Dublin City Tax Forms

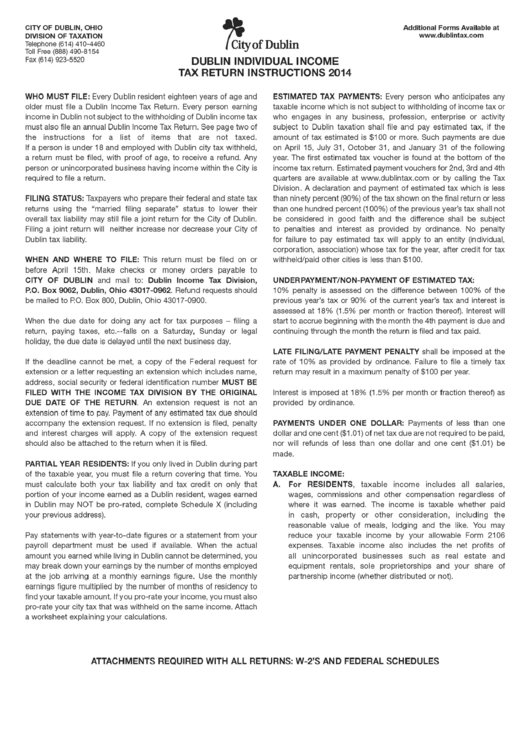

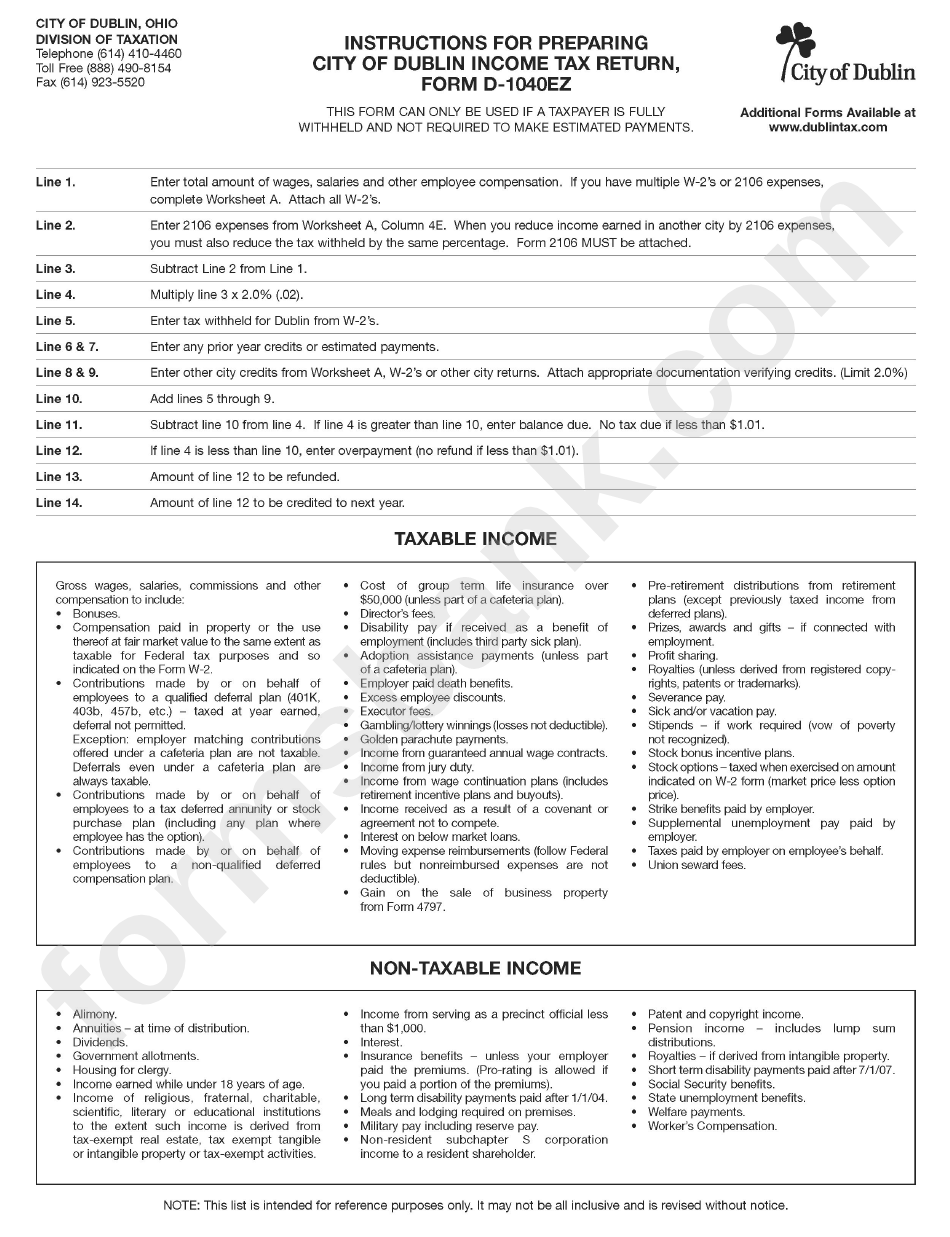

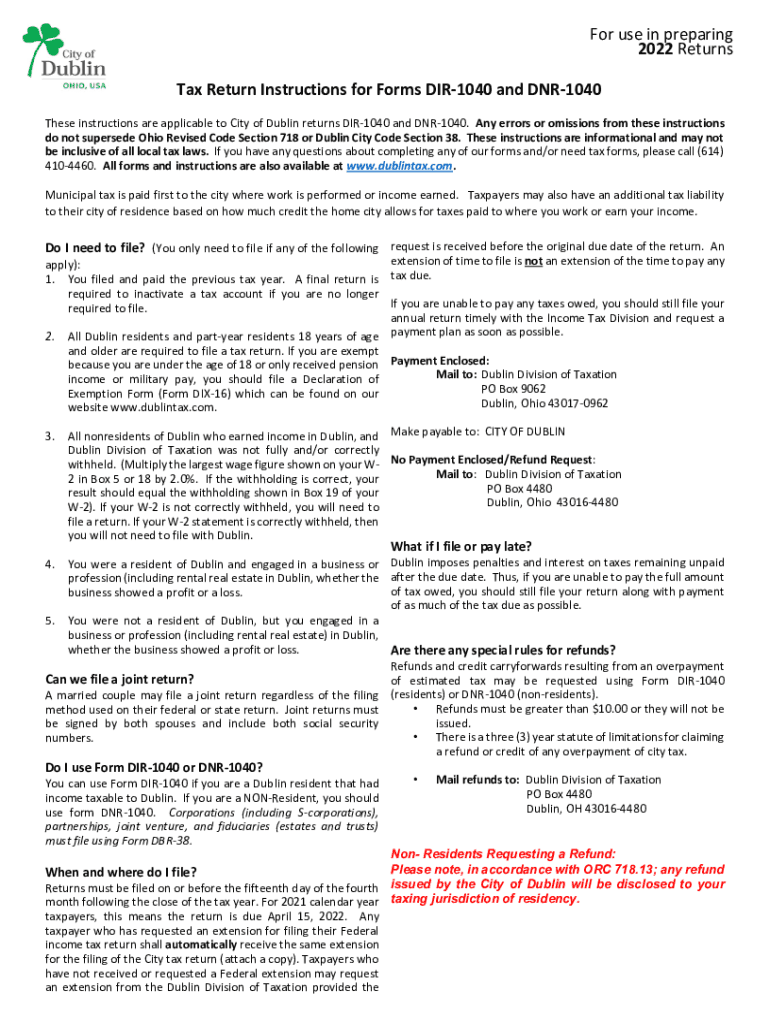

Dublin City Tax Forms - Income tax payments and estimates 1. You’ll need your social security number, street address and birth date or phone. The city of dublin provides individual tax forms and instructions online. The local income tax rate is 2 percent and applies to gross. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the division of taxation at 614.410.4460. You need your city account number and pin to. All residents over 18 years of age must file a tax return each year with the city of dublin.

