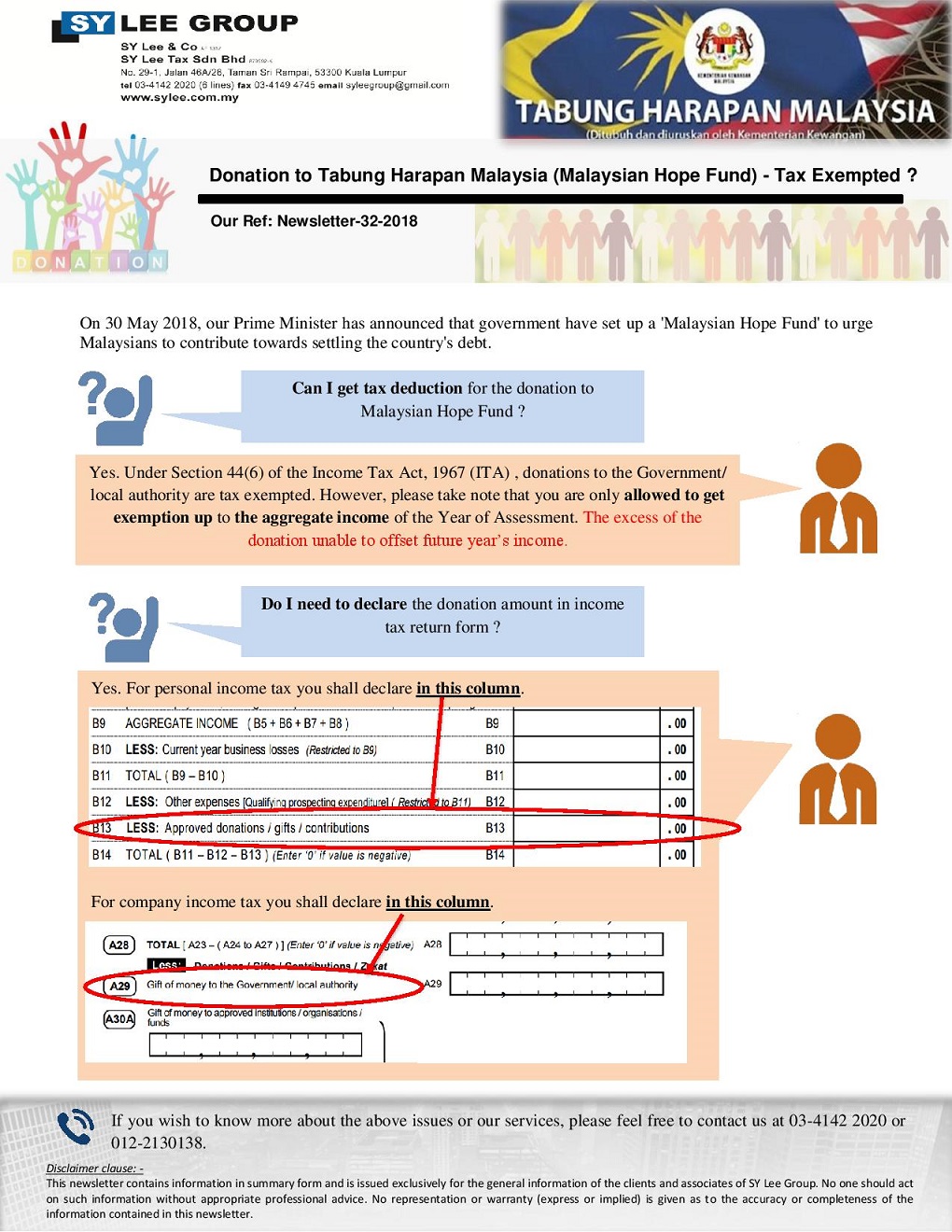

Donation Tax Exemption Malaysia

Donation Tax Exemption Malaysia - This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax.

When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the.

This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the.

Donation Exemption Under Tax Online Chartered

Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. In order for.

This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for.

Tax Deduction Malaysia 2019 Lhdn Irb Personal Tax Relief 2020

In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for.

tax exemption malaysia 2018 Matt North

When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for.

