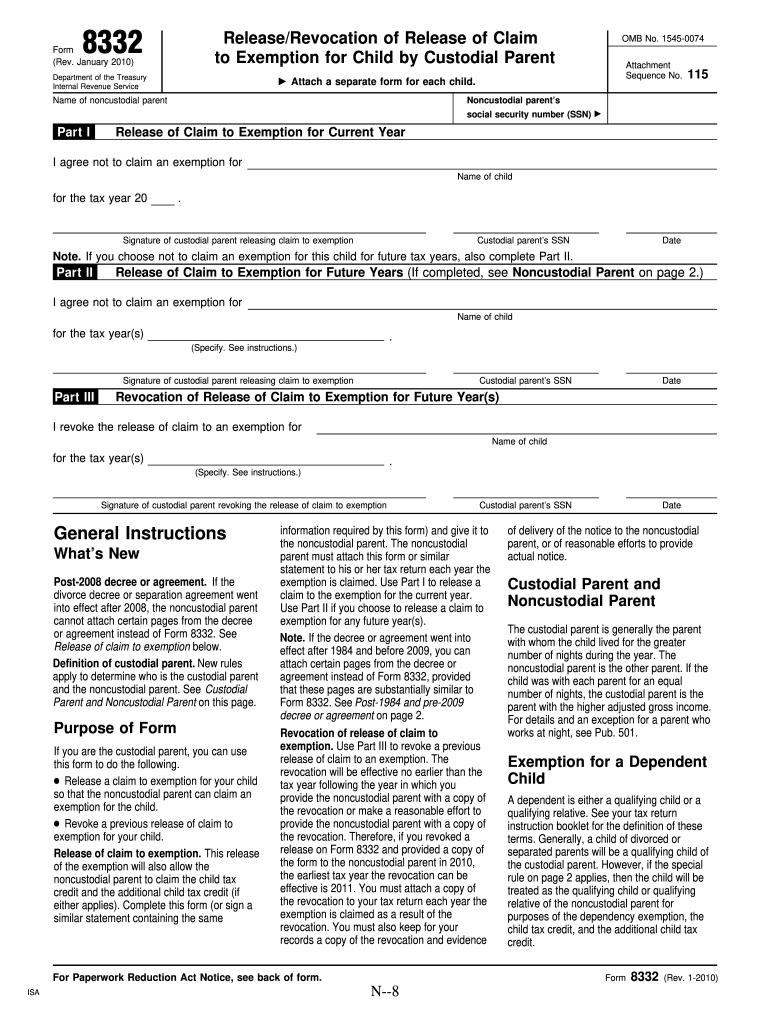

Form 8332 Instructions

Form 8332 Instructions - Pay close attention to eligibility requirements and filing deadlines. Irs form 8332 is titled, “release/revocation of release to claim to exemption for child by custodial parent.” according to section 152(e)(2) of the tax code,. See form 8453 and its instructions for more details. Electronically, you must file form 8332 with form 8453, u.s. Release of claim for current. If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial parent, you’ll need to fill out form 8332. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. Download and review the latest irs form 8332 and instructions.

Release of claim for current. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. Pay close attention to eligibility requirements and filing deadlines. Download and review the latest irs form 8332 and instructions. Electronically, you must file form 8332 with form 8453, u.s. Irs form 8332 is titled, “release/revocation of release to claim to exemption for child by custodial parent.” according to section 152(e)(2) of the tax code,. See form 8453 and its instructions for more details. If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial parent, you’ll need to fill out form 8332.

Download and review the latest irs form 8332 and instructions. Irs form 8332 is titled, “release/revocation of release to claim to exemption for child by custodial parent.” according to section 152(e)(2) of the tax code,. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. Pay close attention to eligibility requirements and filing deadlines. Release of claim for current. Electronically, you must file form 8332 with form 8453, u.s. If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial parent, you’ll need to fill out form 8332. See form 8453 and its instructions for more details.

IRS Form 8332 Instructions A Guide for Custodial Parents

Download and review the latest irs form 8332 and instructions. If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial parent, you’ll need to fill out form 8332. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates,.