You need your city account number and pin to. You’ll need your social security number, street address and birth date or phone. All residents over 18 years of age must file a tax return each year with the city of dublin. Income tax payments and estimates 1. The city of dublin provides individual tax forms and instructions online. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the division of taxation at 614.410.4460. The local income tax rate is 2 percent and applies to gross.

You’ll need your social security number, street address and birth date or phone. All residents over 18 years of age must file a tax return each year with the city of dublin. You need your city account number and pin to. The local income tax rate is 2 percent and applies to gross. The city of dublin provides individual tax forms and instructions online. Income tax payments and estimates 1. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the division of taxation at 614.410.4460.

Fillable Online Individual Tax Forms City of Dublin, Ohio, USA Fax

The local income tax rate is 2 percent and applies to gross. All residents over 18 years of age must file a tax return each year with the city of dublin. You need your city account number and pin to. The city of dublin provides individual tax forms and instructions online. Forms and instructions are available on our web site.

One continuous line drawing of Dublin city skyline, Republic of Ireland

You need your city account number and pin to. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the division of taxation at 614.410.4460. Income tax payments and estimates 1. All residents over 18 years of age must file a tax return each year with the city of dublin. The local income tax rate is.

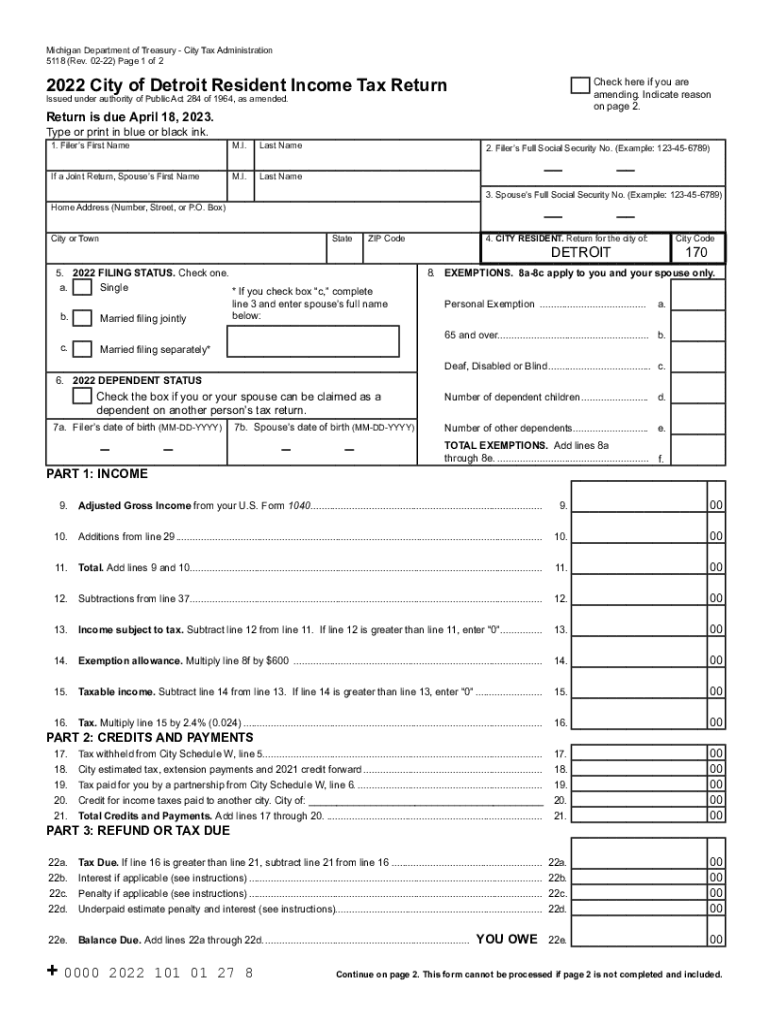

5118 Detroit 20222024 Form Fill Out and Sign Printable PDF Template

You’ll need your social security number, street address and birth date or phone. Income tax payments and estimates 1. The city of dublin provides individual tax forms and instructions online. The local income tax rate is 2 percent and applies to gross. All residents over 18 years of age must file a tax return each year with the city of.

