Form 1099 R Code J

Form 1099 R Code J - Recharacterized ira contribution made for 2017. Taxable amount is blank and it is. If any other code, such as 8 or p, applies, use code j. The amount may or may not be taxable depending on the. One of those questions will ask about. Use code r for a. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Code j indicates that there was an early distribution from a roth ira. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira.

Recharacterized ira contribution made for 2017. If any other code, such as 8 or p, applies, use code j. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. One of those questions will ask about. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Use code r for a. The amount may or may not be taxable depending on the. Taxable amount is blank and it is. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Code j indicates that there was an early distribution from a roth ira.

One of those questions will ask about. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. If any other code, such as 8 or p, applies, use code j. Taxable amount is blank and it is. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Code j indicates that there was an early distribution from a roth ira. The amount may or may not be taxable depending on the. Use code r for a. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Recharacterized ira contribution made for 2017.

Printable 1099 R Form Printable Forms Free Online

One of those questions will ask about. The amount may or may not be taxable depending on the. Use code r for a. Recharacterized ira contribution made for 2017. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira.

Neat What Is Non Standard 1099r A Chronological Report About Tigers

Taxable amount is blank and it is. Use code r for a. The amount may or may not be taxable depending on the. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. If any other code, such as 8 or p, applies,.

1099 Reporting Threshold 2024 Twila Ingeberg

Use code r for a. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Code j indicates that there was an early.

