How Much Loss Can A Small Business Claim

How Much Loss Can A Small Business Claim - Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

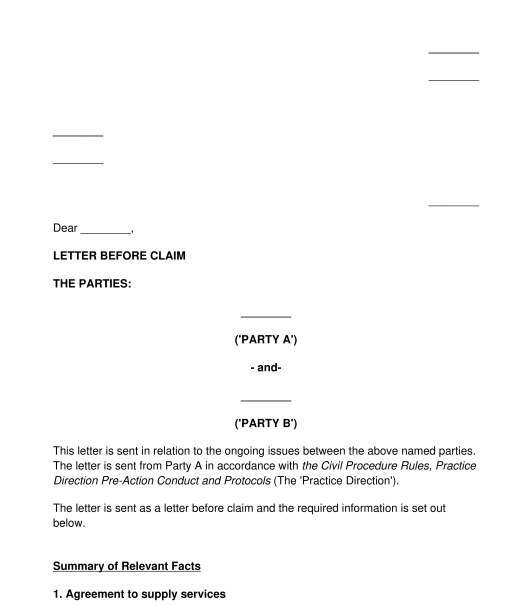

Letter before Small Claim Template Word & PDF

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

Profit and Loss Statement for Small Business » The Spreadsheet Page

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

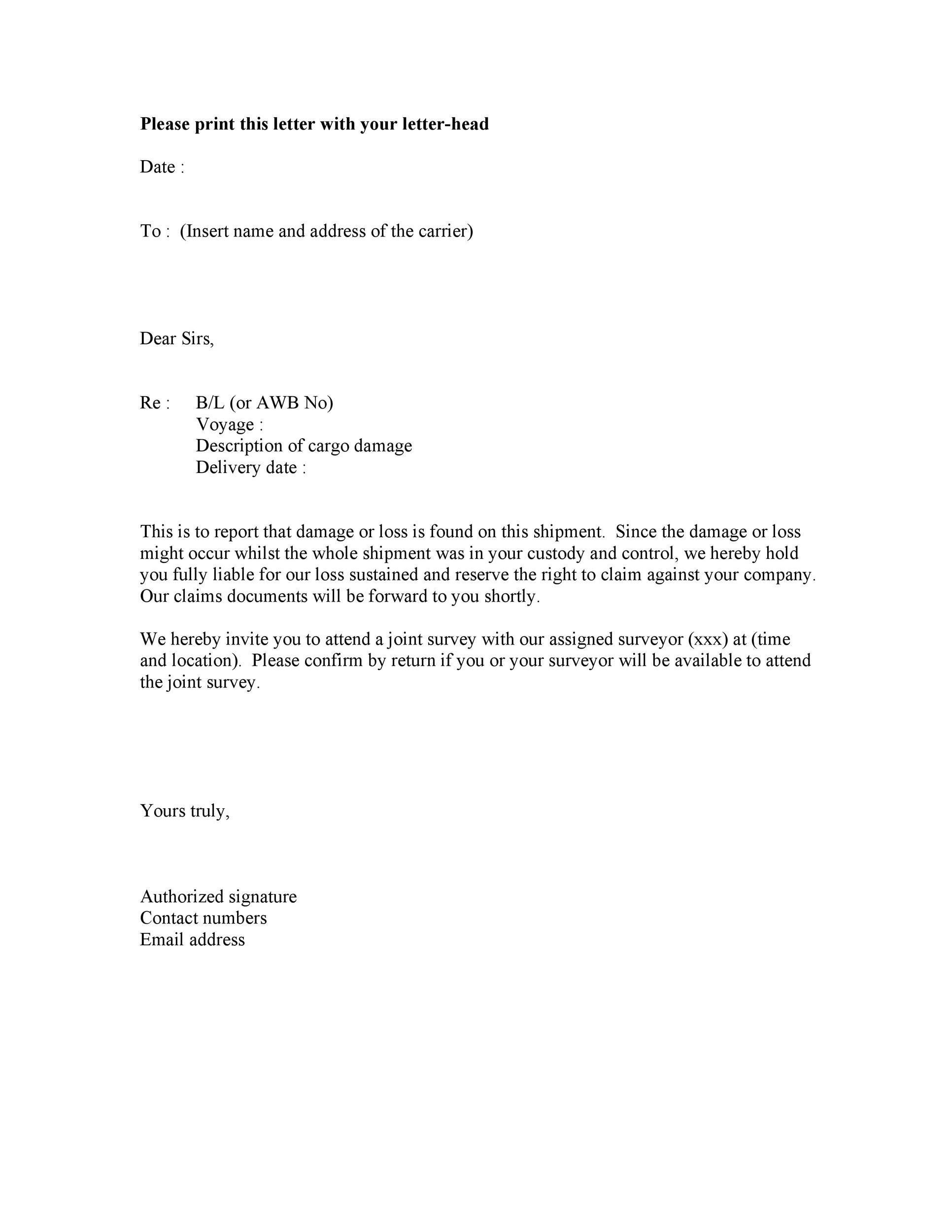

