Federal Tax Lien Payoff Request

Federal Tax Lien Payoff Request - According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable. Procedures for a federal tax lien release and request for balance due the amount on the lien is the assessed amount at the time of filing the. Learn how to request a payoff amount and a certificate of release for a federal tax lien from the irs. Find out the difference between a tax lien and.

According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Find out the difference between a tax lien and. Procedures for a federal tax lien release and request for balance due the amount on the lien is the assessed amount at the time of filing the. Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable. Learn how to request a payoff amount and a certificate of release for a federal tax lien from the irs.

Procedures for a federal tax lien release and request for balance due the amount on the lien is the assessed amount at the time of filing the. Find out the difference between a tax lien and. Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable. According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Learn how to request a payoff amount and a certificate of release for a federal tax lien from the irs.

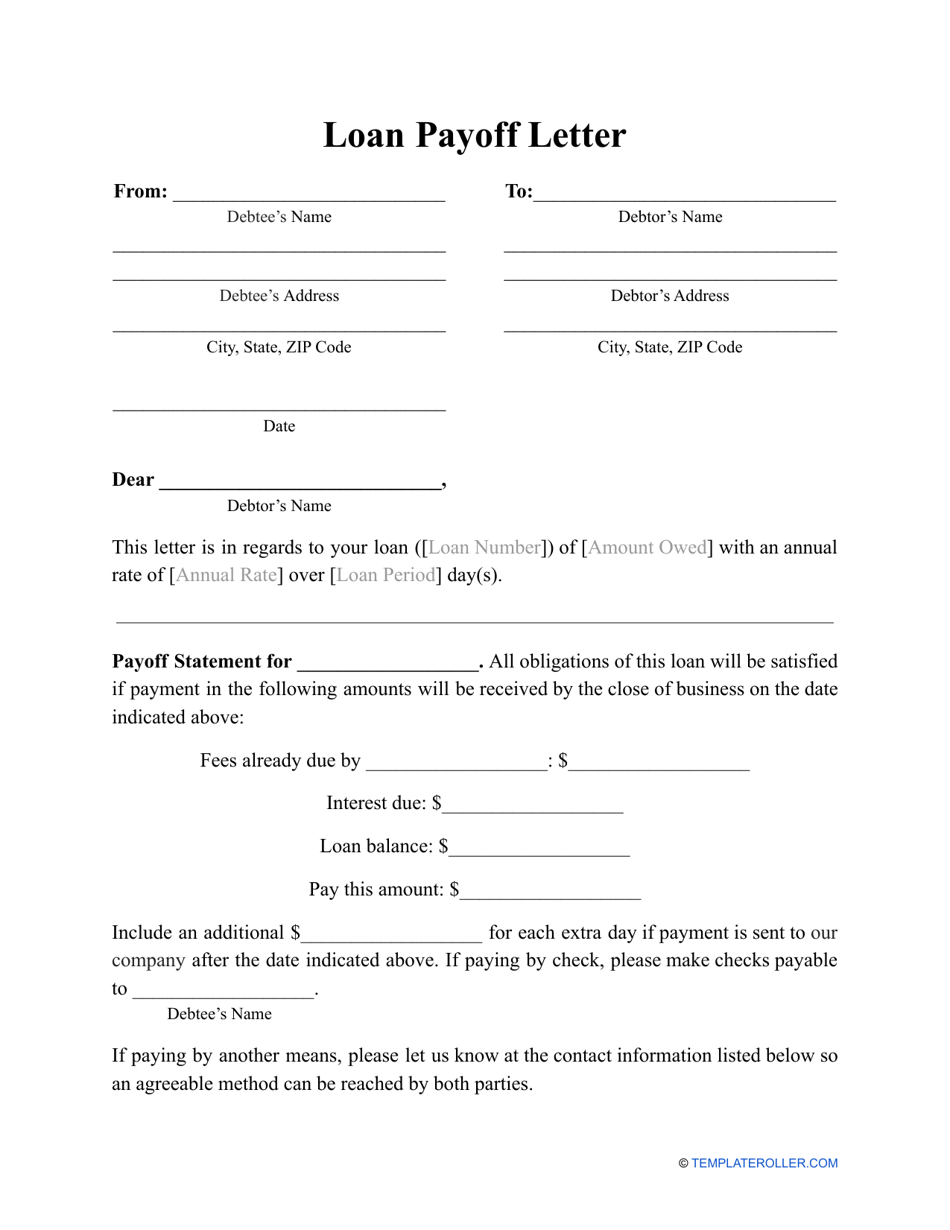

Loan Payoff Letter Template Fill Out, Sign Online and Download PDF

Find out the difference between a tax lien and. Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable. Procedures for a federal tax lien release and request for balance due the amount on the lien is the assessed amount at the time of filing the..

