Foreclosure Tax

Foreclosure Tax - Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property.

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to.

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's.

Foreclosure Defense

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse.

Erie County Tax Foreclosure Auction 2024 Schedule Mona Sylvia

Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a.

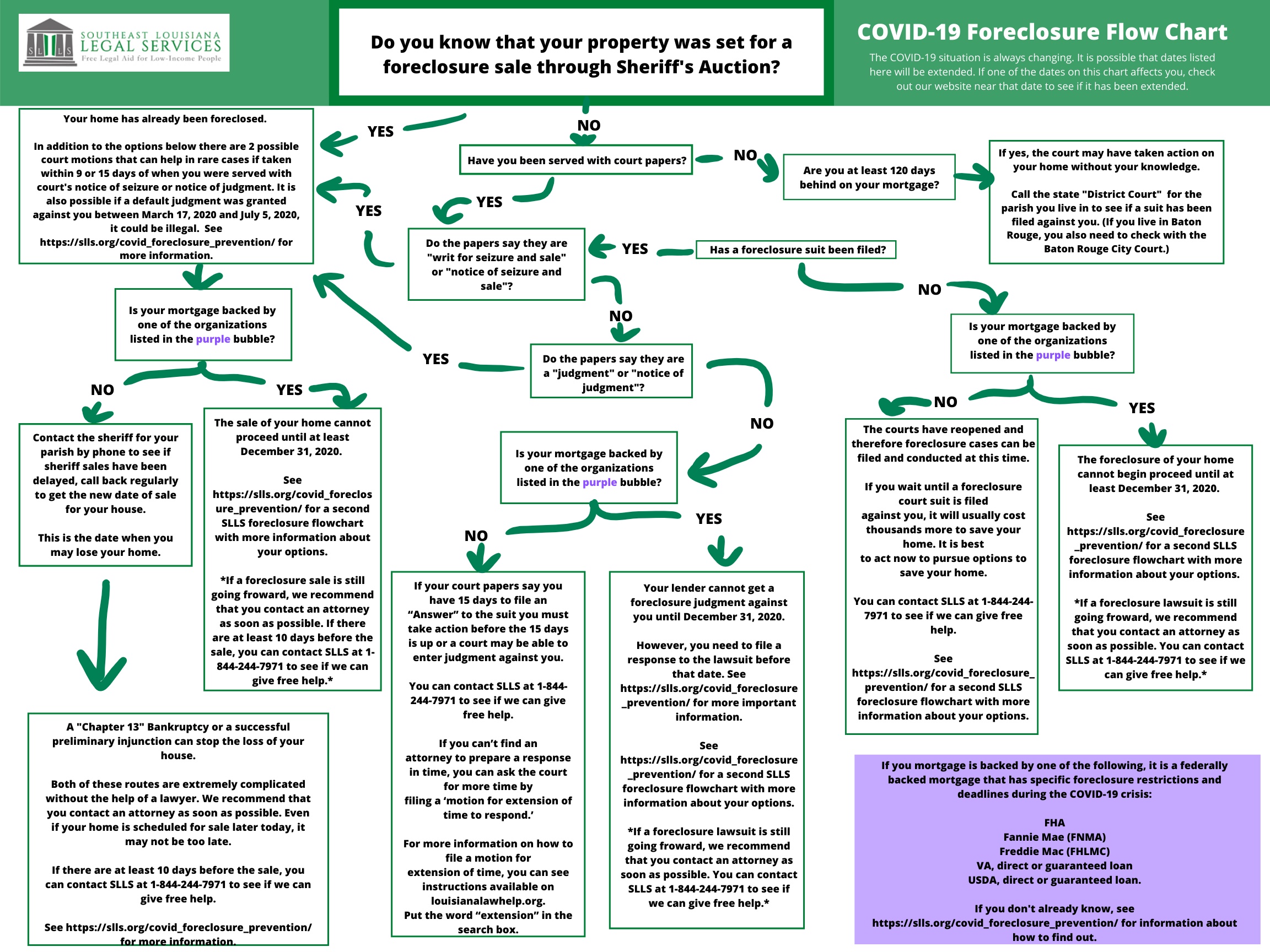

Updated Foreclosure Flow Chart SLLS

Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a.

SampleForeclosureAnswer PDF Foreclosure Complaint

Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or.

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a.

Tax Lien Foreclosure Attorney In Ohio?

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse.

stop property tax foreclosure

Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or.

Illegal Foreclosure Tax Lien Scam by Guy Neighbors

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a.

Investing in a Tax Foreclosure Abernathy Law

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse.

Avoid Tax Foreclosure Jay Buys Detroit Jay Buys Detroit

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a.

But If The Homeowner Doesn't Pay These Taxes, The Delinquent Amount Becomes A Lien On The Property.

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's.