Do Tax Liens Expire

Do Tax Liens Expire - The irs tax lien expires when your tax debt is no longer collectible. If the irs timely refiles the tax lien, it is. When does a federal tax lien expire? An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. If a tax is not paid after a formal demand, the lien automatically. Generally speaking, state and local tax liens arise either at the time notice and demand is issued (similar to federal tax liens), or after administrative appeal procedures to. A federal tax lien expires with your tax debt after 10 years. The collection efforts the irs pursues can only be in place for as long as your.

Generally speaking, state and local tax liens arise either at the time notice and demand is issued (similar to federal tax liens), or after administrative appeal procedures to. The collection efforts the irs pursues can only be in place for as long as your. If a tax is not paid after a formal demand, the lien automatically. When does a federal tax lien expire? If the irs timely refiles the tax lien, it is. A federal tax lien expires with your tax debt after 10 years. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. The irs tax lien expires when your tax debt is no longer collectible. An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt.

An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. If a tax is not paid after a formal demand, the lien automatically. When does a federal tax lien expire? Generally speaking, state and local tax liens arise either at the time notice and demand is issued (similar to federal tax liens), or after administrative appeal procedures to. The irs tax lien expires when your tax debt is no longer collectible. A federal tax lien expires with your tax debt after 10 years. The collection efforts the irs pursues can only be in place for as long as your. If the irs timely refiles the tax lien, it is. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period.

Tax Liens and Deeds Live Class Pips Path

If the irs timely refiles the tax lien, it is. If a tax is not paid after a formal demand, the lien automatically. An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Generally speaking, state and local tax liens arise either at the time notice and demand.

Tax Liens An Overview CheckBook IRA LLC

The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. If a tax is not paid after a formal demand, the lien automatically. The irs tax lien expires when your tax debt is no longer collectible. When does a federal tax lien expire? An irs tax lien.

Tax Liens What You Need to Know Cumberland Law Group

The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. A federal tax lien expires with your tax debt after 10 years. An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. If a tax.