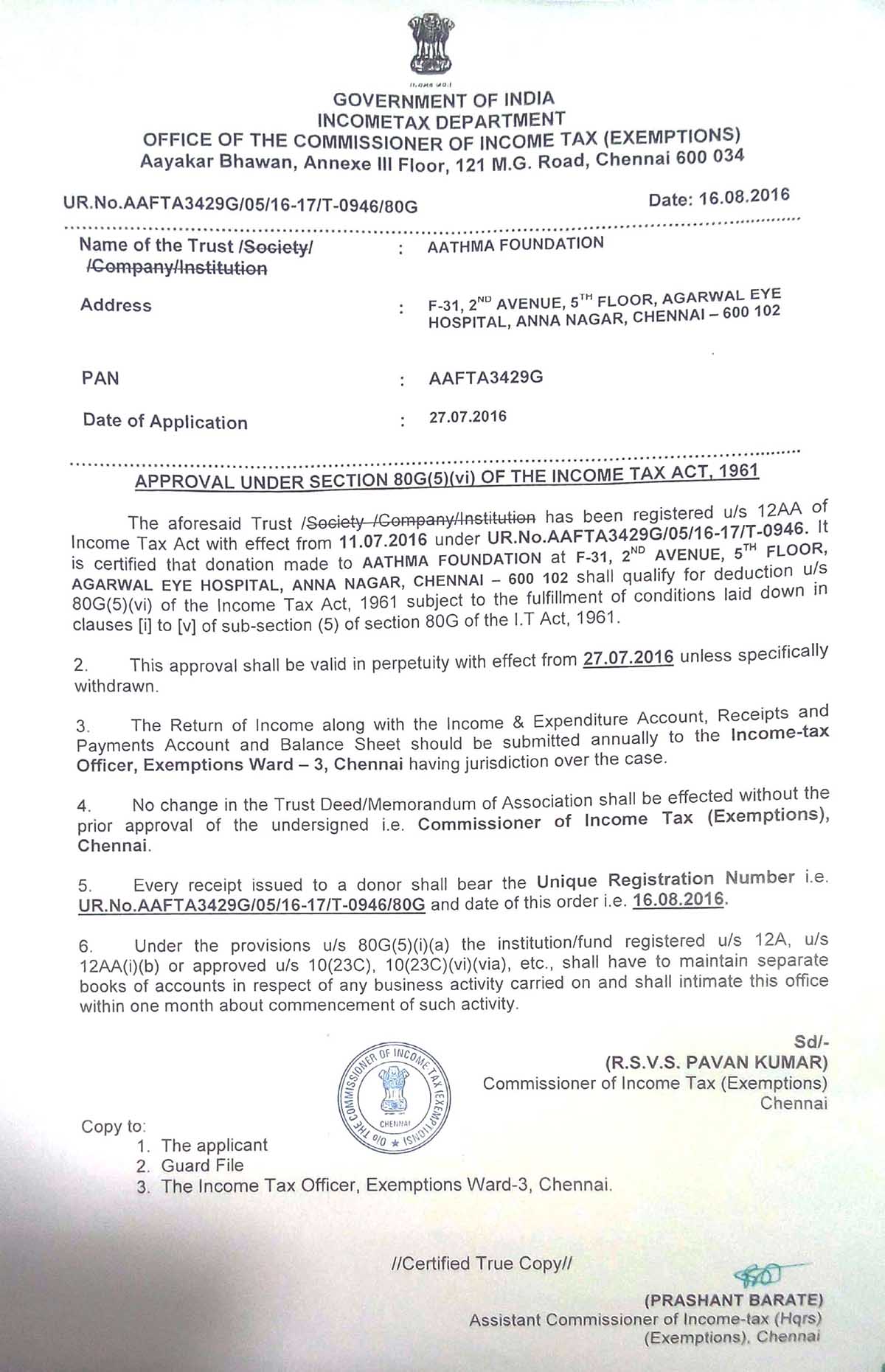

Tax Exemption Certificate Aathma Foundation

When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. In order for.