Automate Standard claim form for loss or damage Document Processing

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

What Can Small Business Claim On Tax Darrin Kenney's Templates

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

Loss Of Use Claim Malaysia For loss of/ damage to golf clubs

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

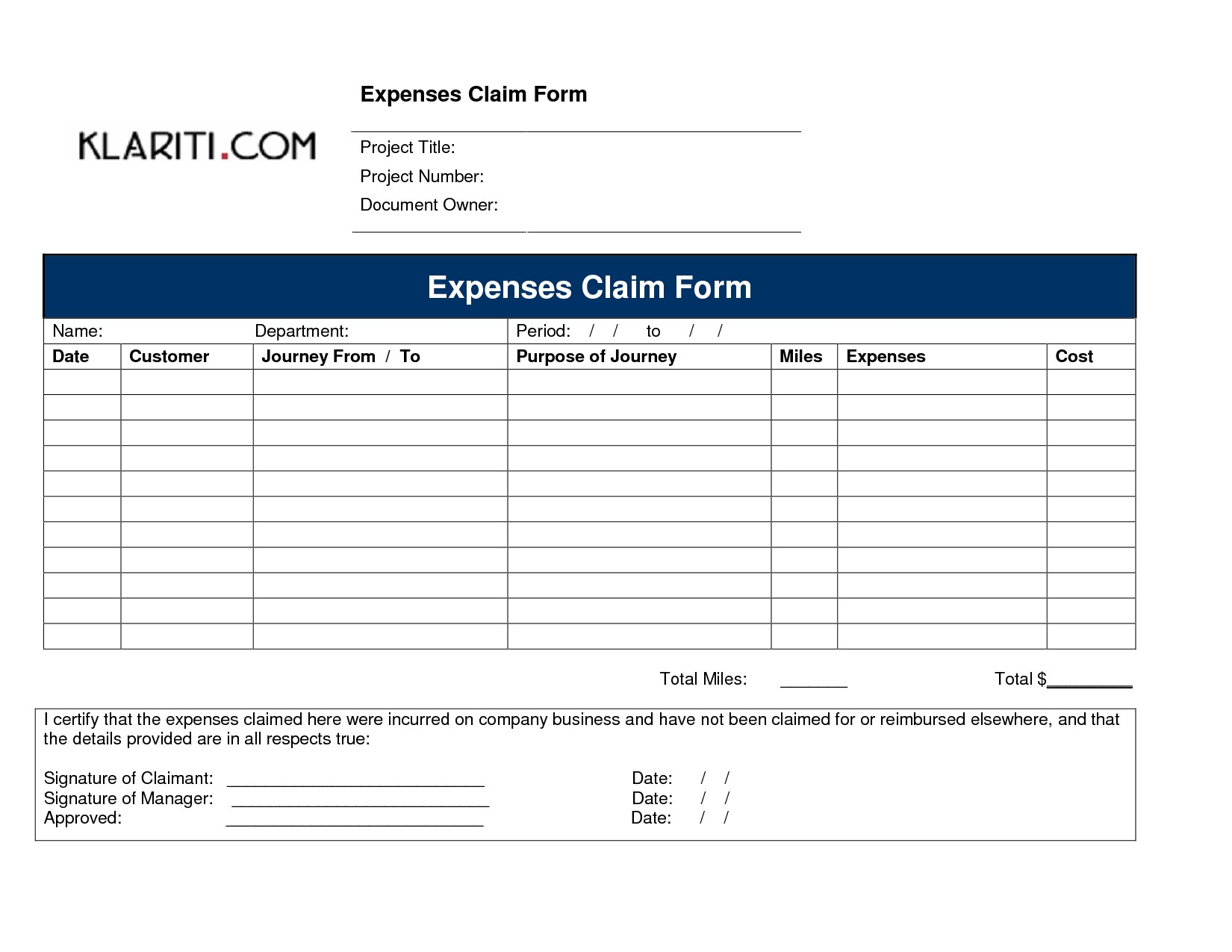

Business Expenses Form Template New Small Business Expense and Business

