Indiana Local Income Tax

Indiana Local Income Tax - Click on a county, and see which. Compare the rates, nonresident taxes and tax forms for each county and city. • local income tax is often referred to. Explore the indiana department of revenue (dor)'s interactive county tax rate map. 1 even as the state income tax rate drops again in. What is local income tax? Find the local income tax rates in 91 localities in indiana for 2024. Effective january 1, 2025, the indiana department of revenue (dor) revised departmental notice no. Each of indiana’s 92 county councils/county income tax councils can choose to adopt an ordinance that imposes a local option income. • it is a county imposed tax that is applied to taxpayers’ taxable income.

Find the local income tax rates in 91 localities in indiana for 2024. • local income tax is often referred to. Click on a county, and see which. Explore the indiana department of revenue (dor)'s interactive county tax rate map. Effective january 1, 2025, the indiana department of revenue (dor) revised departmental notice no. 1 even as the state income tax rate drops again in. Compare the rates, nonresident taxes and tax forms for each county and city. What is local income tax? Each of indiana’s 92 county councils/county income tax councils can choose to adopt an ordinance that imposes a local option income. • it is a county imposed tax that is applied to taxpayers’ taxable income.

Compare the rates, nonresident taxes and tax forms for each county and city. Find the local income tax rates in 91 localities in indiana for 2024. 1 even as the state income tax rate drops again in. Click on a county, and see which. What is local income tax? • it is a county imposed tax that is applied to taxpayers’ taxable income. • local income tax is often referred to. Each of indiana’s 92 county councils/county income tax councils can choose to adopt an ordinance that imposes a local option income. The local income tax rates in six of indiana's 92 counties will increase jan. Effective january 1, 2025, the indiana department of revenue (dor) revised departmental notice no.

State and Local Tax Deduction by State Tax Policy Center

Each of indiana’s 92 county councils/county income tax councils can choose to adopt an ordinance that imposes a local option income. What is local income tax? • it is a county imposed tax that is applied to taxpayers’ taxable income. 1 even as the state income tax rate drops again in. • local income tax is often referred to.

