Federal Tax Liens Filed Maricopa County Az

Federal Tax Liens Filed Maricopa County Az - This is done by filing the lien with the secretary of state,. The treasurer’s tax lien auction web site will be. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. Per irm 5.17.2.3.2, federal tax liens relating to arizona real estate are filed in the county where the property is located. Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Please call the county recorder’s office and/or secretary of state for a copy of full release of the state tax lien document payment options or. Cros are enforced by filing a lien against interests in personal property. The tax on the property is auctioned in open competitive bidding. The tax lien sale provides for the payment of delinquent property taxes by a bidder.

The tax lien sale provides for the payment of delinquent property taxes by a bidder. Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. The tax on the property is auctioned in open competitive bidding. Please call the county recorder’s office and/or secretary of state for a copy of full release of the state tax lien document payment options or. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Cros are enforced by filing a lien against interests in personal property. Outstanding liens have not yet been redeemed. This is done by filing the lien with the secretary of state,. Per irm 5.17.2.3.2, federal tax liens relating to arizona real estate are filed in the county where the property is located. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens.

This is done by filing the lien with the secretary of state,. Outstanding liens have not yet been redeemed. Please call the county recorder’s office and/or secretary of state for a copy of full release of the state tax lien document payment options or. The tax on the property is auctioned in open competitive bidding. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Cros are enforced by filing a lien against interests in personal property. Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. The treasurer’s tax lien auction web site will be. Per irm 5.17.2.3.2, federal tax liens relating to arizona real estate are filed in the county where the property is located. The tax lien sale provides for the payment of delinquent property taxes by a bidder.

Maricopa County, Arizona Seal and Emblem Wooden Plaque

This is done by filing the lien with the secretary of state,. Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Please.

Frequently Asked Questions Regarding Tax Liens

Cros are enforced by filing a lien against interests in personal property. Outstanding liens have not yet been redeemed. The treasurer’s tax lien auction web site will be. Per irm 5.17.2.3.2, federal tax liens relating to arizona real estate are filed in the county where the property is located. The tax on the property is auctioned in open competitive bidding.

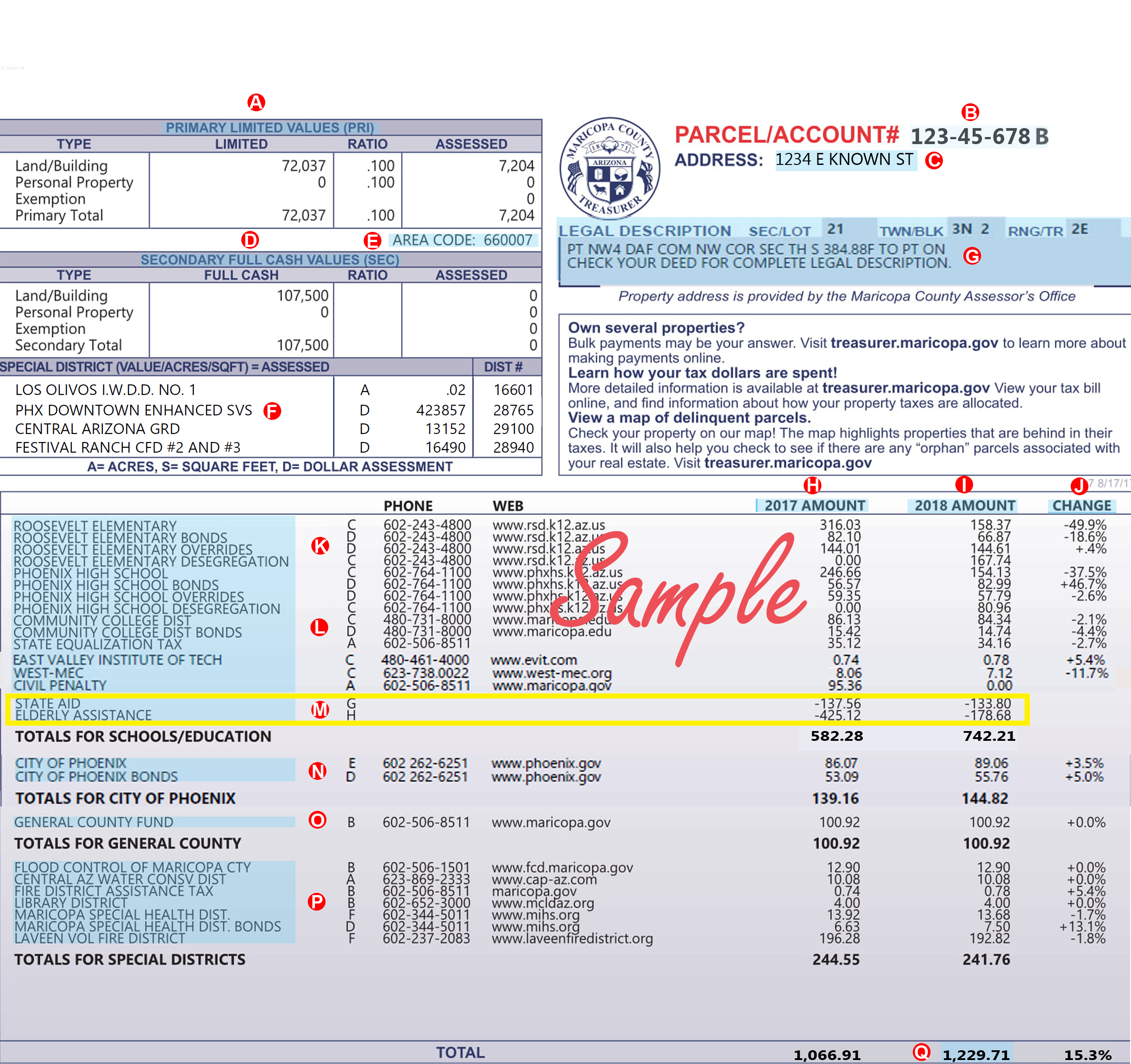

Tax Levy and Rates Maricopa County, AZ

The tax on the property is auctioned in open competitive bidding. The tax lien sale provides for the payment of delinquent property taxes by a bidder. Outstanding liens have not yet been redeemed. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The treasurer’s tax lien auction web.

