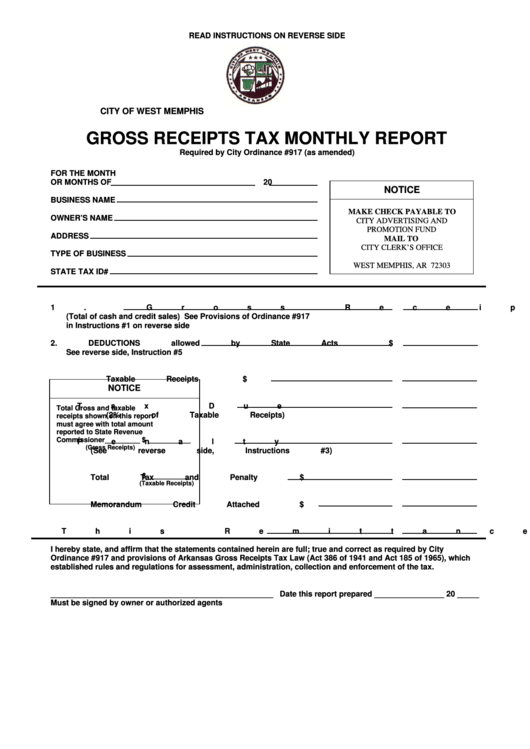

Gross Receipts For Business License

Gross Receipts For Business License - Calculating gross receipts involves tracking and recording all types of income earned by the business. Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. In order to renew your santa monica business license, you will need your current business license renewal notice, your santa monica gross receipts. Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure.

Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. Calculating gross receipts involves tracking and recording all types of income earned by the business. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. In order to renew your santa monica business license, you will need your current business license renewal notice, your santa monica gross receipts.

Calculating gross receipts involves tracking and recording all types of income earned by the business. In order to renew your santa monica business license, you will need your current business license renewal notice, your santa monica gross receipts. Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items.

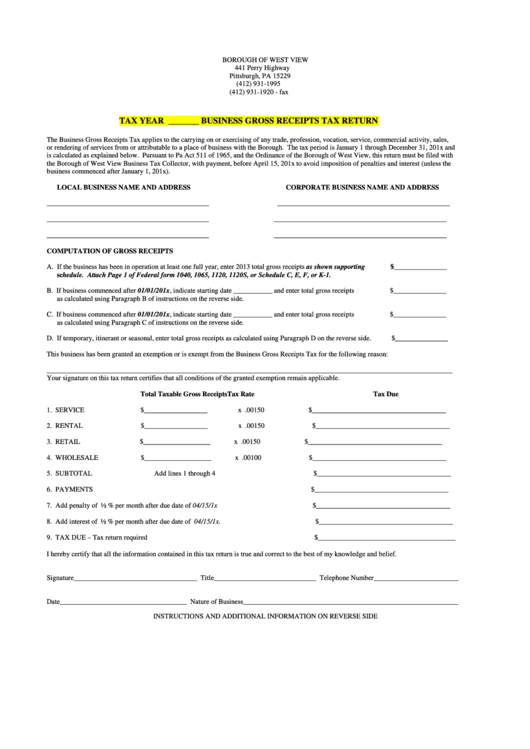

Business Gross Receipts Tax Subisness

Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. In order to renew your santa monica business license, you will need your current business license renewal notice, your santa monica gross receipts. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Gross receipts means.

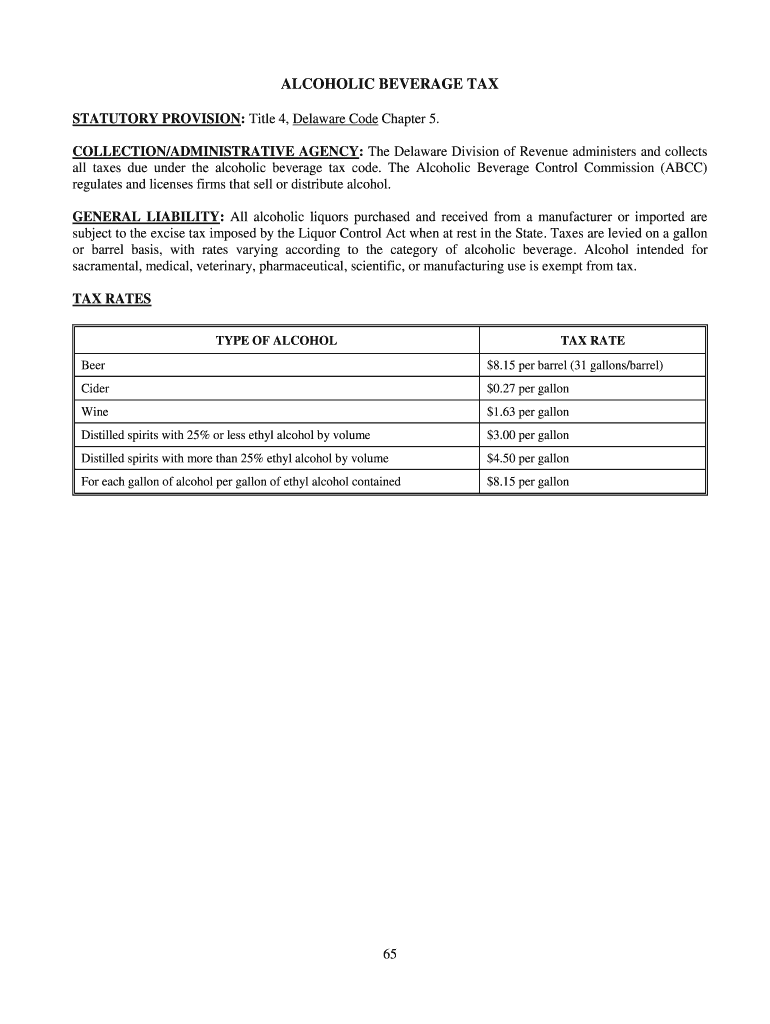

What Are Gross Receipts? Definition, Uses, & More

Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. In order to renew your santa monica business license, you will need your current business license renewal notice, your santa monica gross receipts. Gross receipts means.

Gross receipts pastorstrategy

Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Calculating gross receipts involves tracking and recording all types of income earned by the business. Gross receipts means the total amount of all receipts in cash.