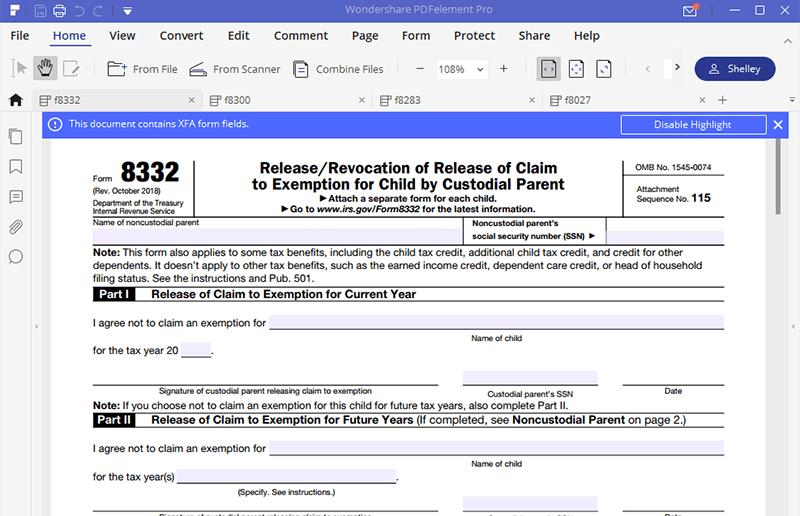

8332 form Fill out & sign online DocHub

Download and review the latest irs form 8332 and instructions. Pay close attention to eligibility requirements and filing deadlines. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. See form 8453 and its instructions for more details. If you have custody of.

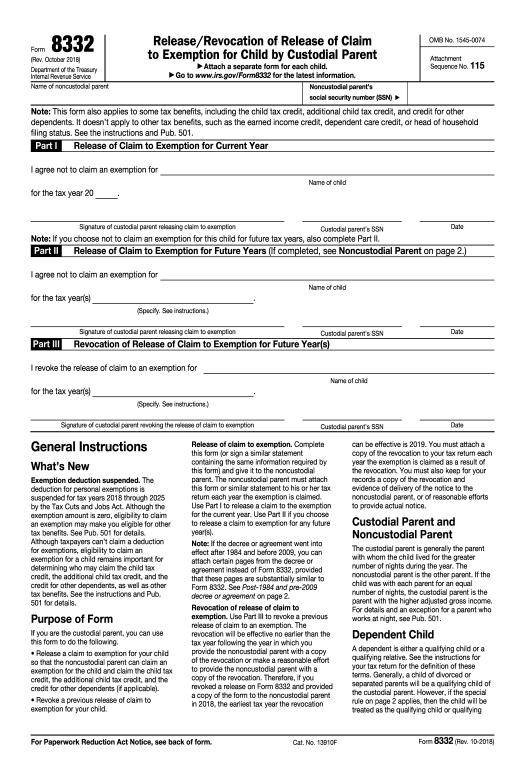

20182020 Form IRS 8332 Fill Online, Printable, Fillable, Blank PDFfiller

If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial parent, you’ll need to fill out form 8332. See form 8453 and its instructions for more details. Irs form 8332 is titled, “release/revocation of release to claim to exemption for child by custodial parent.” according to section.

Tax Form 8332 Printable

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. Pay close attention to eligibility requirements and filing deadlines. Irs form 8332 is titled, “release/revocation of release to claim to exemption for child by custodial parent.” according to section 152(e)(2) of the tax.