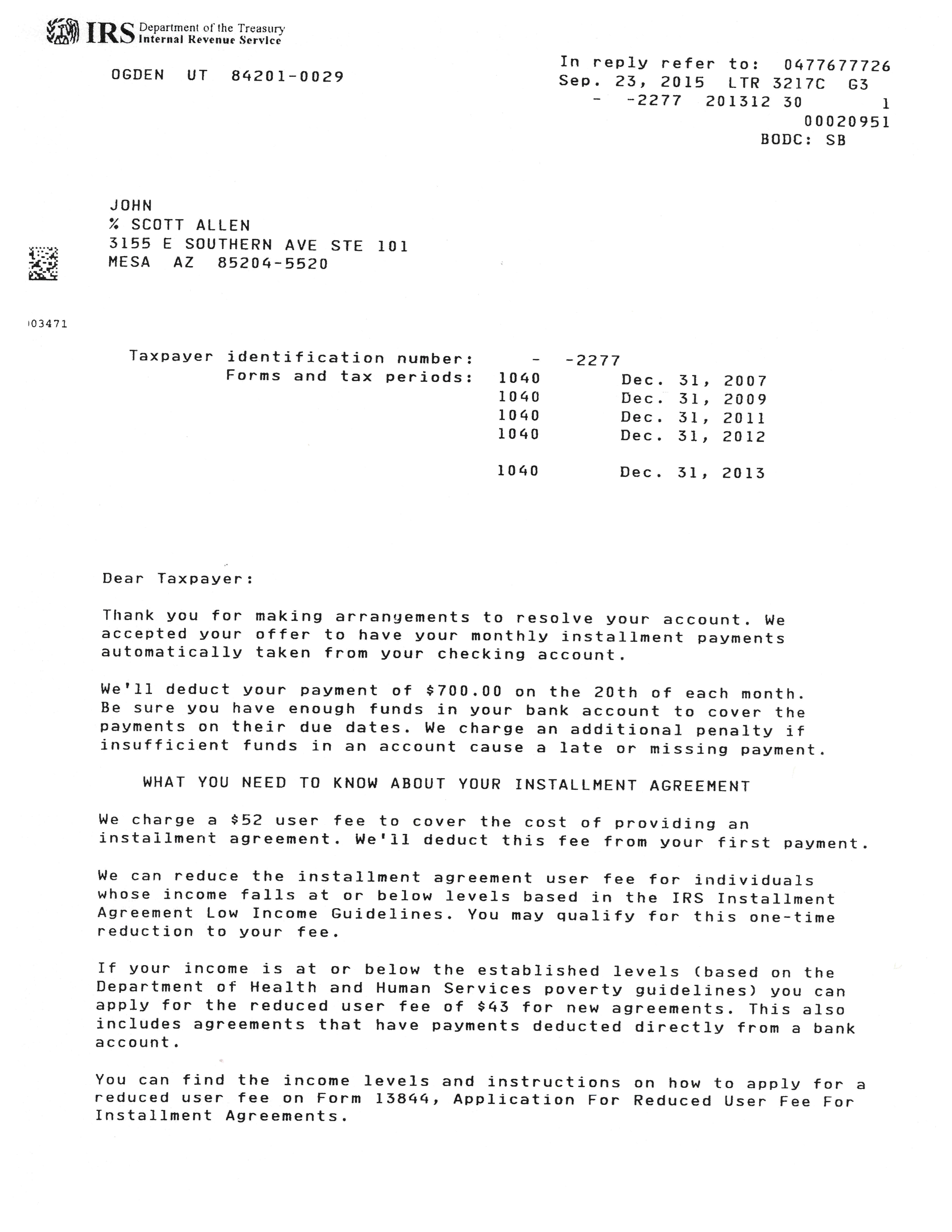

obtain a federal tax lien payoff Wilson Rogers & Company

Learn how to request a payoff amount and a certificate of release for a federal tax lien from the irs. Find out the difference between a tax lien and. According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Learn how to get a certificate of release.

Payoff Request Letter Sample Template with Examples in PDF

Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable. Find out the difference between a tax lien and. Learn how to request a payoff amount and a certificate of release for a federal tax lien from the irs. According to irs notice 1450, you can.

Irs lien payoff request form 8821 Fill out & sign online DocHub

Find out the difference between a tax lien and. Procedures for a federal tax lien release and request for balance due the amount on the lien is the assessed amount at the time of filing the. According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Learn.

Setup Scottsdale AZ IRS payment plan & no tax lien Tax Debt Advisors Inc.

Procedures for a federal tax lien release and request for balance due the amount on the lien is the assessed amount at the time of filing the. Learn how to request a payoff amount and a certificate of release for a federal tax lien from the irs. Find out the difference between a tax lien and. According to irs notice.

Certificate Of Release Of Federal Tax Lien Get What You Need For Free

Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable. Learn how to request a payoff amount and a certificate of release for a federal tax lien from the irs. Procedures for a federal tax lien release and request for balance due the amount on the.

