Georgia State Tax Lien

Georgia State Tax Lien - Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. Search for pending liens issued by the georgia department of revenue. Search the georgia consolidated lien indexes by county, book and page. Also called a state tax. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a.

Search for pending liens issued by the georgia department of revenue. Also called a state tax. Search the georgia consolidated lien indexes by county, book and page. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you.

Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search the georgia consolidated lien indexes by county, book and page. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. Search for pending liens issued by the georgia department of revenue. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Also called a state tax.

Tax Lien Sale PDF Tax Lien Taxes

Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. This tool allows for searching for state tax liens and.

Changes State Tax Lien Law

Search for pending liens issued by the georgia department of revenue. Also called a state tax. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Search the georgia consolidated lien indexes by county, book and page. This tool allows for searching for state tax liens and related documents.

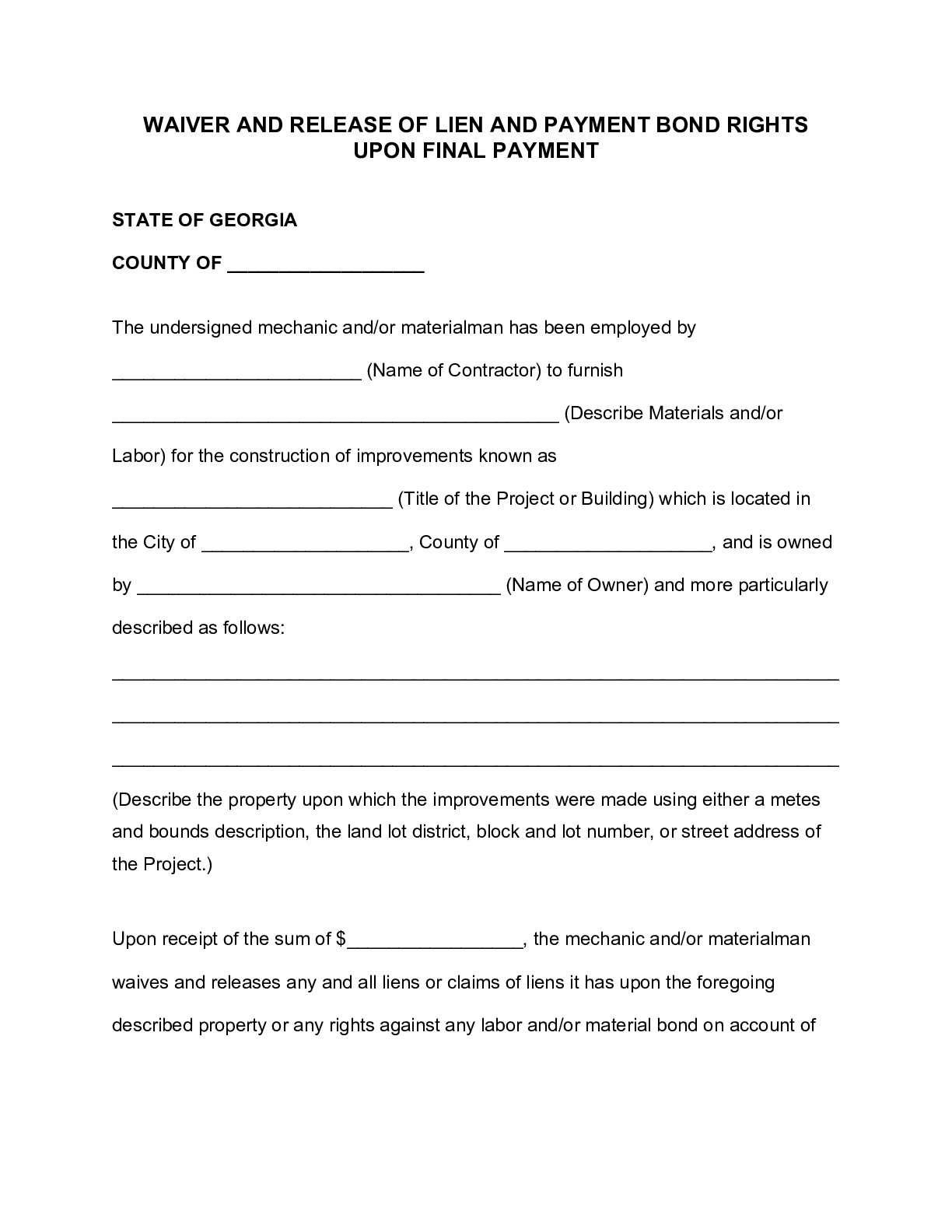

Final Lien Waiver Form Free Template Download

Search for pending liens issued by the georgia department of revenue. Search the georgia consolidated lien indexes by county, book and page. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state.

Auto Lien Release Form Form Resume Examples

This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. Search the georgia consolidated lien indexes by county, book and page. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Notice of.

Property Lien Form Form example download

Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. Also called a state tax. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search for pending liens issued.

20132024 Form GA T4 Fill Online, Printable, Fillable, Blank pdfFiller

Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. Also called a state tax. If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Once filed, the lien is perfected, granting.

