Homestead Exemption Form Florida

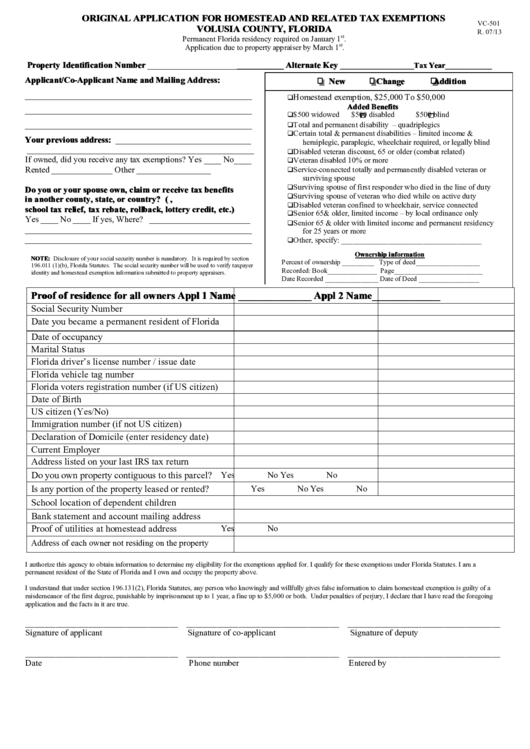

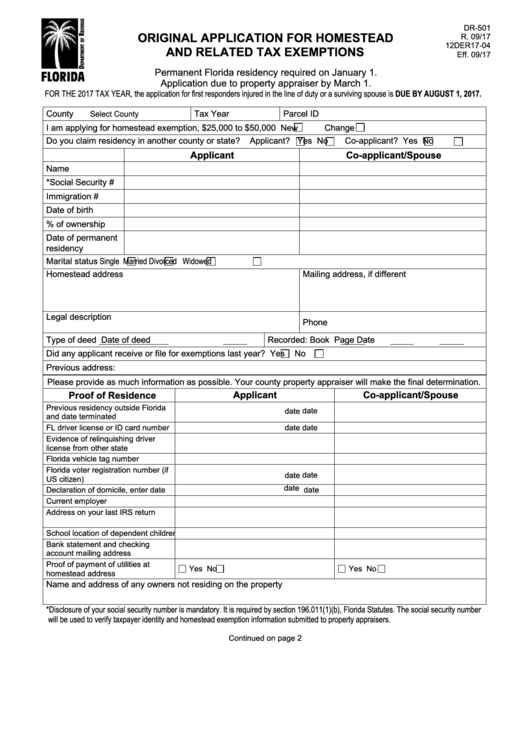

Homestead Exemption Form Florida - Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. Original application for homestead and related tax exemptions permanent florida residency required on january 1. File the signed application for exemption with the county property appraiser. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. The property appraiser has a duty to put a tax lien on your property if.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. The property appraiser has a duty to put a tax lien on your property if. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. File the signed application for exemption with the county property appraiser. Original application for homestead and related tax exemptions permanent florida residency required on january 1. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent.

File the signed application for exemption with the county property appraiser. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. The property appraiser has a duty to put a tax lien on your property if. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. Original application for homestead and related tax exemptions permanent florida residency required on january 1. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a.

Buying a new home in Orlando? Save Money File Homestead Exemption

The property appraiser has a duty to put a tax lien on your property if. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Original application.

MustKnow Facts About Florida Homestead Exemptions Lakeland Real Estate

Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. The property appraiser has a duty to put a tax lien on your property if. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her.

Homestead Waiver Form Edit & Share airSlate SignNow

If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. File the signed application for exemption with the county property appraiser. When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. Original.

Homestead Exemption Form, Don't to File in 2021! Christy Buck Team

Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. Original application for homestead and related tax exemptions permanent florida residency required on january 1. When someone.

Florida Homestead Exemption Application Guide Who is Eligible?

File the signed application for exemption with the county property appraiser. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. 11 rows when someone.