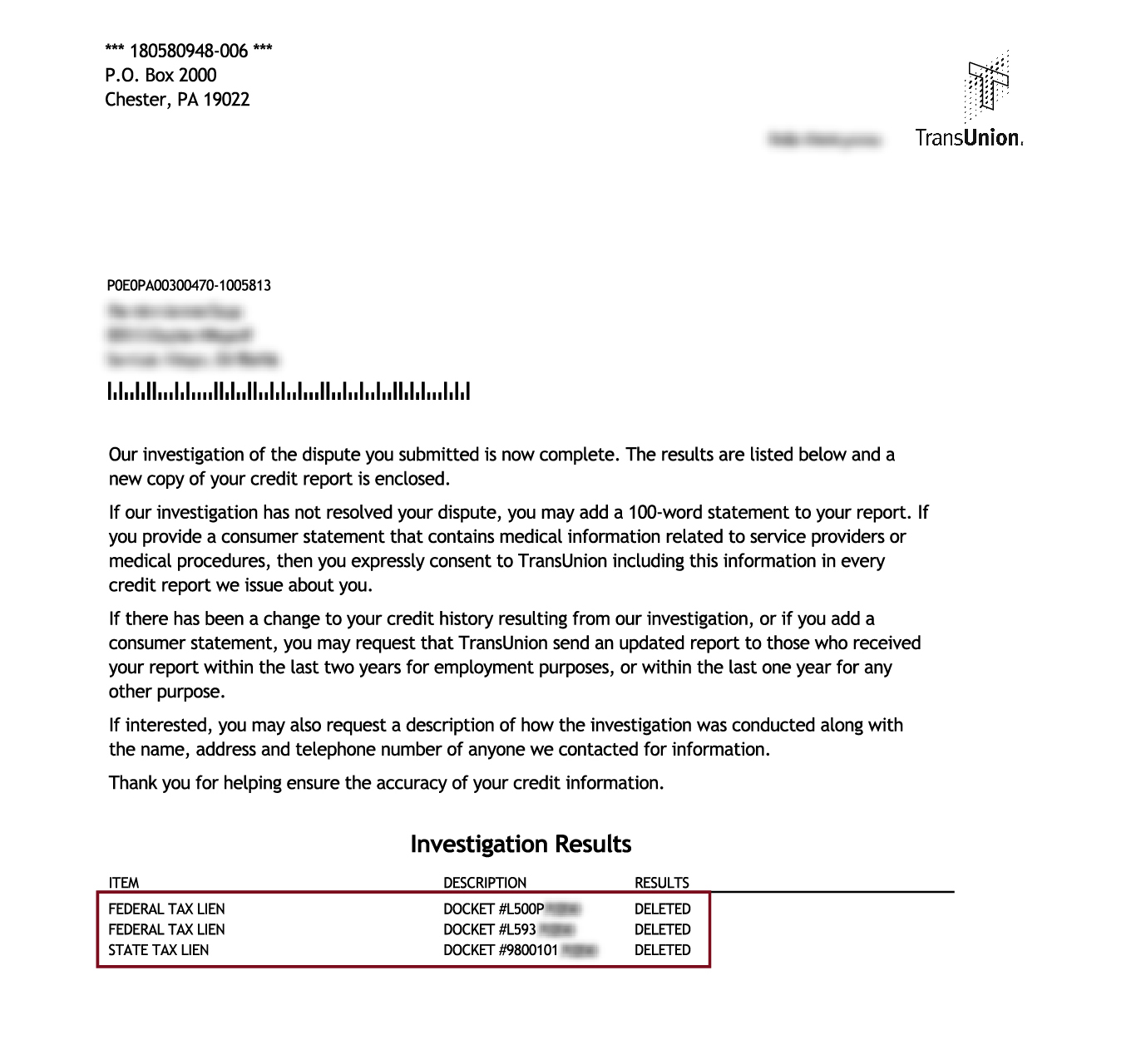

How to Remove an IRS Tax Lien from Your Credit Report

An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. Generally speaking, state and local tax liens arise either at the time notice and demand is issued (similar to federal tax liens), or after administrative appeal procedures to. When does a federal tax lien expire? The general rule.

Freaking Out About a Tax Lien? The Expert Can Help!

When does a federal tax lien expire? If the irs timely refiles the tax lien, it is. A federal tax lien expires with your tax debt after 10 years. If a tax is not paid after a formal demand, the lien automatically. An irs tax lien is the government’s legal claim against your property when you neglect or fail to.

