How Long To Keep Bankruptcy Discharge Papers

How Long To Keep Bankruptcy Discharge Papers - It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Far more important is the list of creditors that were included in the. How long should i keep my bankruptcy documents? Key papers to retain include: I advise my clients to keep copies of their petition, schedules,. • your bankruptcy petition • court.

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. How long should i keep my bankruptcy documents? That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Far more important is the list of creditors that were included in the. I advise my clients to keep copies of their petition, schedules,. • your bankruptcy petition • court. Key papers to retain include:

• your bankruptcy petition • court. Far more important is the list of creditors that were included in the. How long should i keep my bankruptcy documents? That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Key papers to retain include: It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. I advise my clients to keep copies of their petition, schedules,.

How long should I keep my personal bankruptcy discharge papers? YouTube

• your bankruptcy petition • court. How long should i keep my bankruptcy documents? Far more important is the list of creditors that were included in the. I advise my clients to keep copies of their petition, schedules,. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept.

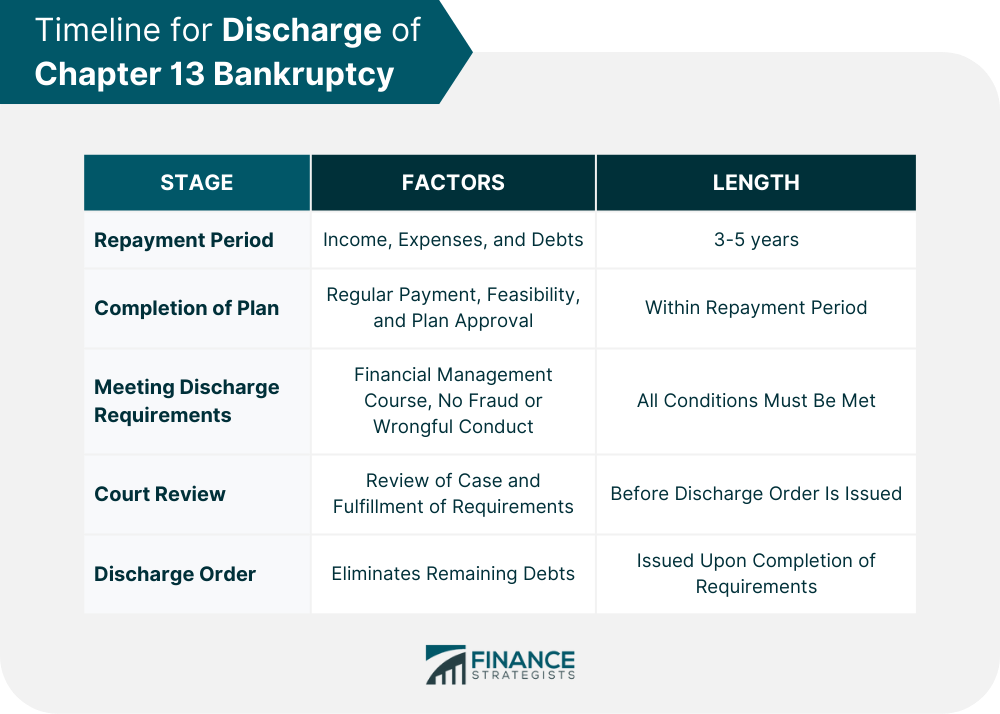

When Does Chapter 13 Bankruptcy Get Discharged?

Far more important is the list of creditors that were included in the. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. • your bankruptcy petition • court. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Key.

The Chapter 7 Discharge Chapter 7 Bankruptcy Attorneys ARM Lawyers

How long should i keep my bankruptcy documents? It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Far more important is the list of creditors that were included in the. I advise my clients to keep copies of their petition, schedules,. That being said, the library of virginia requires that the lists of taxes written.