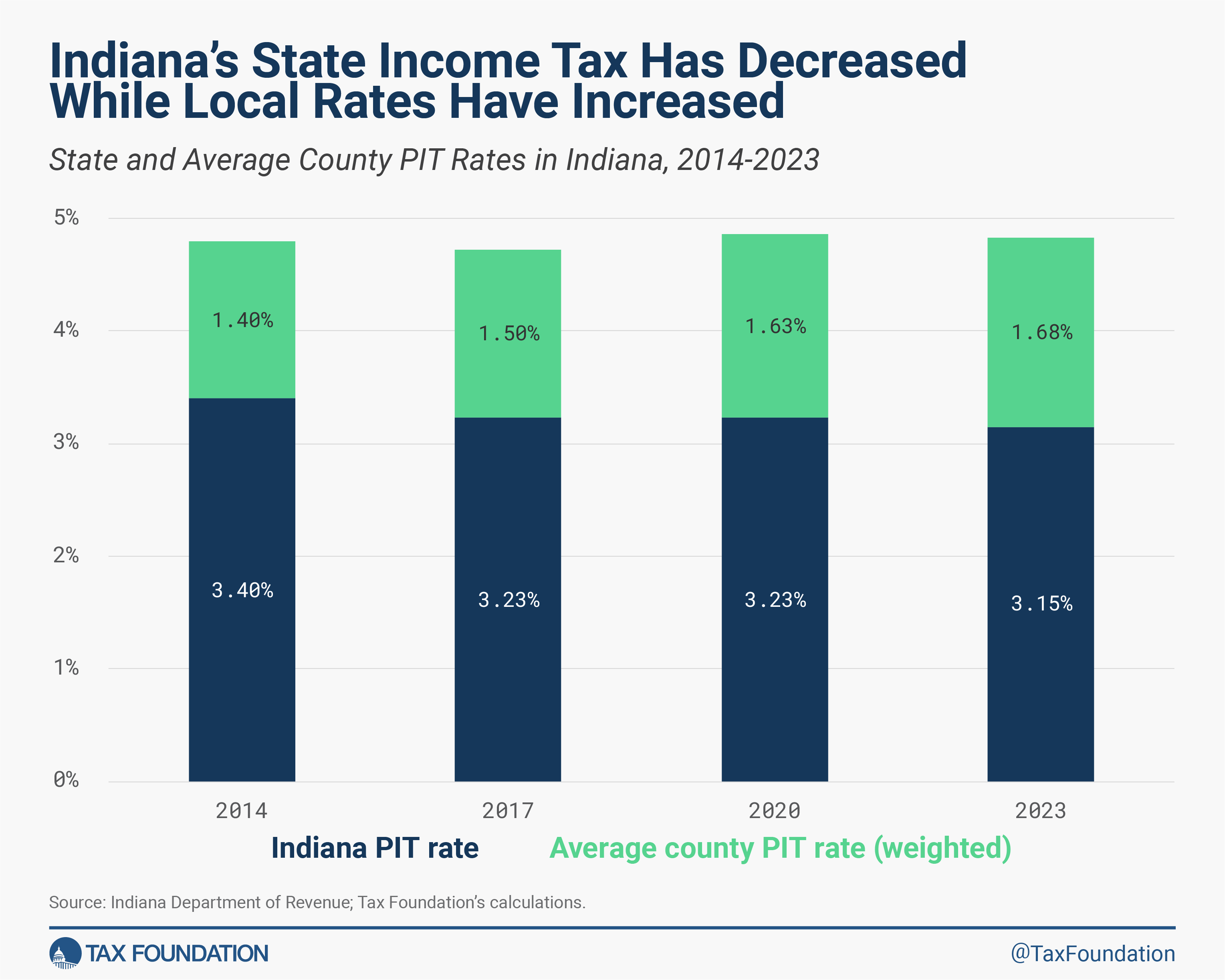

Indiana Local Taxes Compatible with State Tax Reform?

Each of indiana’s 92 county councils/county income tax councils can choose to adopt an ordinance that imposes a local option income. Explore the indiana department of revenue (dor)'s interactive county tax rate map. • it is a county imposed tax that is applied to taxpayers’ taxable income. • local income tax is often referred to. Compare the rates, nonresident taxes.

Indiana Local Taxes Compatible with State Tax Reform?

Click on a county, and see which. • it is a county imposed tax that is applied to taxpayers’ taxable income. 1 even as the state income tax rate drops again in. • local income tax is often referred to. Compare the rates, nonresident taxes and tax forms for each county and city.

