Discharge Of Indebtedness Income

Discharge Of Indebtedness Income - A discharge of debt income occurs when a debt is forgiven by the person who lend the money. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. However, there are some instances. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts.

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. However, there are some instances. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the.

To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. However, there are some instances. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts.

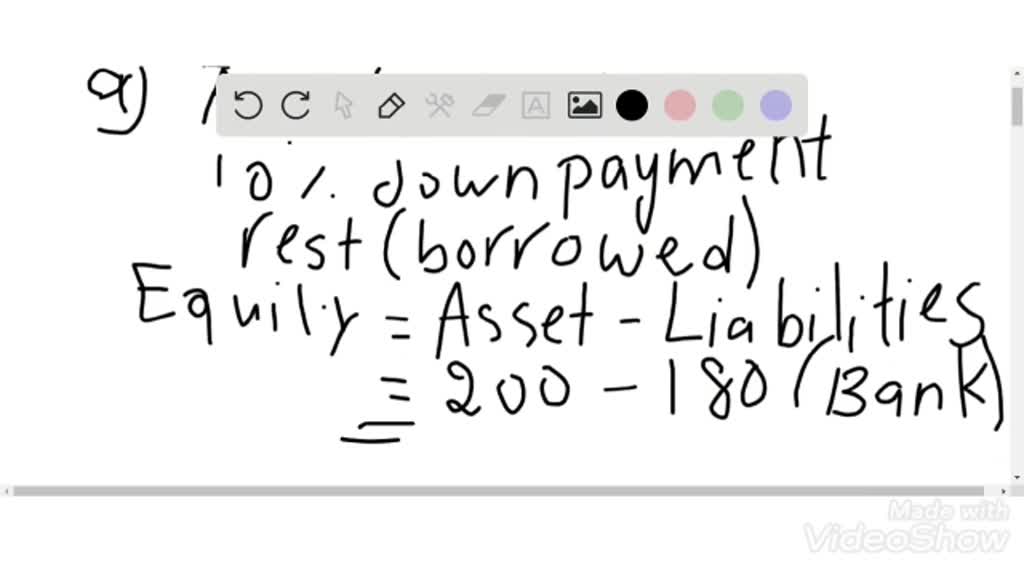

SOLVEDDetermine the amount of that must be recognized in each

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach.

IRS Form 982 Instructions Discharge of Indebtedness

However, there are some instances. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. A discharge of debt income occurs when a debt is forgiven by the.

