lucrative though relatively risky business for those who. Here’s what you need to know about these risky.

Investing in Tax Liens High ROI?

Property tax liens are an investment niche that is overlooked by most investors. What is tax lien investing and how does it work? Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Investing in tax liens gives investors the chance to profit when.

TAX LIENS & TAX DEEDS EXPLAINED! Each year Florida has 254 counties

Here’s what you need to know about these risky assets. What is tax lien investing and how does it work? When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Tax lien investing involves an investor buys the claim that a local government.

Investing In Tax Liens Alts.co

Here’s what you need to know about these risky assets. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. Purchasing tax liens can.

Investing in Tax Liens High ROI?

Here’s what you need to know about these risky assets. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. What is tax lien investing and how does it work? Purchasing tax liens.

Ask The Tax Lien Lady Live Answering your question about investing in

When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. Tax lien investing involves an investor buys the claim that a local government makes.

Tax Liens Investing Pros and Cons Sophisticated Investor

Property tax liens are an investment niche that is overlooked by most investors. Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes. What is.

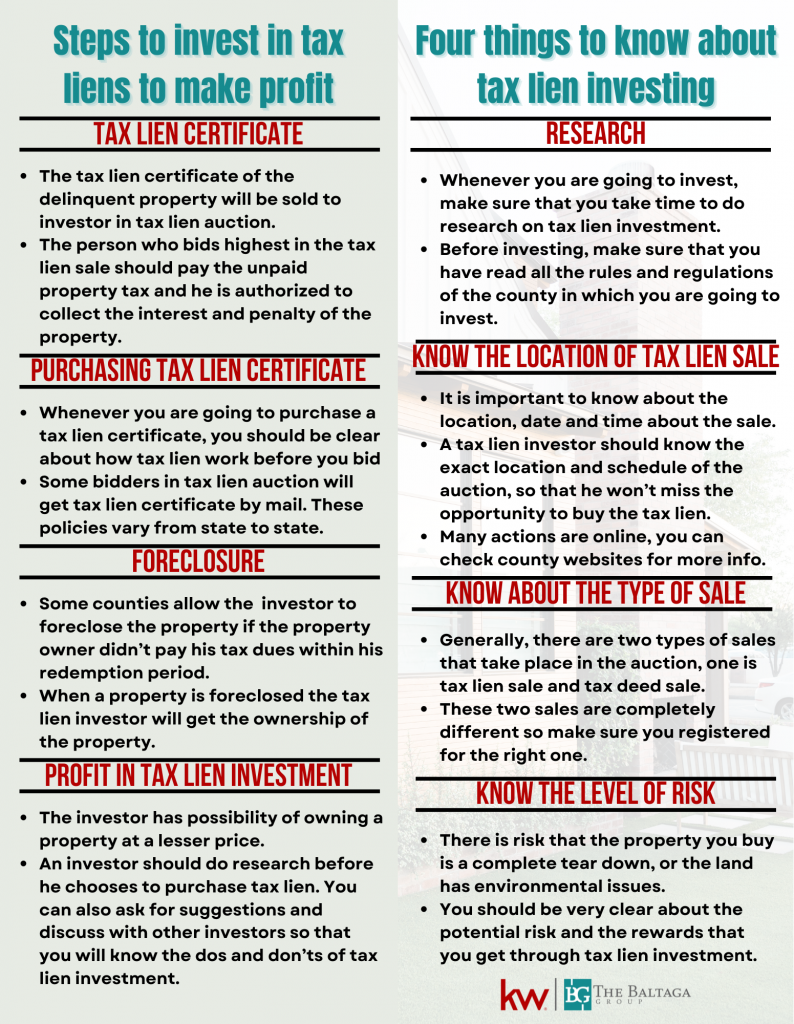

INVESTING IN TAX LIENS Baltaga Group

Tax lien investing involves an investor buys the claim that a local government makes on a property when an owner fails to pay their property taxes. What is tax lien investing and how does it work? Property tax liens are an investment niche that is overlooked by most investors. Purchasing tax liens can be a lucrative though relatively risky business.

What Is Tax Lien Investing And How Does It Work?

Here’s what you need to know about these risky assets. When property owners fail to pay their property tax bills, the government will eventually place a tax lien, or a note of unpaid debts, on their property. Property tax liens are an investment niche that is overlooked by most investors. Tax lien investing is a type of real estate investing where you purchase tax lien certificates at auctions.

Tax Lien Investing Involves An Investor Buys The Claim That A Local Government Makes On A Property When An Owner Fails To Pay Their Property Taxes.

Purchasing tax liens can be a lucrative though relatively risky business for those who. Investing in tax liens gives investors the chance to profit when a property owner fails to pay their taxes.