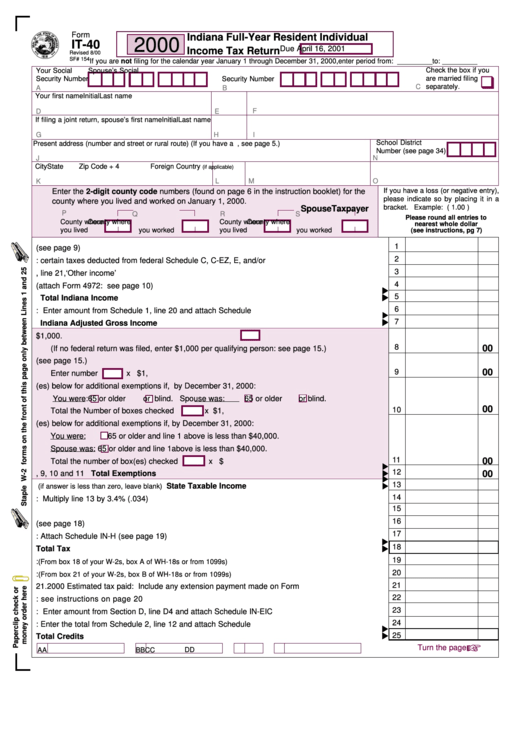

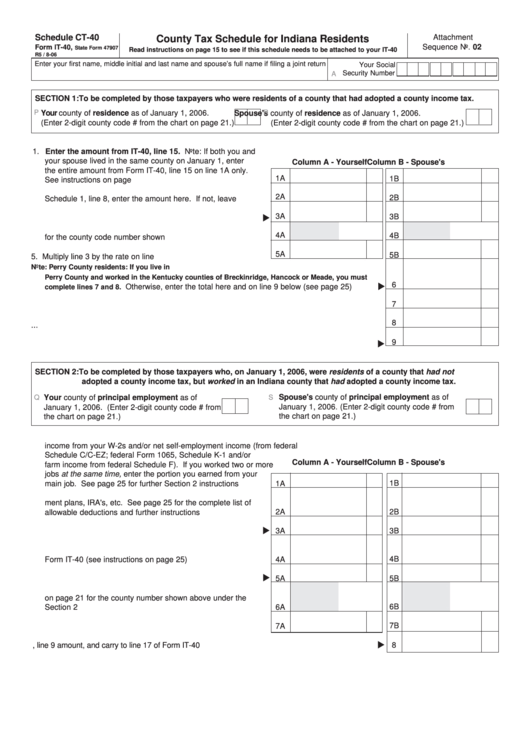

Indiana County Tax Form

What is local income tax? • local income tax is often referred to. Effective january 1, 2025, the indiana department of revenue (dor) revised departmental notice no. 1 even as the state income tax rate drops again in. Compare the rates, nonresident taxes and tax forms for each county and city.