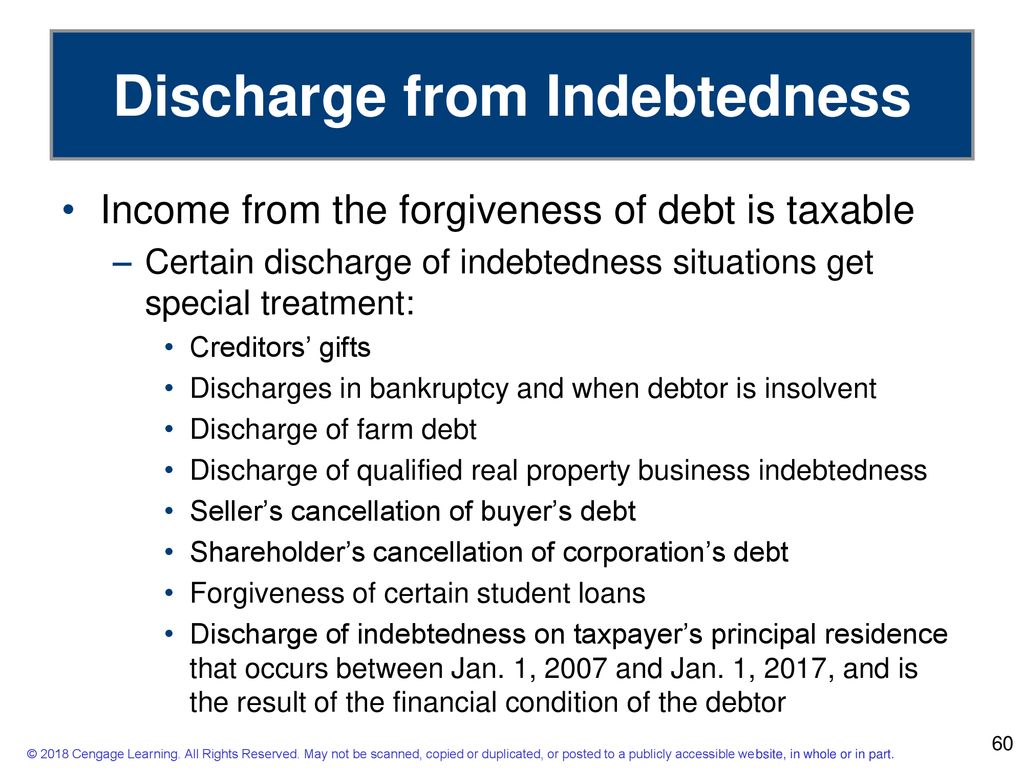

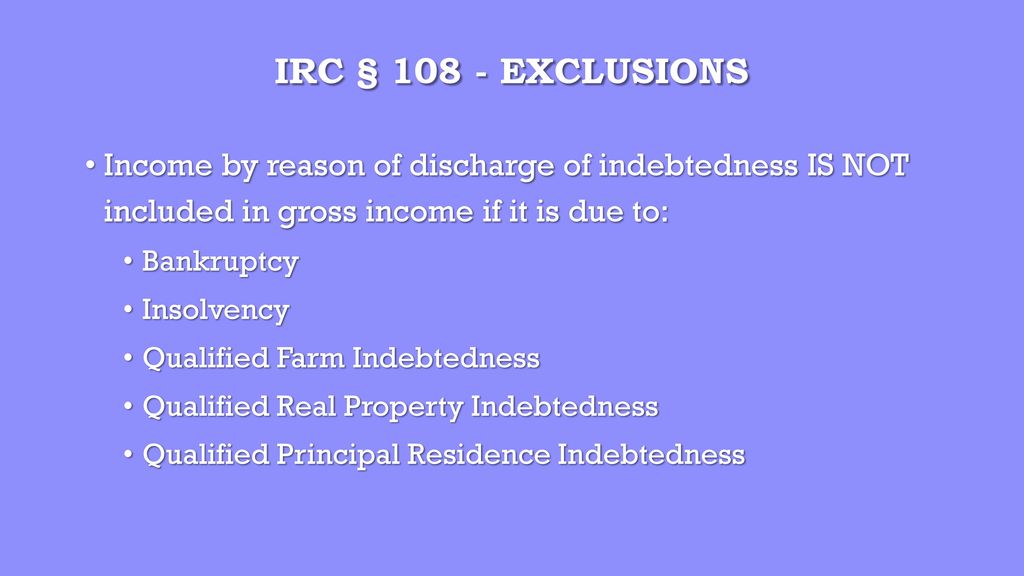

Gross Exclusions ppt download

However, there are some instances. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. Gross income does not include any amount which (but for this subsection).

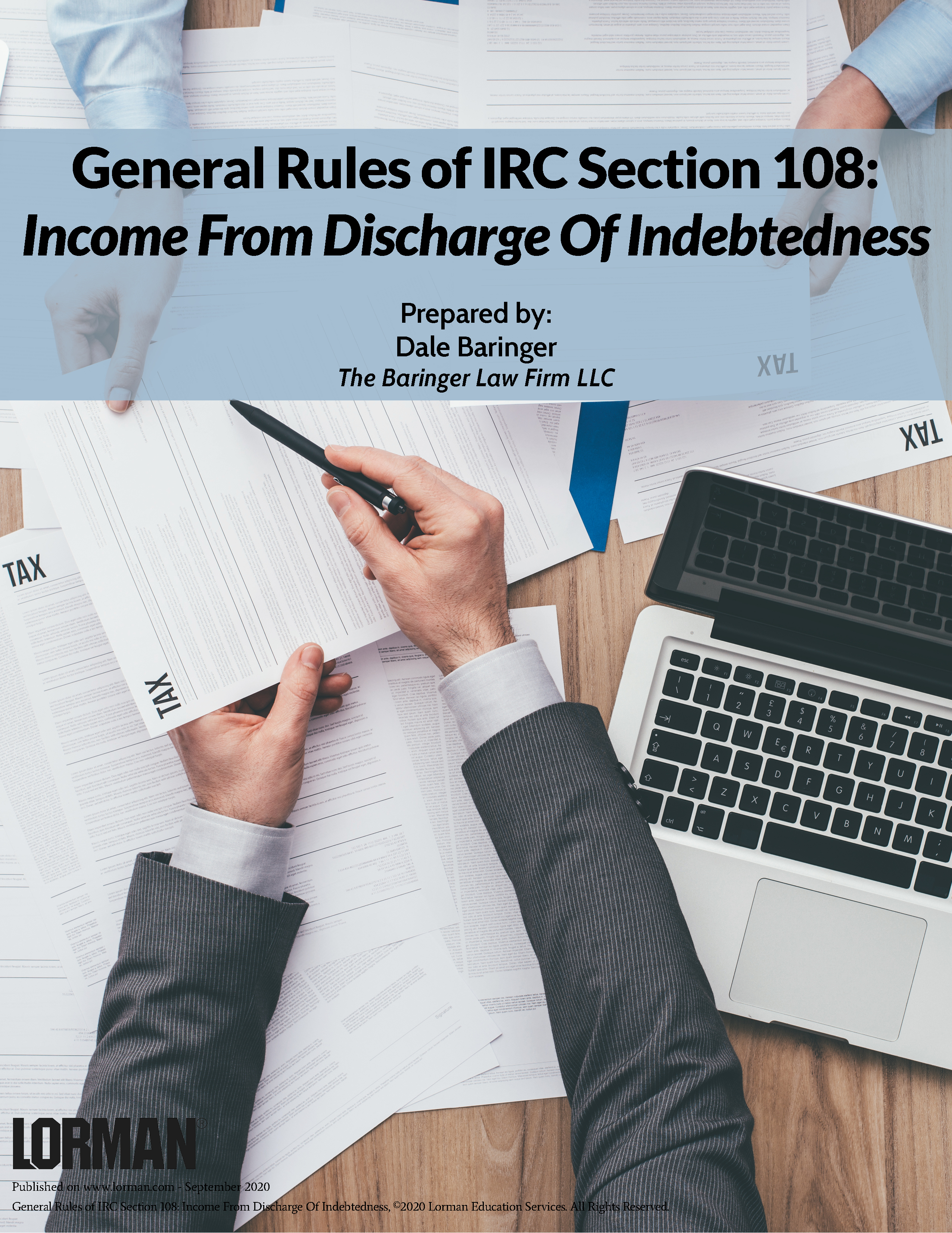

General Rules of IRC Section 108 From Discharge Of Indebtedness

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain.

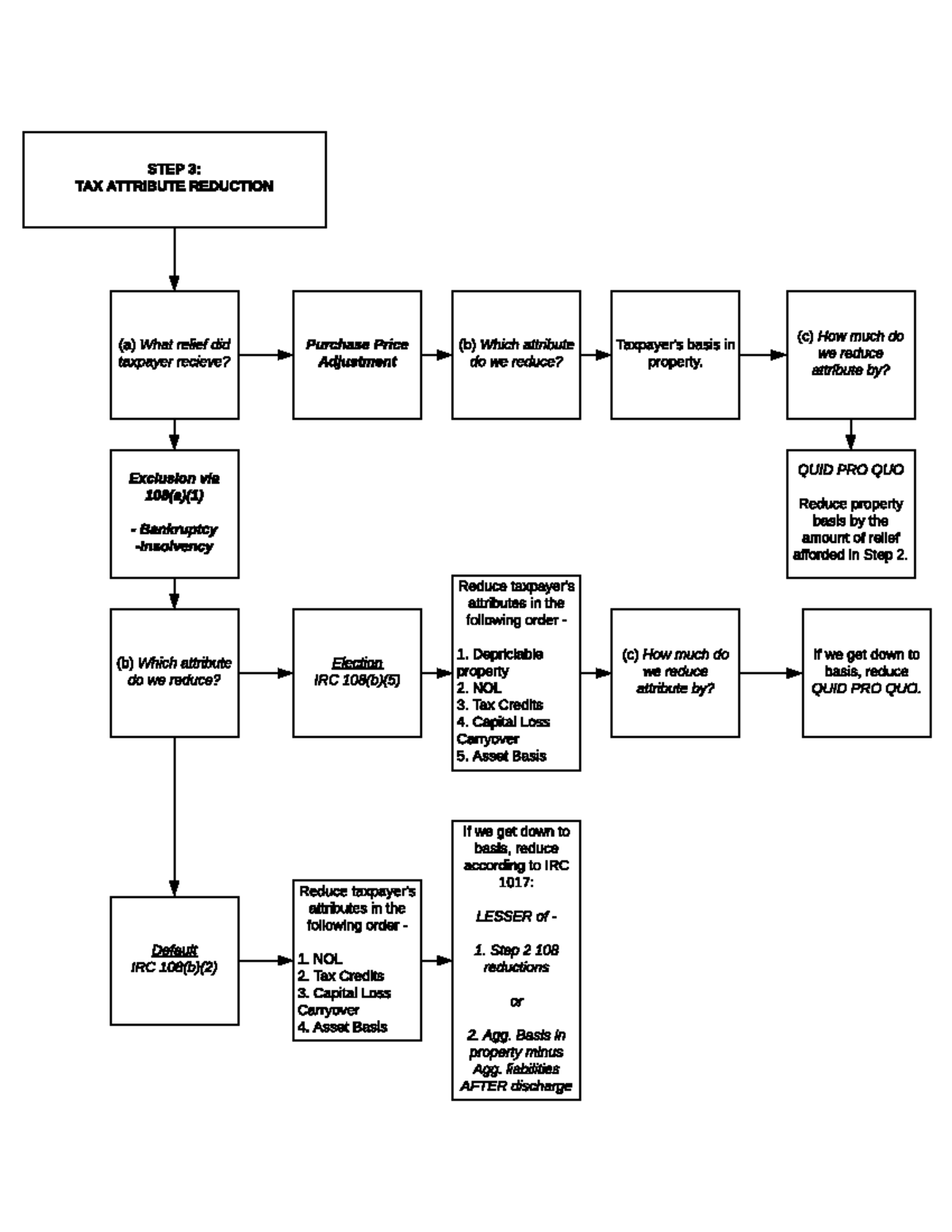

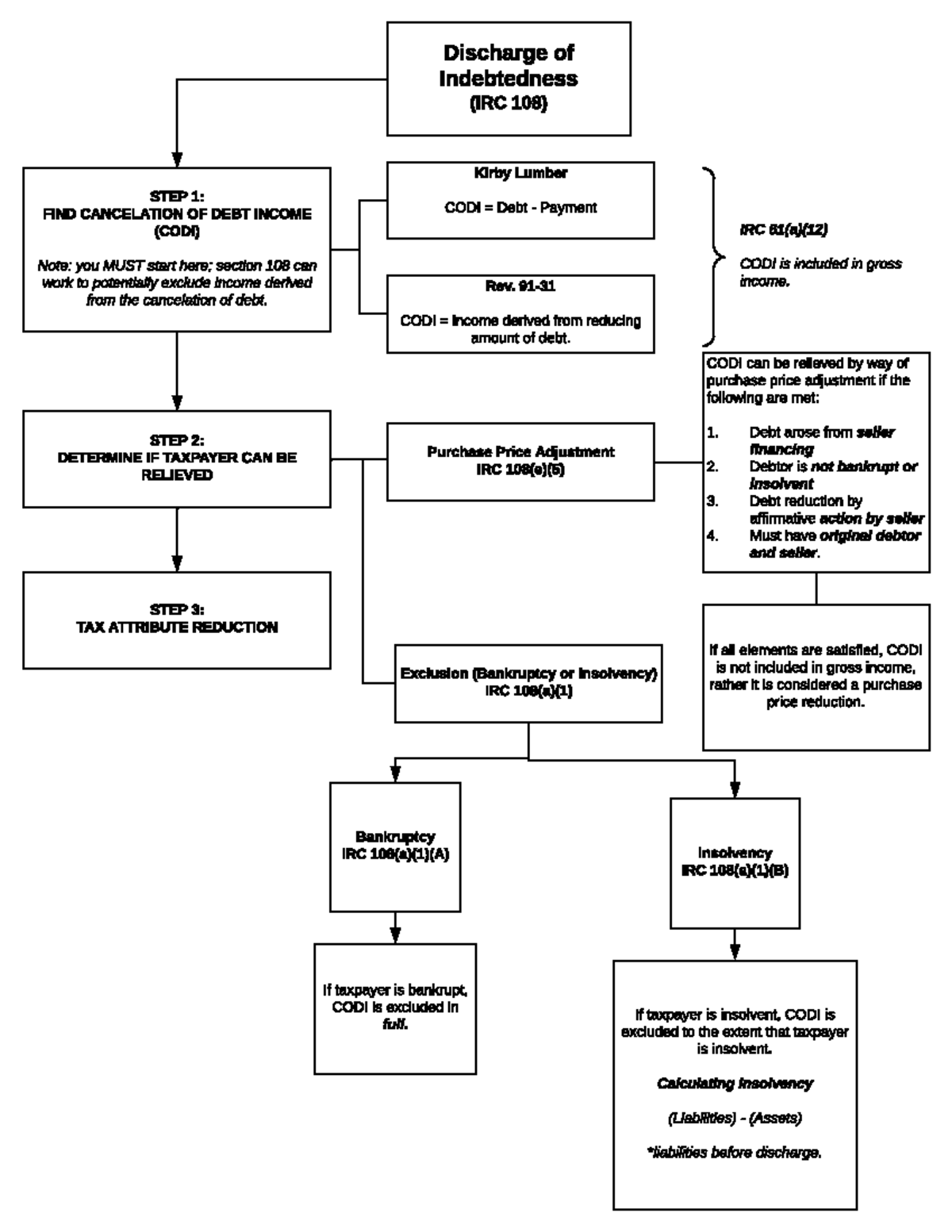

Discharge of Indebtedness Chart 2 STEP 3 TAX ATTRIBUTE REDUCTION

To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. Gross income does not include any amount which (but for this subsection) would be includible in gross income by.

IRS Form 982 Instructions Discharge of Indebtedness

To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. However, there are some instances. Gross income does not include any amount which (but for this subsection) would be.

Discharge of Indebtedness and Student Loan Ambler

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach.

Washington & Lee University School of Law Tax Clinic ppt download

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. However, there are some instances. To show that all or part of your canceled debt is excluded from income because.

Statement Of From Discharge Of Indebtedness Worksheet

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the..

Discharge of Indebtedness Chart 1 Discharge of Indebtedness (IRC

A discharge of debt income occurs when a debt is forgiven by the person who lend the money. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. Gross income does not include any amount which (but for this subsection) would be includible in gross income by.

However, There Are Some Instances.

Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. A discharge of debt income occurs when a debt is forgiven by the person who lend the money.