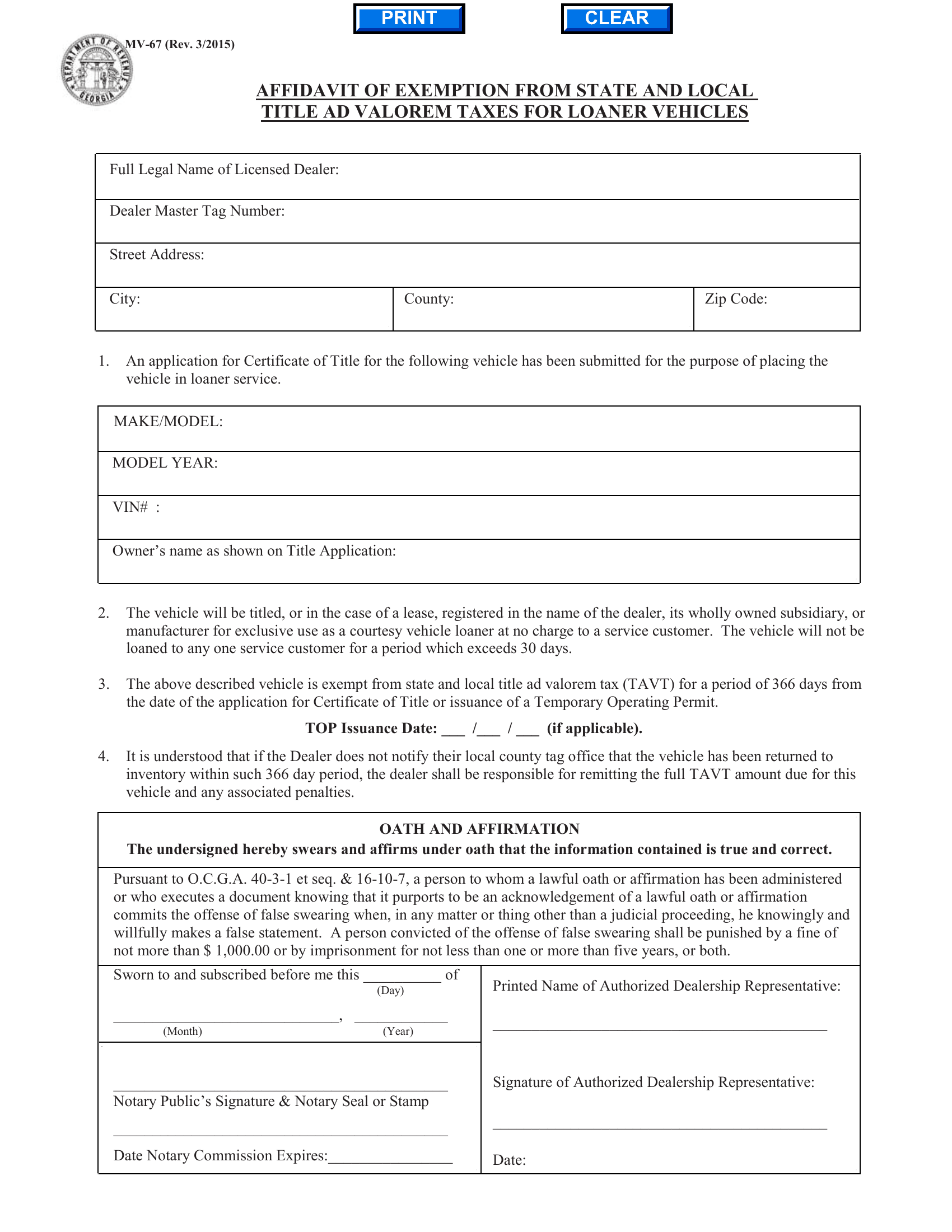

Georgia Ad Valorem Tax Exemption Form

Georgia Ad Valorem Tax Exemption Form - International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable. Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. Giada diligently works to keep members abreast of new forms as they come available. Below are commonly used dor documents:

International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Below are commonly used dor documents: Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. Giada diligently works to keep members abreast of new forms as they come available. Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable.