Maricopa County Tax Lien Sale 2024 Maure Shirlee

Cros are enforced by filing a lien against interests in personal property. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. Per irm 5.17.2.3.2, federal tax liens relating.

Tax Lien Tax Lien Maricopa County

Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. Outstanding liens have not yet been redeemed. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The tax on the property is auctioned in open competitive bidding. Please.

how to buy tax liens in maricopa county I Got Big Webcast Stills Gallery

29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. This is done by filing the lien with the secretary of state,. Please call the county recorder’s office and/or.

how to buy tax liens in maricopa county I Got Big Webcast Stills Gallery

This is done by filing the lien with the secretary of state,. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The treasurer’s tax lien auction web site will be. Per irm 5.17.2.3.2, federal tax liens relating to arizona real estate are filed in the county where the.

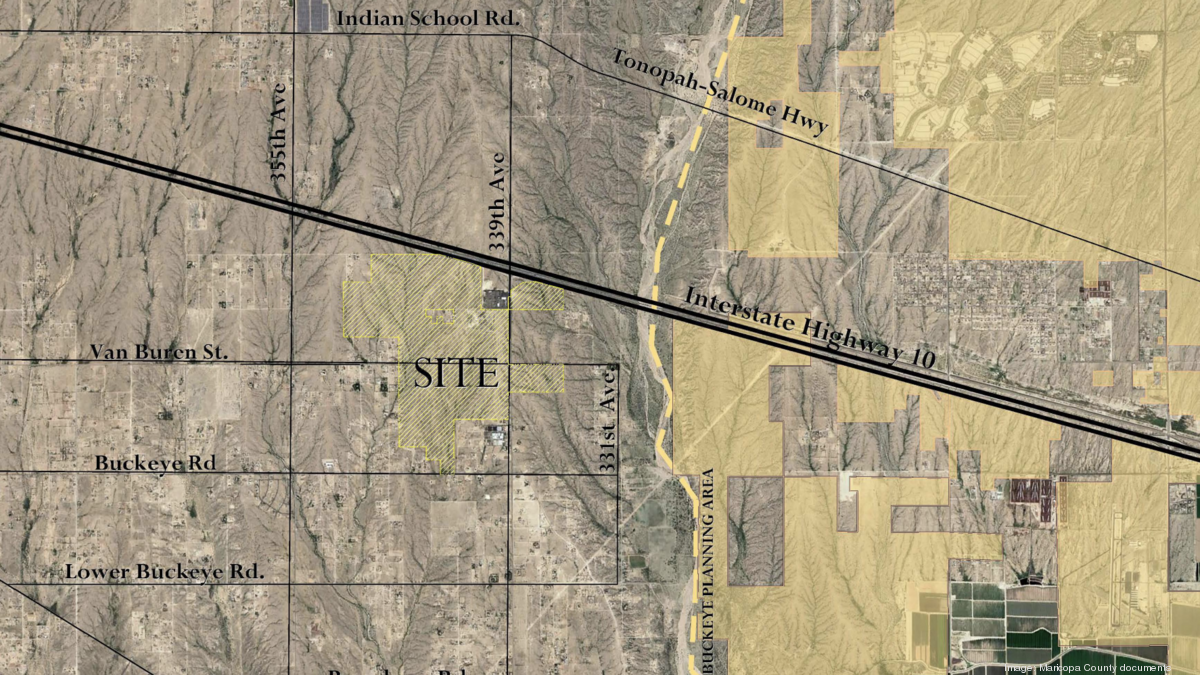

maricopa county tax liens for sale One Measure Blogged Galleria Di

Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. Outstanding liens have not yet been redeemed. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Cros are enforced by filing a.

What Are Federal Tax Liens and What Can You Do About Them? Marcfair

The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Per irm 5.17.2.3.2, federal tax liens relating to arizona real estate are filed in the county where the property is located. The tax lien sale provides for the payment of delinquent property taxes by a bidder. The treasurer’s tax.

Maricopa County, AZ Sheriff Paul Penzone filed an appeal to a federal

This is done by filing the lien with the secretary of state,. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The tax lien sale provides for the payment of delinquent property taxes.

Per Irm 5.17.2.3.2, Federal Tax Liens Relating To Arizona Real Estate Are Filed In The County Where The Property Is Located.

Outstanding liens have not yet been redeemed. This is done by filing the lien with the secretary of state,. Once a payment has posted online, a letter of notice of intent to release state tax lien will be provided within 24 hours to the taxpayer. The tax lien sale provides for the payment of delinquent property taxes by a bidder.

Cros Are Enforced By Filing A Lien Against Interests In Personal Property.

Please call the county recorder’s office and/or secretary of state for a copy of full release of the state tax lien document payment options or. The tax on the property is auctioned in open competitive bidding. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens.