How Long Does Federal Tax Lien Last

How Long Does Federal Tax Lien Last - Does a federal tax lien expire? The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). After the 10 year statute of limitations on collections expires, the irs is required to release the lien. The irs tax lien expires when your tax debt is no longer collectible. If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The irs releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. A discharge removes the lien from.

The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). The irs tax lien expires when your tax debt is no longer collectible. The irs releases your lien within 30 days after you have paid your tax debt. If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. A discharge removes the lien from. Does a federal tax lien expire? The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. After the 10 year statute of limitations on collections expires, the irs is required to release the lien.

The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). Does a federal tax lien expire? The irs tax lien expires when your tax debt is no longer collectible. After the 10 year statute of limitations on collections expires, the irs is required to release the lien. The irs releases your lien within 30 days after you have paid your tax debt. If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. A discharge removes the lien from. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

How Long Does a Tax Lien Last? Community Tax

A discharge removes the lien from. Does a federal tax lien expire? The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. The.

How Long Does a Tax Lien Last? Community Tax

If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. Does a federal tax lien expire? The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. The irs tax lien expires when your tax debt is no longer collectible. A.

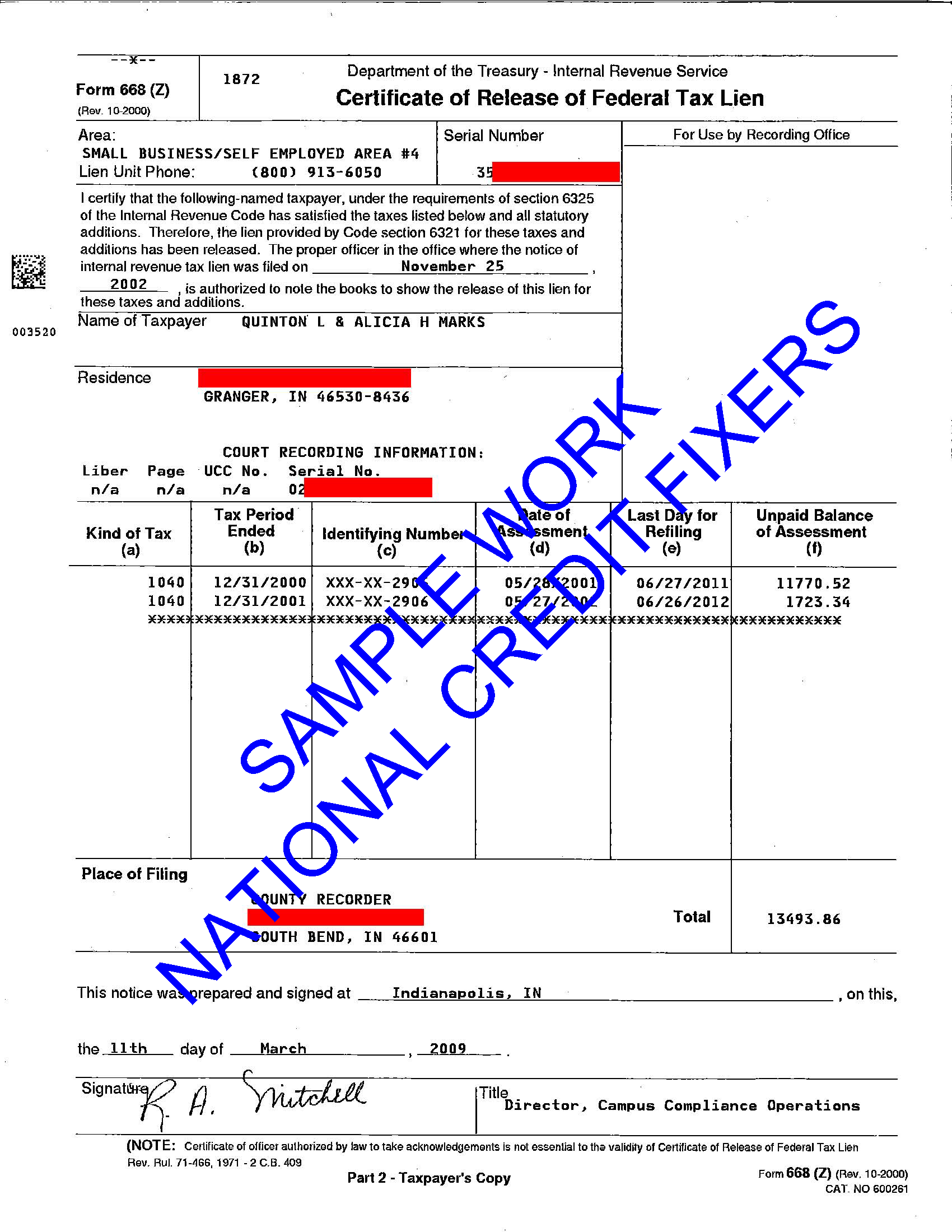

Federal Tax Lien Federal Tax Lien Payment

A discharge removes the lien from. After the 10 year statute of limitations on collections expires, the irs is required to release the lien. The irs tax lien expires when your tax debt is no longer collectible. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien.

Title Basics of the Federal Tax Lien SnapClose

The irs releases your lien within 30 days after you have paid your tax debt. If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. The irs tax lien expires.

Federal Tax Lien Definition and How to Remove

The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). Does a federal tax lien.

How Long Does a Federal Tax Lien Last? Heartland Tax Solutions

When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. After the 10 year statute of limitations on collections expires, the irs is.

Federal tax lien on foreclosed property laderdriver

The irs releases your lien within 30 days after you have paid your tax debt. A discharge removes the lien from. If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this.

Federal tax lien on foreclosed property laderdriver

The irs tax lien expires when your tax debt is no longer collectible. Does a federal tax lien expire? When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable.

How Long Does a State Tax Lien Last? Tax Lien Code

If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). The irs releases your lien within 30 days after you have.

Federal Tax Lien Definition and How to Remove

The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. The irs releases your lien within 30 days after you have paid your tax debt. After the 10 year statute of limitations on collections expires, the irs is required to release the lien. The irs tax lien.

When Conditions Are In The Best Interest Of Both The Government And The Taxpayer, Other Options For Reducing The Impact Of A Lien Exist.

The irs tax lien expires when your tax debt is no longer collectible. A discharge removes the lien from. The irs releases your lien within 30 days after you have paid your tax debt. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period.

The Federal Tax Lien Continues Until The Liability For The Amount Assessed Is Satisfied Or Becomes Unenforceable By Reason Of Lapse Of Time, I.e., Passing Of The Collection Statute Expiration Date (Csed).

After the 10 year statute of limitations on collections expires, the irs is required to release the lien. Does a federal tax lien expire? If the irs timely refiles the tax lien, it is treated as continuation of the initial lien.