International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable. Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. Giada diligently works to keep members abreast of new forms as they come available. Below are commonly used dor documents:

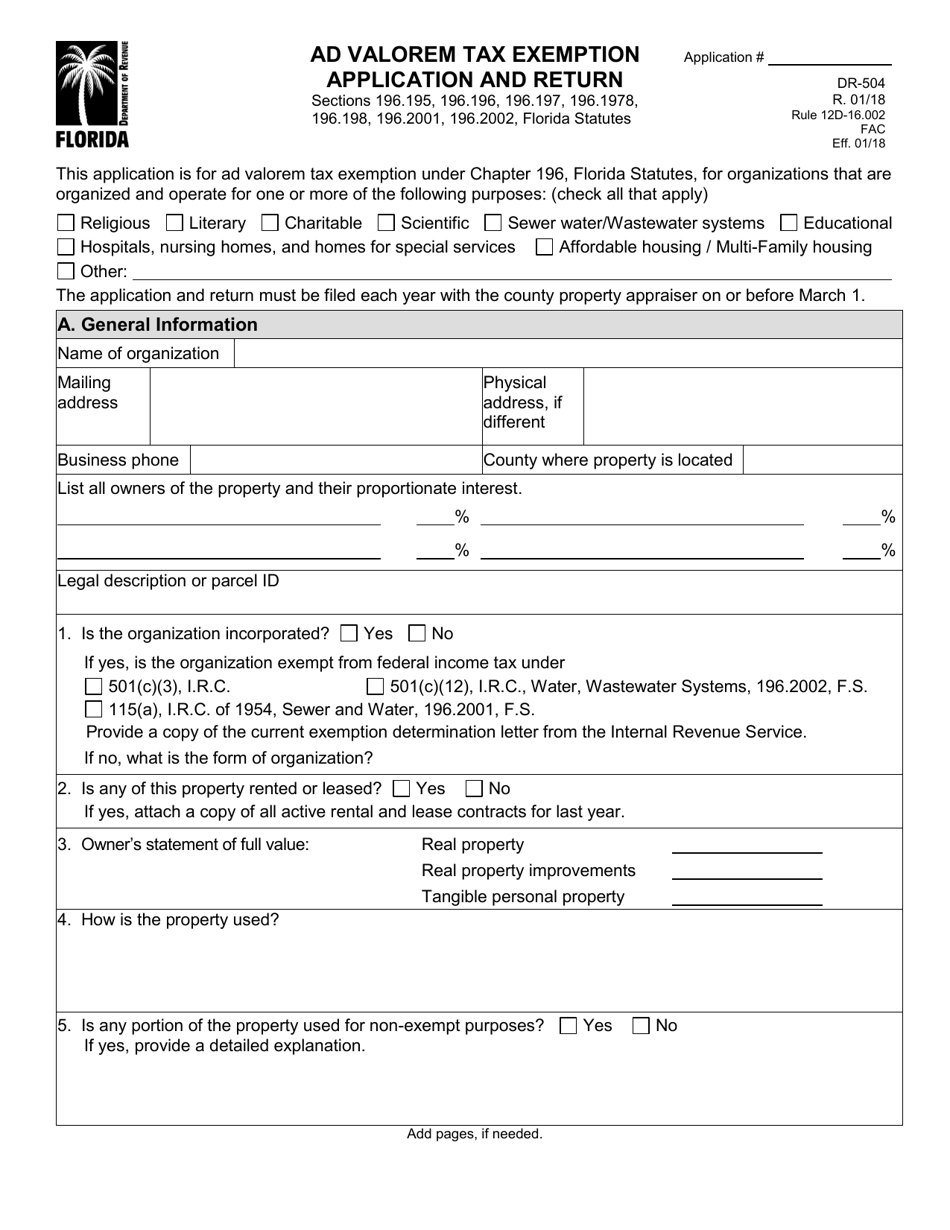

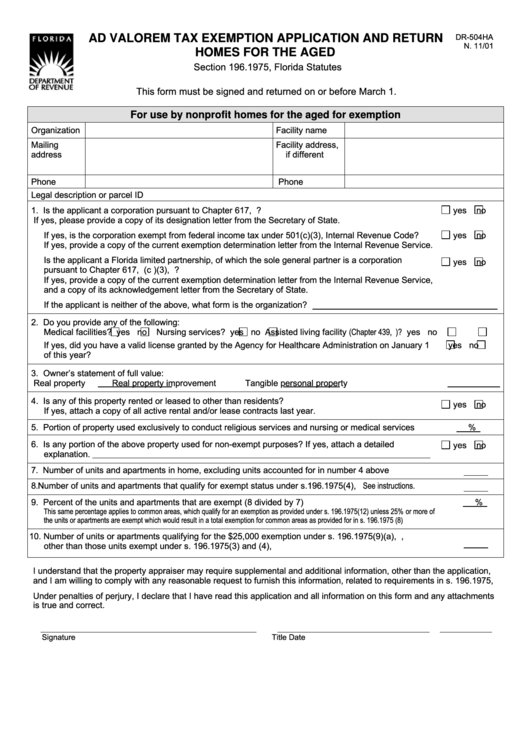

Fillable Online AD VALOREM TAX EXEMPTION APPLICATION AND Fax Email

International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. Giada diligently works to keep members abreast of new forms as they come available. Ad valorem tax on vehicles this exemption applies to.

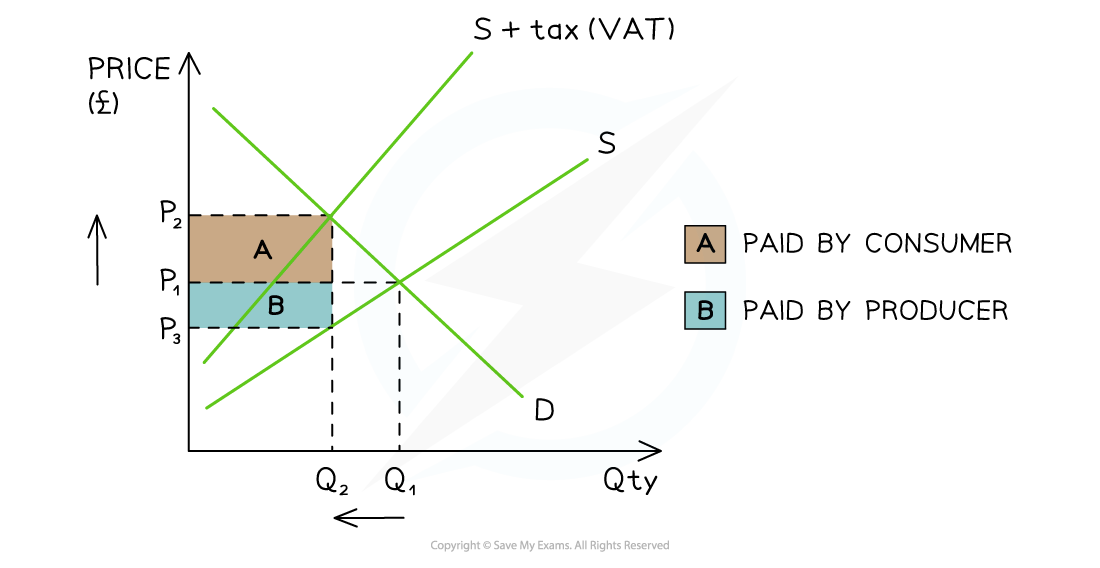

ad valorem tax 2021 Madelaine Riggs

Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. Below are commonly used dor documents: International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Giada diligently works to keep members abreast of new forms as they come available. Ad valorem tax.

Form DR504 Fill Out, Sign Online and Download Fillable PDF, Florida

Below are commonly used dor documents: International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Giada diligently works to keep members abreast of new forms as they come available. Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. Ad valorem tax.

Florida Sales Tax Exemption Application Form

Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable. International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Below are.

Edexcel A Level Economics A复习笔记1.4.1 Government Intervention in

Below are commonly used dor documents: Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title.