Tax Lien Tax Lien Certificates

If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Search the georgia consolidated lien indexes by county, book and page. Also called a state tax. Search for pending liens issued by the georgia department of revenue. Notice of state tax execution (letter) this letter informs you that a.

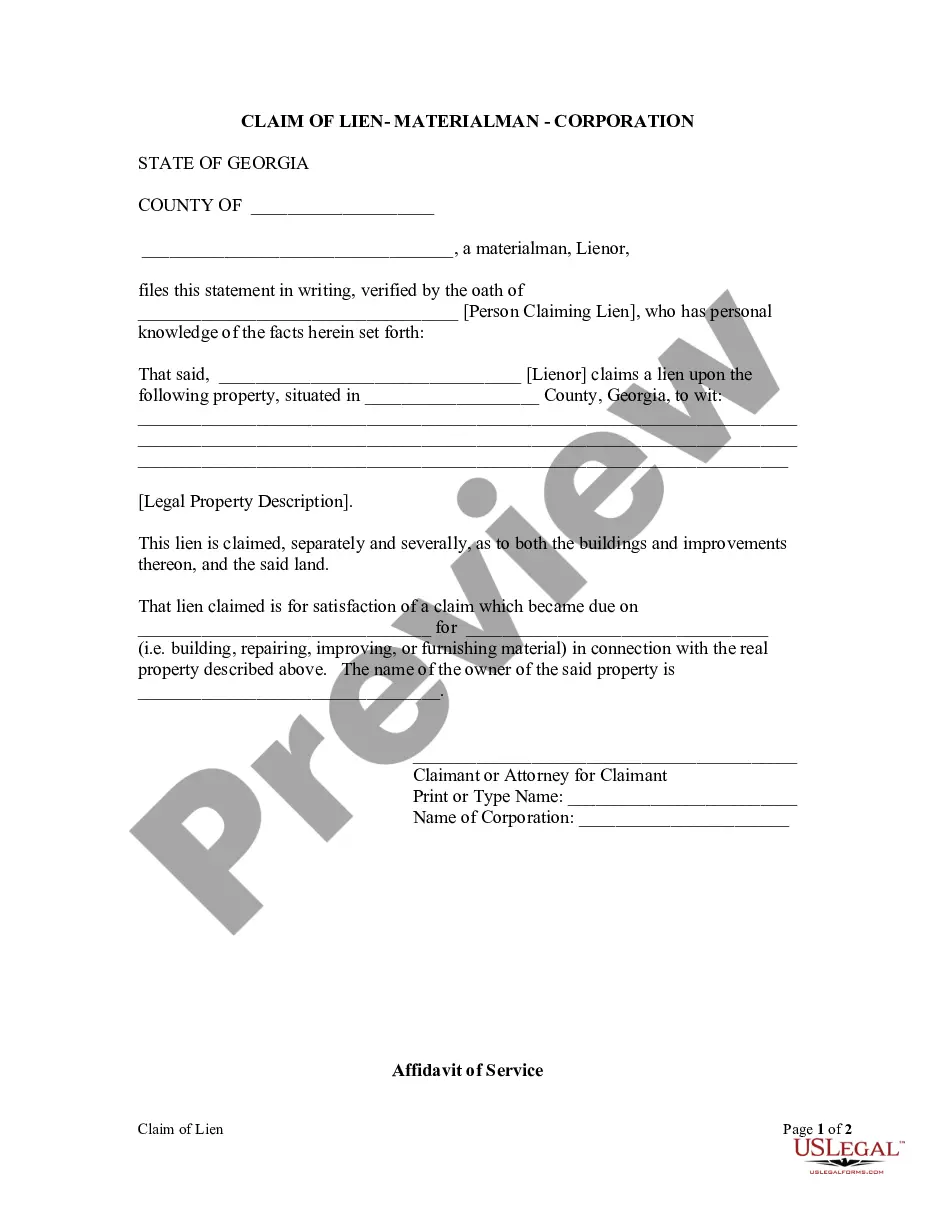

Claim Lien Form Form US Legal Forms

Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Search the georgia consolidated lien indexes by county, book and page. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. Search for.