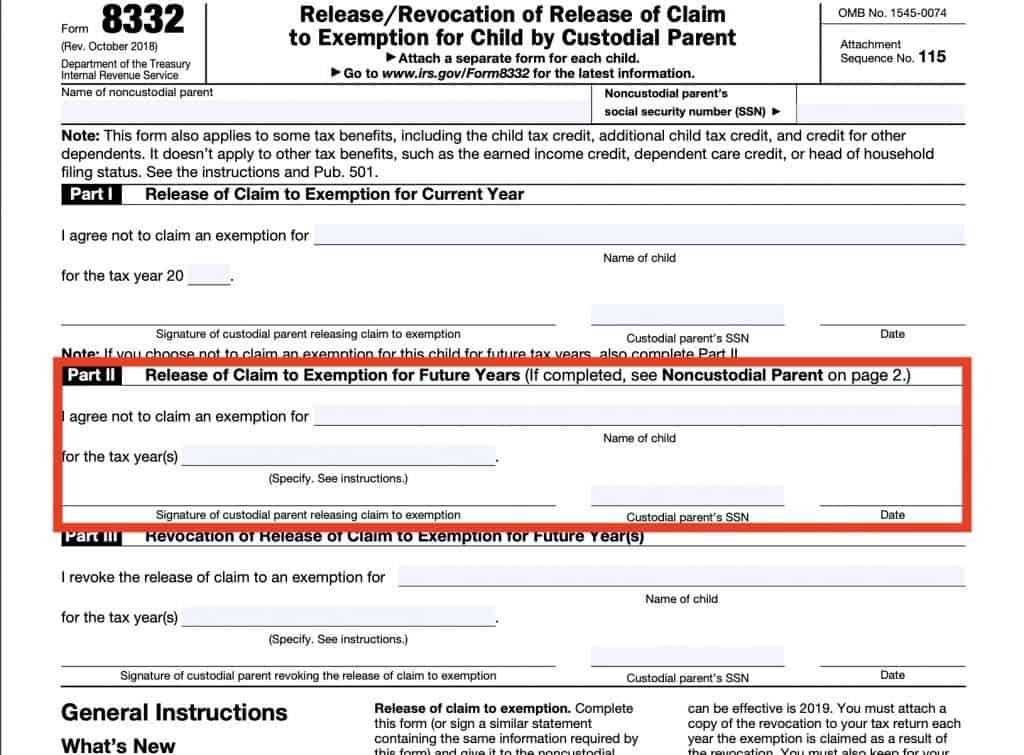

Irs Form 8332 Printable, Release/revocation of release of claim to

Pay close attention to eligibility requirements and filing deadlines. Download and review the latest irs form 8332 and instructions. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. If you have custody of your child but want to release the right to.

IRS Form 8332 Fill it with the Best PDF Form Filler

Download and review the latest irs form 8332 and instructions. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial.

Tax Form 8332 Printable in minutes airSlate

See form 8453 and its instructions for more details. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. Download and review the latest irs form 8332 and instructions. Electronically, you must file form 8332 with form 8453, u.s. Pay close attention to.

IRS Form 8332 Instructions Release of Child Exemption

If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial parent, you’ll need to fill out form 8332. Irs form 8332 is titled, “release/revocation of release to claim to exemption for child by custodial parent.” according to section 152(e)(2) of the tax code,. Electronically, you must file.

A brief guide on filing IRS Form 8332 for release of dependency exemption

Pay close attention to eligibility requirements and filing deadlines. Release of claim for current. Irs form 8332 is titled, “release/revocation of release to claim to exemption for child by custodial parent.” according to section 152(e)(2) of the tax code,. See form 8453 and its instructions for more details. Information about form 8332, release/revocation of release of claim to exemption for.

IRS Form 8332 Instructions Release of Child Exemption

If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial parent, you’ll need to fill out form 8332. Electronically, you must file form 8332 with form 8453, u.s. Download and review the latest irs form 8332 and instructions. Information about form 8332, release/revocation of release of claim.

See Form 8453 And Its Instructions For More Details.

Electronically, you must file form 8332 with form 8453, u.s. Pay close attention to eligibility requirements and filing deadlines. Irs form 8332 is titled, “release/revocation of release to claim to exemption for child by custodial parent.” according to section 152(e)(2) of the tax code,. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file.

Download And Review The Latest Irs Form 8332 And Instructions.

If you have custody of your child but want to release the right to claim your child as a dependent to the noncustodial parent, you’ll need to fill out form 8332. Release of claim for current.