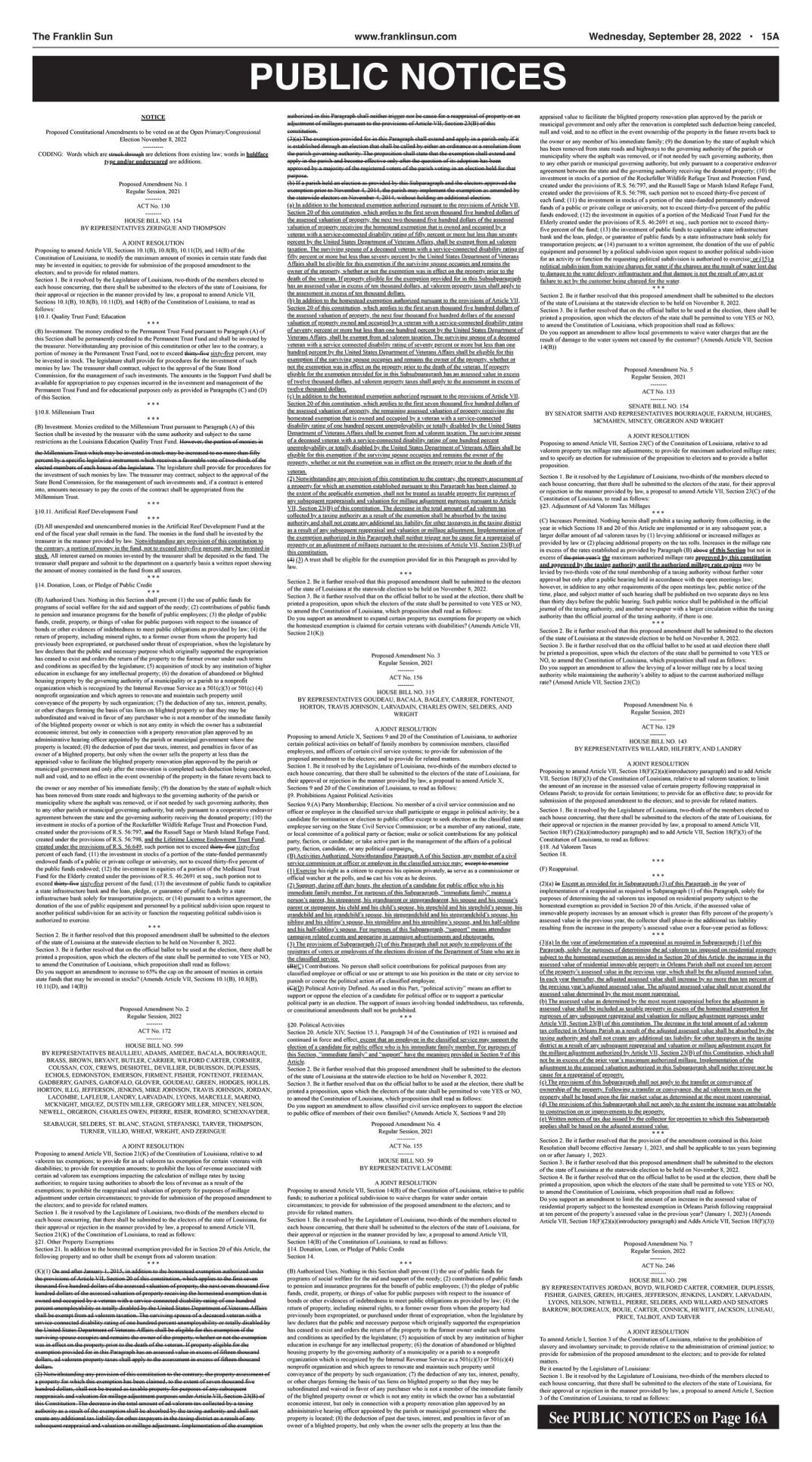

ad valorem tax exemption form family member Glad Of That

Giada diligently works to keep members abreast of new forms as they come available. Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable. Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. International registration plan (irp).

ad valorem tax exemption form family member Glad Of That

Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable. Giada diligently works to keep members abreast of new forms as they come available. International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Below are commonly used dor documents: Any ad valorem.

GA DMV Form MV67 Affidavit of Exemption from State and Local Title Ad

Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable. International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Below are commonly used dor documents: Giada diligently works to keep members abreast of new forms as they come available. Any ad valorem.

Sales And Use Tax Exemption Form Ga

Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable. Giada diligently works to keep members abreast of new forms as they come available. International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Below are commonly used dor documents: Any ad valorem.

Form Dr504ha Ad Valorem Tax Exemption Application And Return Homes

Ad valorem tax on vehicles this exemption applies to either the annual property tax or the title tax, whichever is applicable. Below are commonly used dor documents: Giada diligently works to keep members abreast of new forms as they come available. Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state.

Ad Valorem Tax On Vehicles This Exemption Applies To Either The Annual Property Tax Or The Title Tax, Whichever Is Applicable.

Below are commonly used dor documents: International registration plan (irp) vehicles titled in ga are exempt from title ad valorem tax (tavt). Any ad valorem tax due on the above items is payable to the taxing authority of my home country/state listed above. Giada diligently works to keep members abreast of new forms as they come available.