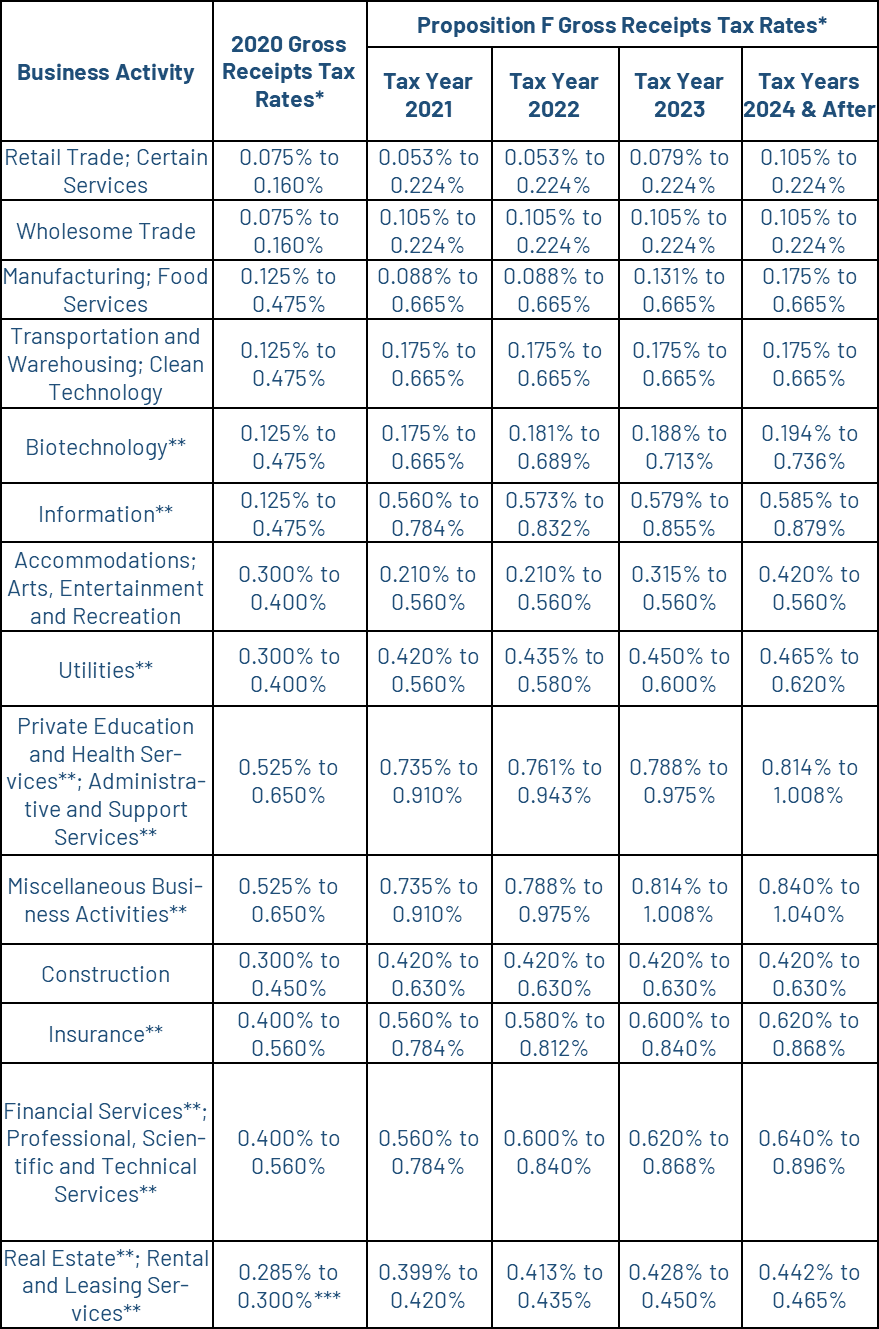

Gross Receipts Tax (GR) Treasurer & Tax Collector

Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. Calculating gross receipts involves tracking and recording all types of income earned by the business. In order to renew your santa monica business license, you will need your current business license renewal notice, your santa monica gross receipts. Gross receipts represent a business’s total.

Fillable Online BUSINESS AND OCCUPATIONAL LICENSE AND GROSS RECEIPTS

Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Calculating gross receipts involves tracking and recording all types of income earned by the business. Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. Understand how to calculate gross receipts,.

SAMPLE1 Gross Receipts Certification PDF

Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. Calculating gross receipts involves tracking and recording all types of income earned by the business. Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. Gross receipts represent a business’s total sales or.