2024 Application For Residential Homestead Exemption Klara Michell

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. The property appraiser has a duty to put a tax lien on your property if. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to.

Homestead related tax exemptions Fill out & sign online DocHub

The property appraiser has a duty to put a tax lien on your property if. Original application for homestead and related tax exemptions permanent florida residency required on january 1. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. If you are a permanent florida resident,.

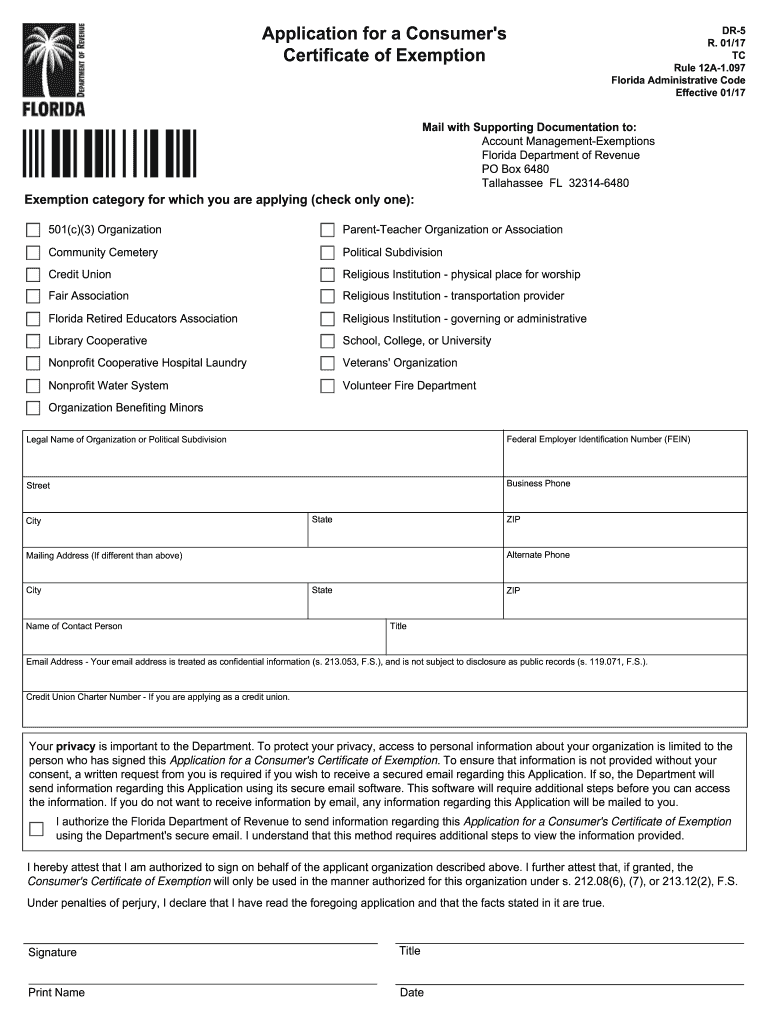

Exemption State of Florida 20172024 Form Fill Out and Sign Printable

11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Original application for homestead and related tax exemptions permanent florida residency required on january 1. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to.

Fillable Form Dr501 Original Application For Homestead And Related

File the signed application for exemption with the county property appraiser. Basic homestead every person who owns and resides on real property in florida on january 1, makes the property his or her permanent. Original application for homestead and related tax exemptions permanent florida residency required on january 1. If you are a permanent florida resident, you may be eligible.

2024 Homestead Exemption Deadline Berny Kissie

File the signed application for exemption with the county property appraiser. If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,. Basic homestead every person who owns.

Original Application For Homestead And Related Tax Exemptions Permanent Florida Residency Required On January 1.

If you have applied for a new homestead exemption and are entitled to transfer a homestead assessment difference from a. If you are a permanent florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property. The property appraiser has a duty to put a tax lien on your property if. 11 rows when someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent,.

Basic Homestead Every Person Who Owns And Resides On Real Property In Florida On January 1, Makes The Property His Or Her Permanent.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property. File the signed application for exemption with the county property appraiser.