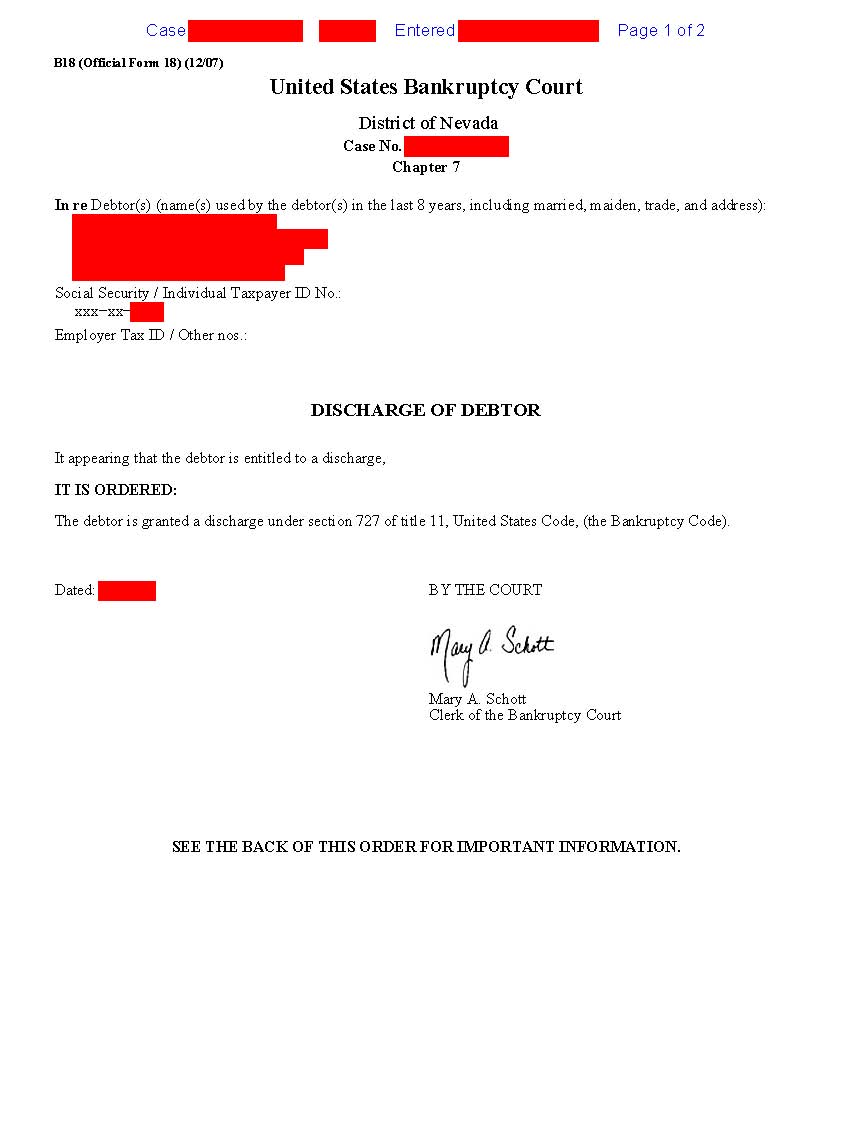

What do my bankruptcy discharge papers look like? Las Vegas

Key papers to retain include: That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. I advise my clients to keep copies of their petition, schedules,. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Far more important is.

How to Get Copy of Bankruptcy Discharge Papers Debt Game Over

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Far more important is the list of creditors that were included in the. How long should i keep my bankruptcy.

How Does a Bankruptcy Discharge Work? Lexington Law

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. I advise my clients to keep copies of their petition, schedules,. Far more important is the list of creditors that were included in the. • your bankruptcy petition • court. That being said, the library of virginia requires that the lists of taxes written off (including.

How to Get Copy of Bankruptcy Discharge Papers Debt Game Over

Key papers to retain include: Far more important is the list of creditors that were included in the. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. I advise.

How to Get Copy of Bankruptcy Discharge Papers Debt Game Over

That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. How long should i keep my bankruptcy documents? I advise my clients to keep copies of their petition, schedules,. Key papers to retain include: Far more important is the list of creditors that were.

How long it take to get my bankruptcy discharge paper?

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Key papers to retain include: Far more important is the list of creditors that were included in the. I advise my clients to keep copies of their petition, schedules,. How long should i keep my bankruptcy documents?

Discharge Las Vegas Bankruptcy Attorney Luh & Associates

How long should i keep my bankruptcy documents? • your bankruptcy petition • court. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Key papers to retain include: I advise my clients to keep copies of their petition, schedules,.

How Long Should I Keep My Bankruptcy Documents?

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Key papers to retain include: I advise my clients to keep copies of their petition, schedules,. Far more important is the list of creditors that were included in the.

• Your Bankruptcy Petition • Court.

That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or.