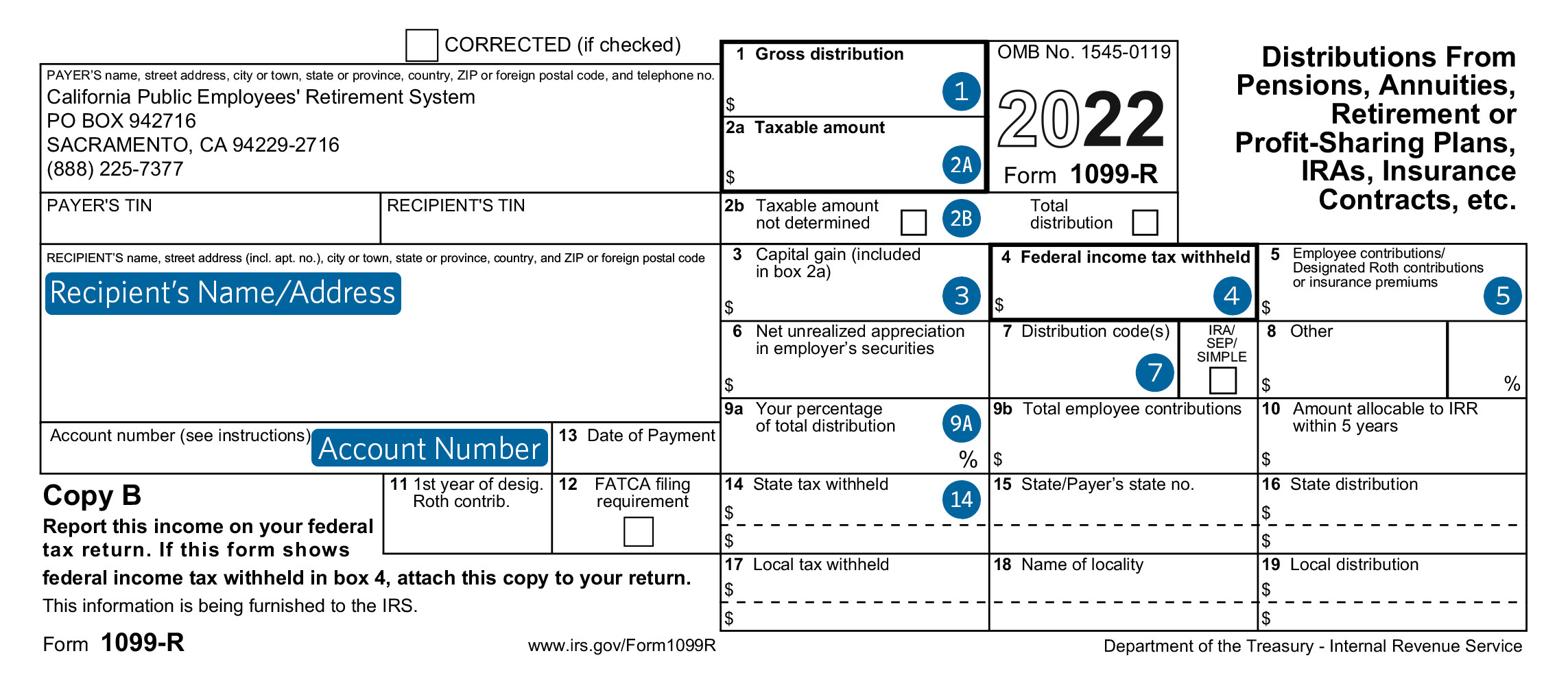

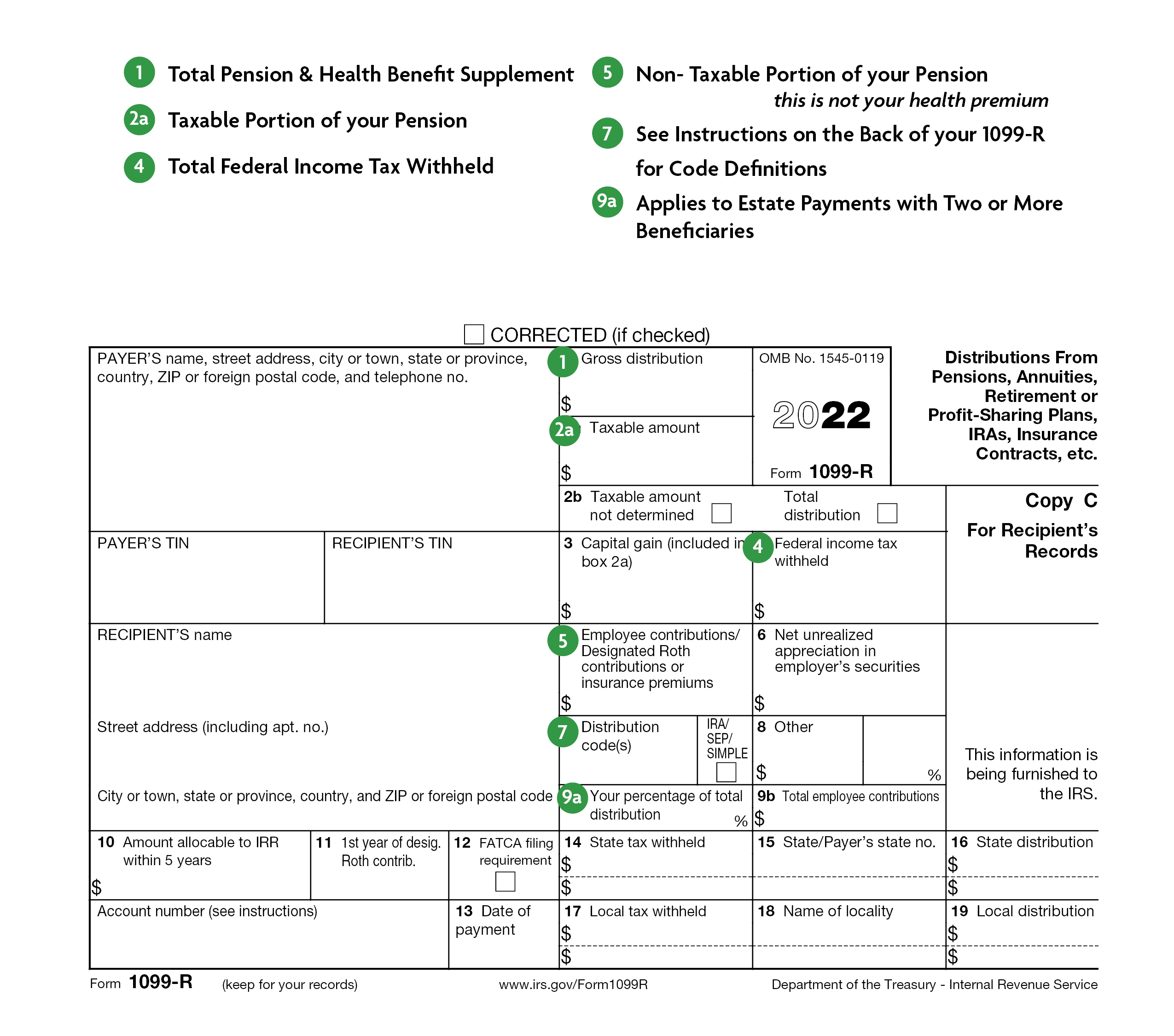

1099 Pension

Use code r for a. The amount may or may not be taxable depending on the. Recharacterized ira contribution made for 2017. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. If a rollover contribution is made to a traditional or roth ira that is.

