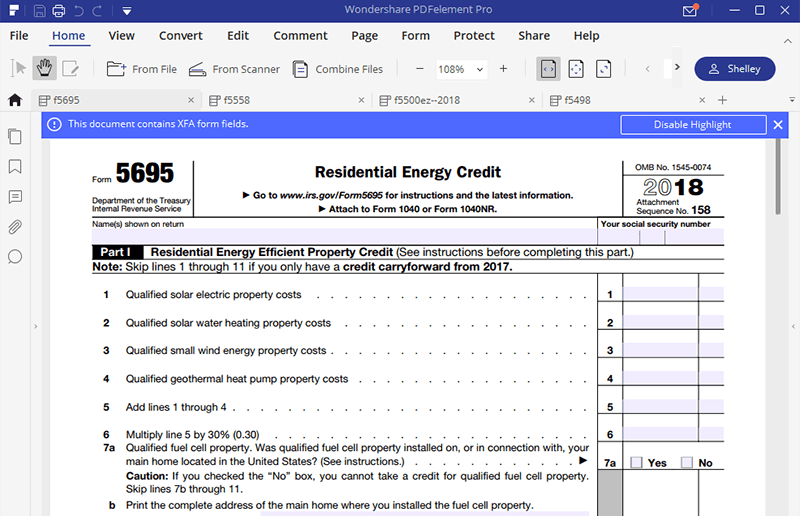

Federal Tax Form 5695

Federal Tax Form 5695 - Irs form 5695 is used to claim residential energy tax credits on your federal tax return. This form helps taxpayers who have made eligible energy improvements to their homes. The residential energy credits are: The energy efficient home improvement credit. Use form 5695 to figure and take your residential energy credits. Information about form 5695, residential energy credits, including. See your tax return instructions. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. It is part of the federal income tax return used by homeowners to capture the. Also use form 5695 to take any residential.

The residential energy credits are: Irs form 5695 is used to claim residential energy tax credits on your federal tax return. Also use form 5695 to take any residential. See your tax return instructions. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. This form helps taxpayers who have made eligible energy improvements to their homes. Information about form 5695, residential energy credits, including. Use form 5695 to figure and take your residential energy credits. It is part of the federal income tax return used by homeowners to capture the. The energy efficient home improvement credit.

The energy efficient home improvement credit. Use form 5695 to figure and take your residential energy credits. See your tax return instructions. This form helps taxpayers who have made eligible energy improvements to their homes. The residential energy credits are: Information about form 5695, residential energy credits, including. Irs form 5695 is used to claim residential energy tax credits on your federal tax return. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. Also use form 5695 to take any residential. It is part of the federal income tax return used by homeowners to capture the.

Form 5695 Fill and Sign Printable Template Online US Legal Forms

This form helps taxpayers who have made eligible energy improvements to their homes. Irs form 5695 is used to claim residential energy tax credits on your federal tax return. It is part of the federal income tax return used by homeowners to capture the. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

Irs form 5695 is used to claim residential energy tax credits on your federal tax return. See your tax return instructions. It is part of the federal income tax return used by homeowners to capture the. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. The energy efficient home improvement credit.

Understanding Form 5695 (Getting the Most From Metal Roofing Federal

See your tax return instructions. Information about form 5695, residential energy credits, including. This form helps taxpayers who have made eligible energy improvements to their homes. The residential energy credits are: The energy efficient home improvement credit.

Claim a Tax Credit for Solar Improvements to Your House IRS Form 5695

Also use form 5695 to take any residential. Use form 5695 to figure and take your residential energy credits. See your tax return instructions. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. The energy efficient home improvement credit.

for How to IRS Form 5695

This form helps taxpayers who have made eligible energy improvements to their homes. It is part of the federal income tax return used by homeowners to capture the. Also use form 5695 to take any residential. Information about form 5695, residential energy credits, including. Use form 5695 to figure and take your residential energy credits.

Federal Solar Tax Credit » Certasun

The residential energy credits are: Use form 5695 to figure and take your residential energy credits. Information about form 5695, residential energy credits, including. See your tax return instructions. The energy efficient home improvement credit.

How to Fill Out Form 5695 for Metal Roofing Federal Tax Credit (All

The energy efficient home improvement credit. Use form 5695 to figure and take your residential energy credits. Also use form 5695 to take any residential. This form helps taxpayers who have made eligible energy improvements to their homes. Irs form 5695 is used to claim residential energy tax credits on your federal tax return.

Form 5695 2021 2022 IRS Forms TaxUni

Use form 5695 to figure and take your residential energy credits. See your tax return instructions. It is part of the federal income tax return used by homeowners to capture the. The residential energy credits are: Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

IRS Form 5695 Instructions Residential Energy Credits

It is part of the federal income tax return used by homeowners to capture the. The energy efficient home improvement credit. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. The residential energy credits are: Irs form 5695 is used to claim residential energy tax credits on your federal tax return.

IRS Form 5695 Instructions Residential Energy Credits

The residential energy credits are: Irs form 5695 is used to claim residential energy tax credits on your federal tax return. The energy efficient home improvement credit. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. This form helps taxpayers who have made eligible energy improvements to their homes.

Information About Form 5695, Residential Energy Credits, Including.

Also use form 5695 to take any residential. The energy efficient home improvement credit. This form helps taxpayers who have made eligible energy improvements to their homes. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The Residential Energy Credits Are:

See your tax return instructions. Irs form 5695 is used to claim residential energy tax credits on your federal tax return. It is part of the federal income tax return used by homeowners to capture the. Use form 5695 to figure and take your residential energy credits.