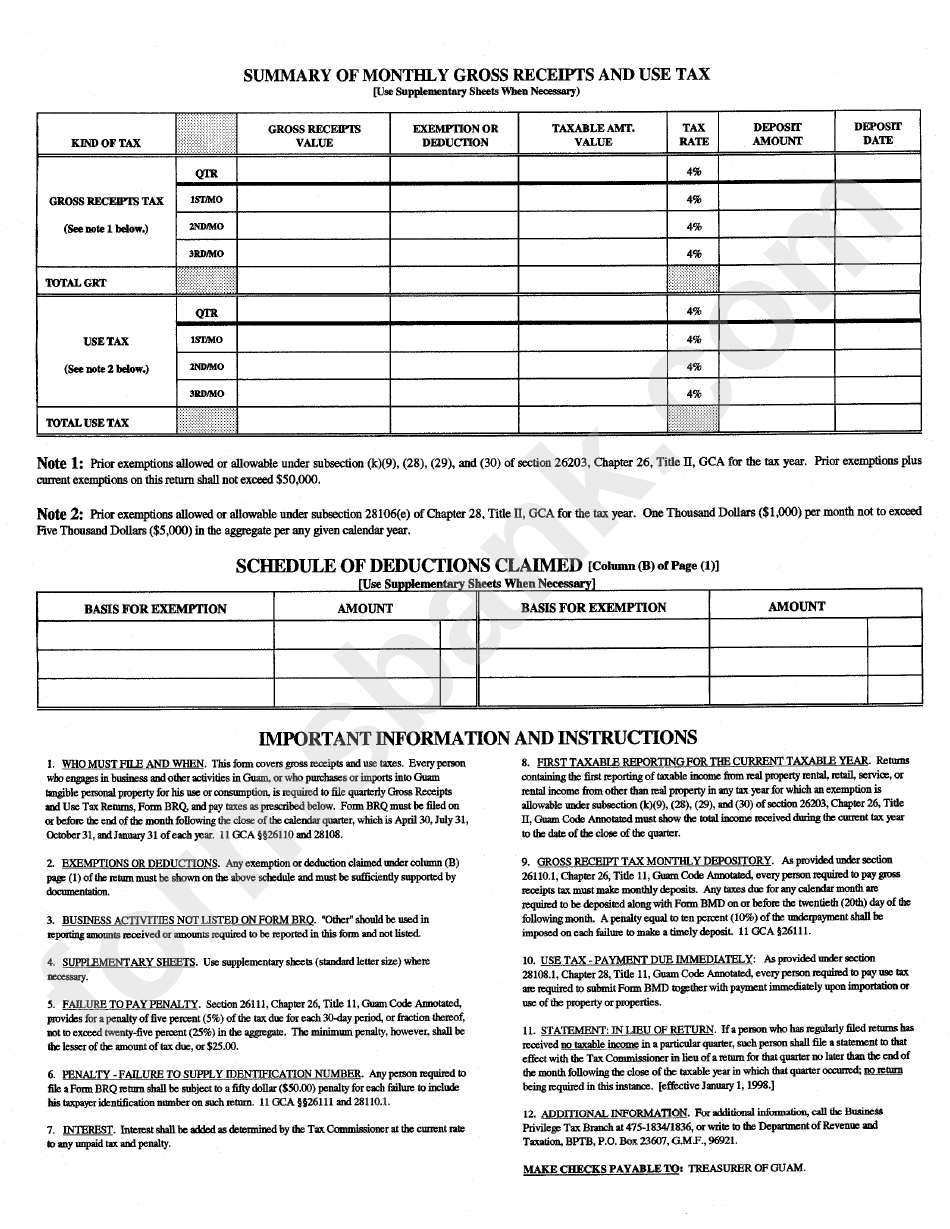

Business Gross Receipts Tax Return printable pdf download

Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Calculating gross receipts involves tracking and recording all types of income earned by the business. In order to renew your santa.