Selecting the Correct IRS Form 1099R Box 7 Distribution Codes — Ascensus

Recharacterized ira contribution made for 2017. Taxable amount is blank and it is. One of those questions will ask about. Code j indicates that there was an early distribution from a roth ira. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of.

Does a 1099R hurt your taxes?

If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Report military retirement pay awarded as a property settlement to a former spouse.

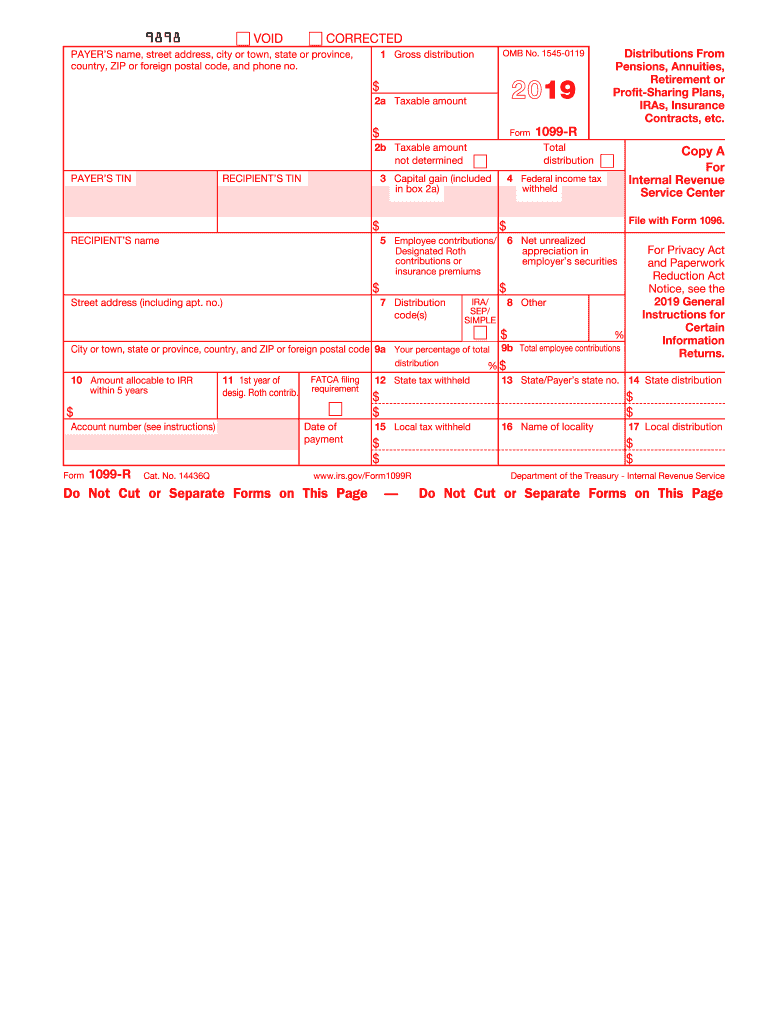

2019 1099 Form Complete with ease airSlate SignNow

Use code r for a. Recharacterized ira contribution made for 2017. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. The amount may or may not be taxable depending on the. If a rollover contribution is made to a traditional or roth ira that is.

1099 r form Fill out & sign online DocHub

If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Taxable amount is blank and it is. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira. Recharacterized ira contribution made for 2017..

2023 Form 1099 R Printable Forms Free Online

If any other code, such as 8 or p, applies, use code j. The amount may or may not be taxable depending on the. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. Code j indicates that there was an early distribution from a roth.

1099 Pension

Use code r for a. Report military retirement pay awarded as a property settlement to a former spouse under the name and tin of the recipient, not that of. If any other code, such as 8 or p, applies, use code j. The amount may or may not be taxable depending on the. Taxable amount is blank and it is.

Report Military Retirement Pay Awarded As A Property Settlement To A Former Spouse Under The Name And Tin Of The Recipient, Not That Of.

If any other code, such as 8 or p, applies, use code j. The amount may or may not be taxable depending on the. Use code r for a. One of those questions will ask about.

Taxable Amount Is Blank And It Is.

Code j indicates that there was an early distribution from a roth ira. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. Recharacterized ira contribution made for 2017. Client has a form 1099r with a code j in box 7 which states early distribution from a roth ira.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)