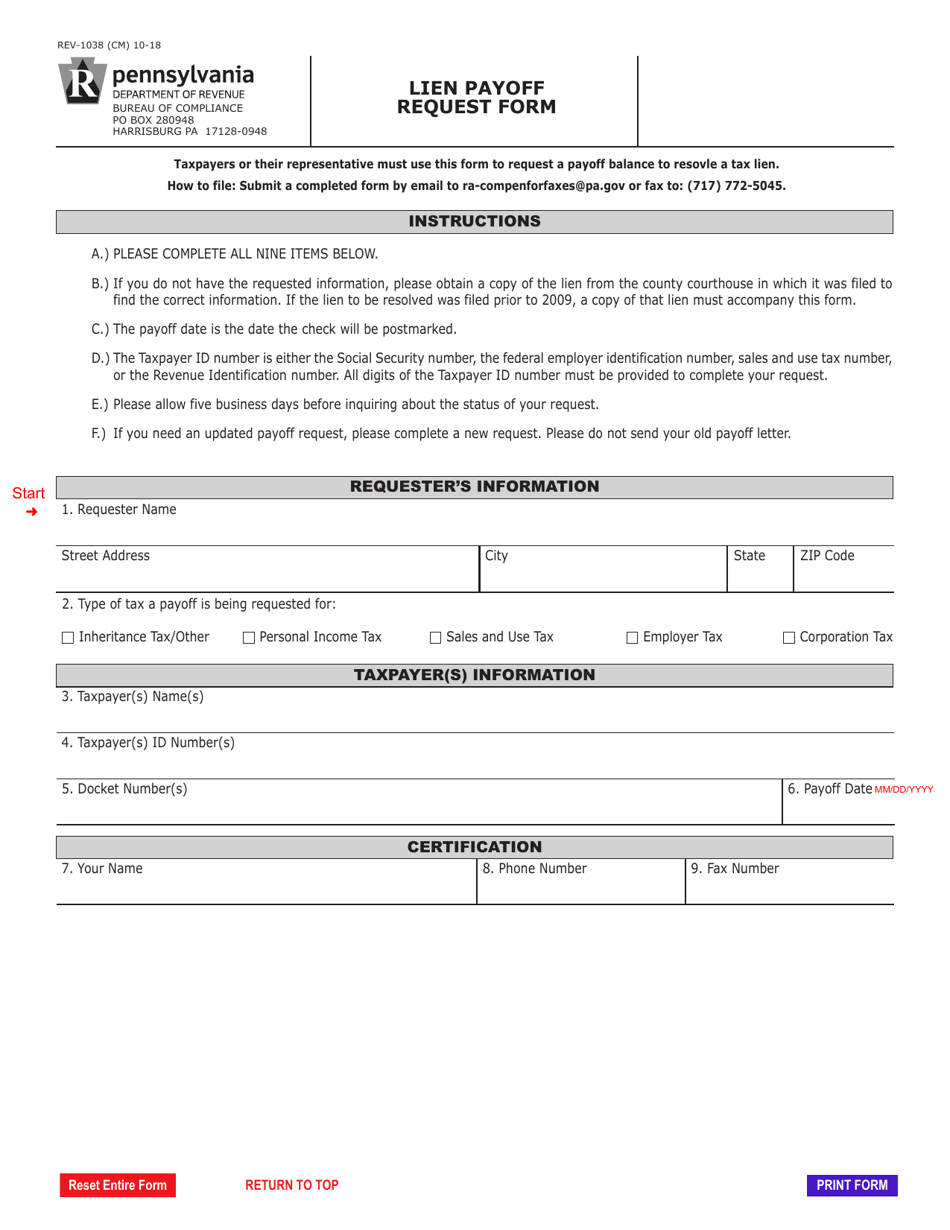

Form REV1038 Fill Out, Sign Online and Download Fillable PDF

Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable. Find out the difference between a tax lien and. According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Learn how to request.

Request for Louisiana Tax Assessment and Lien Payoff PDF

According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable. Find out the difference between a tax lien and. Learn how to request.

Tax Lien Indiana State Tax Lien

According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Learn how to request a payoff amount and a certificate of release for a federal tax lien from the irs. Learn how to get a certificate of release of federal tax lien when you have satisfied your.

Tax Lien Irs Lien On House House Information Center

According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Procedures for a federal tax lien release and request for balance due the amount on the lien is the assessed amount at the time of filing the. Learn how to get a certificate of release of federal.

Learn How To Request A Payoff Amount And A Certificate Of Release For A Federal Tax Lien From The Irs.

According to irs notice 1450, you can request your federal tax lien payoff amount by contacting the irs office where your account is. Procedures for a federal tax lien release and request for balance due the amount on the lien is the assessed amount at the time of filing the. Find out the difference between a tax lien and. Learn how to get a certificate of release of federal tax lien when you have satisfied your tax liability or it is legally unenforceable.