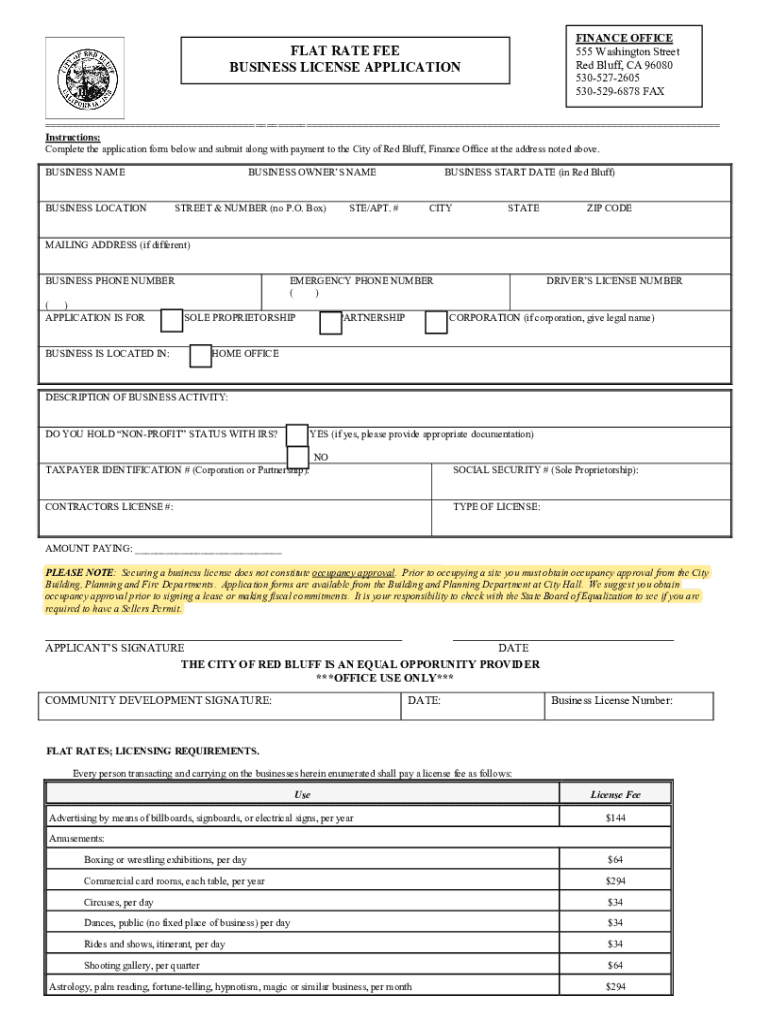

Fillable Online GROSS RECEIPTS TAX BUSINESS LICENSE Fax Email Print

Calculating gross receipts involves tracking and recording all types of income earned by the business. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. In order to renew your santa monica business license, you will need your current business license renewal notice, your santa monica gross receipts. Gross receipts means the.

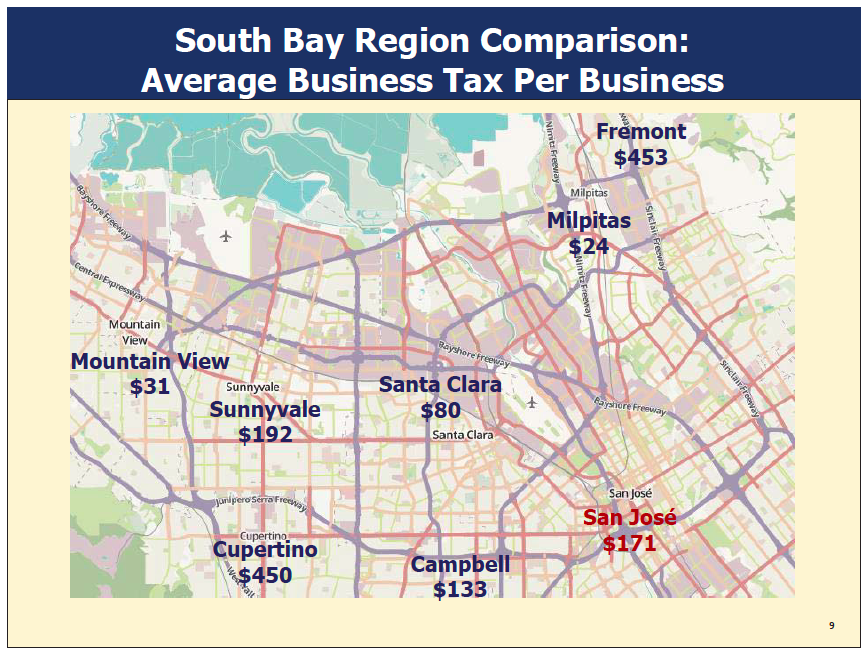

Study Gross Receipts Business Tax Could Quadruple Revenue San Jose

Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. In order to renew your santa monica business license, you will need your current business license renewal notice, your santa monica gross receipts. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Calculating gross receipts.

Monthly gross receipts example

Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. In order to renew your.

In Order To Renew Your Santa Monica Business License, You Will Need Your Current Business License Renewal Notice, Your Santa Monica Gross Receipts.

Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. Gross receipts represent a business’s total sales or revenue from all sources before any deductions for expenses or. Gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. Calculating gross receipts involves tracking and recording all types of income earned by the business.