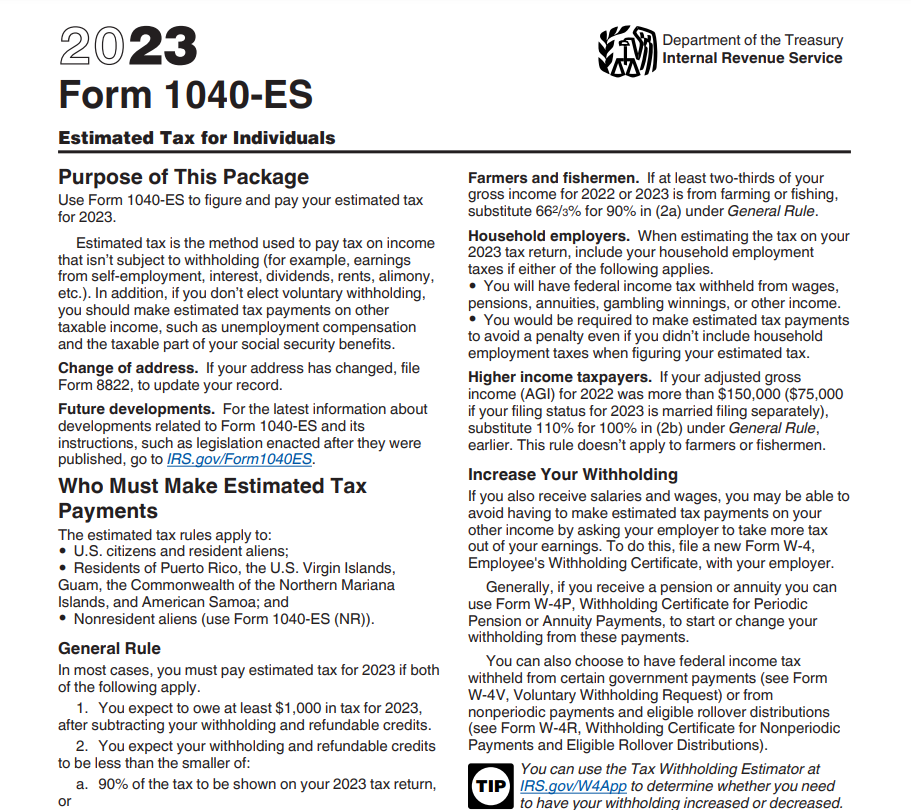

Tax Rebate 2024 How to Claim and Eligibility Requirements

Search for pending liens issued by the georgia department of revenue. Also called a state tax. This tool allows for searching for state tax liens and related documents that have been submitted by the georgia department of revenue for subsequent. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as.

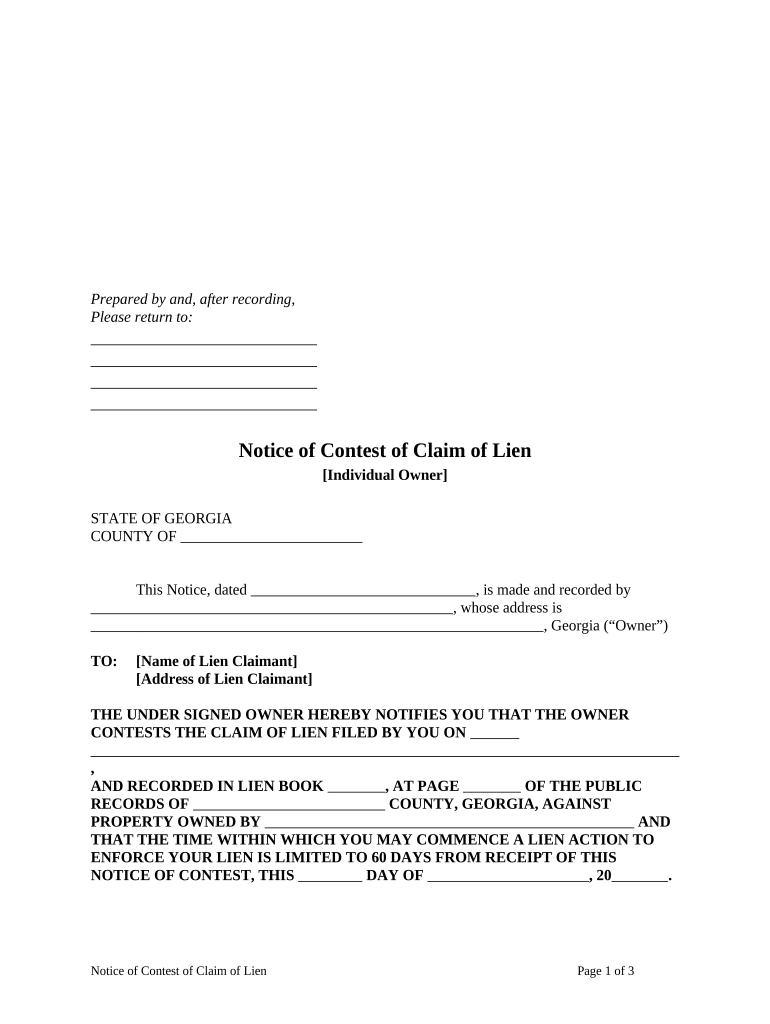

lien Fill out & sign online DocHub

Search the georgia consolidated lien indexes by county, book and page. Once filed, the lien is perfected, granting the state authority to enforce it through garnishment, property seizure, or sale, as described in o.c.g.a. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount.

This Tool Allows For Searching For State Tax Liens And Related Documents That Have Been Submitted By The Georgia Department Of Revenue For Subsequent.

If you don't pay your taxes in georgia, the department of revenue (dor) can issue a state tax lien against you. Search the georgia consolidated lien indexes by county, book and page. Notice of state tax execution (letter) this letter informs you that a state tax execution, or state tax lien, has been issued to collect an amount due. Also called a state tax.

Once Filed, The Lien Is Perfected, Granting The State Authority To Enforce It Through Garnishment, Property Seizure, Or Sale, As Described In O.c.g.a.

Search for pending liens issued by the georgia department of revenue.