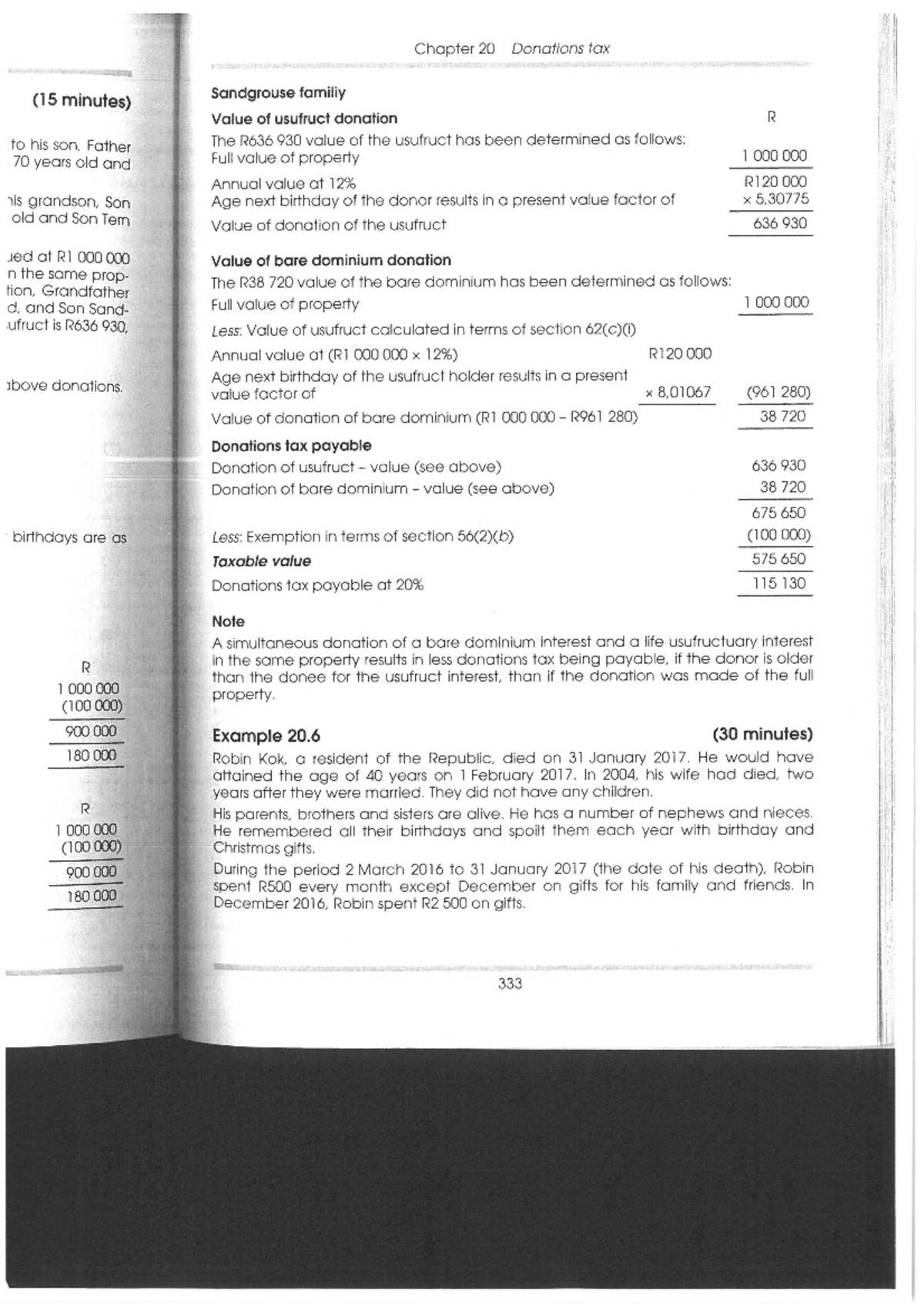

Donations tax Q A Donation Tax TAX327 Studocu

Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts.

donation exemption for tax malaysia Amy Dyer

This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for.

Vehicle Donation Receipt Template

When donated or given to avenues approved by the lembaga hasil dalam negeri (lhdn), these contributions can qualify for tax. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by.

Tax Donation Receipt Template

In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts.

Lhdn Approved Donation List Corporate Tax Malaysia 2020 For Smes

In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts.

When Donated Or Given To Avenues Approved By The Lembaga Hasil Dalam Negeri (Lhdn), These Contributions Can Qualify For Tax.

Gift of money or cost of contribution in kind for any approved project of national interest approved by ministry of finance. In order for your donation to be eligible for a tax deduction, the organisation you donate to must be officially recognised or “approved” by the. This note aims to provide an explanation regarding the procedure for issuing donation/contribution receipts by institutions/organizations/funds.