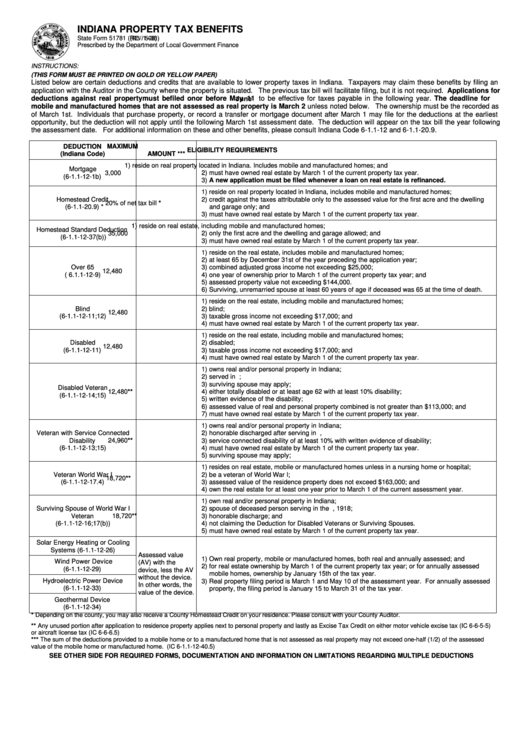

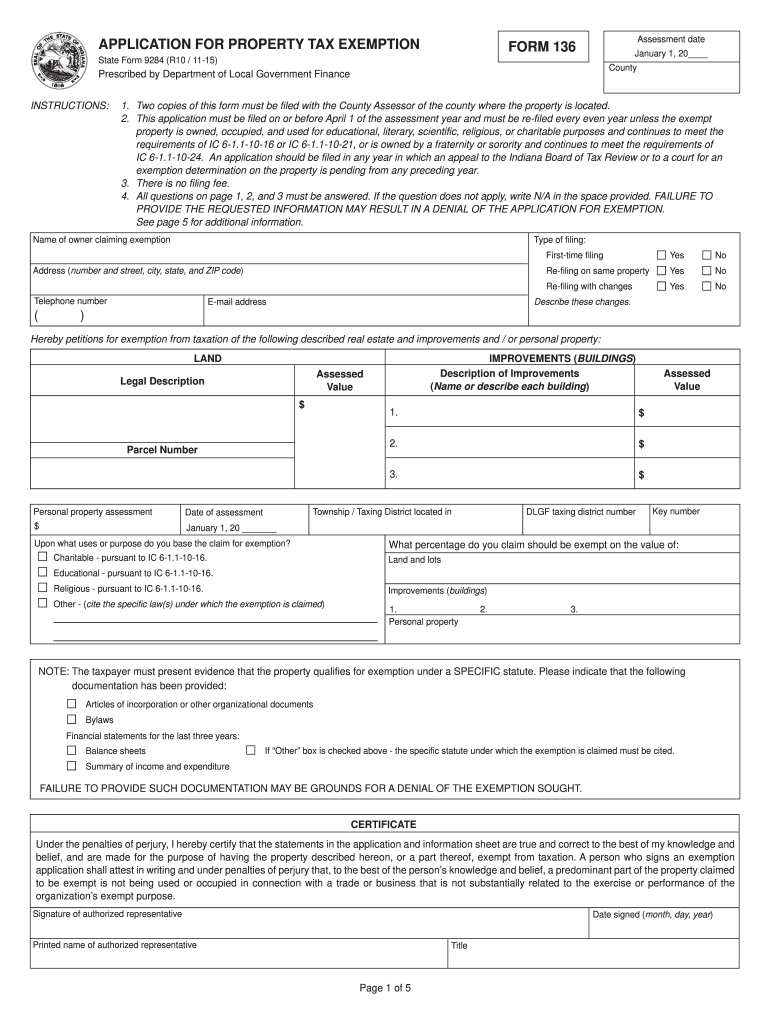

Indiana Property Tax Benefits Form Printable Pdf Download

Each of indiana’s 92 county councils/county income tax councils can choose to adopt an ordinance that imposes a local option income. The local income tax rates in six of indiana's 92 counties will increase jan. 1 even as the state income tax rate drops again in. • it is a county imposed tax that is applied to taxpayers’ taxable income..

Indiana County Tax Form

Compare the rates, nonresident taxes and tax forms for each county and city. • local income tax is often referred to. Explore the indiana department of revenue (dor)'s interactive county tax rate map. The local income tax rates in six of indiana's 92 counties will increase jan. Each of indiana’s 92 county councils/county income tax councils can choose to adopt.

Indiana County Tax Form

Click on a county, and see which. • it is a county imposed tax that is applied to taxpayers’ taxable income. Effective january 1, 2025, the indiana department of revenue (dor) revised departmental notice no. • local income tax is often referred to. Explore the indiana department of revenue (dor)'s interactive county tax rate map.

Indiana Local Taxes Compatible with State Tax Reform?

Each of indiana’s 92 county councils/county income tax councils can choose to adopt an ordinance that imposes a local option income. • it is a county imposed tax that is applied to taxpayers’ taxable income. Effective january 1, 2025, the indiana department of revenue (dor) revised departmental notice no. What is local income tax? The local income tax rates in.

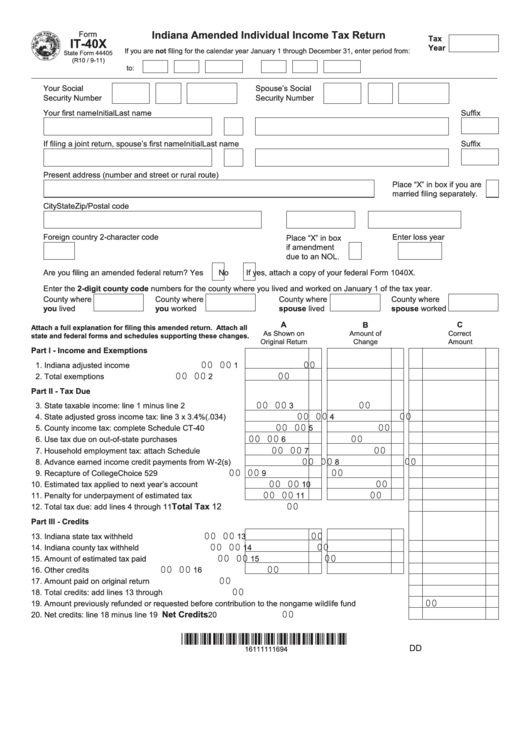

Marion County Indiana Local Tax Form

Compare the rates, nonresident taxes and tax forms for each county and city. Explore the indiana department of revenue (dor)'s interactive county tax rate map. The local income tax rates in six of indiana's 92 counties will increase jan. What is local income tax? 1 even as the state income tax rate drops again in.

Indiana Property Tax Benefits Form Printable Pdf Download

• local income tax is often referred to. Find the local income tax rates in 91 localities in indiana for 2024. Each of indiana’s 92 county councils/county income tax councils can choose to adopt an ordinance that imposes a local option income. • it is a county imposed tax that is applied to taxpayers’ taxable income. Explore the indiana department.

What Is Local Income Tax?

The local income tax rates in six of indiana's 92 counties will increase jan. 1 even as the state income tax rate drops again in. • it is a county imposed tax that is applied to taxpayers’ taxable income. Effective january 1, 2025, the indiana department of revenue (dor) revised departmental notice no.

Explore The Indiana Department Of Revenue (Dor)'S Interactive County Tax Rate Map.

Compare the rates, nonresident taxes and tax forms for each county and city. • local income tax is often referred to. Click on a county, and see which. Find the local income tax rates in 91 localities in indiana for 2024.