Dublin City Hall Loses Power; Offices Closed Tuesday Dublin, CA Patch

You need your city account number and pin to. Income tax payments and estimates 1. All residents over 18 years of age must file a tax return each year with the city of dublin. The city of dublin provides individual tax forms and instructions online. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the.

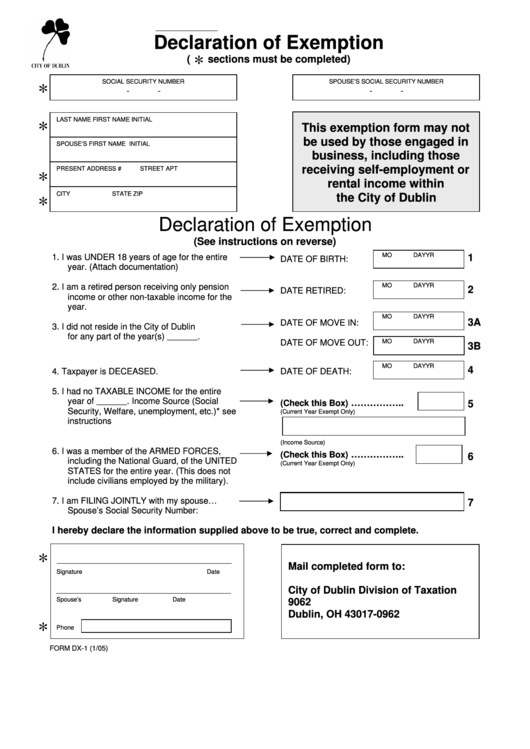

Fillable Form Dx1 Declaration Of Exemption City Of Dublin Division

The city of dublin provides individual tax forms and instructions online. All residents over 18 years of age must file a tax return each year with the city of dublin. Income tax payments and estimates 1. The local income tax rate is 2 percent and applies to gross. You need your city account number and pin to.

Finance Dublin Irish Tax Monitor BDO

The city of dublin provides individual tax forms and instructions online. The local income tax rate is 2 percent and applies to gross. You need your city account number and pin to. All residents over 18 years of age must file a tax return each year with the city of dublin. Forms and instructions are available on our web site.

Instructions For Dublin Individual Tax Return 2014 printable pdf

The city of dublin provides individual tax forms and instructions online. You’ll need your social security number, street address and birth date or phone. You need your city account number and pin to. Income tax payments and estimates 1. All residents over 18 years of age must file a tax return each year with the city of dublin.

Single continuous line drawing of Dublin city skyline, Republic of

Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the division of taxation at 614.410.4460. The local income tax rate is 2 percent and applies to gross. You need your city account number and pin to. You’ll need your social security number, street address and birth date or phone. The city of dublin provides individual.

City Hall Dublin's Majestic Landmark captured in stunning sunshine

Income tax payments and estimates 1. You need your city account number and pin to. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the division of taxation at 614.410.4460. The local income tax rate is 2 percent and applies to gross. All residents over 18 years of age must file a tax return each.

Instructions For Preparing City Of Dublin Tax Return, Form D

The local income tax rate is 2 percent and applies to gross. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the division of taxation at 614.410.4460. You’ll need your social security number, street address and birth date or phone. All residents over 18 years of age must file a tax return each year with.

The City Of Dublin Provides Individual Tax Forms And Instructions Online.

All residents over 18 years of age must file a tax return each year with the city of dublin. You’ll need your social security number, street address and birth date or phone. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the division of taxation at 614.410.4460. You need your city account number and pin to.

Income Tax Payments And Estimates 1.

The local income tax rate is 2 percent and applies to gross.

/irish-tax-monitor-afleming.jpg.aspx?lang=en-GB&width=1920&height=1003&ext=.jpg)