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

State Of Michigan Small Claims Forms

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

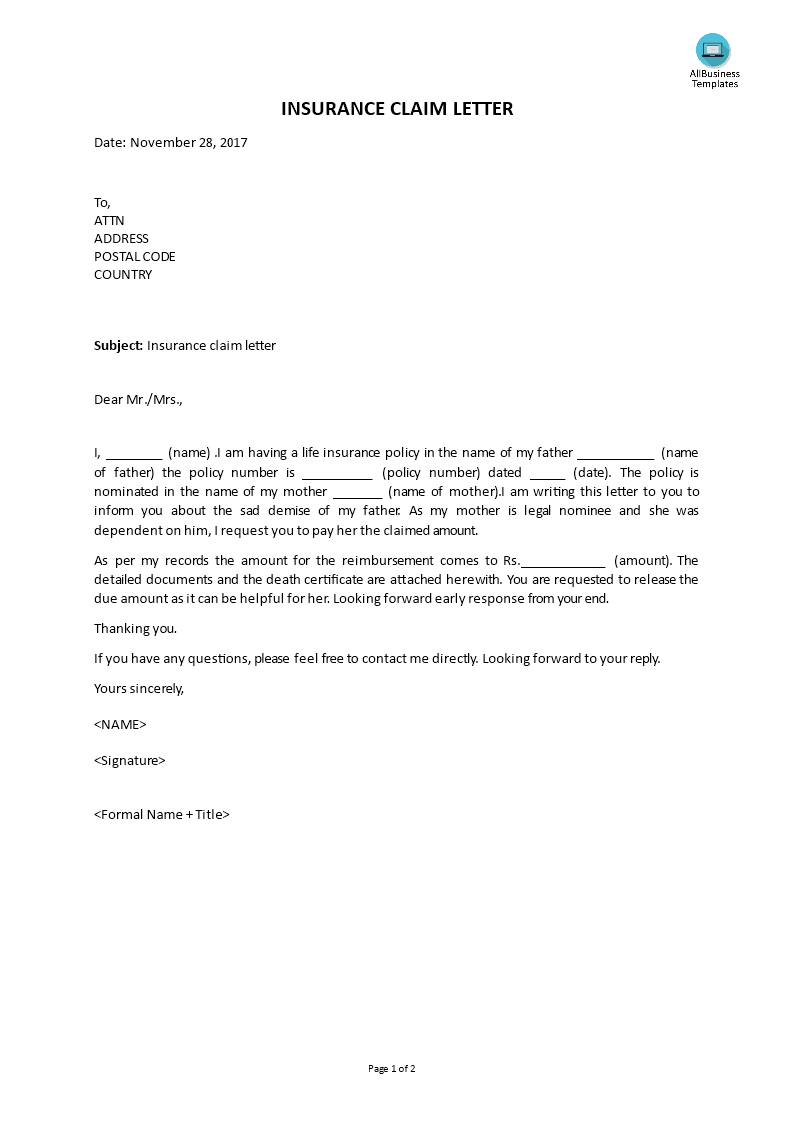

🐈 Life insurance claim letter. Insurance Letters. 20190218

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.

Small Business Post Pandemic Recovery Grant Program San Bruno, CA

Learn how much loss a small business can claim on taxes, including operating losses, deductions, and tips to maximize tax.