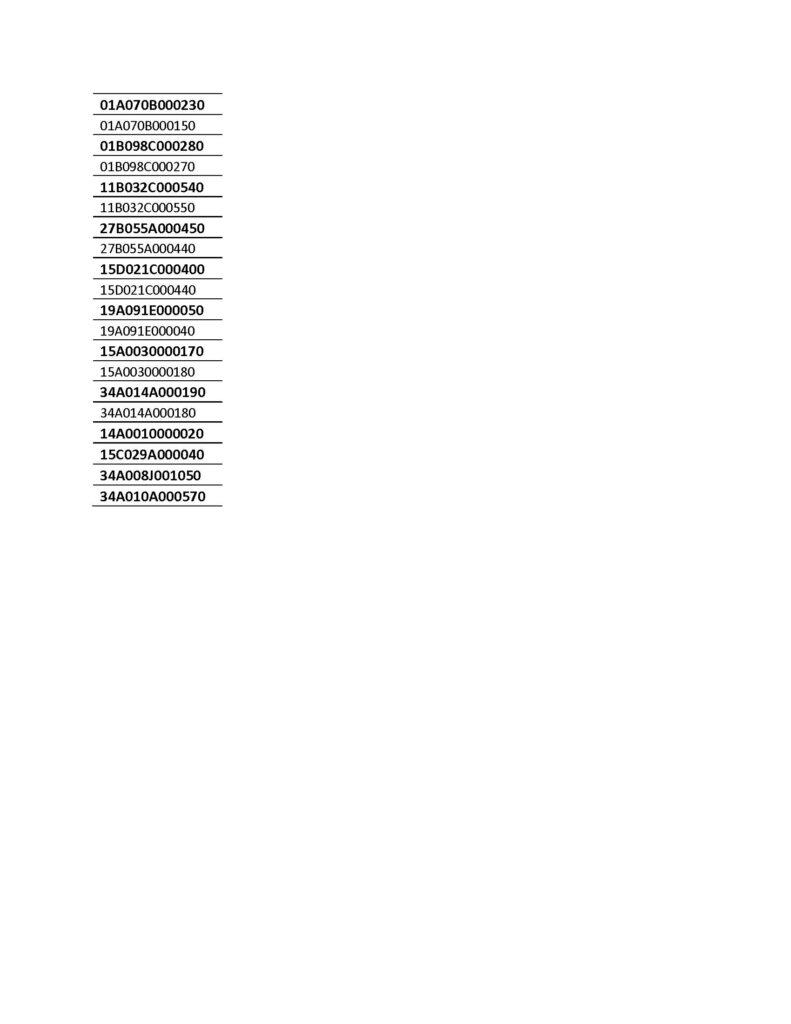

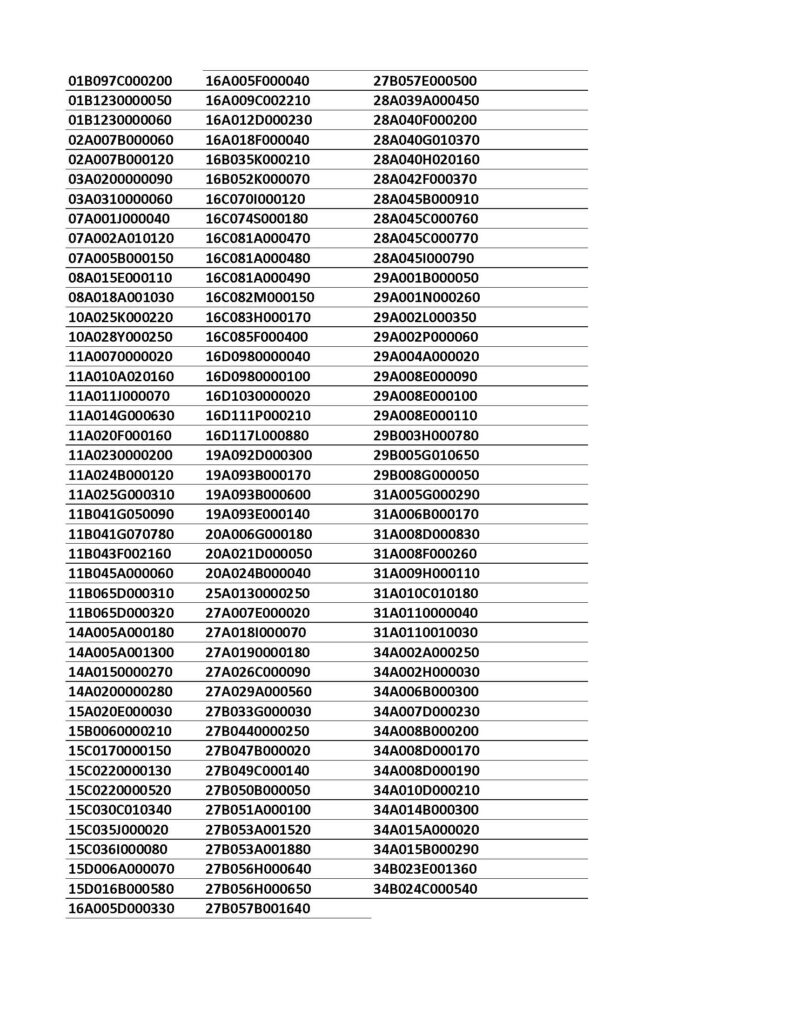

TAX LIENS PENDING CERTIFICATE FILING Treasurer

When does a federal tax lien expire? An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. The collection efforts the irs pursues can only be in place for as long as your. The irs tax lien expires when your tax debt is no longer collectible. Generally speaking,.

Freaking Out About a Tax Lien? The Expert Can Help!

If the irs timely refiles the tax lien, it is. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. Generally speaking, state and local tax liens arise either at the time notice and demand is issued (similar to federal tax liens), or after administrative appeal procedures.

Do Tax Liens Expire? Levy & Associates

Generally speaking, state and local tax liens arise either at the time notice and demand is issued (similar to federal tax liens), or after administrative appeal procedures to. An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. If the irs timely refiles the tax lien, it is..

What Is A Tax Lien? Atlanta Tax Lawyer Alyssa Maloof Whatley

A federal tax lien expires with your tax debt after 10 years. If a tax is not paid after a formal demand, the lien automatically. When does a federal tax lien expire? The irs tax lien expires when your tax debt is no longer collectible. Generally speaking, state and local tax liens arise either at the time notice and demand.

TAX LIENS PENDING CERTIFICATE FILING Treasurer

If a tax is not paid after a formal demand, the lien automatically. The collection efforts the irs pursues can only be in place for as long as your. Generally speaking, state and local tax liens arise either at the time notice and demand is issued (similar to federal tax liens), or after administrative appeal procedures to. An irs tax.

The General Rule Is That The Irs Has Ten Years To Collect Delinquent Taxes, But A Number Of Events Can Extend This Period.

Generally speaking, state and local tax liens arise either at the time notice and demand is issued (similar to federal tax liens), or after administrative appeal procedures to. If the irs timely refiles the tax lien, it is. If a tax is not paid after a formal demand, the lien automatically. The irs tax lien expires when your tax debt is no longer collectible.

A Federal Tax Lien Expires With Your Tax Debt After 10 Years.

The collection efforts the irs pursues can only be in place for as long as your. When does a federal tax lien expire? An irs tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt.